Executive Risk Specialty Insurance Company Review (2026)

Executive Risk Specialty Insurance Company stands out as a premier provider of tailored coverage, specializing in safeguarding executives and organizations from legal complexities with a focus on Directors and Officers (D&O) and Employment Practices Liability Insurance (EPLI), making them the go-to choice for minimizing leadership risk.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Executive Risk Specialty Insurance Company is a specialized insurer that offers coverage for executive-level risks and liabilities.

They provide insurance products such as Directors and Officers (D&O) liability insurance and Employment Practices Liability Insurance (EPLI) to protect executives and organizations from legal and financial challenges related to decision-making and leadership roles.

Their expertise lies in creating tailored solutions for businesses to mitigate the unique risks faced by top executives.

Executive Risk Specialty Insurance Company Insurance Coverage Options

Here are the coverage options offered by Executive Risk Specialty Insurance Company, presented in a bullet list:

- Directors and Officers (D&O) Insurance: Protection for executives and board members against legal actions stemming from their decisions and actions.

- Employment Practices Liability (EPL) Insurance: Coverage for claims related to employment practices, such as discrimination, harassment, and wrongful termination.

- Cyber Liability Insurance: Safeguarding against financial losses due to data breaches, cyberattacks, and digital security incidents.

- Fiduciary Liability Insurance: Coverage for breaches of fiduciary duty, providing financial protection for those responsible for managing employee benefit plans.

- Crime Insurance: Shielding businesses from financial losses caused by various types of fraudulent activities and crimes.

These coverage options are designed to address the unique risks that executives and businesses face in today’s dynamic landscape.

