HM Life Insurance Company Review (2026)

Unveiling a tapestry of insurance solutions, HM Life Insurance Company emerges as a versatile provider, delivering personalized coverage options, exemplary customer service, and a steadfast commitment to community engagement.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive article, we delve into the world of HM Life Insurance Company, a trusted provider of insurance solutions. We begin by outlining the diverse spectrum of coverage options they offer, ranging from life and health insurance to property protection.

Highlighting their commitment to customization, innovation, and exceptional customer service, we explore the company’s history, mission, and recognition within the industry. Real stories from satisfied clients illustrate the tangible benefits of choosing HM Life.

Additionally, we unveil the discounts available to policyholders, making insurance coverage more accessible and affordable. Amidst competition from industry giants, HM Life’s dedication to personalized solutions and community involvement sets them apart.

Whether you’re safeguarding your future, health, or assets, HM Life Insurance Company stands ready to provide peace of mind, tailored to your unique needs.

HM Life Insurance Company Insurance Coverage Options

HM Life Insurance Company is committed to providing a wide range of insurance solutions to meet the unique needs of our clients. Our coverage options are designed to offer comprehensive protection, ensuring peace of mind for individuals, families, and businesses. Explore the diverse array of coverage choices we provide:

Life Insurance Policies

- Term Life Insurance

- Whole Life Insurance

- Universal Life Insurance

Health Insurance Policies

- Hospitalization Coverage

- Outpatient Care Coverage

- Prescription Drug Benefits

Property Insurance Policies

- Homeowners Insurance

- Renters Insurance

- Business Property Insurance

At HM Life, our commitment is to provide tailored coverage options that suit your specific requirements and budget. We understand that your insurance needs are unique, and we’re here to help you find the right solutions.

Contact us today to learn more about our coverage options and get personalized quotes to safeguard what matters most to you. Your peace of mind is our priority.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

