Founders Auto Insurance Review [2026]

Founders Insurance, a non-standard auto insurance provider operating in Illinois, Indiana, Ohio, and Wisconsin, stands out by offering flexible underwriting without credit requirements.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated April 2024

Founders Insurance sells non-standard, low-cost auto insurance policies in Illinois, Indiana, Ohio, and Wisconsin. So high-risk individuals, people with international licenses, and even customers with poor credit can buy Founders Insurance auto insurance policies at a reasonable rate.

In this Founders Insurance auto insurance review, compare customer and financial ratings, learn how to request a quote, and more to determine if this company is a good match for you. After learning about affordable Founders Insurance auto insurance, don’t forget to enter your ZIP code into our free tool above to compare quotes from the top companies in your region.

What You Should Know About Founders Insurance Company

Founders Insurance auto insurance company is a non-standard insurer selling auto policies in four states. You can only secure Founders insurance quotes if you live in Illinois, Indiana, Ohio, or Wisconsin. According to the website, Founders provides drivers with flexible underwriting and personalized coverage with no credit requirements.

So you can get auto insurance with bad credit from Founders. This company provides services for higher-risk individuals who may struggle to secure coverage from traditional companies. Those customers include people in need of SR-22 insurance, new drivers or people with no prior insurance history, auto insurance for bad driving records, and people with international licenses.

You can purchase most of the basic auto insurance coverages from Founders Insurance, including liability, collision, and comprehensive insurance. Plus, Founders also sells medical payments (MedPay) coverage, at least in Wisconsin, where it is legally required.

However, you must contact your independent insurance agent for details about any optional policy add-ons available to you. Currently, there is no Founders Insurance mobile app for customers to use. However, the company does offer a mobile-friendly website designed specifically for when you’re on the go.

Customers also create Founders Insurance logins on the company website that apply to the mobile web link as well. Once you’ve created an account, you can access your ID cards, make necessary policy changes, pay your bill, file claims, and more, all within the customer portal.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the history of Founders Insurance?

Founders Insurance started by selling fire insurance policies in 1901 in Des Plaines, Illinois. With just $100,000 of capital, a small group of farmers, merchants, and homeowners came together to form the Mutual Fire Insurance Company.

In 1960, it merged with Founders Mutual Insurance Company but mainly focused on fire insurance and liquor liability coverage throughout most of the 1950s. Finally, in the 1990s, after the company exchanged leadership a few times, Founders Insurance started selling personal auto insurance policies.

Today, Founders sells both traditional and non-standard auto insurance policies in four states. Plus, it offers homeowner and business insurance policies in 22 states.

Founders Insurance Company Insurance Coverage Options

Founders Insurance offers a range of coverage options to cater to the diverse needs of its customers. Whether you’re a high-risk driver or seeking specialized insurance, Founders provides flexible solutions. Here are the coverage options available:

- Liability Coverage: Provides protection for bodily injury and property damage you may cause to others.

- Collision Coverage: Covers damage to your vehicle resulting from a collision with another object.

- Comprehensive Coverage: Protects against non-collision incidents such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): Offers coverage for medical expenses and other related costs after an accident.

- Uninsured/Underinsured Motorist Coverage: Protects you if involved in an accident with a driver who has insufficient or no insurance.

Tailoring your insurance to your specific needs is crucial, and Founders Insurance provides a comprehensive array of coverage options. To determine the right mix for your situation, consider consulting with an independent insurance agent or contacting Founders directly.

Founders Insurance does sell several other insurance products besides personal auto insurance policies. For example, if you live in Illinois, Founders provides renters coverage for houses, condos, townhomes, and apartments with rates starting at just $1 per day.

Founders Insurance also sells homeowner policies in Illinois and offers a home and auto bundle deal to customers living in that state. Plus, you can purchase commercial auto insurance coverage as long as the vehicle weighs less than 16,000 pounds and travels under a 200-mile radius.

You can purchase snowplow and landscaping insurance policies in both Illinois and Indiana. Finally, Founders Insurance specializes in hospitality industry insurance policies, including special events coverage and liquor liability policies.

According to the website, Founders provides coverage for events ranging from weddings to farmers’ markets and more. It’s been in the hospitality insurance industry for over 50 years and currently supplies coverage in 18 different states across the country.

