Firstcomp Insurance Company Review (2026)

Navigating the intricate landscape of insurance options is a critical endeavor, and in this dynamic realm, Firstcomp Insurance Company stands out as a reliable partner committed to providing personalized solutions, competitive pricing, and exceptional customer support across diverse coverage needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In a world where uncertainties abound, finding a reliable insurance partner is paramount to safeguarding your future and the things that matter most to you. Firstcomp Insurance Company emerges as a beacon of trust, offering a comprehensive suite of coverage options that cater to a diverse range of needs.

Throughout this article, we’ve explored the myriad benefits that Firstcomp brings to the table – benefits that extend far beyond simple insurance coverage. From the moment you embark on your journey with Firstcomp, you’re met with a commitment to personalized service and unwavering support.

Whether it’s protecting your home, vehicle, business, health, or loved ones, Firstcomp’s dedication to tailored coverage ensures that you’re not just another policyholder – you’re a valued individual with unique needs and aspirations. We’ve delved into the various types of insurance that Firstcomp offers, from home and auto to health, business, and life insurance.

Each category is meticulously designed to provide not only financial protection but also peace of mind. The company’s focus on flexibility and customization empowers you to shape your coverage to align with your life’s evolving journey.

Firstcomp Insurance Company Insurance Coverage Options

Firstcomp Insurance Company provides a comprehensive range of coverage options tailored to meet various needs and protect what matters most to you. Here are the coverage options available:

- Dwelling Coverage: Protects your home’s structure against damages from covered perils.

- Personal Property Coverage: Safeguards your belongings, such as furniture, electronics, and valuables.

- Liability Coverage: Provides financial protection if you’re legally responsible for injuries or damages to others.

- Additional Living Expenses: Covers temporary living expenses if your home becomes uninhabitable due to a covered loss.

- Liability Coverage: Offers protection if you’re at fault in an accident and are legally responsible for injuries or damages.

- Collision Coverage: Pays for repairs to your vehicle after a collision, regardless of fault.

- Comprehensive Coverage: Covers damages to your vehicle from non-collision events like theft, vandalism, and natural disasters.

- Uninsured/Underinsured Motorist Coverage: Ensures you’re protected if you’re in an accident with a driver who doesn’t have sufficient insurance.

- General Liability Insurance: Guards against third-party claims for bodily injury, property damage, and advertising mistakes.

- Commercial Property Insurance: Protects your business property, including buildings, equipment, and inventory.

- Business Interruption Insurance: Provides coverage for lost income and ongoing expenses if your business operations are disrupted.

- Professional Liability (Errors and Omissions) Insurance: Covers professional negligence claims that result in financial losses to clients.

- Health Maintenance Organization (HMO): Requires members to choose a primary care physician and get referrals for specialists.

- Preferred Provider Organization (PPO): Offers more flexibility in choosing healthcare providers, both in and out of the network.

- High-Deductible Health Plan (HDHP): Features lower premiums and a higher deductible, often paired with Health Savings Accounts (HSAs).

- Exclusive Provider Organization (EPO): Offers a middle ground between HMO and PPO, with limited out-of-network coverage.

- Term Life Insurance: Provides coverage for a specific period, with a death benefit paid out if you pass away during the term.

- Whole Life Insurance: Offers permanent coverage and includes a cash value component that grows over time.

- Universal Life Insurance: Combines a death benefit with a cash value account that earns interest and offers flexibility in premium payments.

- Variable Life Insurance: Allows you to invest the cash value portion in various investment options.

