The Hanover Insurance Review [2026]

Discover the distinct offerings of The Hanover Insurance Group, where higher rates may find justification through unique coverage options, particularly advantageous for drivers with a DUI.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Imani Francies is a finance and insurance writer who has strong media and communication skills with a bachelor's degree from Georgia State University. She began her writing career freelancing with various blogs and internships while working full-time as an early childhood educator. She has significant experience in both print and online media as a writer, editor, and author. She works efficient...

Imani Francies

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Ty Stewart

Updated April 2024

The Hanover isn’t the largest company you can buy insurance from, but it has a long list of coverages and discounts you can shop from. With some unique choices that are hard to find elsewhere, Hanover might be the best choice for your insurance needs.

Although Hanover’s rates are a little on the high side, the additional coverage might make those prices worth it. However, you should still compare quotes with as many companies as possible to find the best rates for you.

What You Should Know About The Hanover Insurance Group

Generally speaking, The Hanover is considered a good insurance company. However, you don’t need to take a vague statement for it — you should first look at third-party rating companies.

To start, A.M. Best rates companies based on their financial strength. Financial strength is important to look at to determine the likelihood that any future claim you might make will be paid. The Hanover has an excellent rating of A from A.M. Best.

Another rating to look at are those from the National Association of Insurance Commissioners (NAIC). The NAIC compares the number of complaints a company gets compared to its size. The national average is 1.0 — anything lower means the company gets fewer complaints. The Hanover’s most recent score from the NAIC is 0.77.

Finally, you can look at scores from the Better Business Bureau (BBB). The BBB rates companies on their ability to resolve customer complaints. The Hanover has an A+ from the BBB, and only a few complaints are listed on the site.

Generally speaking, The Hanover receives positive reviews. There are, of course, some unsatisfied customers, but people usually recommend Hanover insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Hanover Insurance Group Insurance Coverage Options

Nearly all car insurance companies offer enough types to cover both minimum and full coverage auto insurance policies, and Hanover is no different.

Most states require minimum insurance before you can drive or register your car. Liability insurance is most commonly required, but many states also include uninsured motorist and personal injury protection coverage.

While it’s not required by state law, many drivers need full coverage for their cars, especially if they have a car loan or lease. Even if it’s not required, full coverage is often a good idea because of how much protection it gives your car.

You can buy the following standard car insurance types from Hanover:

- Bodily injury. The first half of liability insurance pays for injuries you cause to other drivers, their passengers, pedestrians, and other bystanders.

- Property damage. The other half of liability coverage pays for damage you cause to other people’s property, including vehicles, buildings, and fences. It does not cover your car.

- Collision. Collision auto insurance is what you need to have your car repairs covered by your insurance. Collision insurance also covers you if you hit a stationary object, like a traffic sign.

- Comprehensive. There are a lot of unexpected events that can damage your car outside of car accidents. Comprehensive auto insurance covers floods, fires, extreme weather, theft, vandalism, and animal contact.

- Uninsured/underinsured motorist. Although most states require insurance, some drivers ignore the law. Uninsured motorist insurance covers you if someone without coverage hits you or if you’re the victim of a hit-and-run.

- Personal injury protection/medical payments. Medical payments and personal injury protection insurance pay for your health care expenses after an accident. It also covers your passengers and may protect you when you’re in someone else’s vehicle.

When you need full coverage, you’ll likely buy every type of insurance listed above. If you’re not sure how much insurance you need, a Hanover representative can help.

Does Hanover sell car insurance add-ons?

Most car insurance companies offer add-ons to increase the value of your policy, and Hanover is no different. If you’re interested in adding additional insurance to your policy, you can buy the following types of coverage from Hanover:

- Roadside assistance. Hanover will come to the rescue when you find yourself stranded. This roadside assistance plan includes towing and other emergency services.

- Ultimate rental reimbursement. When your car is stuck at the mechanic’s after a covered incident, Hanover will cover up to $3,000 for a rental car.

- Rental coverage upgrade. This add-on upgrades your rental car to a large SUV or luxury vehicle.

- Trip interruption. Hanover will reimburse you up to $1,000 for food, lodging, travel, and rental costs if a covered incident causes you to be stranded more than 100 miles from home.

- Second chance accident forgiveness. Your first accident within a three-year period will be forgiven, and your rates won’t increase.

- Deductible dividends. For people with collision insurance, Hanover will reduce your deductible to a minimum of $100.

