First Indemnity of America Insurance Company Review (2026)

First Indemnity of America Insurance Company, offering a comprehensive range of insurance policies to safeguard individuals, families, and businesses in an ever-changing landscape.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In an unpredictable world where safeguarding one’s assets and well-being is paramount, First Indemnity of America Insurance Company emerges as a reliable fortress of protection. Offering a comprehensive array of insurance policies, from home and auto coverage to health, life, and business solutions.

First Indemnity ensures that individuals, families, and businesses are shielded against life’s uncertainties. With customizable policies and a commitment to financial security, the company caters to diverse needs while rewarding responsible behaviors through a range of discounts.

As a steadfast partner, First Indemnity stands firm in its mission to provide peace of mind, making insurance not only a necessity but an investment in a secure and confident future.

First Indemnity of America Insurance Company Insurance Coverage Options

When it comes to safeguarding the important aspects of your life, First Indemnity of America Insurance Company offers a diverse array of coverage options. Whether it’s protecting your home, ensuring your health and well-being, or securing your financial future, First Indemnity is dedicated to providing comprehensive solutions tailored to your specific needs.

- Home Insurance: Protect your haven against property damage, theft, and liability, ensuring your peace of mind.

- Auto Insurance: Stay covered on the road with protection against accidents, damage, and third-party liability.

- Health Insurance: Comprehensive health coverage, including medical, dental, and vision, designed to prioritize your well-being.

- Life Insurance: Ensure the financial security of your loved ones with policies that provide support in times of need.

- Business Insurance: Tailored coverage for businesses, ranging from property and liability protection to employee benefits.

- Travel Insurance: Embark on your journeys worry-free, knowing you’re covered for unexpected travel-related issues.

- Pet Insurance: Care for your beloved pets with coverage that eases the burden of veterinary expenses.

- Specialized Coverage: Unique solutions addressing specialized needs, from high-value items to niche risks.

From the sanctuary of your home to the adventures of travel, from the health of your loved ones to the growth of your business, First Indemnity of America Insurance Company offers an expansive selection of coverage options.

Their commitment to providing tailored protection ensures that you can face life’s uncertainties with confidence, knowing that your assets and loved ones are in capable hands.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

