Independence Life and Annuity Company Review (2026)

Independence Life and Annuity Company, distinguished by its A+ (Excellent) A.M. Best rating and commitment to comprehensive coverage options, stands out in the competitive insurance market with a customer-centric approach, transparent policies, and a notable reputation for reliability and trustworthiness.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Independence Life and Annuity Company is a top-tier insurance company, distinguished by its A+ (Excellent) A.M. Best rating and commitment to providing comprehensive coverage options.

Specializing in a wide spectrum of insurance products, including life, annuity, health, auto, homeowners, rental property, and business insurance, Independence Life and Annuity prioritizes the individual needs of its customers.

Their customer-centric approach, transparent policies, and numerous discounts make them a compelling choice in the insurance market. With a reputation for financial stability and a low complaint level, Independence Life and Annuity exemplify reliability and trustworthiness in the insurance industry, offering peace of mind to policyholders seeking robust coverage solutions.

Independence Life and Annuity Insurance Coverage Options

Independence Life and Annuity Company offers a wide range of coverage options to cater to the diverse needs of their customers. Here is a bullet list of the coverage options provided by the company:

Life Insurance Coverage:

- Term Life Insurance: Provides coverage for a specified term and pays a death benefit if the insured passes away during the term.

- Whole Life Insurance: Offers lifelong coverage with a cash value component that grows over time.

- Universal Life Insurance: Flexible coverage with adjustable premiums and a cash value component.

- Final Expense Insurance: Designed to cover funeral and burial expenses, easing the financial burden on loved ones.

Annuity Coverage:

- Fixed Annuities: Guaranteed, steady income payments over a set period or for life, with a fixed interest rate.

- Variable Annuities: Allows for investment in various funds, potentially providing higher returns but with market-based risks.

- Immediate Annuities: Starts providing income immediately after a lump-sum payment, often chosen by retirees.

- Deferred Annuities: Accumulate funds over time and then provide income in the future, ideal for retirement planning.

Health Insurance Coverage:

- Health Maintenance Organization (HMO) Plans: Requires primary care physicians and referrals for specialist visits.

- Preferred Provider Organization (PPO) Plans: Offers a broader network of healthcare providers and flexibility in choosing specialists.

- High Deductible Health Plans (HDHPs): Paired with Health Savings Accounts (HSAs) for tax advantages and lower premiums.

Auto Insurance Coverage:

- Liability Insurance: Covers damage and injuries caused to others in an accident.

- Collision Insurance: Pays for damage to your vehicle in the event of a collision.

- Comprehensive Insurance: Protects against non-collision events like theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Protects if you’re in an accident with an uninsured or underinsured driver.

Homeowners’ Insurance Coverage:

- Dwelling Coverage: Protects the structure of your home.

- Personal Property Coverage: Covers belongings inside your home.

- Liability Coverage: Protects if someone is injured on your property.

- Additional Living Expenses (ALE) Coverage: Pays for temporary housing if your home is uninhabitable.

Rental Property Insurance Coverage:

- Landlord Dwelling Coverage: Insures rental property structures.

- Landlord Liability Coverage: Protects against liability claims from tenants.

- Loss of Rental Income Coverage: Provides compensation for lost rental income due to covered perils.

Business Insurance Coverage:

- Business Property Insurance: Covers physical assets, such as buildings and equipment.

- General Liability Insurance: Protects against claims of bodily injury or property damage.

- Business Interruption Insurance: Provides income replacement if your business is temporarily closed due to covered events.

This comprehensive list showcases the extensive coverage options available from Independence Life and Annuity, ensuring that individuals and businesses can find the insurance solutions that best meet their specific needs.

It’s important to consult with the company directly to determine which coverage options suit your unique circumstances.

Read more: How long does it take to receive money from my annuity?

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Independence Life and Annuity Insurance Rates Breakdown