Firstcomp Insurance Company ensures that each coverage option is customizable to fit your specific needs. Whether you’re looking to protect your home, vehicle, business, health, or loved ones, Firstcomp’s diverse range of coverage options has you covered.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

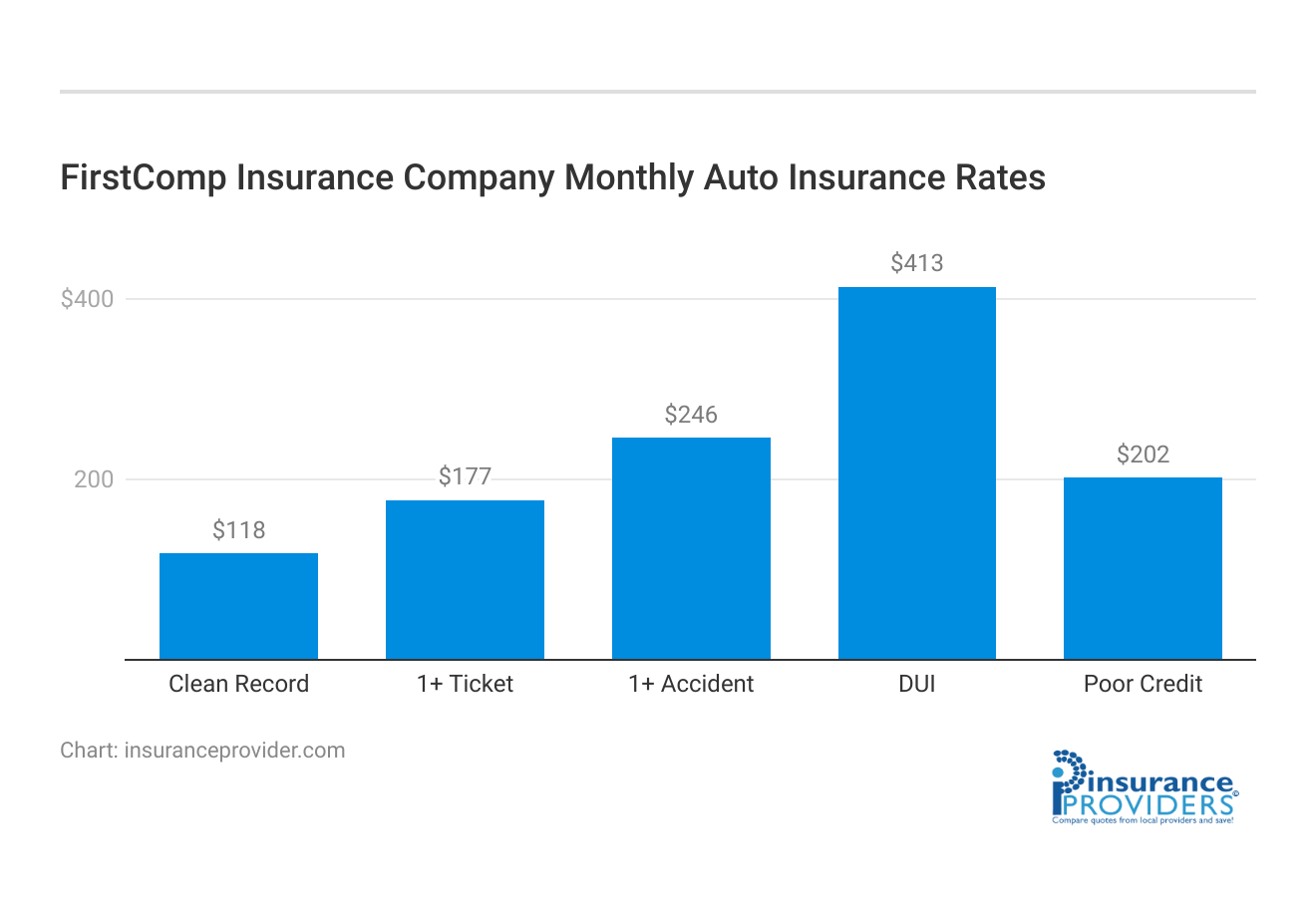

Firstcomp Insurance Company Insurance Rates Breakdown

| Driver Profile | FirstComp Insurance | National Average |

|---|---|---|

| Clean Record | $118 | $119 |

| 1+ Ticket | $177 | $147 |

| 1+ Accident | $246 | $173 |

| DUI | $413 | $209 |

| Poor Credit | $202 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Firstcomp Insurance Company Discounts Available

