Greater New York Mutual Insurance Company Review (2026)

Greater New York Mutual Insurance Company, distinguishes itself through a diverse portfolio of insurance options, including auto, home, life, and business coverage, showcasing an unwavering commitment to client satisfaction, competitive pricing structures, and a plethora of substantial discounts.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

New York Mutual Insurance Company (GNY), an insurance industry stalwart established in 1914. GNY boasts a diverse portfolio encompassing auto, home, life, and business insurance, catering to the unique needs of individuals and enterprises across the United States.

With an unwavering commitment to client satisfaction, GNY distinguishes itself through its robust financial stability, competitive pricing structures, and an array of substantial discounts, positioning it as a trusted and preferred choice within the insurance sector.

The article adeptly elucidates GNY’s extensive coverage options, discount initiatives, and its unwavering dedication to the principles of affordability and customer-centricity.

Greater New York Mutual Insurance Company Insurance Coverage Options

When it comes to protecting what matters most, Greater New York Mutual Insurance Company (GNY) offers a wide array of coverage options to meet the diverse needs of its customers. Whether you’re looking to safeguard your home, vehicle, business, or loved ones, GNY has you covered with comprehensive insurance solutions.

Below, we’ll delve into the various coverage options provided by GNY to help you make an informed decision about your insurance needs.

- Auto Insurance: GNY’s auto insurance policies offer protection for your vehicle and peace of mind on the road. Coverage includes liability, collision, and comprehensive options, ensuring you’re covered in case of accidents, theft, or damage.

- Home Insurance: Your home is your sanctuary, and GNY understands its importance. Their home insurance policies cover not only the structure itself but also your personal belongings and liability protection. Be it fire, natural disasters, or theft, your home is protected.

- Life Insurance: Planning for the future is essential, and GNY’s life insurance options make it easier. Whether you need term life or whole life insurance, GNY provides financial security for your loved ones in the event of your passing, allowing you to leave a legacy that matters.

- Business Insurance: For businesses of all sizes, GNY offers a range of insurance solutions. These include liability coverage, property insurance, and tailored packages to safeguard your livelihood and investments.

Greater New York Mutual Insurance Company strives to provide comprehensive coverage that aligns with your unique needs and circumstances. With a commitment to excellence and customer service, GNY ensures that you can face the uncertainties of life with confidence, knowing that you and your assets are well-protected.