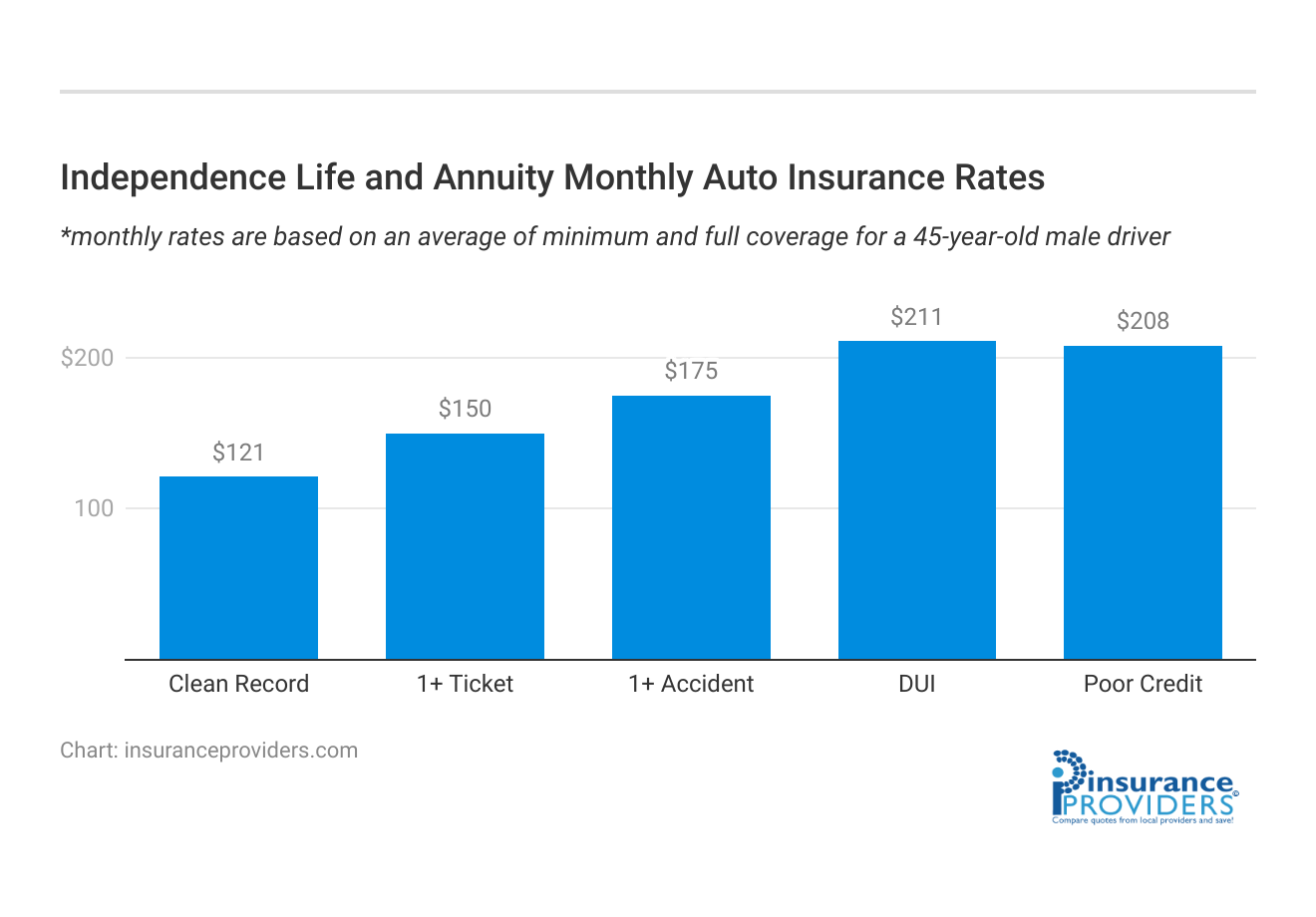

| Driver Profile | Independence Life and Annuity | National Average |

|---|---|---|

| Clean Record | $121 | $119 |

| 1+ Ticket | $150 | $147 |

| 1+ Accident | $175 | $173 |

| DUI | $211 | $209 |

| Poor Credit | $208 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Independence Life and Annuity Discounts Available

| Discount | Independence Life and Annuity |

|---|---|

| Anti Theft | 8% |

| Good Student | 15% |

| Low Mileage | 6% |

| Paperless | 3% |

| Safe Driver | 11% |

| Senior Driver | 7% |

Independence Life and Annuity Company offers a variety of discounts to make their insurance products more affordable for customers. Here is a bullet list of the discounts offered by the company:

- Multi-Policy Discount: Save money when you bundle multiple insurance policies, such as life and annuity insurance, with Independence Life and Annuity.

- Safe Driver Discount: If you have a clean driving record, you can enjoy discounts on auto insurance policies.

- Good Student Discount: Students with excellent academic records may qualify for reduced rates on their insurance premiums.

- Loyalty Discount: Long-term customers who have been with Independence Life and Annuity for a specified period may be eligible for loyalty discounts.

- Defensive Driving Course Discount: Completing a defensive driving course can lead to lower insurance rates for policyholders.

- Home Security Discount: Customers with home security systems in place may receive discounts on their homeowners’ insurance.

- Paid-in-Full Discount: Paying your insurance premium in a lump sum upfront can result in savings on your policy.

- Group Discounts: Independence Life and Annuity offers special discounts to certain groups, such as members of professional organizations or alumni associations.

These discounts demonstrate the company’s commitment to providing cost-effective insurance solutions to its customers. Remember that eligibility for these discounts may vary based on location and specific policy details, so it’s a good idea to inquire with the company directly to determine which discounts you may qualify for.

How Independence Life and Annuity Ranks Among Providers

Independence Life and Annuity Company operates in a highly competitive insurance industry, where several prominent companies offer similar products and services.

The company’s main competitors can vary depending on the specific types of insurance they provide and their geographical reach. Here are some of the notable competitors in various segments of the insurance market:

Life Insurance Competitors:

- Prudential Financial: Prudential is a well-established company known for its diverse range of life insurance products and financial services.