| Discounts | FirstComp Insurance |

|---|---|

| Anti Theft | 19% |

| Good Student | 16% |

| Low Mileage | 20% |

| Paperless | 15% |

| Safe Driver | 28% |

| Senior Driver | 17% |

Firstcomp Insurance Company values its customers and strives to provide not only comprehensive coverage but also cost-effective solutions. Here are some of the discounts available to help you save on your insurance premiums:

- Multi-Policy Discount: Enjoy significant savings by bundling multiple insurance policies with Firstcomp. Combine your home, auto, and other policies to unlock this discount.

- Safe Driver Discount: If you have a clean driving record with no accidents or violations, you can qualify for a safe driver discount on your auto insurance.

- Home Security Discount: Secure your home with safety measures such as alarm systems, smoke detectors, and security cameras to earn discounts on your home insurance.

- Good Student Discount: Students with excellent academic records can benefit from reduced auto insurance premiums, rewarding their dedication to education.

- Multi-Car Discount: Insure more than one vehicle with Firstcomp and receive a discount on the premiums for each car on the policy.

- Claims-Free Discount: Maintain a claims-free history for a specified period, and you could be eligible for discounts on your insurance premiums.

- Loyalty Discount: Stay with Firstcomp for the long term, and your loyalty will be rewarded with special discounts and benefits.

- Professional Association Discount: If you’re a member of a qualifying professional association, you may be eligible for exclusive discounts on your coverage.

- Safety Features Discount: Equip your vehicle with advanced safety features such as anti-lock brakes, airbags, and anti-theft devices to earn discounts on auto insurance.

- Renewal Discount: Renew your policies with Firstcomp, and you may receive renewal discounts as a token of our appreciation for your continued trust.

- Multi-Policy Discount: Save when you combine your business insurance policies with Firstcomp, ensuring comprehensive protection for all aspects of your business.

- Health and Wellness Discount: Embrace a healthy lifestyle and participate in wellness programs to access discounts on your health insurance premiums.

- Payment Discounts: Choose convenient payment options such as annual or semi-annual payments to qualify for additional discounts.

- Online Account Discount: Manage your policies through our user-friendly online portal and enjoy exclusive discounts for your commitment to digital convenience.

Firstcomp Insurance Company believes in making insurance accessible and affordable for everyone. These discounts are a testament to our commitment to rewarding responsible behavior, loyalty, and prudent choices.

How Firstcomp Insurance Company Ranks Among Providers

In the competitive landscape of the insurance industry, Firstcomp Insurance Company faces several notable competitors, each offering their own unique strengths and specialties. Here are some of the company’s main competitors:

- Secureshield Insurance Group: Secureshield is known for its strong emphasis on customer service and personalized insurance solutions. They offer a wide range of coverage options, including home, auto, and life insurance. Secureshield’s competitive pricing and innovative digital tools make them a formidable rival in the market.

- Guardian Assurance Corporation: Guardian Assurance is recognized for its comprehensive health and medical insurance offerings. They provide a variety of health plans, including HMOs, PPOs, and specialized coverage options. Guardian Assurance’s focus on wellness programs and preventive care sets them apart in the health insurance sector.

- Eliterisk Solutions Agency: Eliterisk Solutions specializes in providing tailored business insurance solutions for various industries. Their expertise in risk management and in-depth understanding of sector-specific challenges give them a competitive edge. They offer unique coverage options that cater to the specific needs of businesses.

- Vitallife Insurance Co.: Vitallife Insurance is a strong contender in the life insurance segment, offering diverse policy options such as term, whole life, and variable life insurance. Their emphasis on flexible policy terms and investment-linked coverage makes them a preferred choice for those seeking long-term financial security.

