Fremont Auto Insurance Review [2026]

Fremont Auto Insurance, exclusively available to Michigan drivers through independent agents, offers affordable policies with a comprehensive range of coverage options, including liability, collision, and additional add-ons like roadside assistance and guaranteed asset protection.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Heidi Mertlich

Updated April 2024

Fremont Insurance auto insurance policies are only offered in Michigan through independent agents. However, as of 2021, the company expanded its business insurance offerings into Wisconsin.

In this Fremont Insurance auto insurance review, we’ll compare customer and financial ratings, learn about the claims department, and determine if Fremont Insurance is a good fit for you.

After reading about affordable Fremont Insurance auto insurance, compare quotes and secure the best coverage for you by entering your ZIP code into our free rate comparison tool above.

What You Should Know About Fremont Insurance Company

Fremont Insurance auto insurance company is a subsidiary of the Auto Club Insurance Association, an AAA auto insurance company affiliate. (For more information, read our “Is AAA the same as Auto Club?“).

Currently, this company only sells auto insurance in Michigan.

But as of 2021, it also provides business insurance in both Michigan and Wisconsin.

You can purchase all of the standard auto insurance coverages through Fremont Insurance to meet or exceed the minimum insurance limits required by Michigan law.

View the legal auto insurance limits required in Michigan in the table below.

Michigan Auto Insurance Coverage Requirements

| Auto Insurance Coverage Type | Minimum Required Limits |

|---|---|

| Bodily injury liability per person | $50,000 |

| Bodily injury liability per incident | $100,000 |

| Property damage liability insurance | $10,000 |

| Personal injury protection (PIP) insurance | Choice between unlimited coverage, or up to $500,000 in coverage, or up to $250,000 in coverage, or up to $250,00 with PIP medical exclusions including non-Medicare health insurance coverage, or up to $50,000 in coverage if enrolled in Medicaid or other qualifying health insurance coverage, or fully opt-out if the named insured has Medicare Parts A and B. |

Law changes went into effect in 2020 that allow Michigan drivers to waive personal injury protection (PIP) insurance or select lower levels of coverage.

Besides liability, collision, and comprehensive insurance, this company also sells PIP insurance, uninsured or underinsured motorist coverage, and rental car reimbursement.

For additional coverages, Fremont Insurance offers a handful of optional policy add-ons.

Additional products include roadside assistance and guaranteed asset protection (GAP) insurance.

There’s also full glass coverage, accident or violation forgiveness, excess attendant care, and an enhanced physical damage coverage option.

The excess attendant care option includes additional care for certain policies with limited PIP protection.

The enhanced vehicle damage coverage includes new car replacement services and emergency transportation coverage.

Currently, there is no Fremont Insurance mobile app for customers to use. However, the website provides you with a membership portal to create a log-in.

You can file claims, make necessary policy changes, access your ID cards, and more within the membership portal.

Plus, a handful of Fremont Insurance “pay bill” options are available to customers, including the membership portal, company website, or by contacting the company directly.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How do you request Fremont Insurance auto insurance quotes?

All Fremont Insurance auto insurance quotes come from independent agents. This company does not even provide a quote tool on the website.

What are insurance brokers or independent agents? They are licensed insurance professionals who pull quotes from multiple companies.

Captive agents, on the other hand, typically only work for a single company.

So to request rates, you must contact one of the independent agents affiliated with Fremont Insurance.

While there’s no quote tool, the company website does provide you with a place to enter your ZIP code for a list of available agents near you.

Plus, you can also contact the company directly by calling the home office phone number at 231-924-0300 or sending an email to Info@fmic.com for further assistance.

How do you file an auto insurance claim with Fremont Insurance?

Visit the company website and access the claims center to file Fremont Insurance auto insurance claims.

There, you’re prompted to enter your customer ID or email, as well as your membership portal password.

You can also contact your licensed agent directly to file a claim.

Or, you may call the emergency claims service department phone number at 1-800-550-0325 if it’s after regular business hours.

The claims phone number is also the same number used for roadside assistance.

However, it is not the same as the Fremont Insurance customer service number.

Afterward, you’ll be contacted by your claims specialist, who helps you through the entire process.

Your claims specialist also updates you about the status of your claim. But you can also check the status of any open claims on the company website.

What are the Fremont Insurance ratings and reviews?

Analyzing an insurance company’s financial scores and customer reviews allows you to determine if a company is reliable and efficient before committing to a policy term.

Fortunately, Fremont Insurance earned an A (Excellent) financial evaluation score from the leading credit rating agency, A.M. Best.

This implies that Fremont Insurance can reliably follow through on any promises or obligations to policyholders.

When it comes to the customer experience, Fremont Insurance earned a complaint index of 0.55, according to the National Association of Insurance Commissioners (NAIC).

The complaint index median is always set to 1.00, and lower scores are better. So a 0.55 is impressive and means this company receives fewer customer complaints than the median.