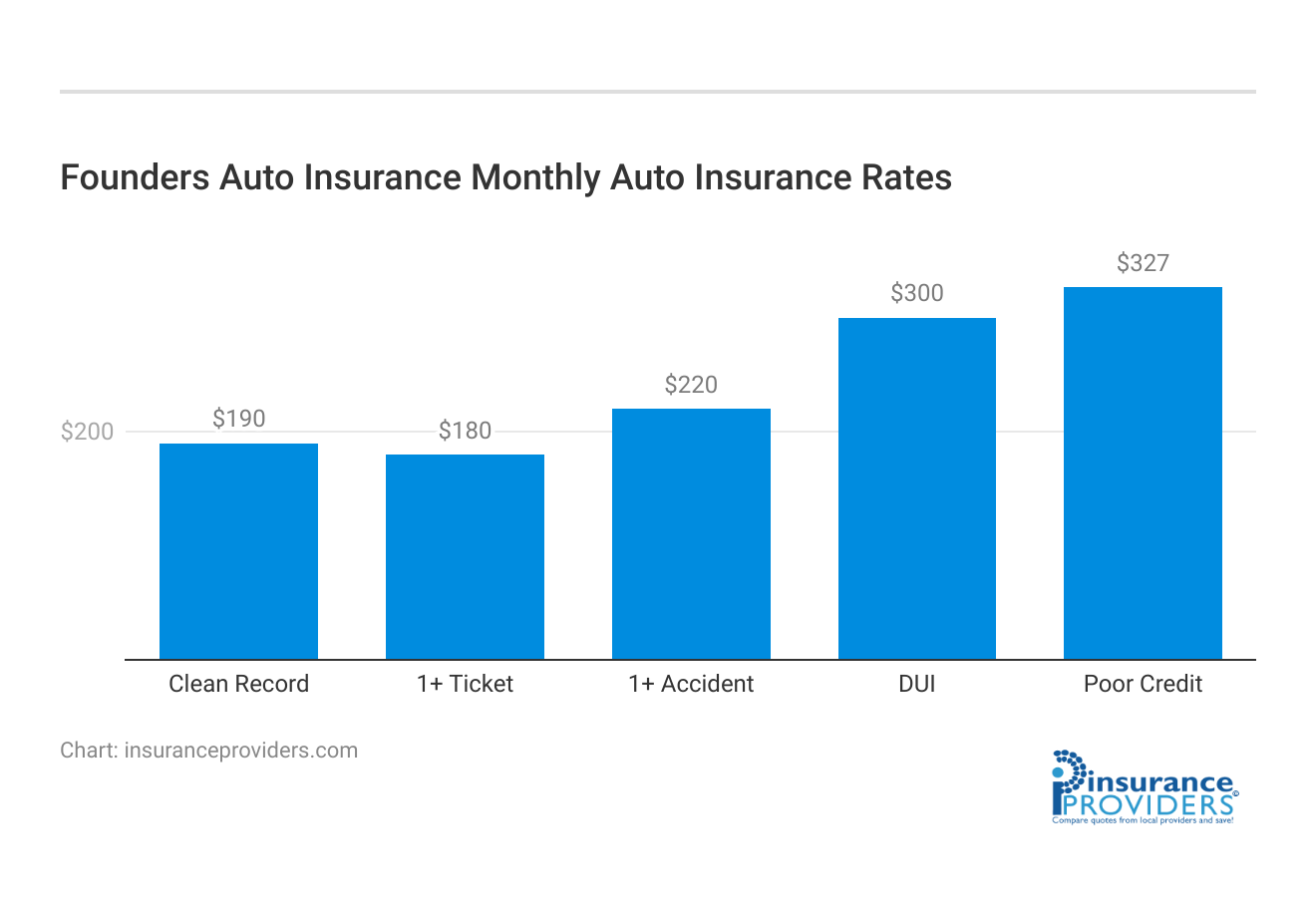

Founders Insurance Company Insurance Rates Breakdown

| Driver Profile | Founders Auto Insurance | National Average |

|---|---|---|

| Clean Record | $190 | $199 |

| 1+ Ticket | $180 | $200 |

| 1+ Accident | $220 | $250 |

| DUI | $300 | $350 |

| Poor Credit | $327 | $342 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Currently, Founders Insurance auto insurance rates are not publicly available. However, the website provides a sample rate of $141.78 per month. If you request a quote, consider comparing it to the average cost of auto insurance in the state where you live.

The table below compares the average annual auto insurance expenditures in the four states where Founders operates, as recorded by the Insurance Information Institute (III).

Average Annual Auto Insurance Expenditures by State

| State | Average Annual Auto Insurance Expenditures |

|---|---|

| Illinois | $916.49 |

| Indiana | $767.72 |

| Ohio | $794.91 |

| Wisconsin | $755.97 |

Many factors impact your auto insurance rates, including your age, ZIP code, coverage needs, and driving record. Plus, if you’re a high-risk driver, your rates will likely be substantially higher than average. So to accurately secure your best possible rates, compare quotes from multiple of the best insurance companies, including standard and non-standard insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Founders Insurance Company Discounts Available

| Discount | Founders Auto Insurance |

|---|---|

| Anti Theft | 10% |

| Good Student | 7% |

| Low Mileage | 5% |

| Paperless | 8% |

| Safe Driver | 10% |

| Senior Driver | 5% |

Founders Insurance provides various discounts to enhance affordability for its customers. These discounts can contribute to potential savings on your auto insurance premiums, making coverage more accessible. Here are some of the available discounts:

- Multi-car Discount: Save by insuring multiple vehicles under a single policy.