- Safedrive Insurance Corporation:Safedrive Insurance focuses primarily on auto insurance and is known for its usage-based insurance (UBI) programs. They leverage telematics and technology to reward safe driving behaviors with lower premiums, appealing to tech-savvy and safety-conscious customers.

- Homeguard Insurance Services: Homeguard Insurance specializes in comprehensive home insurance solutions. Their coverage options extend to not only traditional homes but also condos, renters, and vacation properties. Their attention to detailed property coverage and personalized service distinguishes them in the home insurance sector.

- Businesssure Underwriters: Businesssure Underwriters is a direct competitor in the business insurance arena. They offer specialized coverage options for industries such as manufacturing, hospitality, and professional services. Their tailored approach to business insurance appeals to businesses seeking sector-specific risk mitigation.

- Wellsure Health Plans: Wellsure Health Plans competes in the health insurance market with an emphasis on wellness and preventive care. They offer comprehensive coverage options along with wellness incentives, encouraging policyholders to prioritize their health.

These competitors represent a fraction of the dynamic and evolving landscape of the insurance industry. Firstcomp Insurance Company differentiates itself through its commitment to personalized coverage, exceptional customer support, and competitive pricing.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Firstcomp Insurance Company Claims Process

Ease of Filing a Claim

Firstcomp Insurance Company prioritizes a user-friendly claims process, offering customers multiple convenient options for filing claims. Whether you prefer the speed and efficiency of online claim submission, the personal touch of filing over the phone, or the convenience of using their mobile app, Firstcomp ensures that the process is accessible and hassle-free.

Average Claim Processing Time

Efficiency is a hallmark of Firstcomp’s claims handling. They are committed to providing timely resolutions to claims, minimizing disruptions to your life. Expect your claims to be processed promptly, delivering peace of mind when you need it most.

Customer Feedback on Claim Resolutions and Payouts

Firstcomp Insurance Company values customer feedback as a means of continuous improvement. They actively seek input from their clients to enhance their claims resolution and payout processes. This customer-centric approach ensures a positive experience for policyholders and timely, fair payouts.

Firstcomp Insurance Company’s Digital and Technological Features

Mobile App Features and Functionality

Firstcomp Insurance Company’s mobile app is a comprehensive tool designed to enhance the overall customer experience. With features for policy management, streamlined claims submission, and access to valuable resources, the app is user-friendly and reflects Firstcomp’s commitment to leveraging technology for the benefit of their customers.

Online Account Management Capabilities

Firstcomp empowers its customers with 24/7 access to their accounts through their online portal. This platform allows clients to conveniently manage their policies, make payments, and track claims in real-time. Firstcomp’s commitment to accessibility and user-friendliness ensures an efficient online account management experience.

Digital Tools and Resources

In addition to their range of insurance coverage, Firstcomp equips its customers with a variety of digital tools and resources. These resources include educational materials and interactive tools to provide valuable information and assistance.

By offering these digital resources, Firstcomp ensures that its customers have the knowledge needed to make informed insurance decisions and navigate their coverage effectively.

Frequently Asked Questions

What types of insurance does Firstcomp Insurance Company offer?

Firstcomp provides a wide range of insurance options, including home, auto, business, health, and life insurance.

What sets Firstcomp apart from other insurance providers?

Firstcomp stands out for its personalized coverage, exceptional customer support, and competitive pricing across various insurance categories.

How can I file a claim with Firstcomp Insurance?

Filing a claim is simple – reach out to their dedicated claims team via phone or their online portal, and they’ll guide you through the process.

Is Firstcomp Insurance suitable for both individuals and businesses?

Yes, Firstcomp offers a diverse range of insurance solutions tailored to the needs of individuals, families, and businesses of all sizes.

What kind of customer support does Firstcomp offer?

Firstcomp’s customer support is known for its responsiveness and expertise, ensuring your questions are answered and needs addressed promptly.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.