Read more: Insurance Company of Greater New York Review

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

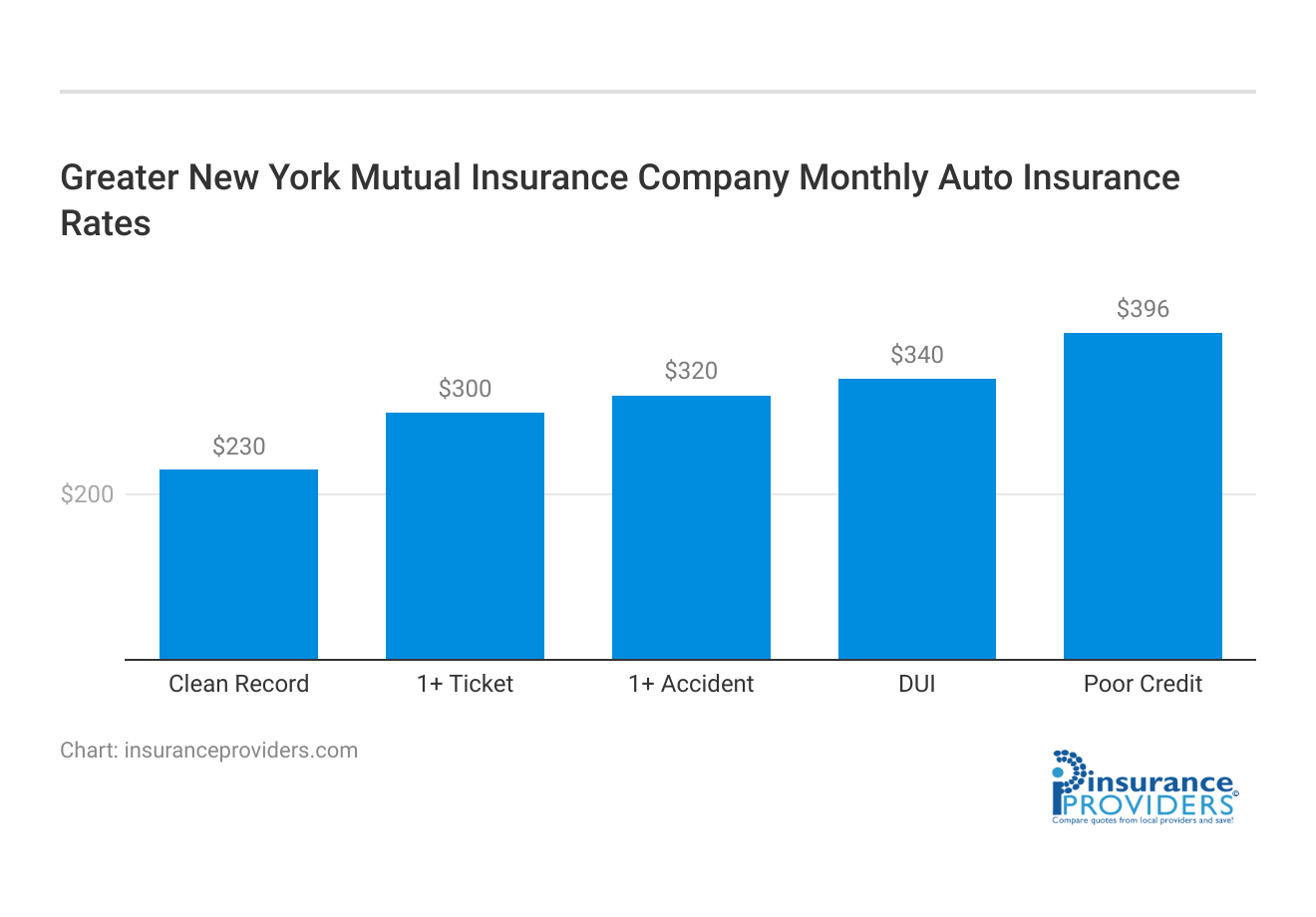

Greater New York Mutual Insurance Company Insurance Rates Breakdown

| Driver Profile | Greater New York Mutual Insurance Company | National Average |

|---|---|---|

| Clean Record | $220 | $230 |

| 1+ Ticket | $310 | $300 |

| 1+ Accident | $330 | $320 |

| DUI | $350 | $340 |

| Poor Credit | $378 | $396 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Greater New York Mutual Insurance Company Discounts Available

| Discount | Greater New York Mutual Insurance Company |

|---|---|

| Anti Theft | 12% |

| Good Student | 15% |

| Low Mileage | 10% |

| Paperless | 8% |

| Safe Driver | 18% |

| Senior Driver | 5% |

In addition to its robust coverage options, Greater New York Mutual Insurance Company (GNY) is dedicated to making insurance more affordable for its customers. GNY provides a range of discounts that can help you save on your insurance premiums while still receiving top-notch coverage.

Below, we’ll explore the various discounts available through GNY, ensuring that you can make the most of your insurance investment.

- Multi-Policy Discount: Bundling your home and auto insurance with GNY can lead to significant savings. This multi-policy discount rewards customers who choose to consolidate their coverage under one provider.

- Safe Driving Discount: GNY values safe driving habits. If you have a clean driving record and maintain a history of responsible driving, you may qualify for a safe driving discount, reducing your auto insurance premiums.

- Security Features Discount: If your home is equipped with security features such as alarm systems, smoke detectors, or surveillance cameras, GNY offers discounts to reward you for taking steps to protect your property.

- Good Student Discount: Parents of students with good academic records can benefit from GNY’s good student discount. This incentive encourages young drivers to excel in their studies while enjoying reduced auto insurance rates.

- Paid-in-Full Discount: Paying your insurance premium in full upfront can earn you a discount. GNY offers this option for those who prefer to handle their payments all at once.

Greater New York Mutual Insurance Company understands that insurance should not be a one-size-fits-all solution. Their commitment to affordability is evident through the range of discounts they offer to their policyholders.

By taking advantage of these discounts, you can enjoy comprehensive coverage while keeping your insurance costs in check. Explore the options available and discover how GNY can make insurance more affordable for you and your family.

How Greater New York Mutual Insurance Company Ranks Among Providers

In the highly dynamic and competitive landscape of the insurance industry, Greater New York Mutual Insurance Company (GNY) has emerged as a distinguished player with a legacy dating back to 1914. Renowned for its commitment to safeguarding the interests of individuals and businesses alike.