- New car replacement guard. If you total your car, Hanover will replace it without considering depreciation. Only cars you’ve owned for one year or less or driven fewer than 15,000 miles qualify.

- Pet injury protection. Hanover will provide up to $500 in vet expenses and $500 for burial costs if your pet is hurt in a covered accident.

- Extended non-owner car coverage. This add-on gives you liability and medical expense coverage when you use a company car for personal use.

- Home care services. Hanover will provide up to $2,500 for home care services after you’ve been temporarily incapacitated after a covered accident. You can claim up to $500 per month.

- Accidental death benefit. This acts as a life insurance policy that pays $10,000 to your beneficiary if you die in a covered accident.

- Accidental airbag deployment. Hanover will pay the cost of reinstalling your airbags if one accidentally deploys.

- Original equipment manufacturer (OEM) parts. This add-on ensures a mechanic will only use OEM parts on your car during repairs rather than aftermarket parts.

- Child car seat replacement. Hanover covers up to $300 with no deductible if you need to replace a car seat after a covered incident.

- Full glass. You can skip your deductible if your windshield or other damaged glass can be repaired.

As you can see, Hanover has a fantastic selection of add-ons, some of which are difficult to find elsewhere. Hanover offers many add-ons grouped together in convenient packages, which makes it easier to buy several coverages at once.

Before you sign up for add-ons, you should make sure it might benefit you. Add-ons offer valuable coverage but can significantly impact your car insurance rates.

