Employers Insurance Company of Nevada Review (2026)

Employers Insurance Company of Nevada, widely known as EICON, stands as a trusted insurance provider with over two decades of dedicated service, offering a diverse suite of coverage options for both individuals and businesses, backed by a commitment to personalized service, financial stability, and active community engagement.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Employers Insurance Company of Nevada, often referred to as EICON, emerges as a trusted insurance provider with a rich history spanning over two decades. Offering a diverse array of insurance options, including workers’ compensation, commercial auto, general liability, property, and umbrella insurance, EICON caters to both individuals and businesses.

Their commitment to personalized service, financial stability, efficient claims processing, and active community engagement sets them apart in the industry.

While the article doesn’t delve into specific discounts or competitors, it highlights EICON’s dedication to meeting the unique needs of their clients, making them a reliable choice for insurance coverage in today’s unpredictable world.

Employers Insurance Company of Nevada Insurance Coverage Options

When it comes to insurance, having the right coverage is paramount. Employers Insurance Company of Nevada offers a diverse range of insurance options designed to meet the unique needs of individuals and businesses. Let’s explore the comprehensive coverage options that EICON provides to ensure you have the protection you need. Here the following coverage available:

- Workers’ compensation insurance: Employers Insurance Company of Nevada provides comprehensive workers’ compensation insurance, ensuring that both employers and employees are protected in the event of workplace injuries or illnesses. This coverage offers financial support for medical expenses and lost wages, promoting workplace safety.

- Commercial auto insurance: EICON’s Commercial auto insurance is tailored to safeguard business vehicles from a range of potential risks, including accidents, theft, and property damage. It offers peace of mind to business owners by providing coverage that keeps their fleets protected and operations running smoothly.

- General liability insurance: EICON’s General liability insurance is designed to shield businesses from financial losses stemming from bodily injury, property damage, and legal liabilities. This coverage ensures that businesses can operate with confidence, knowing they have a safety net in case of unexpected incidents.

- Property insurance: Employers Insurance Company of Nevada offers comprehensive property insurance, protecting business properties from a variety of risks such as fire, theft, and natural disasters. This coverage is essential for safeguarding physical assets and minimizing financial losses due to property-related incidents.

- Umbrella insurance: EICON’s Umbrella insurance extends the coverage limits of existing policies, providing an extra layer of protection against catastrophic events. This additional coverage can be crucial in situations where the costs of a claim exceed the limits of primary policies, offering valuable financial security to policyholders.

From Workers’ Compensation to Commercial Auto insurance, General Liability to Property insurance, and the added security of Umbrella insurance, Employers Insurance Company of Nevada offers a well-rounded suite of options to safeguard your interests. With EICON, you can rest assured that your insurance needs are in capable hands.