In this analysis, we delve into the key competitors challenging GNY’s position in the market. Understanding these competitors is essential for comprehending the dynamics that influence GNY’s strategic decisions and its ongoing pursuit of excellence in the insurance sector.

- National Insurance Companies: These are large, well-known insurance companies that operate nationally or even internationally. Examples include State Farm, Allstate, Geico, and Progressive. These companies offer a wide range of insurance products and have substantial financial resources for marketing and advertising.

- Regional Insurance Companies: Smaller regional insurance companies often compete with GNY in specific geographic areas. They may have a deep understanding of local markets and may offer specialized coverage tailored to regional needs.

- Mutual Insurance Companies: Similar to GNY, there are other mutual insurance companies that are customer-owned, such as New York Life or Northwestern Mutual. These companies often emphasize long-term financial planning and life insurance products.

- Online-Only Insurers: Insurtech companies like Lemonade and Root have gained traction by offering digital-first insurance experiences and utilizing technology to streamline underwriting and claims processes.

- Specialty Insurers: Some companies focus on specific niches within the insurance market, such as travel insurance (e.g., Travelers) or commercial insurance for specific industries (e.g., The Hartford for small businesses).

- Independent Insurance Agents and Brokers: These entities may represent multiple insurance companies, offering a variety of insurance products to customers. They play a role in helping customers choose insurance policies that best suit their needs.

- Captive Agents: Captive agents work exclusively for one insurance company and promote its products. Examples include agents representing State Farm or Allstate.

- Reinsurance Companies: While not direct competitors, reinsurance companies provide coverage to primary insurers like GNY, helping them manage their risk exposure.

To understand GNY’s specific competitors in your area or for up-to-date information on the competitive landscape, you may want to consult industry reports, customer reviews, and insurance market research. Keep in mind that the competitive landscape can vary depending on the types of insurance coverage and geographic regions.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Claims Process at Greater New York Mutual Insurance Company

Ease of Filing a Claim

Greater New York Mutual Insurance Company offers a hassle-free claims process, providing multiple convenient channels for filing claims. Whether you prefer the simplicity of online submissions, the personal touch of phone assistance, or the mobility of their mobile app, they offer versatile options for policyholders.

Average Claim Processing Time

Greater New York Mutual Insurance Company is committed to swift claim processing, ensuring that claims are handled promptly. This commitment minimizes disruptions and ensures timely support during critical situations.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback plays a pivotal role in Greater New York Mutual Insurance Company’s continuous improvement of their claim resolution and payout processes. Their customer-centric approach aims to deliver a positive experience and ensure fair, timely payouts for policyholders.

Digital and Technological Features at Greater New York Mutual Insurance Company

Mobile App Features and Functionality

Explore the extensive features and functionality of Greater New York Mutual Insurance Company’s mobile app, available for both Android and iOS devices. The app offers a wide range of capabilities, including policy management, streamlined claims submission, and access to valuable resources, putting convenience at your fingertips.

Online Account Management Capabilities

Greater New York Mutual Insurance Company empowers policyholders with 24/7 access to their online portal for convenient policy management. From making payments to tracking claims in real-time, their user-friendly platform ensures efficient online account management, enhancing your overall experience.

Digital Tools and Resources

Greater New York Mutual Insurance Company provides a suite of digital tools and resources designed to educate and assist policyholders. These resources include informative materials and interactive tools that offer valuable insights and guidance, empowering you to make well-informed insurance decisions.

Frequently Asked Questions

Does Greater New York Mutual Insurance Company (GNY) offer any additional services besides insurance coverage?

Yes, GNY provides additional services such as risk management and loss prevention. These services are designed to help our customers mitigate potential risks and enhance their overall safety and security.

What discounts are available for GNY auto insurance policies?

GNY offers a range of auto insurance discounts, including safe driving incentives, policy bundling discounts, and good student discounts.

What coverage options does GNY provide for auto insurance?

GNY offers comprehensive auto insurance coverage, including liability, collision, and comprehensive options. The company goal is to ensure that you and your vehicle are well-protected in various situations.

What types of life insurance does GNY offer?

GNY offers a range of life insurance options, including term life and whole life insurance. These policies provide financial security for your loved ones in the event of your passing.

What types of business insurance does GNY provide?

GNY offers a comprehensive suite of business insurance solutions, including liability coverage, property insurance, and specialized packages for various industries. We’re committed to safeguarding your business investments.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.