The Hanover Insurance Group Insurance Rates Breakdown

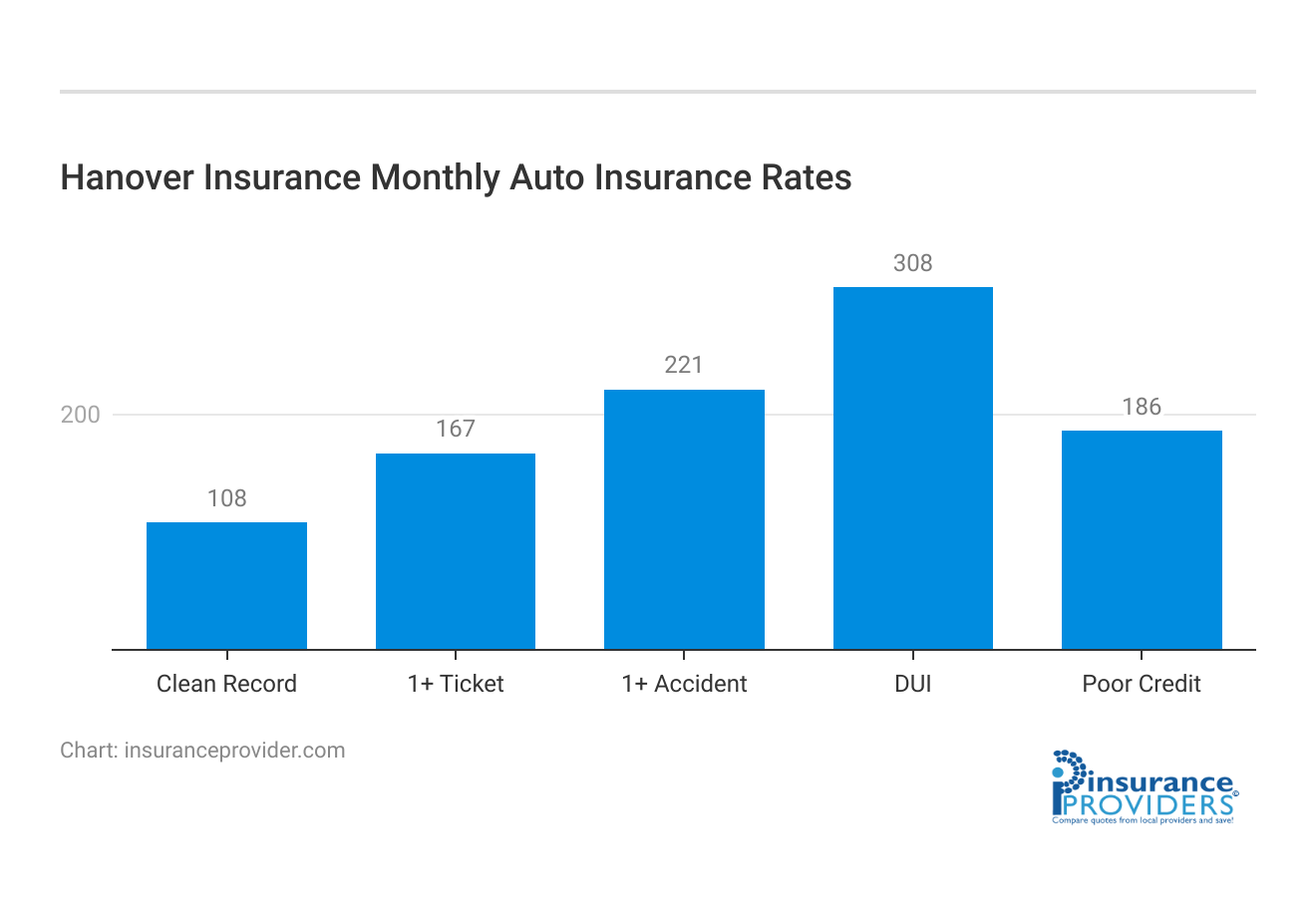

| Driver Profile | Hanover Insurance | National Average |

|---|---|---|

| Clean Record | $108 | $119 |

| 1+ Ticket | $167 | $147 |

| 1+ Accident | $221 | $173 |

| DUI | $308 | $209 |

| Poor Credit | $186 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

The Hanover typically has higher rates than other companies, sometimes with prices over double the national average.

However, you might see lower rates depending on your unique circumstances. Explore what Hanover’s average rates might look like depending on different demographics. Keep in mind, however, that Hanover does not offer online quotes, so it’s difficult to get accurate rates.

The Hanover Insurance Rates by Coverage

When it comes to the amount of coverage you need, minimum insurance is your cheapest option. No matter how much the average price of insurance is in your state, the minimum amount required is the least you’ll pay.

On the other hand, you’ll pay much more for full coverage. Although the protection for your car is much better, you should make sure you actually need it before you sign up.

The Hanover doesn’t have prices posted for either minimum or full coverage insurance. However, you can get an idea of what you might pay by looking at the average rates for minimum and full coverage from Hanover’s competitors.

Average Monthly Liability-Only vs. Full Coverage Auto Insurance Rates by Company

| Companies | Monthly Liability-Only Coverage Auto Insurance Rates | Monthly Full Coverage Auto Insurance Rates |

|---|---|---|

| Allstate | $162 | $318 |

| American Family | $114 | $224 |

| Farmers | $147 | $288 |

| Geico | $91 | $179 |

| Liberty Mutual | $203 | $398 |

| Nationwide | $117 | $229 |

| Progressive | $144 | $283 |

| State Farm | $120 | $235 |

| Travelers | $147 | $287 |

| USAA | $82 | $161 |

| National Average | $133 | $260 |

Some companies are much cheaper than others, especially companies like Geico, Progressive, and State Farm. While The Hanover’s rates tend to be higher than the national average, they’re usually not the most expensive.

When you’re trying to keep your insurance rates low, a Hanover representative can help you pick the right amount of coverage. They’ll know exactly how much insurance you need to legally drive and if extra coverage would benefit you.

The Hanover Insurance Rates by Age

One of the most important factors insurance companies look at to determine your rates is your age. Young drivers are more likely to get into accidents, drive recklessly, and engage in other reckless behaviors.

The national average price for an 18-year-old driver is about $309 a month for males and $272 for females. Hanover’s average rate for an 18-year-old is about $463.

Although insurance companies charge more for teens and young drivers, there is some good news. If you can keep your driving record clean of traffic incidents and accidents, your rates will lower around age 25.

The Hanover Insurance Rates by Location

Another crucial aspect of your insurance is where you live. Insurance companies keep careful track of claims data by ZIP code, meaning you might see much different rates by moving even a single ZIP code over.

The Hanover has not released data on how much it charges by state, but you can get an idea of what you might pay for insurance below.

Average Monthly Auto Insurance Rates by State

| States | Average Monthly Liability Rates | Average Monthly Collision Rates | Average Monthly Comprehensive Rates | Average Monthly Full Coverage Rates |

