Garrison Property and Casualty Insurance Company: Customer Ratings & Reviews [2026]

Garrison Property and Casualty Insurance Company, based exclusively in California, offers a range of insurance products, including auto, home, life, business, and motorcycle coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated April 2024

Garrison Insurance may be a great fit if you’re on the hunt for property and casualty insurance. Garrison Property and Casualty Insurance Company offers several different insurance products, and the company may have more competitive rates than other companies in your area, depending on what you’re looking for.

Garrison Insurance offers auto, home, life, business, and motorcycle insurance — along with other insurance products — with competitive rates. Unfortunately, Garrison products are only available in California.

Keep Garrison Property and Casualty Insurance in mind as you search for the insurance you need, especially if you live in Chula Vista or San Diego. You may find the company offers just what you need in terms of insurance coverage.

It’s important for anyone looking for insurance to shop online and compare quotes from multiple providers before making any official coverage decisions. When you compare quotes online, you can determine which company offers the coverage you’re looking for at a rate that works with your budget.

What You Should Know About Garrison Property and Casualty Insurance Company

Garrison Insurance may be a great fit if you’re on the hunt for property and casualty insurance. Garrison Property and Casualty Insurance Company offers several different insurance products, and the company may have more competitive rates than other companies in your area, depending on what you’re looking for.

Garrison Insurance offers auto, home, life, business, and motorcycle insurance — along with other insurance products — with competitive rates. Unfortunately, Garrison products are only available in California.

Keep Garrison Property and Casualty Insurance in mind as you search for the insurance you need, especially if you live in Chula Vista or San Diego. You may find the company offers just what you need in terms of insurance coverage.

It’s important for anyone looking for insurance to shop online and compare quotes from multiple providers before making any official coverage decisions. When you compare quotes online, you can determine which company offers the coverage you’re looking for at a rate that works with your budget.

Depending on where you live, you may find that several companies offer insurance coverage in your area. You need to take time to find the best option and ensure you get all the details before making any final decisions.

Garrison Property & Casualty Insurance Company could be exactly what you’re looking for in terms of an insurance company. If that’s the case, you can learn more about the company to determine which products might work best.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Does Garrison insurance have good ratings and reviews?

You won’t find much if you look online for Garrison Property and Casualty insurance reviews. The company has maintained obscurity in most cases. However, because Garrison is affiliated with USAA, the company benefits from USAA’s ratings and reviews.

A.M. Best, S&P, and Moody’s are financial strength and credit rating agencies. Garrison Property and Casualty share USAA’s ratings. Each rating listed in our research shows that USAA carries a stable financial outlook and has low credit risk. It has proven in many instances that it is a stable and sound company with a good outlook regarding future investments and endeavors.

USAA has an A++ (superior) rating with A.M. Best, suggesting the company is financially stable.

It has similar ratings with S&P — AA+, and it has an Aaa with Moody’s as well.

According to the National Association of Insurance Commissioners (NAIC), USAA’s complaint index ratio is average. This means USAA has its fair share of complaints, but no more than the average company of its size.

While Garrison Property and Casualty Insurance Company has its own name, its association with USAA means the company can benefit from some of USAA’s positive and strong insurance ratings.

Garrison Property and Casualty Insurance Company Insurance Coverage Options

Garrison Property and Casualty offers several insurance products throughout California. Some of the most popular products Garrison Insurance offers include:

- Auto insurance

- Home insurance

- Boat insurance

- Life insurance

- Business insurance

- Motorcycle insurance

If you live in California and are looking for additional insurance options, you may want to contact Garrison Insurance. The company states on its website that it offers more than just the products listed above, though it is not specific.

What types of coverage does Garrison offer for auto insurance?

While Garrison Property and Casualty is not Garrison Auto Insurance Company, it is still well known for its car insurance coverage options. If you choose auto insurance coverage with Garrison, you’ll likely be able to choose from the following coverages

- Liability coverage. Liability offers coverage to others if you’re at fault in an accident. With liability coverage, your insurance will pay for repairs to other people’s vehicles as well as hospital and doctor visits if individuals were injured in an accident you caused.