First Indemnity of America Insurance Company Insurance Rates Breakdown

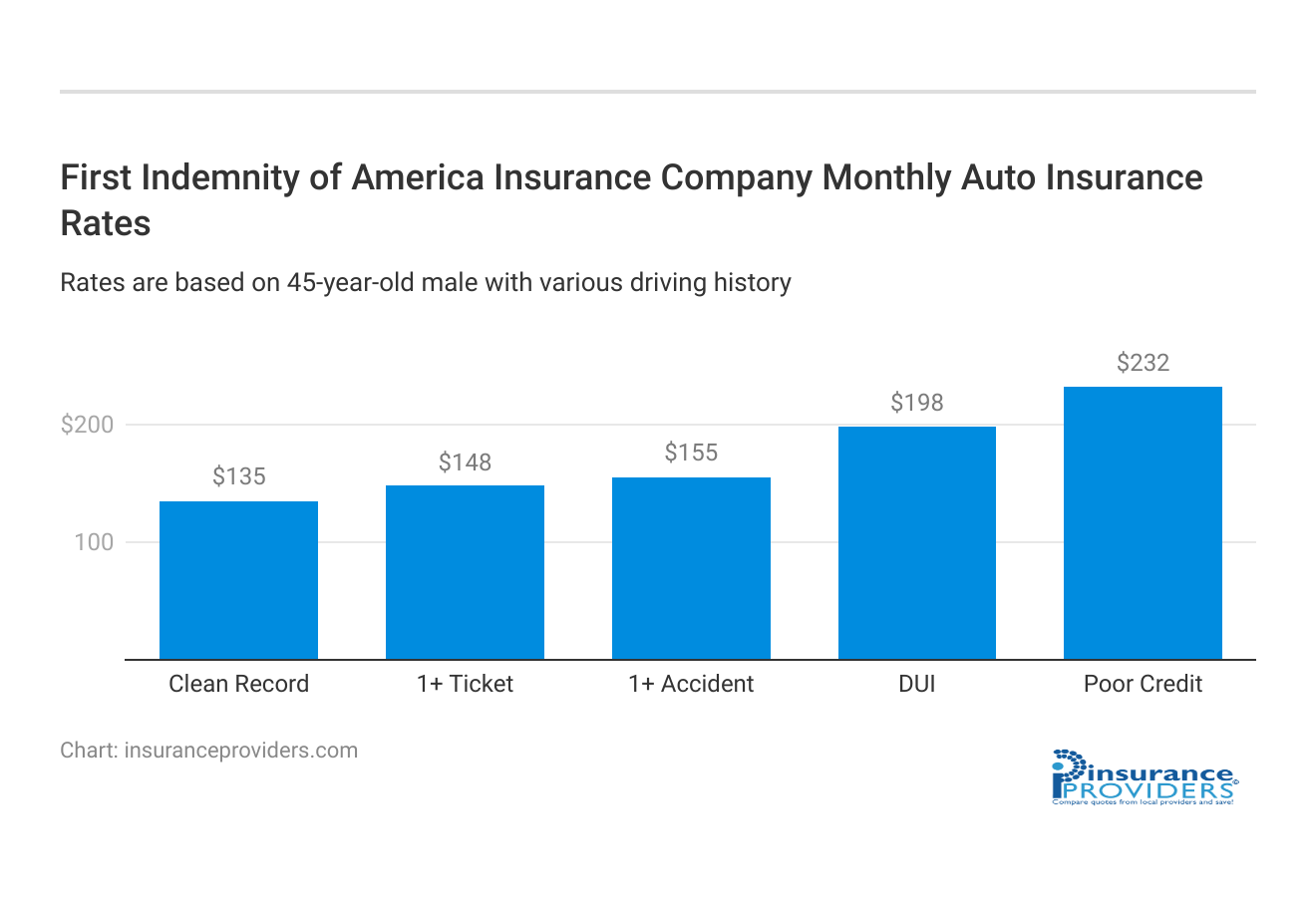

| Driver Profile | First Indemnity of America Insurance Company | National Average |

|---|---|---|

| Clean Record | $135 | $119 |

| 1+ Ticket | $148 | $147 |

| 1+ Accident | $155 | $173 |

| DUI | $198 | $209 |

| Poor Credit | $232 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

First Indemnity of America Insurance Company Discounts Available

| Discount | First Indemnity of America Insurance Company |

|---|---|

| Anti Theft | 20% |

| Good Student | 25% |

| Low Mileage | 20% |

| Paperless | 5% |

| Safe Driver | 20% |

| Senior Driver | 15% |

At First Indemnity of America Insurance Company, your protection and satisfaction are paramount. To make insurance even more accessible and beneficial, they offer a range of discounts that not only help you save but also recognize your responsible actions. These discounts can add up to significant savings while ensuring that you receive the coverage you need.

- Multi-Policy Discount: Bundle multiple policies and enjoy reduced rates across the board.

- Safe Driver Discount: Be rewarded for your safe driving habits with lowered insurance premiums.

- Good Student Discount: Students excelling in academics can benefit from reduced insurance costs.

- Home Security Discount: Secure your home and get rewarded with discounts on your policy.

- Multi-Car Discount: Insure all your vehicles together to receive discounted rates.

- Loyalty Discount: Long-term customers enjoy increasing savings over time.

- Claim-Free Discount: Maintain a claim-free record and enjoy lower rates as a result.

- Group Discounts: Special rates for being part of specific organizations or groups.

- Pay-in-Full Discount: Pay your premium upfront and receive a discount on your policy.

- Good Health Discount: Certain health insurance plans offer lower rates based on your overall health.

Beyond just providing coverage, First Indemnity of America Insurance Company strives to offer additional value to its policyholders. These discounts not only make insurance more affordable but also acknowledge your efforts towards responsible behavior.

As you invest in your protection, First Indemnity invests in you, ensuring that you’re covered in more ways than one.

How First Indemnity of America Insurance Company Ranks Among Providers

While the article doesn’t explicitly mention the company’s main competitors, I can provide you with some general information about potential competitors in the insurance industry that First Indemnity of America Insurance Company might face. Keep in mind that this information is not specific to the company mentioned in the previous sections.

- Global Insurance Group: A multinational insurance conglomerate offering a wide range of insurance solutions including home, auto, health, and business coverage.