|---|---|---|---|---|

| Alabama | $37 | $28 | $14 | $79 |

| Alaska | $47 | $31 | $12 | $90 |

| Arizona | $48 | $25 | $16 | $89 |

| Arkansas | $36 | $29 | $17 | $82 |

| California | $45 | $36 | $8 | $88 |

| Colorado | $49 | $25 | $17 | $91 |

| Connecticut | $59 | $32 | $11 | $102 |

| Delaware | $69 | $28 | $11 | $107 |

| District of Columbia | $58 | $41 | $19 | $118 |

| Florida | $76 | $26 | $11 | $113 |

| Georgia | $55 | $30 | $14 | $98 |

| Hawaii | $39 | $27 | $9 | $75 |

| Idaho | $32 | $20 | $10 | $62 |

| Illinois | $40 | $27 | $11 | $77 |

| Indiana | $34 | $22 | $11 | $67 |

| Iowa | $27 | $19 | $16 | $62 |

| Kansas | $32 | $23 | $21 | $76 |

| Kentucky | $47 | $24 | $12 | $83 |

| Louisiana | $73 | $37 | $19 | $128 |

| Maine | $30 | $23 | $9 | $62 |

| Maryland | $55 | $31 | $13 | $100 |

| Massachusetts | $52 | $34 | $12 | $98 |

| Michigan | $72 | $37 | $13 | $121 |

| Minnesota | $39 | $20 | $16 | $76 |

| Mississippi | $41 | $29 | $18 | $88 |

| Missouri | $38 | $24 | $16 | $79 |

| Montana | $34 | $23 | $21 | $77 |

| Nebraska | $33 | $21 | $20 | $74 |

| Nevada | $64 | $27 | $10 | $100 |

| New Hampshire | $35 | $26 | $9 | $70 |

| New Jersey | $76 | $33 | $11 | $119 |

| New Mexico | $44 | $24 | $15 | $84 |

| New York | $71 | $34 | $15 | $120 |

| North Carolina | $31 | $26 | $11 | $67 |

| North Dakota | $25 | $22 | $20 | $67 |

| Ohio | $35 | $24 | $10 | $69 |

| Oklahoma | $40 | $27 | $20 | $88 |

| Oregon | $53 | $20 | $8 | $81 |

| Pennsylvania | $43 | $29 | $13 | $85 |

| Rhode Island | $68 | $36 | $11 | $116 |

| South Carolina | $50 | $24 | $16 | $89 |

| South Dakota | $26 | $19 | $24 | $69 |

| Tennessee | $37 | $27 | $13 | $77 |

| Texas | $49 | $33 | $19 | $101 |

| Utah | $45 | $23 | $10 | $78 |

| Vermont | $30 | $26 | $11 | $68 |

| Virginia | $38 | $25 | $12 | $74 |

| Washington | $53 | $24 | $9 | $86 |

| West Virginia | $43 | $28 | $18 | $88 |

| Wisconsin | $33 | $20 | $12 | $65 |

| Wyoming | $29 | $24 | $23 | $75 |

| National Average | $48 | $29 | $13 | $90 |

As you can see, some states have significantly higher rates than others. For some states, this is because of heavier traffic, more accidents, or higher car theft rates. Other states see higher rates due to extreme weather or fire risks.

Since Hanover rates tend to be higher than their competitors, you can expect to pay more than your state’s average price for coverage.

The Hanover Insurance Rates After an At-Fault Accident

One of the most impactful events on your car insurance is causing an accident. Having an at-fault accident on your driving record can increase your rates by up to 42%. The more accidents you have, the more your rates will increase.

Once again, Hanover does not post rates after an accident, but you can expect to pay much more for your coverage. You can get an idea of how much other companies charge for insurance below.

Average Monthly Auto Insurance Rates for Drivers with One Accident

| Company | Average Rates with Clean Record | Average Rates with 1 Accident |

|---|---|---|

| Allstate | $318.33 | $415.64 |

| American Family | $224.47 | $310.23 |

| Farmers | $288.38 | $376.56 |

| Geico | $178.83 | $266.06 |

| Liberty Mutual | $397.86 | $517.07 |

| Nationwide | $228.85 | $283.08 |

| Progressive | $282.76 | $398.09 |

| State Farm | $235.10 | $283 |

| Travelers | $287.31 | $357.48 |

| USAA | $161.14 | $209.69 |

Some companies are much more forgiving than others when it comes to at-fault accidents. Even if you already have a policy, you should compare rates with other companies. You’ll likely overpay for car insurance if you don’t compare rates.

The good news is that you won’t have to pay higher rates forever. An at-fault car accident stays on your record for about three years — as long as you keep your record clean, your rates will return to normal..

The Hanover Insurance Rates After a Speeding Ticket

Another event that can significantly impact your rates is getting a speeding ticket. The average speeding ticket increases your rates by about 23%, but having multiple or an excessive speeding ticket can make your rates skyrocket. You might need to get auto insurance for high-risk drivers if you have too many.

A 45-year-old driver with a single speeding ticket on their record can expect to pay about $155 a month. Compare that price with some of the largest companies in the U.S. below.