- Uninsured/underinsured motorist coverage. Uninsured or underinsured motorist coverage will pay for repairs to your vehicle and medical bills incurred after an accident if someone else caused it and did not carry the proper insurance.

- Collision coverage. Collision insurance covers your vehicle if you were in an accident and your car was damaged. Collision works regardless of fault, so you will be covered even if you caused the accident.

- Comprehensive coverage. Comprehensive coverage helps if your vehicle was damaged by something other than an accident. Damage from inclement weather, wild animals, and vandalism are covered by comprehensive insurance.

In addition to the coverages listed above, Garrison Property and Casualty Insurance may offer the following optional coverage options.

- GAP insurance. With GAP insurance, your insurance provider will pay the difference between what you owe on your vehicle and what it is worth based on its actual cash value. GAP coverage is most helpful for new vehicles that are less than two years old.

- Rental car reimbursement. You may have to rent a vehicle when your car is damaged and in the shop for repairs. If this is the case, rental car reimbursement will pay you back if you had to spend money out of pocket on the top rental car insurance coverage.

- Roadside assistance coverage. Roadside assistance coverage helps if you are stranded and in need of assistance. Most roadside assistance plans cover lockout services, flat tire repair, fuel delivery, and towing.

If you have an older car, you may want to purchase less coverage on your vehicle. You only have to carry 15/30/5 in minimum liability drive legally in California, which can save you hundreds per year on car insurance.

Still, it’s a good idea to consider buying additional coverage on your vehicle if you can afford it. Liability insurance only offers coverage to others if you are at fault in an accident. Liability will not help pay for repairs to your vehicle.

A full coverage policy, which includes both collision and comprehensive coverage, could be a great option for added protection. You can call Garrison Property and Casualty Insurance Company to learn more about your options.

What does Garrison home insurance cover?

Garrison does not specify on its website what its home insurance policies cover. If you want specific information from the company, you can call and speak with a representative to learn more about a homeowners policy with Garrison.

Because Garrison is a subsidiary of USAA, its home insurance policies may be similar. You might find cheap homeowner’s insurance coverage with Garrison.

A homeowner’s insurance policy with USAA will cover:

- Floors, walls, and cabinets in the home

- Garage doors

- Windows, chimneys, and roofs on the home

- Detached garages

- Fences

- Sheds and other small, unattached structures

- Furniture, jewelry, clothes, and electronics you own

You can purchase additional coverages with USAA, such as

- Loss of use

- Liability

- Medical payments

- Personal property protection

Each of the coverages listed above will help with very specific issues that come along with being a homeowner.

Loss of Use

You may encounter times when your home is damaged, and you require a temporary place to live. If that happens, a loss-of-use plan will pay for the increase in expenses.

Loss of use coverage helps with things like a hotel, apartment, restaurants, laundry services, moving expenses, and pet boarding. Without a loss-of-use coverage, you’ll pay for these things out of pocket.

Liability

Owning a home and inviting guests is a liability. Liability coverage is one of the most important aspects of a homeowners insurance policy. Liability coverage protects you if someone is injured on your property.

Most experts agree that your liability coverage should match your net worth, which would be the sum of your assets minus any debt. You may need to consider additional liability coverage if your assets are more than the highest level of coverage.

Some people choose to purchase additional liability coverage or an umbrella policy in the following circumstances

- They own a pool or trampoline.

- They own a large dog.

- They frequently invite guests onto their property, putting themselves at higher risk.

- They use social media or the internet to write reviews or share opinions about specific experiences. Some companies will sue for libel or slander, which is not typically covered in a standard home insurance policy.

Speak with an insurance professional with Garrison Property and Casualty to learn more about the coverages the company offers and what you might need.

Medical Payments

Medical payments coverage covers certain medical costs for individuals that were injured in your home or on your property. Medical payments coverage can also help pay for medical bills associated with injuries you caused while off your property. However, medical payments insurance does not cover lost wages or funeral expenses.

