Forethought Life Insurance Company: Customer Ratings & Reviews [2026]

Forethought Life Insurance Company stands as a distinguished provider in the realm of life insurance and annuity products, offering a range of comprehensive options tailored to meet the unique needs and financial goals of its customers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Jimmy McMillan

Updated April 2024

Forethought Life Insurance Company is a reputable insurance provider that offers a variety of life insurance and annuity products.

With an A- rating from A.M. Best, Forethought Life Insurance Company provides competitive rates compared to other providers, along with discounts for eligible policyholders. The company’s flexible and customizable policy options make it easy for customers to find a plan that suits their needs.

With a low complaint level and excellent customer service, Forethought Life Insurance Company is a top choice for those in need of life insurance. While availability may be limited in some areas, overall, the company provides reliable and comprehensive insurance coverage for its customers.

What You Should Know About Forethought Life Insurance Company

Company Contact Information:

- Phone: 1-800-642-4657

- Email: customerservice@forethought.com

- Mailing Address: Forethought Life Insurance Company, 10 West Market Street, Suite 2300, Indianapolis, IN 46204

Related Parent or Child Companies:

Forethought Financial Group, Inc.

Financial Ratings:

- A.M. Best: A-

Customer Service Ratings:

- Forethought Life Insurance Company has excellent customer service with high ratings from customers.

Claims Information:

- Customers can file claims online through the company’s website or by calling their claims department at 1-800-642-4657.

Company Apps:

- Forethought Life Insurance Company does not currently have a mobile app available.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Forethought Life Insurance Company Insurance Coverage Options

Forethought Life Insurance Company offers a variety of life insurance and annuity products to meet the needs of its customers. These coverage options include:

- Term life insurance: Provides coverage for a specified period, typically ranging from 10 to 30 years.

- Whole life insurance: Offers lifetime coverage and builds cash value over time.

- Universal life insurance: A flexible type of life insurance that allows customers to adjust their coverage and premiums over time.

- Indexed universal life insurance: Similar to universal life insurance but with the potential to earn higher interest rates based on the performance of an underlying index.

- Variable universal life insurance: Similar to universal life insurance but with the ability to invest the cash value portion of the policy in various investment options.

Forethought Life Insurance Company also offers annuity products, including fixed annuities and indexed annuities. Annuities can provide a guaranteed stream of income in retirement and may be a good option for those looking to supplement their retirement savings.