Read more: Executive Risk Indemnity Inc. Review

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

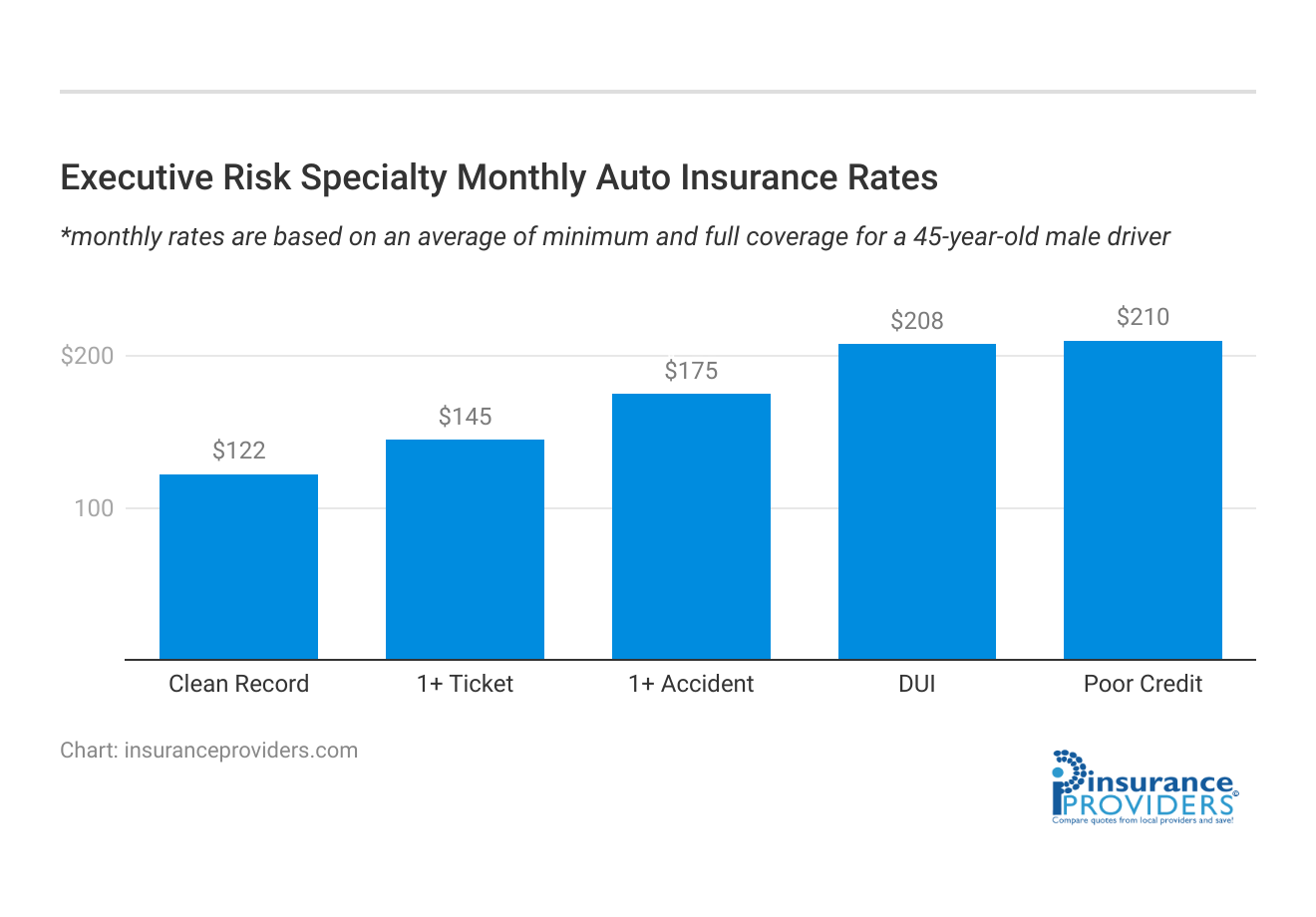

Executive Risk Specialty Insurance Company Insurance Rates Breakdown

| Driver Profile | Executive Risk Specialty | National Average |

|---|---|---|

| Clean Record | $122 | $119 |

| 1+ Ticket | $145 | $147 |

| 1+ Accident | $175 | $173 |

| DUI | $208 | $209 |

| Poor Credit | $210 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Executive Risk Specialty Insurance Company Discounts Available

| Discount | Executive Risk Specialty |

|---|---|

| Anti Theft | 6% |

| Good Student | 12% |

| Low Mileage | 9% |

| Paperless | 5% |

| Safe Driver | 18% |

| Senior Driver | 7% |

Executive Risk Specialty Insurance Company also provides discounts to customers. Here are some of the discounts offered by Executive Risk Specialty Insurance Company, presented in a bullet list:

- Multi-Policy Discount: When you bundle multiple insurance policies with Executive Risk Specialty, such as combining commercial property insurance with professional liability coverage, you can qualify for significant discounts on your premiums.

- Claims-Free Discount: Businesses that have a history of being claims-free may be eligible for lower insurance premiums as a reward for their responsible risk management practices.

- Safety and Risk Management Discount: If your business has implemented robust safety measures and risk management protocols, you may be entitled to discounts as a reflection of your commitment to minimizing potential risks.

- Industry-Specific Discounts: Executive Risk Specialty offers tailored discounts for businesses within specific industries. These discounts acknowledge the unique risks and needs of different sectors, allowing you to get the most cost-effective coverage.

- Membership or Association Discounts: If your business is a member of an industry association or professional organization that partners with Executive Risk Specialty, you might be eligible for exclusive discounts on insurance premiums.

- Renewal Discounts: Staying loyal to Executive Risk Specialty can have its rewards. Renewing your insurance policies with the company often comes with renewal discounts as a token of appreciation for your continued trust.

- Safety Training Discounts: If your employees undergo safety training programs, you can benefit from discounts, as this demonstrates your commitment to workplace safety.

- Good Credit Discounts: A strong credit history can positively impact your insurance premiums. Executive Risk Specialty may offer discounts to businesses with good credit scores.

- Early Payment Discounts: Paying your insurance premiums in advance can result in cost savings. Executive Risk Specialty may provide discounts for businesses that make early payments.

It’s important to note that the availability of these discounts may vary depending on your specific business situation and the type of insurance policies you choose. To determine your eligibility for these discounts and to get accurate information on potential savings, it’s advisable to consult directly with Executive Risk Specialty’s insurance agents or representatives. They can provide personalized guidance based on your unique circumstances.

How Executive Risk Specialty Insurance Company Ranks Among Providers

Executive Risk Specialty Insurance Company likely operates in the specialty insurance sector, focusing on coverage for executive liability risks and related areas. Competitors in this space could include:

- Chubb Limited: Chubb is a global insurance company that offers a wide range of insurance products, including executive liability coverage. They are known for providing tailored solutions for complex risks faced by executives and corporations.

- AIG (American International Group): AIG is another major player in the insurance industry that offers various specialty insurance products, including executive liability coverage. They have a significant presence in the corporate and commercial insurance market.

- Hiscox: Hiscox is known for offering specialized insurance products, including directors and officers liability insurance, professional liability insurance, and other forms of coverage relevant to executive risk.