Average Monthly Auto Insurance Rates with One Speeding Ticket

| Company | Average Rates with Clean Record | Average Rates with 1 Speeding Violation |

|---|---|---|

| Allstate | $318.33 | $373.63 |

| American Family | $224.47 | $252.15 |

| Farmers | $288.38 | $339.92 |

| Geico | $178.83 | $220.45 |

| Liberty Mutual | $397.86 | $475.11 |

| Nationwide | $228.85 | $259.47 |

| Progressive | $282.76 | $333.52 |

| State Farm | $235.10 | $265.50 |

| Travelers | $287.31 | $355.07 |

| USAA | $161.14 | $182.77 |

The Hanover is more expensive than most of its competitors, except for a few companies like Allstate, Liberty Mutual, and Farmers.

Like at-fault accidents, speeding tickets eventually fall off your record. Avoid adding more incidents to your driving record, and your rates will lower after about three years.

Read more: How a Traffic Ticket Affects Your Auto Insurance Rates

The Hanover Insurance Rates After a DUI

Of all the things that can increase your rates, a DUI is one of the worst. The average driver sees their rates increase by 75%, but some people will see their prices double or even triple.

Like other demographics, some companies are more forgiving of a DUI than others. Although Hanover is often one of the most expensive car insurance options, it offers relatively affordable DUI insurance. The average 45-year-old driver pays about $157 a month for insurance after a single DUI charge.

Compare Hanover’s average monthly rate with its competitors to see how it stacks up.

Average Monthly Auto Insurance Rates with One DUI

| Company | Average Monthly Rates with Clean Record | Average Monthly Rates with 1 DUI |

|---|---|---|

| Allstate | $318.33 | $521.73 |

| American Family | $224.47 | $360.85 |

| Farmers | $288.38 | $393.23 |

| Geico | $178.83 | $406.32 |

| Liberty Mutual | $397.86 | $634.46 |

| Nationwide | $228.85 | $378.60 |

| Progressive | $282.76 | $330.80 |

| State Farm | $235.10 | $303.07 |

| Travelers | $287.31 | $478.45 |

| USAA | $161.14 | $292.17 |

The Hanover is one of the cheapest options for car insurance after a DUI, with only State Farm offering lower prices.

While your rates will eventually return to normal after a DUI, it takes much longer than a speeding ticket or at-fault accident. It takes about seven years for a DUI to stop affecting your car insurance rates. Find out how long a DUI can stay on your record.

The Hanover Insurance Rates by Credit Score

Auto insurance companies do background checks and charge more for drivers with low credit scores for two primary reasons. The first is that companies assume people with higher scores are more likely to pay their monthly bills on time.

The second is that drivers with lower scores are statistically more likely to get into accidents and file other claims. While there isn’t any data for The Hanover’s rates based on credit scores, you can get an idea of how much other companies charge below.

Average Monthly Credit-Based Auto Insurance Rates by Company

| Companies | Monthly Rates Based on Good Credit | Monthly Rates Based on Fair Credit | Monthly Rates Based on Bad Credit |

|---|---|---|---|

| USAA | $152 | $185 | $308 |

| State Farm | $181 | $238 | $413 |

| Geico | $203 | $249 | $355 |

| American Family | $224 | $264 | $372 |

| Nationwide | $244 | $271 | $340 |

| Progressive | $302 | $330 | $395 |

| Farmers | $306 | $325 | $405 |

| Allstate | $322 | $382 | $541 |

| Travelers | $338 | $362 | $430 |

| Liberty Mutual | $366 | $467 | $734 |

If your credit score is low, you should carefully research your options. For example, Geico is usually one of the cheapest options on the market, but it has some of the most expensive rates for drivers with low credit scores.

Your car insurance rates don’t have to stay high, but it takes more effort to lower them when you have a low credit score. If you can increase your credit score, your rates will lower.

The Hanover Insurance Group Discounts Available

| Discounts | Hanover Insurance |

|---|---|

| Anti Theft | 13% |

| Good Student | 17% |

| Low Mileage | 11% |

| Paperless | 8% |

| Safe Driver | 16% |

| Senior Driver | 9% |

Insurance companies offer customers discounts to help them save money. Car insurance discounts are so important that you should research what companies offer before you sign up.

Hanover doesn’t have the longest list of discounts, but it does have a few solid ways to save. Look for the following discounts from Hanover:

- Multi-vehicle. If you have multiple cars in your household, Hanover will give you a discount for insuring them on the same plan.

