Independence American Insurance Company: Customer Ratings & Reviews [2026]

Independence American Insurance Company: Offering a diverse array of coverage options for individuals, families, and businesses, Independence American Insurance Company has established itself as a reliable provider with an A- (Excellent) rating from A.M. Best and favorable customer feedback, making it a noteworthy choice in the competitive insurance landscape.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Dorothea Hudson has been professionally writing in many spheres since 2013. She has written on entertainment, insurance, finance, travel, technology, AI, renewable energy, crypto, fundraising, and real estate for many websites. Her work has been published for British retailer Marks and Spencer, Kroger Magazine, the Vision Group, and more. Her passions include writing, music, running, travel, te...

Dorothea Hudson

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated April 2024

Independence American Insurance Company is a reliable insurance provider that offers a range of coverage options for individuals, families, and businesses. Founded in 2008, the company provides affordable and comprehensive insurance coverage for health, specialty, accident, and life insurance.

The cost of the services varies depending on the type of insurance, coverage amount, and state of residence, and discounts are available to eligible customers.

Independence American Insurance Company offers coverage in all 50 states and the District of Columbia, and customers appreciate the easy application process and helpful customer service.

While some customers have expressed frustration with exclusions and limitations in their policies, overall, the company has received low complaints and an A- (Excellent) rating from A.M. Best.

Independence American Insurance Company Insurance Coverage Options

Independence American Insurance Company offers a range of coverage options for individuals, families, and businesses. These coverage options include:

- Health Insurance: Offers comprehensive coverage for medical expenses, including hospital stays, doctor visits, and prescription drugs. Customers can choose from various plan options, including traditional PPOs, high-deductible health plans, and short-term medical plans.

- Specialty Insurance: Provides coverage for accidents and illnesses that are not typically covered by health insurance, such as dental, vision, and critical illness insurance.

- Accident Insurance: Offers financial protection in the event of an accidental injury, including coverage for medical expenses, hospital stays, and other related expenses.

- Life Insurance: Provides coverage for the financial needs of loved ones in the event of the policyholder’s death. Customers can choose from term life insurance or permanent life insurance options.

- Small Business Insurance: Offers coverage options for small businesses, including group health insurance, dental insurance, and short-term disability insurance.

Coverage options and availability may vary by state, and policy details and exclusions will depend on the specific plan selected. Customers should review the details of each policy carefully before making a purchase to ensure they have the coverage they need.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