- Berkshire Hathaway Specialty Insurance (BHSI): Berkshire Hathaway’s specialty insurance arm offers a range of specialized insurance solutions, including coverage for executive and professional liability risks.

- Travelers Companies: Travelers is a large insurance company that provides a range of commercial insurance products, including executive liability coverage, to businesses of all sizes.

- AXA XL: AXA XL, a division of AXA Group, offers a variety of specialty insurance coverages for businesses, which may include executive liability and professional liability insurance.

- Marsh & McLennan Companies: While not an insurance company itself, Marsh & McLennan is a prominent insurance brokerage and risk management firm. They work with various insurers to provide customized insurance solutions, including those related to executive risks.

- Zurich Insurance Group: Zurich is a global insurance company that offers a range of commercial insurance products, including coverages related to executive liability and management risks.

- Allied World Assurance Company: Allied World is known for providing specialty insurance solutions, including executive liability and professional liability coverage.

- Liberty Mutual Insurance: Liberty Mutual offers a variety of commercial insurance solutions, which could include executive liability coverage and related products.

It’s important to conduct up-to-date market research to determine the current competitors of Executive Risk Specialty Insurance Company and their respective market positions. Changes in the insurance industry can impact the competitive landscape, so consulting industry reports, financial news sources, and market research databases will provide the most accurate and current information.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Executive Risk Specialty Insurance Company Claims Process

Ease of Filing a Claim

Executive Risk Specialty Insurance Company (ERSIC) prioritizes simplicity and convenience for policyholders when it comes to filing claims. Whether through their user-friendly online platform, over the phone with the assistance of their dedicated team, or via their mobile app, ERSIC offers multiple channels for filing claims, ensuring a hassle-free experience.

Average Claim Processing Time

Efficiency is a hallmark of ERSIC’s claim processing. Recognizing that businesses rely on timely resolutions, ERSIC is committed to swift claim processing. They strive to minimize disruptions by ensuring an expedited average claim processing time.

Customer Feedback on Claim Resolutions and Payouts

ERSIC values customer feedback as a vital tool for enhancing their claim resolutions and payout processes. They actively seek input from policyholders to gauge their satisfaction with the outcomes. Positive feedback underscores ERSIC’s commitment to fair and transparent claim resolutions, reinforcing their mission to support businesses effectively.

Executive Risk Specialty Insurance Company’s Digital and Technological Features

Mobile App Features and Functionality

ERSIC offers a robust mobile app equipped with features that enhance the insurance experience. The app provides a user-friendly interface, allowing policyholders to manage their accounts, submit claims, and access essential resources while on the move. It serves as a valuable tool, granting convenient access to insurance-related tasks and information.

Online Account Management Capabilities

ERSIC empowers policyholders with 24/7 online account management capabilities. Through their secure online portal, customers can make premium payments, update personal information, and track claims in real-time. The platform prioritizes accessibility and simplicity, ensuring a seamless insurance management experience.

Digital Tools and Resources

In addition to comprehensive coverage, ERSIC offers a suite of digital tools and resources designed to assist policyholders in making informed decisions.

These resources include educational materials and interactive tools, equipping policyholders with the knowledge and resources necessary to confidently navigate the complexities of insurance. ERSIC’s commitment to providing valuable digital resources sets it apart in the insurance landscape.

Frequently Asked Questions

What does Executive Risk Specialty Insurance Company specialize in?

Executive Risk Specialty Insurance Company specializes in providing coverage for executive-level risks and liabilities within organizations.

What types of insurance products does Executive Risk Specialty Insurance Company offer?

Executive Risk Specialty Insurance Company offers insurance products such as Directors and Officers (D&O) liability insurance and Employment Practices Liability Insurance (EPLI), designed to protect executives and organizations from legal and financial challenges.

Who benefits from the insurance products offered by Executive Risk Specialty Insurance Company?

Executives, directors, officers, and high-ranking officials within organizations benefit from the insurance products, as they provide protection against personal financial liabilities resulting from their leadership roles.

How does Executive Risk Specialty Insurance Company tailor its coverage?

Executive Risk Specialty Insurance Company assesses the unique risks faced by each organization and its executives, customizing insurance solutions to address specific challenges and liabilities.

What is the claims process like with Executive Risk Specialty Insurance Company?

Executive Risk Specialty Insurance Company prioritizes simplicity and convenience for policyholders when filing claims, offering multiple channels, including an online platform, phone assistance, and a mobile app, with a commitment to swift claim processing and customer feedback for continuous improvement.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.