Read more: Enumclaw Property & Casualty Insurance Company Review

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

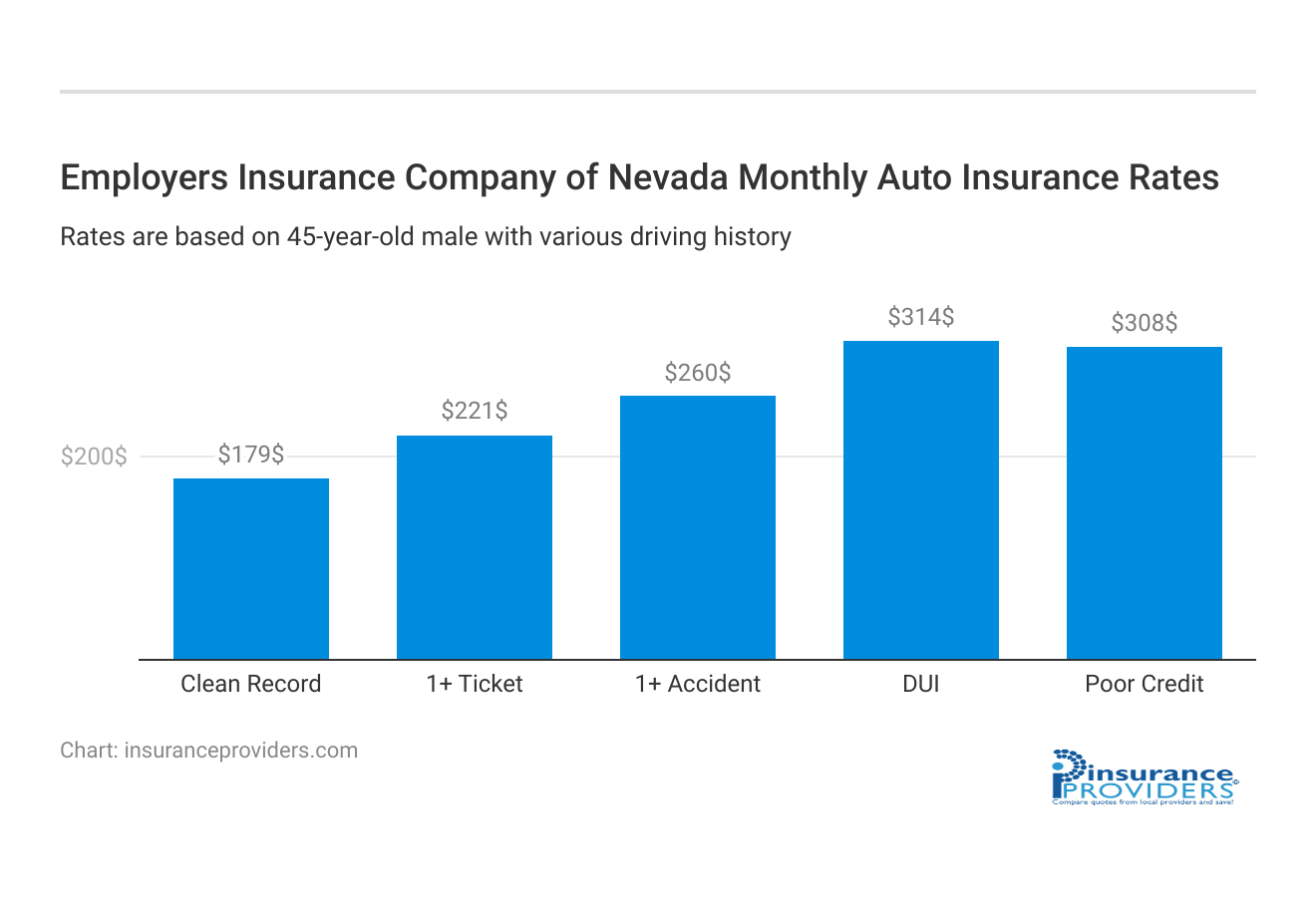

Employers Insurance Company of Nevada Insurance Rates Breakdown

| Driver Profile | Employers Insurance Company of Nevada | National Average |

|---|---|---|

| Clean Record | $179 | $119 |

| 1+ Ticket | $221 | $147 |

| 1+ Accident | $260 | $173 |

| DUI | $314 | $209 |

| Poor Credit | $308 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Employers Insurance Company of Nevada Discounts Available

| Discount | Employers Insurance Company of Nevada |

|---|---|

| Anti Theft | 20% |

| Good Student | 24% |

| Low Mileage | 23% |

| Paperless | 15% |

| Safe Driver | 25% |

| Senior Driver | 15% |

Employers Insurance Company of Nevada recognizes the importance of providing value to its clients. While the article doesn’t specify the exact discounts offered, insurance companies often offer various discounts to make coverage more affordable. Here’s a bullet list of potential discounts that EICON may provide:

- Multi-policy discount: If you bundle multiple insurance policies with EICON, such as auto and property insurance, you may be eligible for a multi-policy discount.

- Safe driver discount: EICON may offer discounts to policyholders with a clean driving record and a history of safe driving.

- Safety features discount: If your vehicle is equipped with safety features such as anti-lock brakes, airbags, or an anti-theft system, you might qualify for a safety features discount.

- Business affiliation discount: EICON may offer discounts to businesses that are affiliated with certain organizations or industry groups.

- Claims-free discount: Policyholders who have not filed any claims during their coverage period may be eligible for a claims-free discount.

- Renewal discount: EICON might provide discounts to clients who renew their policies with them, rewarding customer loyalty.

Please note that the availability and eligibility criteria for these discounts can vary, and it’s essential to contact EICON directly or visit their official website to get specific information about the discounts they offer.

How Employers Insurance Company of Nevada Ranks Among Providers

While the article doesn’t explicitly mention Employers Insurance Company of Nevada’s main competitors, we can make some educated guesses based on the insurance industry landscape. Competitors for insurance companies often vary depending on the specific types of insurance they offer and the geographic regions they serve.