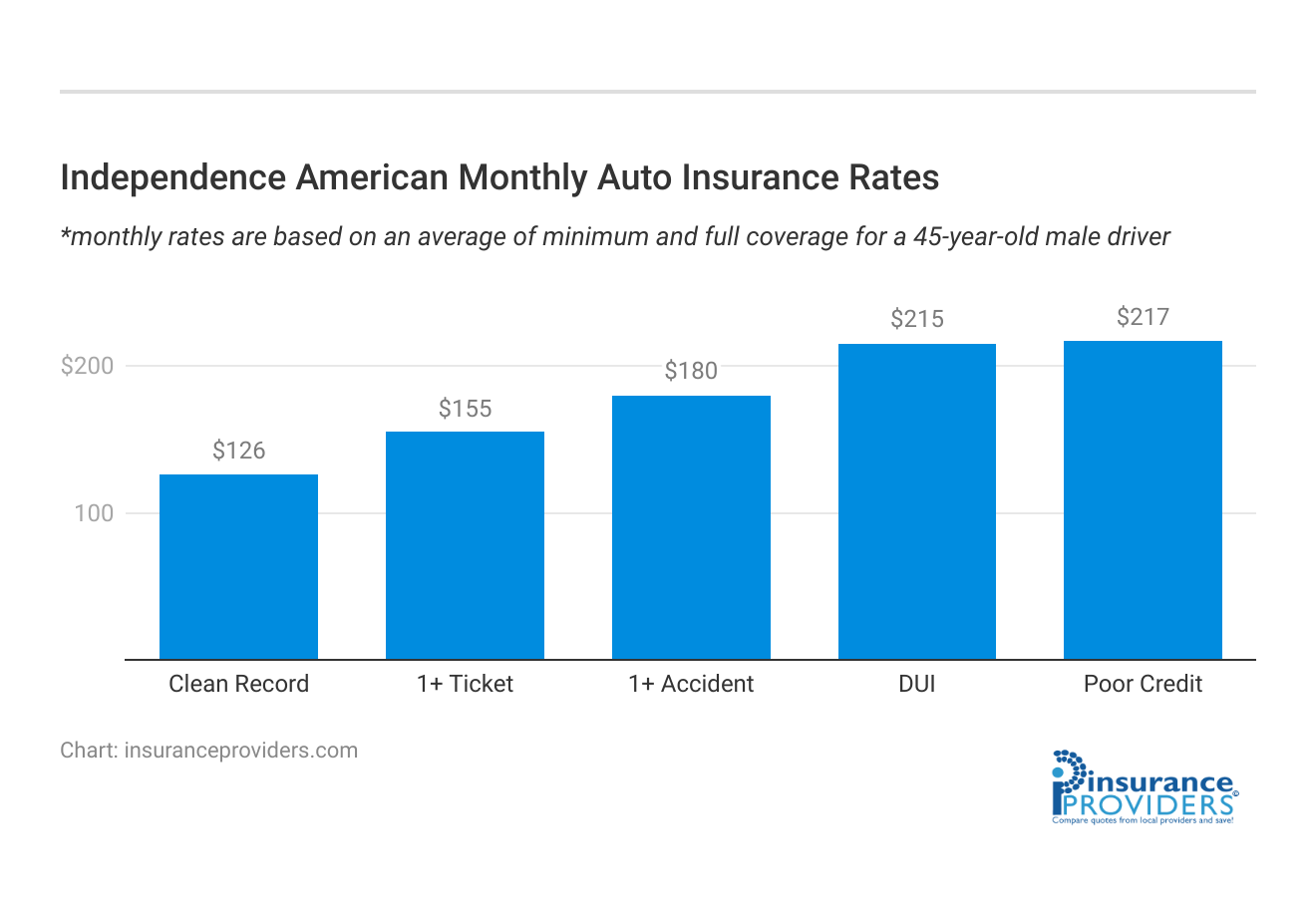

Independence American Insurance Company Insurance Rates Breakdown

| Driver Profile | Independence American | National Average |

|---|---|---|

| Clean Record | $126 | $119 |

| 1+ Ticket | $155 | $147 |

| 1+ Accident | $180 | $173 |

| DUI | $215 | $209 |

| Poor Credit | $217 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Independence American Insurance Company Discounts Available

| Discount | Independence American |

|---|---|

| Anti Theft | 7% |

| Good Student | 12% |

| Low Mileage | 8% |

| Paperless | 5% |

| Safe Driver | 15% |

| Senior Driver | 7% |

Independence American Insurance Company offers various discounts to eligible customers, helping them save on their insurance premiums. These discounts include:

- Multi-Policy Discount: Customers who bundle multiple policies, such as health and accident insurance, may qualify for a discount.

- Safe and Secure Discount: Policyholders who have installed smoke detectors, security systems, or other safety features in their homes may be eligible for a discount.

- Healthy Living Discount: Customers who participate in healthy activities, such as gym memberships, weight loss programs, or non-smoking initiatives, may qualify for a discount.

- Claim-Free Discount: Policyholders who have not filed a claim during a specified period may be eligible for a discount.

- Loyalty Discount: Customers who have been with Independence American Insurance Company for a certain amount of time may qualify for a discount.

- Group Discount: Policyholders who are members of certain organizations or associations may be eligible for a group discount.

These discounts can vary by state and policy type, and not all customers will be eligible for all discounts. Contacting an Independence American Insurance Company representative or checking their website can help customers determine which discounts they may qualify for.

How Independence American Insurance Company Ranks Among Providers

Independence American Insurance Company operates in a highly competitive industry with numerous companies vying for market share. Some of the company’s main competitors include:

- Blue Cross Blue Shield: As a nationwide healthcare company, Blue Cross Blue Shield offers a range of health insurance plans and related products, including dental and vision insurance.

- Aetna: Aetna provides health insurance, dental insurance, and Medicare plans to individuals, families, and employers. They offer a broad range of plans, including HMO, PPO, and POS options. (For more information, read our “Aetna Life Insurance Company: Customer Ratings & Reviews“).

- United Healthcare: United Healthcare is a diversified healthcare company that offers a range of insurance and related products, including health insurance, dental insurance, and Medicare Advantage plans.

- Humana: Humana offers health insurance, dental insurance, and Medicare Advantage plans to individuals and families. They also provide services such as wellness programs and telemedicine.

- Cigna: Cigna offers a range of healthcare products and services, including health insurance, dental insurance, and Medicare Advantage plans. They also offer wellness programs and access to healthcare providers through their network.

These competitors all have significant market share in the healthcare industry, and their products and services are often similar to those offered by Independence American Insurance Company. However, Independence American Insurance Company differentiates itself by offering specialty insurance products, accident insurance, and small business insurance, which may appeal to certain customers.

Frequently Asked Questions

How do I file a claim with Independence American Insurance Company?

To file a claim, you can contact the customer service department or log in to your online account and submit a claim form.

Can I cancel my policy with Independence American Insurance Company?

Yes, you can cancel your policy at any time. Depending on the type of policy you have, there may be a cancellation fee or other restrictions.

Does Independence American Insurance Company cover pre-existing conditions?

Coverage for pre-existing conditions may vary depending on the type of insurance and state of residence. Contact the customer service department for more information.

How do I contact Independence American Insurance Company?

You can contact Independence American Insurance Company by phone, email, or through the online customer service portal. Contact information is available on the company’s website.

What is Independence American Insurance Company?

Independence American Insurance Company (IAIC) is an insurance provider offering a wide range of products, including health, life, dental, and short-term medical insurance. They provide coverage options for individuals, families, and small businesses.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.