Plus, according to the company website, Fremont Insurance maintains a retention rate of over 90%.

So overall, it appears real Fremont customers are satisfied with their insurance experiences with this company.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Fremont Insurance Company Insurance Coverage Options

Fremont Insurance does sell a variety of additional insurance products besides auto policies.

For auto or recreation options, this company also sells marine, RV, camper, ATV, and snowmobile insurance.

In addition, Fremont sells homeowners insurance and coverage for renters, condos, and mobile homes.

Plus, you can purchase umbrella insurance from Fremont Insurance as well. All policies are currently available only in Michigan.

However, as of 2021, Fremont expanded its business insurance offerings into Wisconsin and Michigan.

What is the history of Fremont Insurance?

Fremont Insurance started selling policies in Michigan back in 1876 under the name Patron’s Mutual Farm Fire Insurance Company of Newaygo and Muskegon Counties.

It became a state-wide farm fire insurance company in 1932. However, it wasn’t until 2004 that the company demutualized and became the Fremont Insurance Company.

In 2011, with over 75,000 policyholders, Fremont became part of the Auto Club Group, an affiliate of AAA, to assist with its growth and service improvements.

In 2021, the company started rolling out plans to expand its business insurance offerings into Michigan and Wisconsin.

Today, with more than 130,000 policies and 53,000 customers, the company focuses on selling policies in Michigan and Wisconsin designed to meet the needs of the unique customer base.

Fremont Insurance: The Bottom Line

Overall, if you live in Michigan, consider adding Fremont Insurance auto insurance company to your comparison shopping list.

Not only are Fremont Insurance reviews from real customers overwhelmingly positive, but this company is also rated highly by credit rating companies like A.M. Best.

However, some customers may prefer using a company that doesn’t rely on independent agents for services. Plus, this company does not offer a mobile app to drivers.

So remember to compare quotes from multiple companies to truly find your best auto insurance coverage.

You’ve learned how to buy Fremont Insurance auto insurance, now secure the best policy for you by entering your ZIP code into our free quote comparison tool below and receive rates from the best companies near you.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

