Equitable Life and Casualty Insurance Company: Customer Ratings & Reviews [2026]

Equitable Life and Casualty Insurance Company, a stalwart in the insurance industry, stands out as a reliable choice for comprehensive coverage, offering a spectrum of insurance products, including Medicare Supplement, final expense, and life insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Jeff Root

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Jeffrey Manola

Updated April 2024

Equitable Life and Casualty Insurance Company is a reputable insurance provider that has been serving customers since 1935. The company offers a range of insurance products, including Medicare Supplement, final expense, and life insurance.

Equitable Life and Casualty Insurance Company has a B+ (Good) rating from A.M. Best and a low complaint level, indicating that it’s a reliable choice for insurance coverage. The company’s rates are competitive and its underwriting requirements are flexible, making it accessible to a wide range of customers.

Additionally, Equitable Life and Casualty Insurance Company provides excellent customer service and offers online claims processing for added convenience. While the company has some limitations in terms of policy options and claims processing speed, overall it is a solid choice for those in need of insurance coverage.

What You Should Know About Equitable Life and Casualty Insurance Company

Company Contact Information:

- Website: https://www.equilife.com/

- Phone: 800-352-5170

- Address: 1145 South 800 East, Orem, UT 84097

Financial Ratings:

Equitable Life and Casualty Insurance Company has a B+ (Good) rating from A.M. Best.

Customer Service Ratings:

The company is known for its excellent customer service, and it has received positive reviews from customers for its responsiveness and helpfulness.

Claims Information:

Equitable Life and Casualty Insurance Company offers online claims processing for added convenience. The company is committed to providing a smooth and efficient claims process for its customers.

Company Apps:

Equitable Life and Casualty Insurance Company offers a mobile app called “EquiMobile” that allows customers to access their policies, pay bills, and view their claims status. The app is available for free download on both the App Store and Google Play.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Equitable Life and Casualty Insurance Company Insurance Coverage Options

Equitable Life and Casualty Insurance Company offers a range of insurance coverage options to its customers. These include:

- Auto Insurance: Equitable Life and Casualty Insurance Company offers liability, collision, and comprehensive coverage options for cars, trucks, and SUVs.

- Home Insurance: The company offers coverage options for homeowners, including dwelling, personal property, liability, and additional living expenses coverage.

- Medicare Supplement Insurance: Equitable Life and Casualty Insurance Company provides Medicare supplement insurance to help cover the costs of healthcare that are not covered by Medicare.

- Life Insurance: The company offers a range of life insurance policies, including term life, whole life, and universal life insurance.

- Health Insurance: Equitable Life and Casualty Insurance Company offers individual and group health insurance policies.

- Long-Term Care Insurance: The company provides long-term care insurance policies to help cover the costs of long-term care services.

These coverage options can be tailored to meet the specific needs of each customer, providing them with the protection they need for themselves and their families.

Equitable Life and Casualty Insurance Company Insurance Rates Breakdown

| Driver Profile | Equitable Life and Casualty Insurance Company | National Average |

|---|---|---|

| Clean Record | $240 | $220 |

| 1+ Ticket | $330 | $300 |

| 1+ Accident | $310 | $290 |

| DUI | $360 | $350 |

| Poor Credit | $413 | $378 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Equitable Life and Casualty Insurance Company Discounts Available

| Discount | Equitable Life and Casualty Insurance Company |

|---|---|

| Anti Theft | 10% |

| Good Student | 15% |

| Low Mileage | 8% |

| Paperless | 5% |

| Safe Driver | 15% |

| Senior Driver | 10% |

Equitable Life and Casualty Insurance Company offers a variety of discounts to help customers save money on their insurance policies. These include:

- Multi-Policy Discount: Customers can save money by bundling multiple policies, such as home and auto insurance, with Equitable Life and Casualty Insurance Company.

- Safe Driver Discount: Customers who have a clean driving record and no recent accidents or violations can save money on their auto insurance.

- Senior Discount: Customers who are 55 years of age or older can save money on their auto insurance.

- Homeowner Discount: Homeowners can save money on their insurance policies with Equitable Life and Casualty Insurance Company.

- Good Student Discount: Students who maintain a certain grade point average can save money on their auto insurance.

- Anti-Theft Device Discount: Customers who have anti-theft devices installed in their vehicles can save money on their auto insurance.

- Paid in Full Discount: Customers who pay their insurance premiums in full can save money on their policies.

These discounts can help customers save money on their insurance premiums and make Equitable Life and Casualty Insurance Company an affordable option for many.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Equitable Life and Casualty Insurance Company Ranks Among Providers

Equitable Life and Casualty Insurance Company faces rivals that offer similar services to consumers. Understanding the alternatives in the market allows potential customers to make informed decisions based on their specific needs and preferences.

- Prudential Financial: A global financial services leader providing a wide range of insurance and investment products.

- Mutual of Omaha: Known for its diverse insurance and financial products, including life insurance, Medicare supplements, and more.

