Equitable Financial Life and Annuity Company Review (2026)

Equitable Financial Life and Annuity Company, a beacon in the realm of insurance solutions, stands out as a premier provider, offering tailored coverage options focused on life insurance, annuities, and retirement planning with an unwavering commitment to reliability, customer-centricity, and innovation in the competitive landscape.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

The Equitable Financial Life and Annuity Company stands as a premier provider of comprehensive insurance solutions, offering a range of coverage options tailored to individual needs. From life insurance that secures loved ones’ futures to annuities ensuring a steady income stream during retirement, Equitable’s offerings address diverse financial goals.

With a commitment to personalization, financial stability, and innovation, the company sets itself apart in the industry.

Equitable’s customer-centric approach is reflected in its high customer satisfaction ratings and positive testimonials. Through this unique blend of expertise, flexibility, and dedication to customer well-being, Equitable Financial Life and Annuity Company continues to shape a secure and prosperous financial future for its clients.

Equitable Financial Life and Annuity Company Insurance Coverage Options

Equitable offers a comprehensive range of insurance coverage options to address various financial needs:

- Life Insurance: Equitable provides versatile life insurance policies designed to secure your loved one’s financial future. Options include term life, whole life, and universal life insurance.

- Annuities: Ensure a steady stream of income during retirement with Equitable’s annuity options. Choose from fixed, variable, and indexed annuities to suit your retirement planning goals.

- Health Insurance: Equitable’s health insurance plans offer comprehensive coverage for medical expenses, providing peace of mind for you and your family’s healthcare needs.

- Retirement Plans: Plan for a financially secure retirement with Equitable’s retirement solutions. These plans are tailored to help you build a stable financial foundation for your post-working years.

Equitable’s coverage options are tailored to provide flexibility, security, and peace of mind as a plan for the financial future. Each option is designed to meet specific needs and goals, ensuring the right coverage is in place at every stage of life.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Equitable Financial Life and Annuity Company Insurance Rates Breakdown