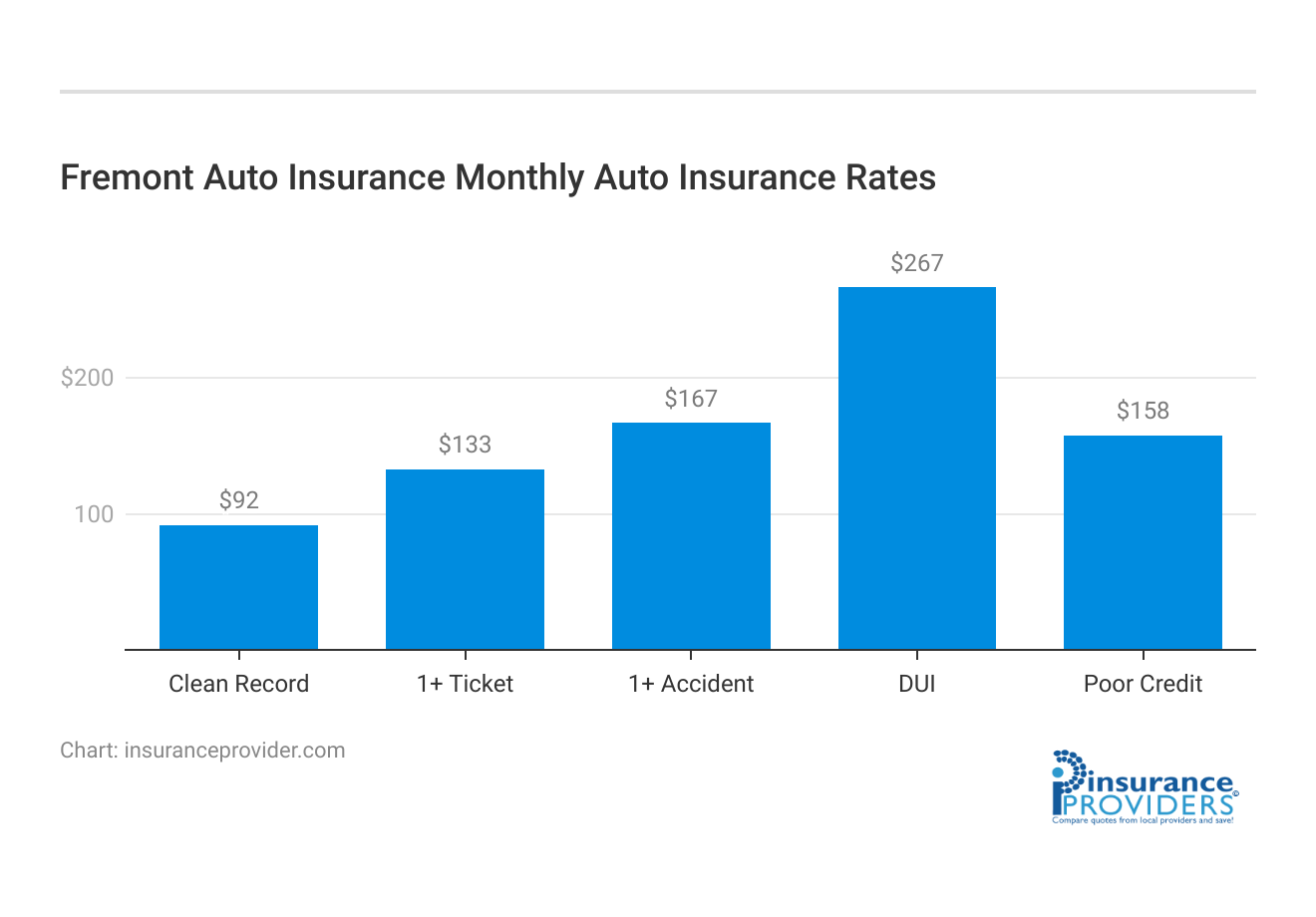

Fremont Insurance Company Insurance Rates Breakdown

| Driver Profile | Fremont Auto | National Average |

|---|---|---|

| Clean Record | $92 | $119 |

| 1+ Ticket | $133 | $147 |

| 1+ Accident | $167 | $173 |

| DUI | $267 | $209 |

| Poor Credit | $158 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

At this time, Fremont Insurance auto insurance rates are not publicly available. However, if you request a quote, you can compare it to the average insurance cost in Michigan.

The table below compares the average annual and monthly expenditures for various types of auto insurance in Michigan as recorded by the Insurance Information Institute (III).

Michigan Average Auto Insurance Expenditures

| Auto Insurance Policy Type | Average Monthly Auto Insurance Expenditure | Average Annual Auto Insurance Expenditure |

|---|---|---|

| Liability insurance | $79.35 | $952.15 |

| Collision insurance | $39.92 | $479.11 |

| Comprehensive insurance | $13.26 | $159.08 |

| Average total expenditure | $122.48 | $1,469.73 |

The data above reflects average rates prior to the law change. But remember, changes to the minimum PIP insurance requirements allow drivers to waive the coverage or choose lower limits.

That coverage change does impact the average auto insurance rates in your state.

Plus, many other factors also influence your auto insurance rates, including your age, driving record, coverage needs, and even the make and model of the type of vehicle you drive.

So ultimately, to secure your lowest possible costs, it’s worth comparing your Fremont Insurance quote to rates from other best insurance companies as well.

Fremont Insurance Company Discounts Available

| Discounts | Fremont Auto |

|---|---|

| Anti Theft | 7% |

| Good Student | 10% |

| Low Mileage | 5% |

| Paperless | 8% |

| Safe Driver | 13% |

| Senior Driver | 6% |

Fremont Insurance offers a few discounts to drivers that lead to some minor policy rate reductions.

According to the website, Fremont provides a multi-car discount to drivers who insure more than one vehicle under their personal auto insurance policy.

You can also earn a multi-policy discount by bundling more than one insurance line through Fremont.

Plus, if you’re a member of specific associations, you may qualify for group discounts through Fremont Insurance.

Finally, if you’re a young driver, you may qualify for a good student discount by maintaining B grades or higher. However, you must contact an independent agent for a complete list of available discounts.

Frequently Asked Questions

What types of auto insurance coverage does Fremont Auto Insurance offer?

Fremont Auto Insurance provides standard auto insurance coverage, including liability, collision, and comprehensive coverage. Additionally, they offer personal injury protection, uninsured or underinsured motorist coverage, and rental car reimbursement.

How can I obtain a quote from Fremont Auto Insurance?

To get a quote from Fremont Auto Insurance, you need to contact one of the independent agents affiliated with the company. Fremont Auto Insurance does not provide a quote tool on its website.

Is Fremont Auto Insurance available outside of Michigan?

Fremont Auto Insurance expanded its business insurance offerings into Wisconsin. However, they only offer auto insurance policies to drivers in Michigan.

What are the average auto insurance rates and customer satisfaction metrics for Fremont Insurance?

As of the provided information, the average cost of auto insurance from Fremont Auto Insurance for Michigan drivers is $122.47 per month or $1,469.73 per year. Customer satisfaction metrics include an A (Excellent) financial evaluation score from A.M. Best and a complaint index of 0.55 from the National Association of Insurance Commissioners (NAIC).

How do I file an auto insurance claim with Fremont Insurance?

To file an auto insurance claim with Fremont Insurance, you can visit the company website and access the claims center. Alternatively, you can contact your licensed agent directly or call the emergency claims service department phone number at 1-800-550-0325 if it’s after regular business hours.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.