Most medical payment coverages do not extend past $5,000. This is because medical payment coverage is not intended to cover major injuries. Instead, this coverage helps to take care of smaller medical costs for injured guests.

You may wonder whether carrying medical payments and liability coverage is necessary. While it’s probably not required by your homeowners’ association, you should consider keeping both coverages on a policy.

Liability claims are often much more serious, and the deductible for this type of claim can be expensive. But deductibles for medical payment claims often cost less, which can save you money in the long run.

Personal Property Protection

Personal property protection is included in many home insurance plans. It often reimburses individuals when they lose personal items, like furniture, jewelry, firearms, and more. While personal property insurance can be helpful, you should ensure your home insurance plan covers items based on replacement cost rather than actual cash value.

Unless you collect antiques, your personal property will depreciate in value over time. You will want the item replaced if that property is damaged in a fire. But if you go with an actual cash value policy, you will only receive the amount for what the item is worth, which may not be enough to buy a new version of the item.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Does Garrison Property and Casualty offer renters insurance?

Garrison likely offers renters insurance if you rent a home or apartment. Most renters insurance policies offer similar coverage for personal property, but you may get to choose higher limits to replace your damaged items.

With Garrison, you may be able to find coverage similar to USAA renters insurance coverage. A renters policy with USAA includes:

- Flood coverage

- Earthquake coverage

- Replacement cost coverage for personal items

- Overseas insurance

In addition, a renters policy with Garrison may cover:

- Theft

- Vandalism

- Smoke, fire, and lightning damage

- Flood and water damage

- Building collapse

- Falling objects

- Damage from frozen pipes

- Explosions

- Damage from aircraft

- Damage from riots

Some renters insurance policies can cost around $10 per month, though your monthly costs will depend on how much coverage you need. As you consider different companies for renters insurance, you can call and speak with a Garrison Insurance representative to learn more about your options.