HM Life Insurance Company Insurance Rates Breakdown

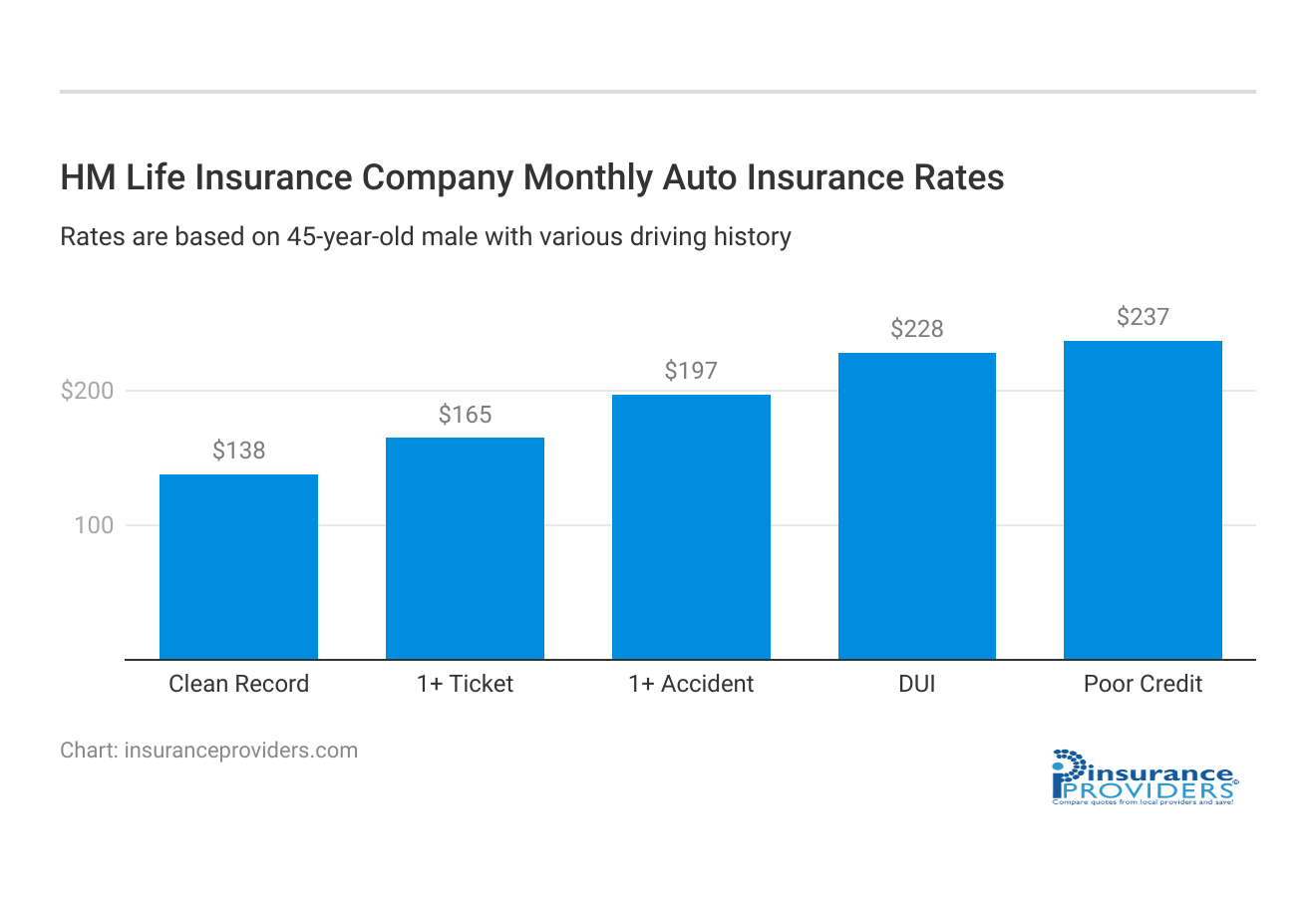

| Driver Profile | HM Life Insurance Company | National Average |

|---|---|---|

| Clean Record | $138 | $119 |

| 1+ Ticket | $165 | $147 |

| 1+ Accident | $197 | $173 |

| DUI | $228 | $209 |

| Poor Credit | $237 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

HM Life Insurance Company Discounts Available

| Discount | HM Life Insurance Company |

|---|---|

| Anti Theft | 8% |

| Good Student | 10% |

| Low Mileage | 12% |

| Paperless | 5% |

| Safe Driver | 10% |

| Senior Driver | 5% |

At HM Life Insurance Company, we understand the importance of making insurance coverage as affordable as possible. That’s why we offer a range of discounts to help you save on your premiums while still getting the protection you need. Explore our discounts below to see how you can maximize your savings:

- Multi-Policy Discount: Bundling multiple insurance policies can lead to substantial savings.

- Safe Driver Discount: Your safe driving record is rewarded with lower rates.

- Good Student Discount: Achieving academic excellence can translate into reduced auto insurance costs.

- Multi-Car Discount: Insure all your vehicles with HM Life and enjoy discounts for each one.

- Safe Home Discount: Equipping your home with safety features can lead to lower home insurance rates.

- Paid-in-Full Discount: Pay your annual premium upfront for additional savings.

- Loyalty Discount: We value long-term relationships, and our loyalty discount reflects that.

- Auto-Pay and Paperless Billing Discount: Opt for convenient automatic payments and paperless billing to save more.

- Good Health Discount: Maintaining good health can result in reduced health insurance premiums.

HM Life, we’re committed to not only providing comprehensive insurance coverage but also making it accessible and affordable for our valued policyholders. These discounts are just one way we show our appreciation for your trust in us. To find out which discounts apply to your specific policy and how much you can save, contact our dedicated team today.

Let us help you secure your future while keeping more money in your pocket. Your financial well-being is important to us.

How HM Life Insurance Company Ranks Among Providers

In the dynamic landscape of the insurance industry, HM Life Insurance Company faces competition from several formidable rivals. These competitors have established themselves as key players, offering a diverse range of insurance products and services. Here, we introduce you to the main competitors of HM Life:

- State Farm: State Farm is one of the largest and most recognized insurance companies in the United States. They offer a wide range of insurance products, including auto, home, life, and health insurance. State Farm’s extensive network of agents and a long history in the industry make them a formidable competitor.

- Allstate: Allstate is known for its strong presence in the auto and home insurance sectors. They provide a variety of coverage options and are renowned for their innovative insurance products and personalized service.