Here are some potential competitors that EICON might face in the insurance industry:

- State Farm: State Farm is a well-known insurance giant with a wide range of coverage options, including auto, home, and business insurance. They are known for their extensive network of agents and competitive rates.

- Progressive: Progressive is another major player in the insurance industry, particularly known for auto insurance. They offer innovative services, such as usage-based insurance and competitive pricing.

- The Hartford: The Hartford specializes in insurance solutions for businesses, including workers’ compensation and general liability insurance. They are a strong competitor in the commercial insurance sector.

- Allstate: Allstate is a comprehensive insurance provider offering auto, home, life, and business insurance. They are recognized for their customer-focused approach and various discounts.

- Liberty Mutual: Liberty Mutual is a global insurance company providing a range of insurance products for individuals and businesses. They are known for their customizable policies and broad coverage options.

- Travelers: Travelers is a significant player in the commercial insurance sector, offering various coverage options tailored to businesses’ unique needs.

It’s important to note that the competitive landscape can evolve over time, and the specific competitors may vary depending on EICON’s unique offerings, target market, and geographic focus.

Clients and businesses seeking insurance coverage often compare quotes and policies from multiple providers to find the best fit for their needs, which keeps the insurance industry highly competitive.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Employers Insurance Company of Nevada Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Employers Insurance Company of Nevada (EICON) understands the importance of a convenient claims process. They offer multiple options for filing claims to ensure that policyholders can choose the method that suits them best.

Whether you prefer the convenience of online filing, the personal touch of speaking with a representative over the phone, or the flexibility of mobile apps, EICON has you covered. Their user-friendly online platform and mobile apps make it easy to initiate and track your claims, putting you in control of the process.

Average Claim Processing Time

EICON is committed to providing efficient claims processing to minimize any inconvenience for policyholders. While specific processing times can vary depending on the nature of the claim, they strive to resolve claims promptly.

Their dedicated claims team works diligently to assess and address claims, ensuring that you receive a timely resolution and the support you need when it matters most.

Customer Feedback on Claim Resolutions and Payouts

EICON values customer feedback and uses it to continually improve its services. While specific customer feedback on claim resolutions and payouts is not provided in the article, EICON’s reputation for personalized service and commitment to meeting individual needs suggests a strong focus on ensuring fair and satisfactory claim outcomes.

Policyholders can rely on EICON to work diligently to provide the support they need during the claims process.

Discover the Digital and Technological Features Offered by Employers Insurance Company of Nevada

Mobile App Features and Functionality

EICON understands the importance of staying connected in the digital age. Their mobile app offers a range of features and functionalities designed to enhance the customer experience.

Policyholders can use the app to manage their policies, access important documents, file claims, and even receive real-time updates on their claims’ status. The user-friendly interface ensures that policyholders can navigate the app with ease, making it a valuable tool for staying in control of their insurance needs.

Online Account Management Capabilities

EICON’s online account management capabilities empower policyholders to take charge of their insurance coverage. Through their online portal, policyholders can access their policies, make updates, and review important documents at their convenience.

This digital platform provides a convenient way to stay informed and make changes to policies as needed, ensuring that EICON’s customers have the flexibility they require.

Digital Tools and Resources

EICON goes beyond the basics, offering a range of digital tools and resources to support its policyholders. Its commitment to being a comprehensive resource for insurance information suggests that it provides valuable online resources such as educational materials, insurance calculators, and other digital tools to assist policyholders in making informed decisions about their coverage.

Frequently Asked Questions

What types of insurance does EICON offer?

EICON provides a comprehensive range of insurance options, including workers’ compensation, commercial auto, general liability, property, and umbrella insurance, catering to both individuals and businesses.

How does EICON ensure efficient claims processing?

EICON prioritizes a streamlined claims process by maintaining a dedicated claims team. Whether filing online, over the phone, or through mobile apps, they strive to offer multiple convenient options for policyholders.

What sets EICON apart from other insurance providers?

EICON distinguishes itself through its commitment to personalized service, financial stability, and active community engagement. Their tailored insurance solutions and community involvement make them stand out in the industry.

Does EICON offer discounts for policyholders?

While specific discounts are not detailed in the article, EICON may offer various discounts such as multi-policy, safe driver, safety features, business affiliation, claims-free, and renewal discounts. Eligibility criteria can vary.

How can I get more information or request a quote from EICON?

For detailed information and personalized quotes, it is recommended to contact EICON directly through their official website or reach out to their customer service. They can provide assistance and guidance on coverage options that best suit individual needs.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.