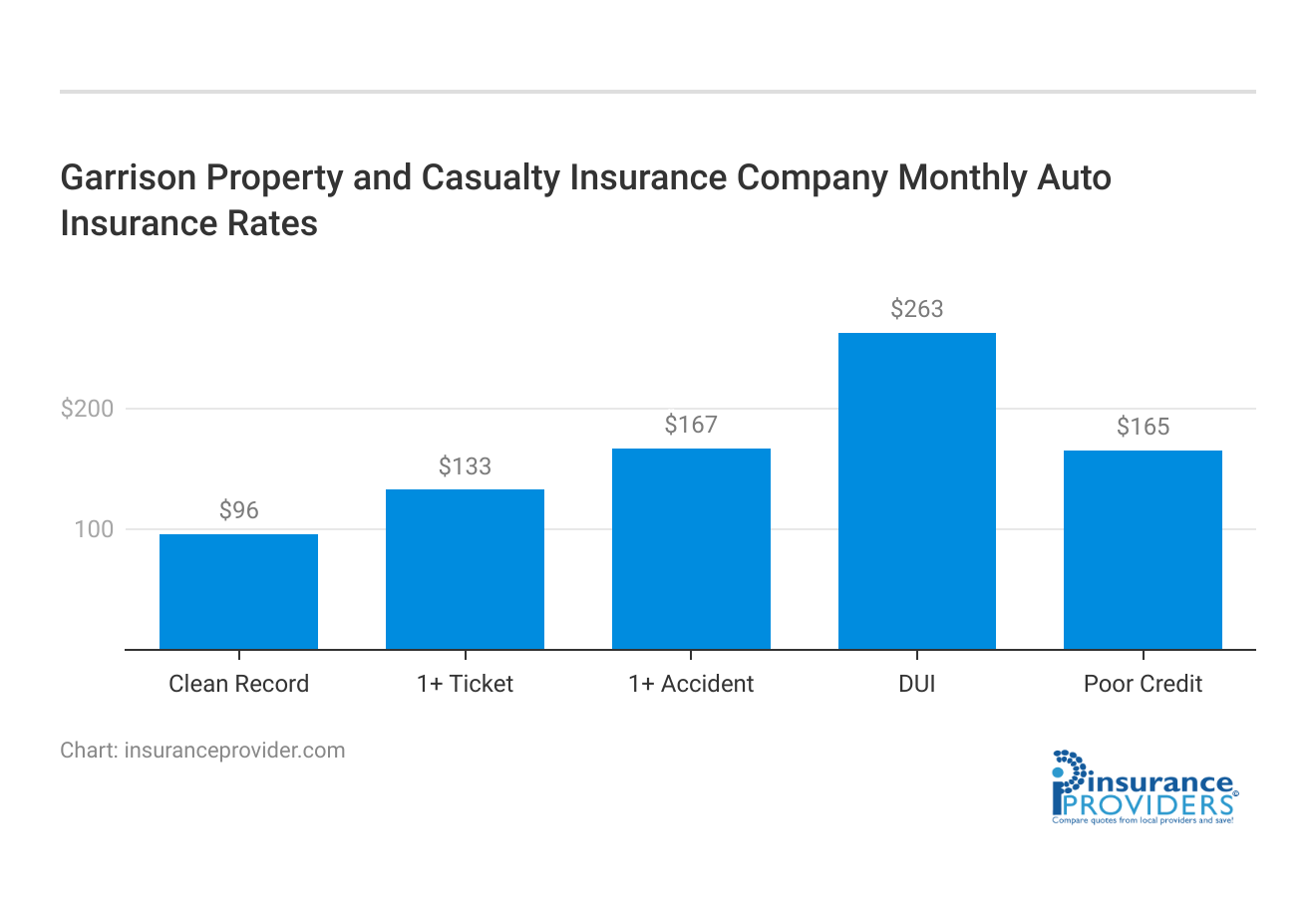

Garrison Property and Casualty Insurance Company Insurance Rates Breakdown

| Driver Profile | Garrison Property | National Average |

|---|---|---|

| Clean Record | $96 | $119 |

| 1+ Ticket | $133 | $147 |

| 1+ Accident | $167 | $173 |

| DUI | $263 | $209 |

| Poor Credit | $165 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Garrison does not offer specific rate information online. However, since the company is a subsidiary of USAA, we can assume pricing may be similar to what USAA offers.

Garrison Auto Insurance for Teen Drivers

When it comes to teen drivers, USAA charges around $3,055 annually, or $255 each month, for coverage. The national average for auto insurance for teen drivers is $4,962 annually or $414 per month.

How much is auto insurance for a 16-year-old? Auto Insurance Company Rates Comparison

| Company | 16-Year-Old Male | 16-Year-Old Female |

|---|---|---|

| Safeco | $1,364.10 | $1,161.50 |

| USAA | $1,660.64 | $1,414.01 |

| Farmers | $2,664.75 | $1,932 |

| Geico | $2,881.30 | $2,453.37 |

| Travelers | $3,046.81 | $2,594.30 |

| Liberty Mutual | $3,180.60 | $2,708.22 |

| Nationwide | $3,016 | $2,036 |

| Progressive | $2,640 | $1,989 |

| State Farm | $3,782 | $3,022 |

| Allstate | $3,185 | $2,357 |

USAA’s auto insurance rates are lower than average, and there’s potential for Garrison to charge the same low rates on car insurance for a 16-year-old.

Garrison Auto Insurance for Young Adult Drivers

Young adult drivers pay roughly $1,189 annually or $99 each month for auto insurance with USAA. Comparatively, the national average for the same coverage is around $1,734 annually or $145 per month.

Young adults pay around 40% less for coverage with USAA than with many other companies.

Garrison Auto Insurance for Adult Drivers

People over 25 pay around $922 annually for auto insurance with USAA. This breaks down to about $77 each month for coverage.