- Metlife: Metlife is one of the largest life insurance providers globally, offering a wide array of life insurance and retirement products.

- New York Life Insurance: New York Life is a mutual insurance company known for its focus on whole life insurance and strong financial stability.

Annuity Competitors:

- Jackson National Life Insurance Company: Jackson offers a variety of annuity products, including fixed, variable, and indexed annuities.

- American Equity Investment Life Insurance Company: This company specializes in fixed-indexed annuities and is a strong player in the annuity market.

- Allianz Life: Allianz offers a broad range of annuity products and is known for its global presence in the financial industry.

Read more: Jackson National Life Insurance Company Review

Health Insurance Competitors:

- Unitedhealth Group: Unitedhealth Group is a leading provider of health insurance, healthcare services, and wellness programs.

- Anthem, Inc.: Anthem is a major health insurance company serving millions of members across the United States.

- Cigna: Cigna offers health insurance plans, as well as dental, vision, and pharmacy services.

Auto Insurance Competitors:

- State Farm: State Farm is one of the largest auto insurance providers in the United States, offering a wide range of coverage options.

- Geico: Known for its competitive rates and extensive advertising, Geico is a prominent auto insurance competitor.

- Progressive: Progressive is recognized for its innovative approach to auto insurance and offers various discounts and coverage options.

Homeowners’ Insurance Competitors:

- Allstate: Allstate is a well-known provider of homeowners’ insurance with a strong network of agents.

- Nationwide: Nationwide offers homeowners’ insurance coverage, along with various other insurance products.

- Farmers Insurance: Farmers is known for its homeowners’ insurance and personalized policy options.

Read more: Nationwide Life and Annuity Insurance Company Review

It’s important to note that the competitive landscape in the insurance industry is dynamic, with companies continuously adapting their offerings and strategies. Independence Life and Annuity competes by offering unique features, excellent customer service, and competitive pricing to distinguish itself from its competitors.

When choosing an insurance provider, consumers often consider factors like coverage options, pricing, customer service, and the company’s financial stability.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Claims Process at Independence Life and Annuity Company

Ease of Filing a Claim

Independence Life and Annuity Company has made it convenient for policyholders to file claims by offering multiple options. Whether you prefer the ease of online submissions, the personal touch of phone assistance, or the convenience of mobile apps, the company ensures that you can report a claim in a way that suits your preferences.

Average Claim Processing Time

Efficiency is a hallmark of Independence Life and Annuity’s claims processing. Policyholders can expect a prompt and streamlined experience when filing claims. The company is committed to minimizing claim processing times, and providing swift assistance during critical situations.

Customer Feedback on Claim Resolutions and Payouts

Independence Life and Annuity Company values customer feedback, especially when it comes to the resolution of claims and payout experiences. Their dedication to exceptional customer service extends to the claims process.

Real customer input plays a crucial role in their ongoing efforts to improve. The company is focused on delivering fair and satisfactory claim settlements while maintaining high levels of customer satisfaction.

Digital and Technological Features by Independence Life and Annuity Company

Mobile App Features and Functionality

Explore the comprehensive mobile app offered by Independence Life and Annuity Company, available for both Android and iOS users. This app is equipped with a wide array of features and functionalities designed to simplify insurance management. From reporting claims to accessing policy information, the mobile app provides a user-friendly interface for efficient insurance management.

Online Account Management Capabilities

Independence Life and Annuity Company provides a user-friendly online account management platform. Policyholders can access their accounts 24/7, allowing them to make payments, review policy details, and track claim statuses effortlessly. This online portal enhances convenience and empowers policyholders to take control of their insurance needs.

Digital Tools and Resources

Discover Independence Life and Annuity Company’s comprehensive set of digital tools and resources. These resources are thoughtfully designed to educate and assist policyholders, providing informative materials and interactive tools that offer valuable insights and guidance. Stay informed about insurance matters and make well-informed decisions with the help of these digital resources.

Frequently Asked Questions

What types of insurance does Independence Life and Annuity offer?

Independence Life and Annuity offers a wide range of insurance products, including life insurance, annuity insurance, health insurance, auto insurance, homeowners’ insurance, rental property insurance, and business insurance.

How does Independence Life and Annuity’s A.M. Best rating impact their reliability?

Independence Life and Annuity’s A+ (Excellent) A.M. Best rating signifies strong financial stability and reliability, assuring policyholders of the company’s ability to meet its financial commitments.

What discounts are available for policyholders with Independence Life and Annuity?

Policyholders can benefit from various discounts, such as multi-policy discounts, safe driver discounts, good student discounts, and more, depending on their specific insurance needs.

How does Independence Life and Annuity handle customer complaints?

Independence Life and Annuity maintains a low complaint level, indicating their commitment to resolving customer issues promptly and effectively, ensuring a positive customer experience.

Can I get personalized insurance solutions from Independence Life and Annuity?

Yes, Independence Life and Annuity is known for its customer-centric approach, offering tailored insurance solutions to meet individual needs, ensuring coverage that fits your unique circumstances.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.