- Secureshield Insurance: Known for its comprehensive home and auto insurance, Secureshield also offers specialized coverage options for unique needs.

- Healthfirst Assurance: A prominent player in the health insurance sector, providing comprehensive medical, dental, and vision coverage.

- Lifeprotect Assurance: A leading provider of life insurance policies, offering various options to secure the financial well-being of loved ones.

- Enterpriseguard Insurance: Specializing in business insurance, Enterpriseguard offers tailored coverage for different industries, focusing on property, liability, and employee benefits.

- Travelsure Coverage: A go-to choice for travel insurance, Travelsure provides coverage for unforeseen events during trips, ensuring peace of mind for travelers.

- Petguard Protect: A competitor in the pet insurance sector, Petguard offers coverage for veterinary expenses and pet care.

It’s important to note that the competitiveness of these companies may vary based on factors such as market presence, reputation, coverage options, pricing, and customer satisfaction. Additionally, the landscape of competitors can change over time due to shifts in the industry, regulatory changes, and emerging players.

It’s recommended to research and analyze the current market to identify the most relevant and up-to-date competitors for First Indemnity of America Insurance Company.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

First Indemnity of America Insurance Company Claims Process

Ease of Filing a Claim

First Indemnity of America Insurance Company recognizes the importance of a hassle-free claims process. They offer multiple channels for filing claims, allowing customers to choose the method that suits them best. Whether it’s through their user-friendly online portal, over the phone, or using their mobile app, First Indemnity ensures that filing a claim is convenient and accessible.

Average Claim Processing Time

Efficiency is a hallmark of First Indemnity’s claims processing system. They are committed to swift claim resolution, aiming to minimize disruptions for their policyholders. First Indemnity’s dedication to prompt claims processing means you can expect a timely response when you need it most.

Customer Feedback on Claim Resolutions and Payouts

First Indemnity of America Insurance Company values customer feedback regarding their claim resolutions and payouts. They actively seek input from their customers to continually enhance their claims handling process. This customer-centric approach ensures that policyholders have a positive experience when making claims and receive fair and timely payouts.

First Indemnity of America Insurance Company’s Digital and Technological Features

Mobile App Features and Functionality

First Indemnity of America Insurance Company offers a feature-rich mobile app designed to enhance the overall customer experience.

The app provides policyholders with convenient access to their accounts, streamlined claims submissions, and a wealth of resources. Its user-friendly interface ensures that managing insurance on the go is a seamless process, exemplifying First Indemnity’s commitment to technological innovation.

Online Account Management Capabilities

First Indemnity of America Insurance Company empowers its policyholders with 24/7 access to their insurance accounts through its online portal.

This platform allows customers to conveniently make premium payments, update personal information, and track claims in real-time. First Indemnity’s commitment to accessibility and user-friendliness guarantees an efficient online account management experience.

Digital Tools and Resources

In addition to offering comprehensive coverage, First Indemnity of America Insurance Company equips policyholders with a range of digital tools and resources.

These resources include educational materials and interactive tools that provide valuable information and assistance. By offering these digital resources, First Indemnity ensures that its customers have the knowledge needed to navigate the complexities of insurance and make informed decisions.

Frequently Asked Questions

What types of insurance does First Indemnity of America Insurance Company offer?

First Indemnity offers a wide range of insurance coverage, including home, auto, health, life, business, travel, and even specialized policies tailored to unique needs.

How can I save on my insurance premiums with First Indemnity?

First Indemnity of America Insurance Company provides various discounts to help you save, such as multi-policy, safe driver, good student, home security, multi-car, loyalty, claim-free, group, pay-in-full, and good health discounts.

What makes First Indemnity of America Insurance Company stand out from other insurance providers?

First Indemnity’s comprehensive coverage options, customizable policies, streamlined claims process, financial stability, and trusted partnerships set it apart, ensuring a holistic and reliable approach to protection.

Can I tailor my insurance policy with First Indemnity to my specific needs?

Absolutely. First Indemnity of America Insurance Company offers customizable policies that can be tailored to fit your unique requirements, ensuring you receive coverage that aligns with your individual circumstances.

How can I get in touch with First Indemnity of America Insurance Company to discuss my insurance options?

You can contact First Indemnity’s team of experts by visiting their official website or calling their customer service hotline. First Indemnity of America Insurance Company is ready to guide you through the insurance selection process.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.