Average Monthly Auto Insurance Rates by Age and by Company

| Companies | 25-Year-Old Female | 25-Year-Old Male | 17-Year-Old Female | 17-Year-Old Male |

|---|---|---|---|---|

| Allstate | $219.51 | $220.97 | $678.65 | $733.87 |

| Farmers | $172.13 | $179.75 | $810.38 | $773.12 |

| Geico | $108.35 | $111.96 | $259.76 | $385.52 |

| Liberty Mutual | $279.38 | $296.29 | $544.95 | $882.56 |

| Nationwide | $170.12 | $216.52 | $304.87 | $452.46 |

| Progressive | $192.71 | $187.71 | $527.40 | $587.72 |

| State Farm | $181.32 | $192.87 | $497.40 | $641.39 |

| Travelers | $247.44 | $255.98 | $558.84 | $664.92 |

| USAA | $162.66 | $179.06 | $520.49 | $617.89 |

The national average for coverage for adult drivers is $1,476 annually or $123 each month. USAA’s rates are around 45% lower than the national average.

Garrison Auto Insurance for Senior Drivers

With many companies, senior drivers pay higher rates for coverage. But with USAA, senior drivers have rates that are lower on average than adult driver rates.

With USAA, senior drivers pay around $853 annually or $71 monthly for coverage. The national average for this demographic is $1,332 annually or $111 per month.

Garrison Auto Insurance for Speeding Tickets

If you have a speeding ticket on your driving record, it is likely to increase your monthly or annual rates for auto insurance coverage.

Average Monthly Auto Insurance Rates with One Speeding Ticket

| Company | Average Rates with Clean Record | Average Rates with 1 Speeding Violation |

|---|---|---|

| Allstate | $318.33 | $373.63 |

| American Family | $224.47 | $252.15 |

| Farmers | $288.38 | $339.92 |

| Geico | $178.83 | $220.45 |

| Liberty Mutual | $397.86 | $475.11 |

| Nationwide | $228.85 | $259.47 |

| Progressive | $282.76 | $333.52 |

| State Farm | $235.10 | $265.50 |

| Travelers | $287.31 | $355.07 |

| USAA | $161.14 | $182.77 |

USAA charges $1,203 annually or $100 each month for coverage. The national average for car insurance after a speeding ticket is around $1,911 annually or $159 each month. USAA beats most companies by around $700 in terms of cheap rates after a speeding ticket.

Garrison Auto Insurance for At-Fault Accidents

If you have an at-fault accident on your record, you can expect higher-than-average car insurance rates to follow. You may even need auto insurance for high-risk drivers.

Average Monthly Auto Insurance Rates for Drivers with One Accident

| Company | Average Rates with Clean Record | Average Rates with 1 Accident |

|---|---|---|

| Allstate | $318.33 | $415.64 |

| American Family | $224.47 | $310.23 |

| Farmers | $288.38 | $376.56 |

| Geico | $178.83 | $266.06 |

| Liberty Mutual | $397.86 | $517.07 |

| Nationwide | $228.85 | $283.08 |

| Progressive | $282.76 | $398.09 |

| State Farm | $235.10 | $283 |

| Travelers | $287.31 | $357.48 |

| USAA | $161.14 | $209.69 |

USAA charges $1,404 annually or $117 per month for coverage. The national average for coverage after an accident is $2,180 annually, or $182 each month. If you can get cheap rates, like those offered by USAA, you could save a great deal of money. USAA charges $800 less per year than the national average.

Garrison Auto Insurance for DUI Convictions

If you have a DUI on your record, car insurance rates may be the last thing on your mind. You could face extreme fines, a license suspension, and even jail time. But anyone with a DUI on their driving record can expect their insurance rates to increase significantly.