- Transfer Discount: Earn discounts when switching to Founders Insurance from another provider.

- Homeowners Discount: Enjoy savings if you own a home.

- Renewal Discount: Receive discounts upon renewing your policy with Founders Insurance.

Exploring and leveraging these discounts can play a crucial role in optimizing your insurance costs with Founders. To understand specific details and eligibility criteria, it’s advisable to contact your independent insurance agent or reach out to Founders Insurance directly.

Founders Insurance does offer some stackable discounts to customers, but availability is limited by state. According to the website, you may earn multi-car, transfer, homeowners, and renewal discounts as a Founders Insurance customer. However, there are no available details about exactly how much you may save by earning the discounts.

Additional rate reductions may also be available to you. Contact your independent insurance agent or call the company directly to know what discounts you can earn from Founders.

How Founders Insurance Company Ranks Among Providers

In the competitive landscape of auto insurance, Founders Insurance faces various contenders, each vying to meet the diverse needs of policyholders. Here are some key competitors in the market:

- State Farm: A leading provider known for its extensive network and diverse coverage options.

- Geico: Recognized for competitive rates and a user-friendly online platform.

- Progressive: Renowned for its innovative policies and a focus on customer convenience.

- Allstate: Offers a wide range of coverage options and personalized policy features.

- Farmers Insurance: Known for comprehensive coverage and strong customer service.

Navigating the options among these competitors allows consumers to make informed decisions about their auto insurance. Consider comparing quotes, assessing coverage features, and consulting with an independent insurance agent to find the policy that aligns best with your preferences and requirements.

How do you request Founders Insurance auto insurance quotes?

To request Founders Insurance auto insurance quotes, you must use an independent agent. In fact, all Founders Insurance policies are sold by independent agents. So this means there are no convenient online quote tools for you to use on the Founders Insurance website.

But you can find independent agents near you on the company website. Independent agents differ from captive agents in that they remain loyal to the customer, not to one specific company. Know that once you connect with an agent, they may also provide you with quotes from other companies they’re contracted with besides Founders.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How do you file an auto insurance claim with Founders Insurance?

To file a Founders Insurance auto insurance claim, you may use the company website or the mobile web link or call the Founders Insurance phone number for the claims department directly. If you use the website or mobile link, you can log in to your customer account or report a claim without signing in. Next, you’re prompted to fill out a small form and provide details about the incident.

If you prefer to talk to someone directly, you can call the company to file claims on weekdays between 8 a.m. and 5 p.m. central time. Plus, the office accepts calls for new losses only on Saturdays until 1 p.m. central time.

How are the Founders Insurance ratings and reviews?

It’s a good idea to look into an insurance company’s customer ratings and financial reviews. This way, you can determine if a company is reliable and efficient before committing to a full policy. The good news is that Founders earned an A (Excellent) score from one of the leading credit rating agencies, A.M. Best.

This implies that Founders is financially robust and can follow through on any promises it makes to policyholders. Plus, despite not being Better Business Bureau (BBB) accredited, this company earned an A- score, suggesting it interacts positively with customers.

However, according to the National Association of Insurance Commissioners (NAIC), Founders earned a complaint index score of 7.19. The median is always set to 1.00, and lower scores are ideal. So, unfortunately, a 7.19 means Founders received seven times as many customer complaints as the median.

Founders’ customers primarily complain about a slow-moving claims process and fluctuating auto insurance prices. While it’s typical for insurance companies to receive negative reviews online, it’s important to keep these customer experiences in mind while you shop around for your best coverage.

Frequently Asked Questions

What is Founders Auto Insurance?

Founders Auto Insurance is an insurance company that offers coverage for automobiles. They provide a range of policies and options to meet the needs of drivers.

How can I contact Founders Auto Insurance?

To contact Founders Auto Insurance, you can visit their website and find their contact information. They typically have a customer service phone number and email address available for inquiries.

What types of auto insurance policies does Founders Auto Insurance offer?

Founders Auto Insurance offers various types of auto insurance policies, including liability coverage, collision coverage, comprehensive coverage, personal injury protection (PIP), uninsured/underinsured motorist coverage, and more. They also offer optional add-ons and discounts.

How can I get a quote from Founders Auto Insurance?

To get a quote from Founders Auto Insurance, you can visit their website and fill out the quote request form. You will typically need to provide information such as your personal details, vehicle information, driving history, and desired coverage options.

Can I manage my Founders Auto Insurance policy online?

Yes, Founders Auto Insurance usually provides an online portal or mobile app where policyholders can manage their policies. This includes accessing policy documents, making payments, updating personal information, and filing claims.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.