Foremost County Mutual Insurance Company: Customer Ratings & Reviews [2026]

Foremost County Mutual Insurance Company stands as a trusted provider, offering a diverse range of insurance products such as home, auto, renters, umbrella, and flood insurance, underscored by competitive rates and a customer-centric approach.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Operations Specialist

Michael earned a degree in Business Management with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Automatio...

Michael Leotta

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated April 2024

Foremost County Mutual Insurance Company is a reputable insurance provider with a strong presence in multiple states. They offer a wide range of insurance products including home, auto, renters, umbrella, and flood insurance, with competitive rates for coverage.

With a customer-centric mission and a history of reliable service, Foremost County Mutual Insurance Company provides various discounts to customers.

However, limited information on their website, higher rates compared to other providers, limited availability in certain states, and limited online customer reviews may be considered potential drawbacks.

What You Should Know About Foremost County Mutual Insurance Company

Company Contact Information:

- Website: www.foremost.com

- Phone Number: 1-800-527-3907

- Mailing Address: Foremost County Mutual Insurance Company, P.O. Box 2450, Grand Rapids, MI 49501-2450

Related Parent or Child Companies:

Foremost Insurance Group

Financial Ratings:

A.M. Best Rating: A

Customer Service Ratings:

Customer reviews indicate generally positive experiences with customer service.

Claims Information:

- Claims can be reported through the website or by calling the phone number provided.

- Claims process and turnaround time may vary depending on the nature and complexity of the claim.

Company Apps:

Foremost County Mutual Insurance Company does not currently have a dedicated mobile app for managing policies or filing claims. However, customers can access their accounts and policy information online through the company’s website.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Foremost County Mutual Insurance Company Insurance Coverage Options

Foremost County Mutual Insurance Company offers a wide range of coverage options to meet the insurance needs of their customers. These coverage options include:

- Home insurance: Provides coverage for the structure of the home, personal belongings, liability protection, and additional living expenses in the event of a covered loss.

- Auto insurance: Offers coverage for liability, collision, comprehensive, uninsured/underinsured motorist, medical payments, and personal injury protection (PIP) for vehicles.

- Renters insurance: Protects personal belongings, provides liability coverage, and may offer additional living expenses coverage for renters.

- Umbrella insurance: Offers additional liability coverage beyond the limits of home and auto insurance policies, providing an extra layer of protection.

- Flood insurance: Provides coverage for damage caused by floods, which is not typically covered under standard home insurance policies.

- Other specialty insurance: Foremost County Mutual Insurance Company also offers other specialty insurance options such as motorcycle insurance, off-road vehicle insurance, boat insurance, and more.

Please note that coverage options may vary by state and policy, and it’s important to review the specific coverage details and policy terms with the company to ensure that it meets your individual insurance needs.