Average Monthly Auto Insurance Rates with One DUI

| Company | Average Monthly Rates with Clean Record | Average Monthly Rates with 1 DUI |

|---|---|---|

| Allstate | $318.33 | $521.73 |

| American Family | $224.47 | $360.85 |

| Farmers | $288.38 | $393.23 |

| Geico | $178.83 | $406.32 |

| Liberty Mutual | $397.86 | $634.46 |

| Nationwide | $228.85 | $378.60 |

| Progressive | $282.76 | $330.80 |

| State Farm | $235.10 | $303.07 |

| Travelers | $287.31 | $478.45 |

| USAA | $161.14 | $292.17 |

With USAA, you will pay $1,905 annually or $159 monthly for car insurance with a DUI on your record. The national average for car insurance following a DUI is $2,601 annually or $217 each month. How long a DUI stays on your record will depend on the state you live in, but you can expect to pay higher rates for ten years in California.

Garrison Auto Insurance for Bad Credit

Believe it or not, your credit score can impact your car insurance rates. Many companies charge more when people have poor credit because there’s a likelihood they will make more claims on their car insurance coverage.

Average Annual Auto Insurance Rates Based on Credit Rating

| Company | Good Credit Rating | Fair Credit Rating | Poor Credit Rating |

|---|---|---|---|

| Allstate | $3,859.66 | $4,581.16 | $6,490.65 |

| American Family | $2,691.74 | $3,169.53 | $4,467.98 |

| Farmers | $3,677.12 | $3,899.41 | $4,864.14 |

| Geico | $2,434.82 | $2,986.79 | $4,259.50 |

| Liberty Mutual | $4,388.18 | $5,604.24 | $8,802.22 |

| Nationwide | $2,925.94 | $3,254.83 | $4,083.29 |

| Progressive | $3,628.85 | $3,956.31 | $4,737.64 |

| State Farm | $2,174.26 | $2,853.00 | $4,951.20 |

| Travelers | $4,058.97 | $4,344.10 | $5,160.22 |

| USAA | $1,821.20 | $2,219.83 | $3,690.73 |

USAA offers rates for car insurance around $1,869 annually or $156 each month if you have poor credit. The national average for this demographic is $2,757 annually, or $230 each month. USAA’s rates are high compared to the company’s rates for other demographics. Still, USAA offers rates around $900 less than the national average.

Garrison Auto Insurance for Minimum Coverage

If you purchase a minimum coverage policy with USAA, you will pay the least amount for coverage. USAA, along with other auto insurance providers, charges cheaper rates for a minimum coverage policy.

Average Monthly Liability-Only vs. Full Coverage Auto Insurance Rates by Company

| Companies | Monthly Liability-Only Coverage Auto Insurance Rates | Monthly Full Coverage Auto Insurance Rates |

|---|---|---|

| Allstate | $162 | $318 |

| American Family | $114 | $224 |

| Farmers | $147 | $288 |

| Geico | $91 | $179 |

| Liberty Mutual | $203 | $398 |

| Nationwide | $117 | $229 |

| Progressive | $144 | $283 |

| State Farm | $120 | $235 |

| Travelers | $147 | $287 |

| USAA | $82 | $161 |

| National Average | $133 | $260 |

A minimum coverage policy with USAA is around $948 annually or $79 per month. The national average for a minimum coverage car insurance policy is $1,463 annually, or $122 each month.

Garrison Auto Insurance for Full Coverage

Full coverage includes both collision and comprehensive coverage and provides added protection when you’re behind the wheel. You will pay more for car insurance if you purchase a full coverage policy.

With USAA, a full coverage policy costs around $1,056 annually, or $88 each month. The national average for a full coverage policy costs $1,622 annually or $135 per month.

Garrison Car Insurance vs. USAA Car Insurance

Unfortunately, there’s no way to know whether Garrison Property and Casualty Insurance Company offers the same rates as USAA. All rates listed above are an average based on USAA’s statistics throughout the U.S.

California can be an expensive place to live, and auto insurance in California is no different. As a California resident, you may find that Garrison’s auto insurance rates are more expensive than what’s listed above. Still, you should compare quotes from multiple companies to better understand what a typical auto insurance policy costs in your area.