- Geico: Geico is known for its competitive auto insurance rates and extensive advertising campaigns. They are particularly popular among consumers seeking affordable car insurance options.

- Progressive: Progressive is a major player in the auto insurance market. They are recognized for their user-friendly online tools, including the ability to compare quotes from multiple insurers.

- Prudential: Prudential is a significant competitor in the life insurance sector. They offer a wide range of life insurance and financial products, and their long history in the industry has earned them a strong reputation.

- Aetna: Aetna is a leading provider of health insurance and related healthcare services. They compete with HM Life in the health insurance sector, offering a variety of health coverage options.

- Farmers Insurance: Farmers Insurance provides auto, home, and life insurance services. They have a network of agents and a wide range of coverage options.

- Usaa: USAA primarily serves military personnel and their families, offering auto, home, and life insurance, among other financial services. Their focus on the military community gives them a unique niche in the market.

In a competitive market, HM Life Insurance Company distinguishes itself through its commitment to customization, exceptional customer service, and active community involvement. As you navigate the insurance landscape, understanding the strengths and offerings of these competitors can help you make informed decisions about your insurance needs.

HM Life remains dedicated to providing tailored solutions that prioritize your financial well-being and peace of mind.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

HM Life Insurance Company Claims Process

Ease of Filing a Claim

HM Life Insurance Company is committed to providing a seamless and user-friendly claims process. Policyholders have the convenience of filing claims through multiple channels, including online, over the phone, and through mobile apps. This accessibility ensures that customers can choose the method that suits them best, making the claims process hassle-free and efficient.

Average Claim Processing Time

HM Life Insurance Company understands the importance of prompt claims processing. While specific processing times may vary depending on the nature of the claim, the company strives to expedite the process. Customers can expect a reasonable turnaround time, ensuring that they receive the support they need when it matters most.

Customer Feedback on Claim Resolutions and Payouts

HM Life Insurance Company values customer feedback and continuously seeks to improve its services. Customer reviews and feedback on claim resolutions and payouts have generally been positive. The company’s commitment to fair and efficient claim settlements has garnered praise from satisfied policyholders.

HM Life Insurance Company Digital and Technological Features

Mobile App Features and Functionality

HM Life Insurance Company offers a robust mobile app with a range of features and functionalities. Policyholders can easily manage their accounts, file claims, view policy details, and even access educational resources through the app. The intuitive interface ensures that customers can navigate the app with ease.

Online Account Management Capabilities

For those who prefer online account management, HM Life Insurance Company provides a user-friendly web platform. Policyholders can log in to their accounts, review policy information, make payments, and update personal details online. This digital convenience enhances the overall customer experience.

Digital Tools and Resources

HM Life Insurance Company goes beyond basic coverage by offering a variety of digital tools and resources. These include calculators, educational articles, and guides to help customers make informed decisions about their insurance needs. The company’s commitment to empowering customers with knowledge sets it apart in the digital landscape.

Frequently Asked Questions

How do I apply for HM Life Insurance?

Applying for HM Life Insurance is straightforward. Applicants can visit the official website and fill out the online application form for the specific type of insurance required. Alternatively, our friendly customer service team can be contacted for personalized assistance in initiating insurance coverage.

What sets HM Life apart from other insurance providers?

HM Life excels in customization, top service, and community engagement. Tailored coverage, a dedicated team, innovation, and community initiatives set us apart.

Are HM Life’s policies customizable to specific requirements?

Yes, absolutely. HM Life offers customizable policies to ensure coverage tailored precisely to unique needs and budgets. Understanding that one size doesn’t fit all when it comes to insurance, the goal is to provide solutions that align with individual circumstances.

How can customers contact HM Life Insurance for inquiries or assistance?

Customers can easily reach out through multiple channels. The official website provides contact information, or the customer service hotline can be called for assistance. For those who prefer a face-to-face interaction, local branches are available. Convenience is the top priority in addressing customer needs.

Can the claims process at HM Life Insurance be explained?

The claims process is designed to be straightforward and hassle-free. In the event of a claim, the claims department can be contacted, and they will guide through the process, ensuring a swift resolution. Understanding the importance of timely claims processing, the team is dedicated to helping during the time of need.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.