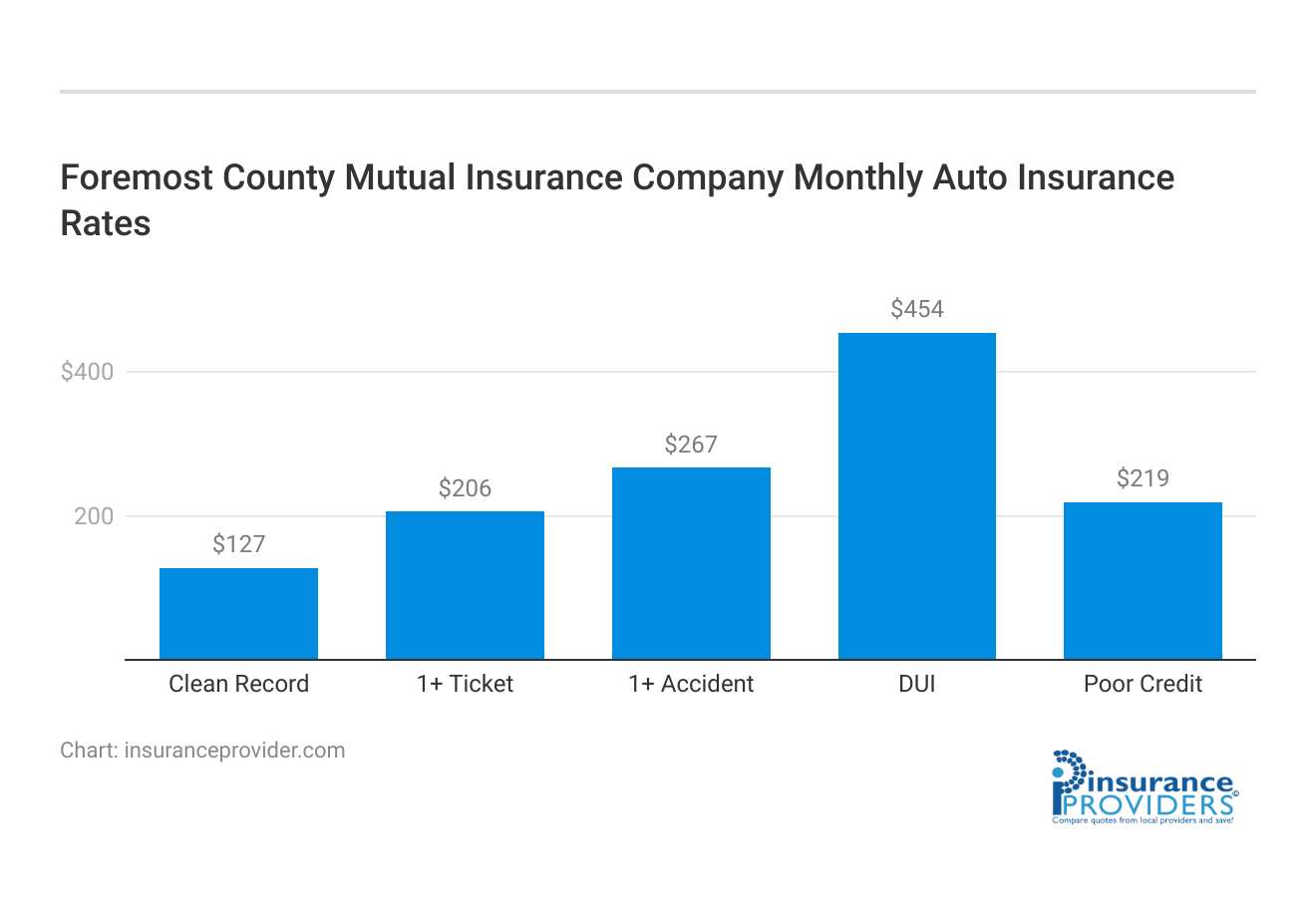

Foremost County Mutual Insurance Company Insurance Rates Breakdown

| Driver Profile | Foremost County Mutual Insurance | National Average |

|---|---|---|

| Clean Record | $127 | $119 |

| 1+ Ticket | $206 | $147 |

| 1+ Accident | $267 | $173 |

| DUI | $454 | $209 |

| Poor Credit | $219 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Foremost County Mutual Insurance Company Discounts Available

| Discounts | Foremost County Mutual Insurance |

|---|---|

| Anti Theft | 20% |

| Good Student | 17% |

| Low Mileage | 22% |

| Paperless | 13% |

| Safe Driver | 31% |

| Senior Driver | 19% |

Foremost County Mutual Insurance Company offers a variety of discounts to qualifying customers. These discounts can help policyholders save on their insurance premiums. Some of the discounts offered by the company include:

- Multi-policy discount: Customers who bundle multiple policies, such as home and auto insurance, with Foremost County Mutual Insurance Company may be eligible for a multi-policy discount.

- Safe driver discount: Policyholders with a clean driving record and no at-fault accidents or traffic violations may qualify for a safe driver discount.

- Home safety features discount: Customers who have installed safety features in their homes, such as smoke detectors, burglar alarms, or fire extinguishers, may be eligible for a discount.

- Mature homeowner discount: Policyholders who are 55 years or older and own their home may qualify for a mature homeowner discount.

- Paid-in-full discount: Customers who pay their annual premium in full upfront may be eligible for a paid-in-full discount.

- Renewal discount: Policyholders who renew their policy with Foremost County Mutual Insurance Company may be eligible for a renewal discount.

Please note that discounts and eligibility criteria may vary by state and policy, and it’s best to contact the company directly for specific information on available discounts.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Foremost County Mutual Insurance Company Ranks Among Providers

Foremost County Mutual Insurance Company faces competition from other insurance companies offering similar products and services. Some of its main competitors include:

- State Farm: Known for its extensive network and personalized service, providing coverage across various insurance types.

- Allstate: Offers a comprehensive range of insurance products, emphasizing personalized coverage and customer support.

- Farmers Insurance: Recognized for its diverse insurance solutions and commitment to customer satisfaction.

- Progressive: Stands out for innovation, with a focus on user-friendly technology and competitive rates.

- Nationwide: A reliable choice offering a broad spectrum of insurance options with a strong customer-centric approach.

- Geico: Renowned for its cost-effective policies and straightforward approach to insurance.

- Liberty Mutual: Providing comprehensive coverage and a range of policy options to meet diverse needs.

- USAA: Catering to military personnel and their families, known for exceptional service and specialized coverage.

These companies offer a wide range of insurance products, including home, auto, and business insurance. They may also offer discounts and promotions to attract customers. However, Foremost County Mutual Insurance Company distinguishes itself from its competitors by providing tailored insurance solutions for residents in rural communities and offering specialized coverage options.

Frequently Asked Questions

What types of insurance does Foremost County Mutual Insurance Company offer?

Foremost County Mutual Insurance Company offers home, auto, renters, umbrella, flood, motorcycle, off-road vehicle, and boat insurance.

What states does Foremost County Mutual Insurance Company operate in?

Foremost County Mutual Insurance Company operates in select states. Please check their website for specific coverage areas.

How can I contact Foremost County Mutual Insurance Company?

Contact them through their website or by calling their customer service hotline.

How can I qualify for discounts with Foremost County Mutual Insurance Company?

Contact the company or a local agent for specific details on discounts, which may include safe driving, bundling, and loyalty discounts.

Does Foremost County Mutual Insurance Company have a mobile app?

No, Foremost County Mutual Insurance Company does not currently have a dedicated mobile app for managing policies or filing claims. However, customers can access their accounts and policy information online through the company’s website.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.