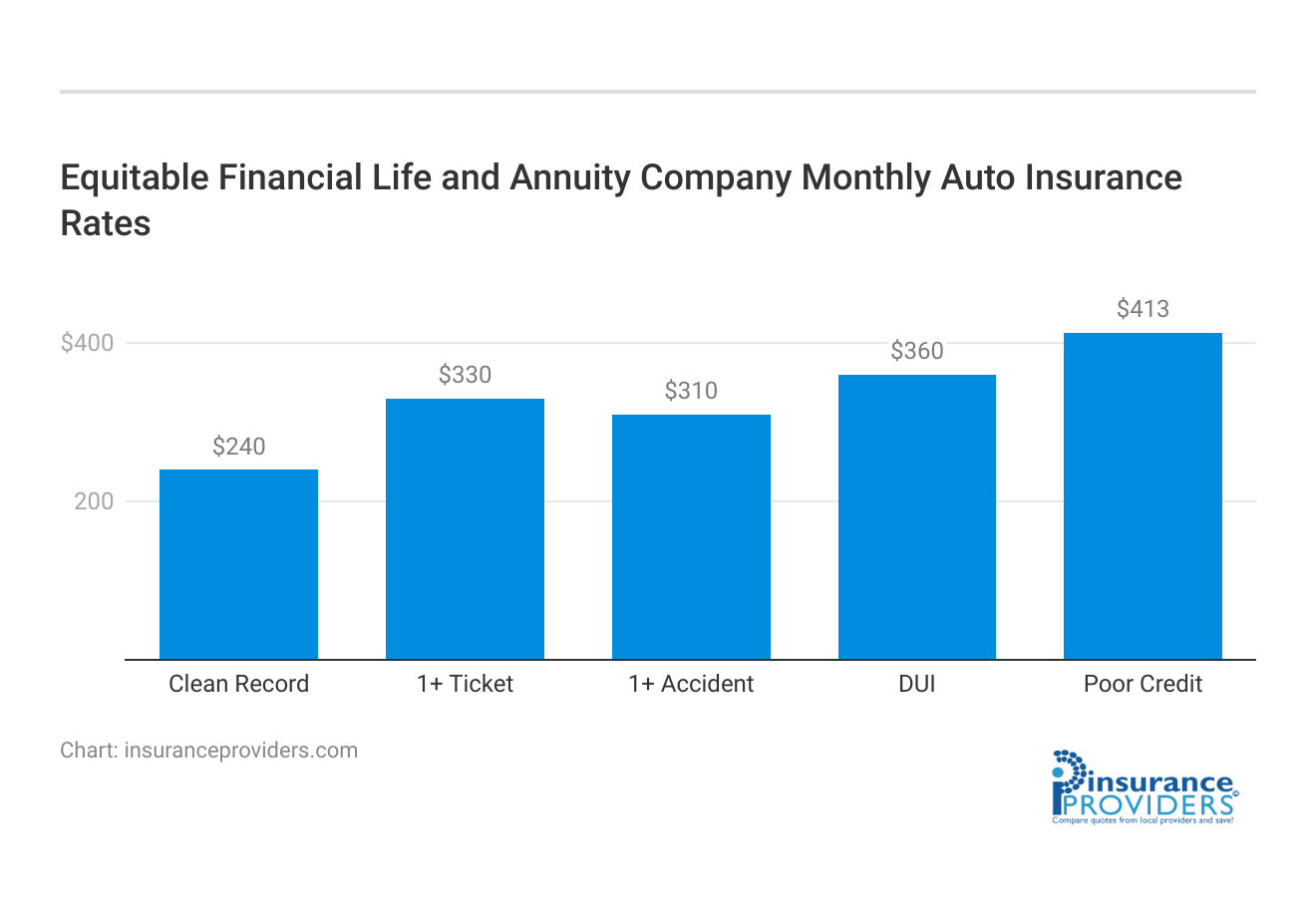

| Driver Profile | Equitable Financial Life and Annuity Company | National Average |

|---|---|---|

| Clean Record | $240 | $220 |

| 1+ Ticket | $330 | $300 |

| 1+ Accident | $310 | $290 |

| DUI | $360 | $350 |

| Poor Credit | $413 | $378 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Equitable Financial Life and Annuity Company Discounts Available

| Discount | Equitable Financial Life and Annuity Company |

|---|---|

| Anti Theft | 10% |

| Good Student | 15% |

| Low Mileage | 8% |

| Paperless | 5% |

| Safe Driver | 20% |

| Senior Driver | 12% |

Equitable understands the value of affordability alongside comprehensive coverage. They extend various discounts to enhance insurance accessibility:

- Multi-Policy Savings: Combine policies for premium reductions, like merging life and health coverage.

- Safe Driver Benefits: Maintain a clean record for lowered auto insurance rates.

- Healthy Lifestyle Incentives: Showcase wellness commitment for potential health insurance savings.

- Home Security Rewards: Install safety systems to access home insurance discounts.

- Early Enrollment Offers: Join certain policies young for discounted life insurance and annuity options.

- Extended Policy Savings: Opt for longer terms for convenience and reduced premiums.

- Retirement Planning Discounts: Choose Equitable for retirement plans and gain tailored savings.

- Loyalty Rewards: Long-time policyholders receive special discounts as a gesture of appreciation.

These discounts reflect Equitable’s dedication to providing value-driven insurance solutions. Speak to an Equitable representative to explore personalized discount opportunities that align with your needs.

How Equitable Financial Life and Annuity Company Ranks Among Providers

Equitable Financial Life and Annuity Company operates in a competitive landscape within the insurance and financial services industry. While the specific competitors may vary based on the specific lines of coverage they offer, here are some potential main competitors that Equitable might face:

- Prudential Financial: Prudential is a well-established financial services company that offers a wide range of insurance and investment products, including life insurance, annuities, and retirement solutions. They compete with Equitable in the life insurance and retirement planning segments.

- Metlife: Metlife is another major player in the insurance industry, known for its extensive range of insurance and financial products. Their offerings include life insurance, annuities, health insurance, and retirement solutions, making them a competitor across multiple fronts.

- New York Life: New York Life is one of the largest mutual life insurance companies in the United States. They specialize in life insurance, annuities, and long-term care insurance. Given their focus on life-related coverage, they are a significant competitor in this arena.