- Pay in full. Many drivers choose to pay for their policies in monthly increments, but you can save a little by paying for your entire policy at once.

- Bundling. You can earn this discount by buying both home and car insurance from The Hanover.

- Anti-theft devices. Save on your comprehensive insurance by installing an anti-theft device in your car, including GPS tracking and audible alarms.

- Good student. Full-time students can earn a discount by maintaining a high GPA. Students must be 25 or younger to qualify.

- Student away from home. College students can see significant savings if they attend a college more than 100 miles from home and leave their car at home.

- Defensive driving. Earn this discount by passing an accident avoidance class pre-approved by Hanover.

- Teen safety. Young drivers can lower their rates by passing a driver’s education course. You’ll need to check with a representative, but drivers must be under 25 to qualify.

Hanover will check which discounts you qualify for when you apply for insurance, but you can also ask a representative to double-check. Some discounts — like the good student — require proof before they’ll be applied to your rates.

How do you file a claim with Hanover?

The Hanover offers a variety of ways to file a claim. The most convenient way to start a claim is to use the mobile app. Hanover Mobile allows you to start claims, call for roadside assistance, view your policy, and make payments. You can also use it to view your ID cards, and many states count this as proof of insurance.

You can also use the Hanover Snap Claims Inspection to upload pictures of the incident and get a repair estimate once your claim is started.

Alternatively, you can use Hanover’s website to report a claim. You can also use the site to pay your monthly bill or locate a mechanic. Unfortunately, you can’t use the site to get a quote or buy a policy, but you can start the claims process.

Finally, you can call a Hanover representative or speak with a local agent to get your claim started. You should make sure you have some basic information about your claim on hand, including your policy number, the police report, and details of the incident.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How The Hanover Insurance Group Ranks Among Providers

Comparing quotes from Hanover and other companies can be difficult due to the fact that you can’t get online Hanover quotes. However, you can still get an idea of how Hanover compares with other companies by looking at the average rates from each.

Average Monthly Auto Insurance Rates by Age and by Company

| Companies | 25-Year-Old Female | 25-Year-Old Male | 17-Year-Old Female | 17-Year-Old Male |

|---|---|---|---|---|

| Allstate | $219.51 | $220.97 | $678.65 | $733.87 |

| Farmers | $172.13 | $179.75 | $810.38 | $773.12 |

| Geico | $108.35 | $111.96 | $259.76 | $385.52 |

| Liberty Mutual | $279.38 | $296.29 | $544.95 | $882.56 |

| Nationwide | $170.12 | $216.52 | $304.87 | $452.46 |

| Progressive | $192.71 | $187.71 | $527.40 | $587.72 |

| State Farm | $181.32 | $192.87 | $497.40 | $641.39 |

| Travelers | $247.44 | $255.98 | $558.84 | $664.92 |

| USAA | $162.66 | $179.06 | $520.49 | $617.89 |

The Hanover usually sits in the middle when it comes to car insurance rates. Some companies, like Geico and State Farm, are often cheaper than Hanover’s rates. Others, like Allstate, are usually more expensive.

As you saw above, there can be a great deal of variety between companies when it comes to rates. This highlights why it’s important to compare quotes using your personal information – you’ll likely overpay for your insurance if you don’t.

Frequently Asked Questions

What sets The Hanover Insurance Group apart from its competitors?

The Hanover distinguishes itself through unique coverage options, providing a potential advantage, especially for drivers with a DUI, despite slightly higher rates compared to competitors.

How does The Hanover Insurance Group fare in terms of financial strength?

The company boasts an excellent A rating from A.M. Best, indicating robust financial strength and reliability in meeting future claims, offering customers a sense of security.

What is the customer satisfaction level with The Hanover Insurance Group?

According to the National Association of Insurance Commissioners (NAIC) and the Better Business Bureau (BBB), The Hanover maintains a low complaint level, with an A+ rating from the BBB, showcasing positive customer experiences.

How does The Hanover Insurance Group handle claims, and what options are available for customers?

The company offers multiple avenues for claims filing, including a mobile app, Snap Claims Inspection for quick estimates, website submission, and traditional phone contact, providing flexibility and convenience for customers.

Does The Hanover Insurance Group offer additional coverage options, and how does it compare to competitors in terms of add-ons?

The Hanover presents a diverse selection of add-ons, some of which are exclusive, bundled in convenient packages. While impactful, customers should assess the value against potential rate increases, as add-ons can influence overall insurance costs.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.