Read more: Understanding Indexed Universal Life Insurance

Forethought Life Insurance Company Insurance Rates Breakdown

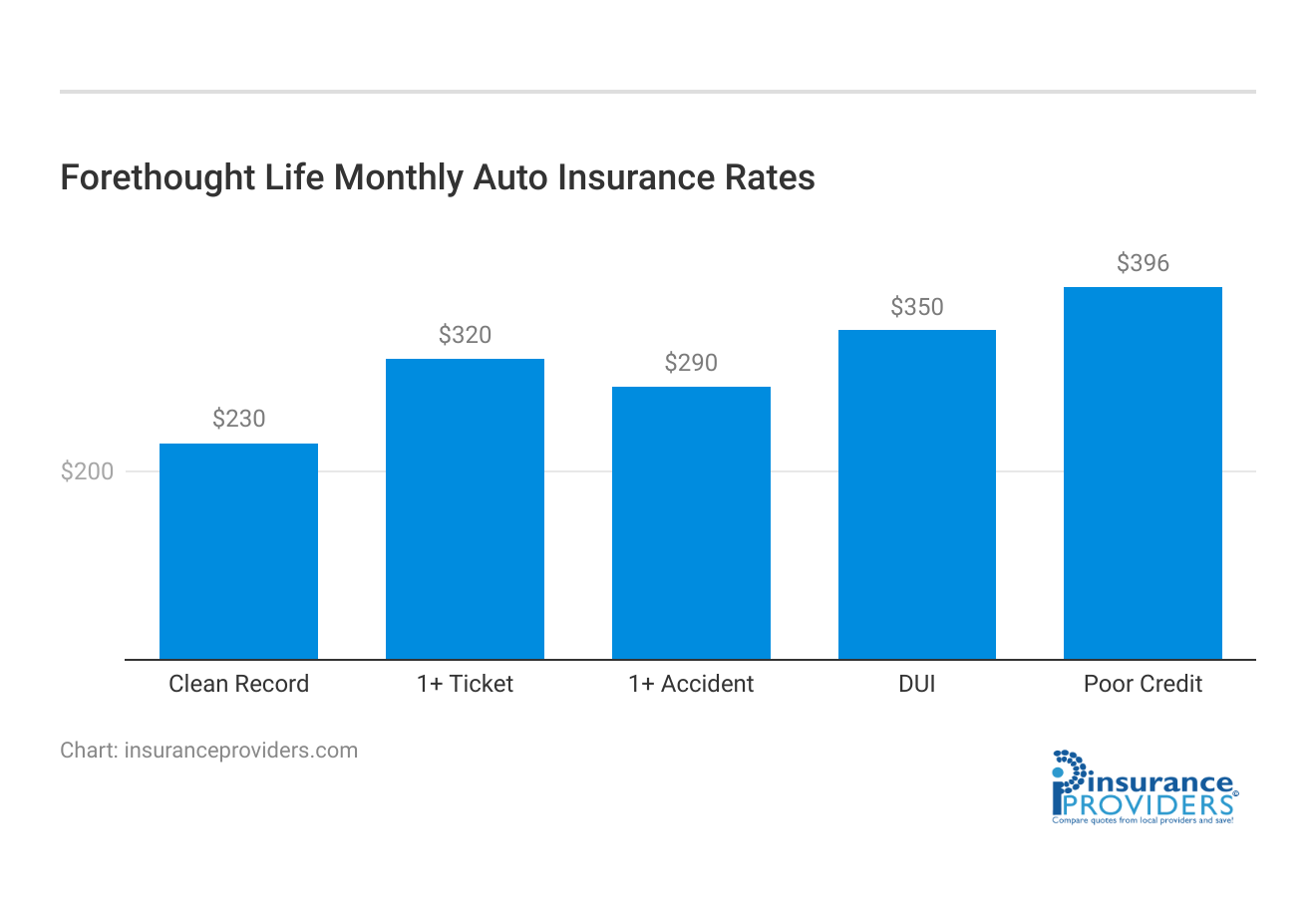

| Driver Profile | Forethought Life Insurance Company | National Average |

|---|---|---|

| Clean Record | $230 | $220 |

| 1+ Ticket | $320 | $300 |

| 1+ Accident | $290 | $280 |

| DUI | $350 | $330 |

| Poor Credit | $396 | $378 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Forethought Life Insurance Company Discounts Available

| Discount | Forethought Life Insurance Company |

|---|---|

| Anti Theft | 10% |

| Good Student | 15% |

| Low Mileage | 8% |

| Paperless | 5% |

| Safe Driver | 15% |

| Senior Driver | 12% |

Forethought Life Insurance Company offers various discounts to eligible policyholders to help them save money on their life insurance premiums. These discounts include:

- Multi-policy discount: Customers can save money by bundling their life insurance policy with other insurance policies, such as home or auto insurance.

- Healthy lifestyle discount: Customers who lead a healthy lifestyle, such as non-smokers or those who maintain a healthy weight, may be eligible for discounted rates.

- Safe driving discount: Customers who have a good driving record may be eligible for a safe driving discount.

- Loyalty discount: Customers who have been with Forethought Life Insurance Company for a certain period may be eligible for a loyalty discount.

- Preferred rates: Customers who meet certain criteria, such as a high income or excellent health, may be eligible for preferred rates, which offer lower premiums than standard rates.

Overall, these discounts can help eligible policyholders save money on their life insurance premiums and make life insurance more affordable. It’s important to note that not all customers may be eligible for these discounts, and discounts may vary by state and policy.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Forethought Life Insurance Company Ranks Among Providers

Forethought Life Insurance Company operates in a competitive market with many other life insurance providers offering similar products and services. Some of Forethought’s main competitors include:

- Prudential Financial: As one of the largest life insurance companies in the U.S., Prudential offers a variety of life insurance products and annuities to its customers.

- MetLife: Another large life insurance provider, MetLife offers a range of life insurance and annuity products, as well as other financial products and services.

- Northwestern Mutual: A mutual company that offers life insurance, disability income insurance, and long-term care insurance, as well as investment and wealth management services.

- New York Life: A mutual company that offers life insurance and annuity products, as well as investment and retirement solutions.

- MassMutual: Offers life insurance, disability income insurance, and long-term care insurance, as well as retirement and investment solutions.

While Forethought Life Insurance Company may face competition from these and other providers, the company has carved out a niche in the market by offering a range of coverage options and excellent customer service. By continuing to innovate and adapt to changing customer needs, Forethought will remain a strong player in the life insurance industry.

Frequently Asked Questions

Where can I find customer ratings and reviews for Forethought Life Insurance Company?

You can find customer ratings and reviews for Forethought Life Insurance Company on various online platforms such as insurance review websites, consumer advocacy websites, and social media platforms. Additionally, you may also find reviews on the company’s official website or by reaching out to their customer service for testimonials.

Are customer ratings and reviews important when considering Forethought Life Insurance Company?

Customer ratings and reviews can provide valuable insights into the experiences and satisfaction levels of existing customers. While they should not be the sole factor in your decision-making process, they can help you assess the company’s reputation, customer service quality, and overall satisfaction levels reported by policyholders.

How can I interpret customer ratings and reviews effectively?

When interpreting customer ratings and reviews, it’s important to consider the overall sentiment and the number of reviews. A high volume of positive reviews generally indicates a positive customer experience. Conversely, a large number of negative reviews might suggest potential issues. Look for specific details within the reviews to understand the reasons behind the ratings.

What if I can’t find any customer ratings or reviews for Forethought Life Insurance Company?

If you cannot find customer ratings and reviews for Forethought Life Insurance Company, it could mean that there is limited feedback available or that the company is relatively new. In such cases, you may want to rely on other factors like financial stability, industry ratings, and the company’s reputation to make an informed decision.

Can I trust the customer ratings and reviews found online?

While customer ratings and reviews can be helpful, it’s essential to approach them with some caution. Not all reviews may be genuine, and some might be biased or based on individual experiences. Look for patterns in reviews and consider multiple sources to get a more balanced perspective.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.