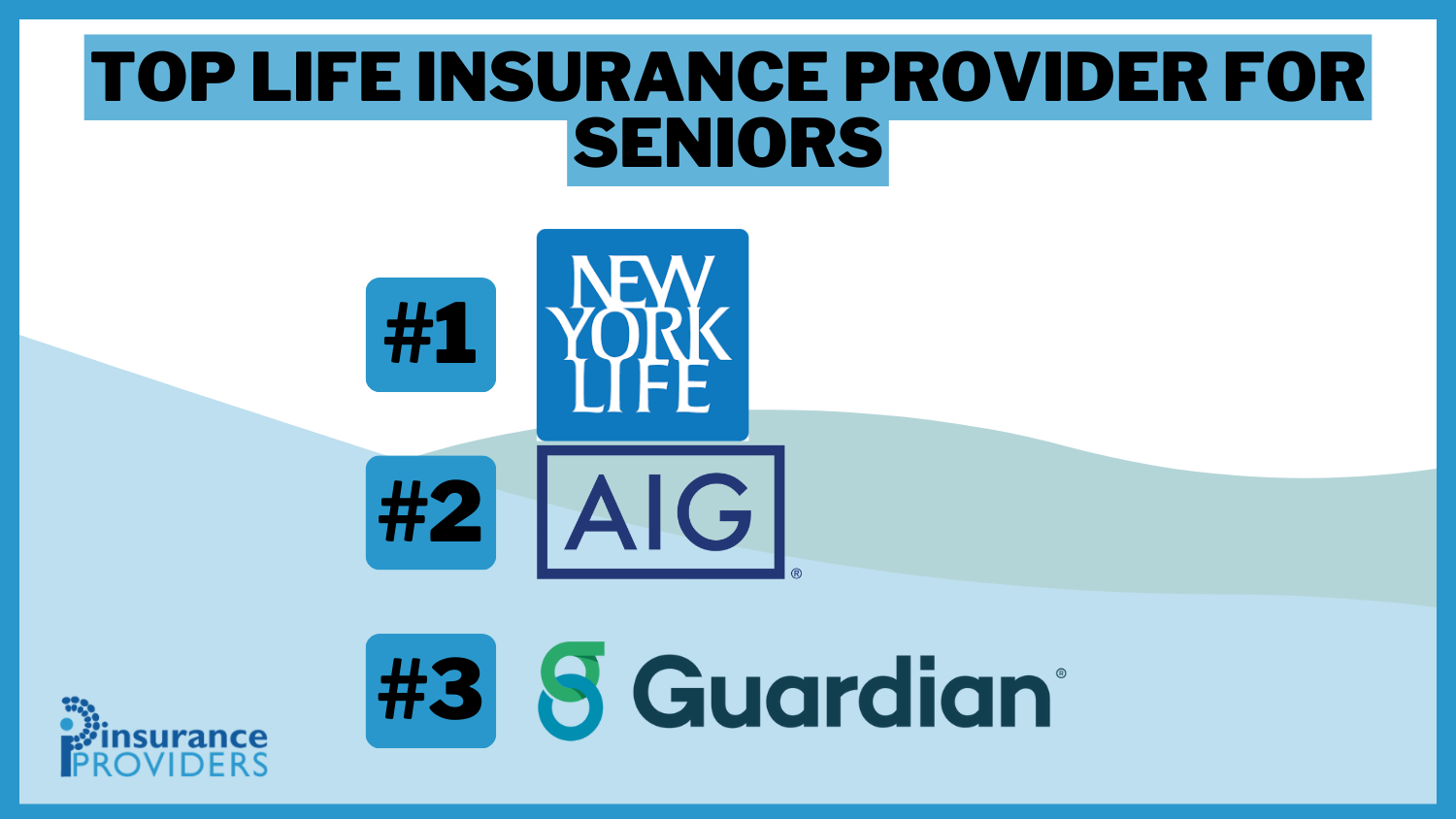

- New York Life Insurance Company: A prominent mutual life insurance company offering a variety of insurance and investment options.

- AARP Insurance Program: Catering to the 50+ demographic, this program offers insurance solutions, including life and health coverage.

- Aflac: A major player in supplemental insurance, offering various policies to help with expenses not covered by major medical insurance.

Navigating the insurance market involves considering various providers, each with its strengths and offerings. Equitable Life and Casualty Insurance Company competes with these key players, and customers are encouraged to explore and compare the services, coverage, and customer satisfaction levels of these competitors to make well-informed insurance decisions.

Frequently Asked Questions

What insurance products do Equitable Life and Casualty Insurance Company offer?

Equitable Life and Casualty Insurance Company provides a range of insurance products, including life insurance, Medicare supplement insurance, final expense insurance, and various other coverage options designed to meet the diverse needs of individuals and families.

How can I contact Equitable Life and Casualty Insurance Company?

To contact Equitable Life and Casualty Insurance Company, you can visit their official website and find their contact information. They typically provide phone numbers and email addresses for customer inquiries and support.

What are the financial ratings of Equitable Life and Casualty Insurance Company?

Equitable Life and Casualty Insurance Company holds a B+ (Good) rating from A.M. Best, indicating a solid financial standing. This rating reflects the company’s ability to meet its financial obligations and underscores its reliability as an insurance provider.

Does Equitable Life and Casualty Insurance Company offer online claims processing?

Yes, Equitable Life and Casualty Insurance Company provides online claims processing for added convenience. The company is committed to ensuring a smooth and efficient claims process for its customers.

What discounts are available with Equitable Life and Casualty Insurance Company?

Equitable Life and Casualty Insurance Company offers a variety of discounts to help customers save money on their insurance policies. These include but are not limited to multi-policy discounts, safe driver discounts, and loyalty discounts, providing an opportunity for policyholders to reduce their insurance premiums.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.