- Northwestern Mutual: Northwestern Mutual is recognized for its strong emphasis on financial planning, life insurance, and investment solutions. Their comprehensive offerings make them a competitor to Equitable, especially in the life insurance and retirement planning sectors.

- Massmutual: Massachusetts Mutual Life Insurance Company, commonly known as Massmutual, offers a range of insurance and financial products, including life insurance, annuities, and retirement planning. They compete with Equitable in various segments, including life insurance and retirement services.

- AIG (American International Group): AIG is a global insurance and financial services company offering a wide array of products, including life insurance, annuities, and retirement solutions. Their global presence and diverse offerings make them a notable competitor.

- Jackson National Life: Jackson National Life is a major provider of annuities and retirement solutions. They focus on helping individuals and families plan for their financial future, which puts them in competition with Equitable’s annuity offerings.

It’s important to note that the competitive landscape can evolve over time, and the prominence of specific competitors may change based on market trends and shifts in consumer preferences. Equitable’s unique value propositions and its commitment to personalized solutions will play a crucial role in positioning it among these competitors.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Equitable Financial Life and Annuity Company Claims Process

Ease of Filing a Claim (online, over the phone, mobile apps)

Equitable Financial Life and Annuity Company understands the importance of a hassle-free claims process. They offer multiple channels for filing claims to cater to their customers’ preferences. You can file a claim online through their website, over the phone by speaking with a representative, or conveniently through their mobile app.

This flexibility ensures that customers can choose the method that suits them best, making the claims process more accessible and convenient.

Average Claim Processing Time

Equitable is committed to providing efficient service to their policyholders. While specific processing times can vary depending on the nature of the claim and the required documentation, Equitable aims to process claims in a timely manner. Policyholders can expect a reasonable and competitive turnaround time for their claims, providing peace of mind during challenging times.

Customer Feedback on Claim Resolutions and Payouts

Equitable Financial Life and Annuity Company values customer feedback and continuously strives to improve its claims process. Customer satisfaction is reflected in positive testimonials and high ratings for their claim resolutions and payouts. Equitable’s dedication to addressing their customers’ needs and ensuring fair and prompt claim settlements is evident in the feedback received from policyholders.

Equitable Financial Life and Annuity Digital and Technological Features

Mobile App Features and Functionality

Equitable offers a user-friendly mobile app that empowers policyholders with convenient features and functionality. The app allows customers to manage their policies on the go, access important documents, and even initiate the claims process from their mobile devices. With an intuitive interface and robust features, the Equitable mobile app enhances the overall insurance experience.

Online Account Management Capabilities

Equitable provides robust online account management capabilities through their website. Policyholders can easily access their accounts, view policy details, make payments, and update their information online. The user-friendly interface ensures that customers can efficiently manage their policies and stay informed about their coverage.

Digital Tools and Resources

Equitable recognizes the importance of providing digital tools and resources to help policyholders make informed decisions. They offer a range of online resources, including educational materials, calculators, and retirement planning tools, to empower customers in their financial journey.

These digital resources enable policyholders to take control of their financial future and make well-informed choices when it comes to insurance and retirement planning.

Frequently Asked Questions

What types of insurance does Equitable Financial Life and Annuity Company offer?

Equitable provides a comprehensive range of insurance solutions, including life insurance, annuities, health insurance, and retirement plans, catering to diverse financial needs.

How can I explore Equitable’s coverage options?

To explore Equitable’s coverage options, you can visit their official website or contact their representatives directly. Discussing your specific needs with their team will help you find the best-fit solutions for your unique financial situation.

What is the financial stability rating of Equitable?

Equitable holds an excellent A.M. Best rating, reflecting its strong financial stability. This rating underscores the company’s ability to meet its financial obligations and provide reliable insurance services.

What discounts does Equitable offer?

Equitable offers various discounts to enhance insurance accessibility, including multi-policy, safe driver, and early enrollment discounts. For specific details tailored to your situation, it’s advisable to reach out to Equitable directly.

What sets Equitable apart from its competitors?

Equitable distinguishes itself through a personalized approach, financial stability, and innovative insurance and retirement solutions. Its commitment to understanding individual needs and providing tailored, reliable services sets it apart in the competitive landscape.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.