If you are interested in an auto insurance policy with Garrison, you can contact the company to learn more about its products and services. You may find that Garrison Insurance offers competitive rates in your area, but you’ll have to compare Garrison’s quotes with quotes from other top companies to know for sure.

Garrison Property and Casualty Insurance Company Discounts Available

| Discounts | Garrison Property |

|---|---|

| Anti Theft | 5% |

| Good Student | 6% |

| Low Mileage | 3% |

| Paperless | 4% |

| Safe Driver | 7% |

| Senior Driver | 7% |

Garrison Insurance does not state online whether it offers discounts on car insurance coverage. Its parent company, USAA, offers several discount options, including

- Multi-policy discount

- Military on-base discount

- Good student discount

- Clean driving record discount

- Safe driver discount

- Defensive driver training discount

- Basic driver training course discount

- SafePilot discount

- Bundling discount

- Newer vehicle discount

- Anti-theft devices discount

- Deployment/storing discount

- Driving less discount

- Loyal member discount

- Multi-vehicle discount

- Family discount

- Automatic payments discount

Discounts can save you up to 25% on car insurance coverage. If you’re interested in Garrison and believe you may qualify for a discount, you can call the company and speak with a representative to learn more about your options.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Garrison Property and Casualty Insurance Company Ranks Among Providers

Garrison Property and Casualty Insurance Company operates in California, offering various insurance products. In the competitive landscape of the insurance industry, several companies provide similar services. Below is a list of potential competitors that individuals in California might consider when shopping for insurance coverage.

- State Farm: A well-known insurance provider offering a range of coverage options, including auto, home, and life insurance.

- Geico: Recognized for competitive auto insurance rates and a user-friendly online platform.

- Allstate: Known for its extensive range of insurance products and personalized coverage options.

- Progressive: A major player in the insurance market, offering a variety of coverage types and renowned for its innovative approach.

- Farmers Insurance: Provides a diverse range of insurance products, including auto, home, life, and business coverage.

- Liberty Mutual: Offers a wide array of insurance options, including auto, home, and renters insurance.

- Nationwide: Known for its flexible policy options and strong presence in various insurance sectors.

- AAA (American Automobile Association): Provides auto insurance and various additional services to its members.

- Esurance: An online-focused insurance provider offering auto, home, and renters insurance.

- The Hartford: Particularly known for its insurance solutions for older adults and AARP members.

Read more:

- AAA Texas County Mutual Insurance Company: Customer Ratings & Reviews

- Esurance Insurance Company of New Jersey Review

- Esurance Insurance Company of New Jersey: Customer Ratings & Reviews

- Esurance Property and Casualty Insurance Company: Customer Ratings & Reviews

- Hartford Life and Accident Insurance Company Review

- Nationwide Property and Casualty Insurance Company Review

When exploring insurance options, consumers need to compare quotes, coverage options, and customer reviews from various providers. Each company has its strengths and unique offerings, and finding the right fit involves considering individual needs and preferences. Seeking personalized quotes from these competitors can help individuals make informed decisions about their insurance coverage.

Frequently Asked Questions

What types of insurance does Garrison Property and Casualty Insurance Company offer?

Garrison Property and Casualty Insurance Company offers auto, home, life, business, and motorcycle insurance, among other insurance products.

Is Garrison Property and Casualty Insurance Company available nationwide?

No, Garrison Property and Casualty Insurance Company only offers coverage in California.

How can I compare quotes from Garrison Property and Casualty Insurance Company?

To compare quotes from Garrison Property and Casualty Insurance Company, you can contact the company directly or use their online quote tool.

Are there any customer ratings and reviews for Garrison Property and Casualty Insurance Company?

While there are not many online reviews specifically for Garrison Property and Casualty Insurance Company, it is affiliated with USAA, which has positive ratings and reviews from A.M. Best, S&P, and Moody’s.

What are the rates for auto insurance with Garrison Property and Casualty Insurance Company?

Specific rate information for Garrison Property and Casualty Insurance Company is not available online. However, since it is a subsidiary of USAA, rates may be similar to what USAA offers.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.