Indiana Lumbermens Mutual Insurance Company Review (2026)

Indiana Lumbermens Mutual Insurance Company, a stalwart in the insurance industry, stands as a trusted provider offering tailored coverage options for businesses, ensuring their protection with a commitment to strong financial stability, positive customer reviews, and efficient claims processing.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Indiana Lumbermens Mutual Insurance Company, a stalwart in the insurance industry, offers a wide array of coverage options tailored to the unique needs of businesses.

From comprehensive property insurance protecting against unforeseen disasters to vital general liability coverage safeguarding against claims, this reputable company ensures that businesses can thrive with peace of mind.

Their commitment to clients is underlined by a low complaint level, strong financial stability, and favorable customer reviews.

Additionally, Indiana Lumbermens provides efficient claims processing and customizable policies, making them a dependable partner for businesses of various sizes and industries.

Indiana Lumbermens Mutual Insurance Company Insurance Coverage Options

Indiana Lumbermens Mutual Insurance Company offers a range of coverage options tailored to meet the diverse needs of businesses. Here are the coverage options they provide:

- Property Insurance: This coverage protects your physical assets, including buildings, equipment, and inventory, against various perils such as fire, theft, vandalism, and more.

- General Liability Insurance: General liability insurance shields your business from claims of bodily injury, property damage, or advertising injury, providing crucial protection in interactions with customers, suppliers, or the public.

- Workers’ Compensation Insurance: Indiana Lumbermens offers comprehensive workers’ compensation coverage, ensuring that both employees and employers are safeguarded in the event of workplace injuries. It covers medical expenses and lost wages for injured employees.

- Commercial Auto Insurance: For businesses that rely on vehicles for transportation, commercial auto insurance provides coverage for accidents, injuries, and property damage involving company-owned vehicles.

- Umbrella Insurance: Umbrella insurance offers an additional layer of liability coverage, providing peace of mind when facing potential lawsuits or unforeseen circumstances. It extends the protection of your existing policies.

Over the years, they’ve expanded their product offerings and geographic reach while staying true to their core values of integrity and reliability.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Indiana Lumbermens Mutual Insurance Company Insurance Rates Breakdown

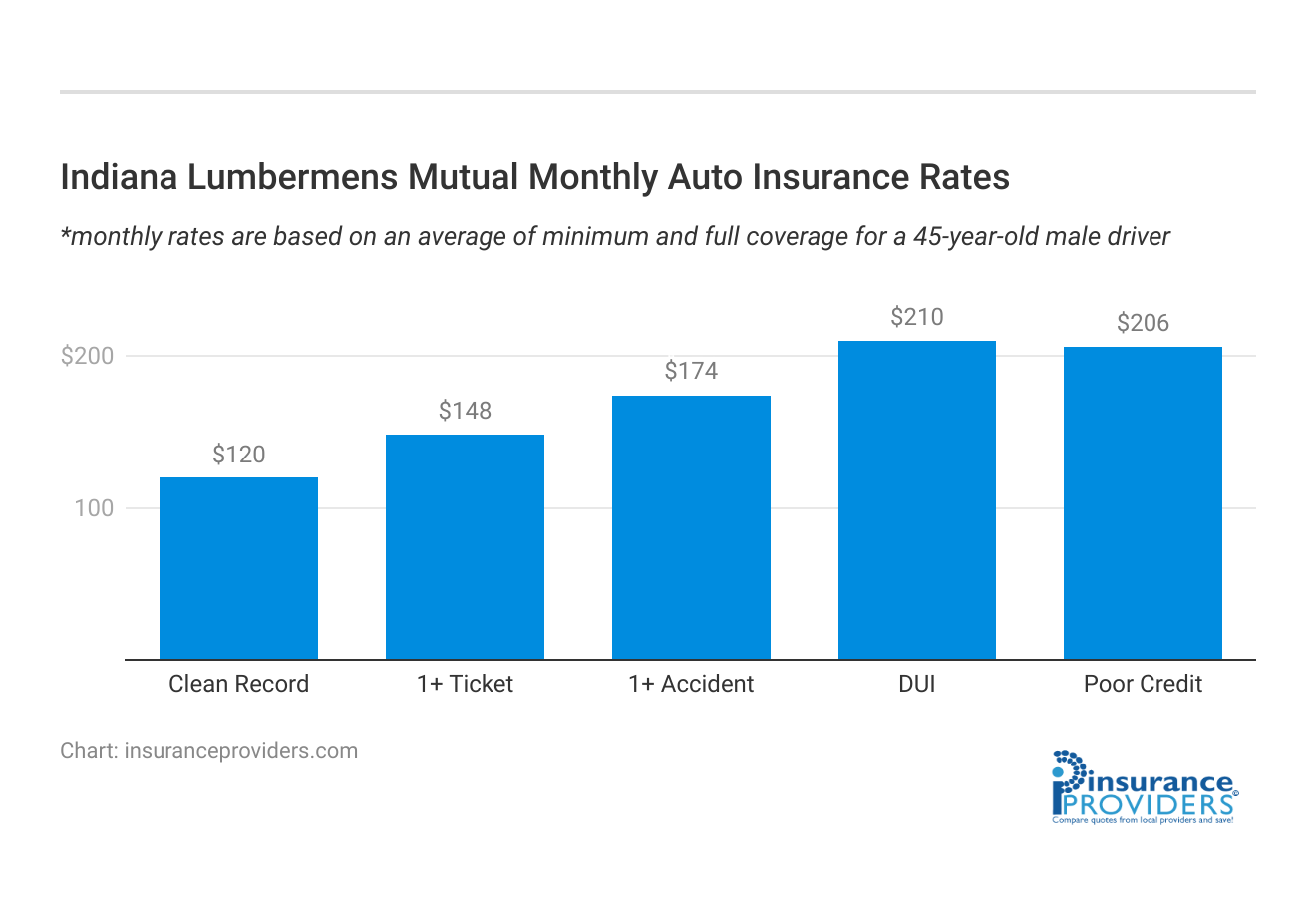

| Driver Profile | Indiana Lumbermens Mutual | National Average |

|---|---|---|

| Clean Record | $120 | $119 |

| 1+ Ticket | $148 | $147 |

| 1+ Accident | $174 | $173 |

| DUI | $210 | $209 |

| Poor Credit | $206 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Indiana Lumbermens Mutual Insurance Company Discounts Available

| Discount | Indiana Lumbermens Mutual |

|---|---|

| Anti Theft | 6% |

| Good Student | 12% |

| Low Mileage | 4% |

| Paperless | 9% |

| Safe Driver | 7% |

| Senior Driver | 2% |

It’s common for insurance companies to offer various discounts to help businesses save on their premiums. Here are some typical discounts that insurance providers like Lumbermens Mutual Insurance Company may offer:

- Multi-Policy Discount: Businesses can often save by bundling multiple insurance policies with the same company. For example, combining general liability and property insurance.

- Claims-Free Discount: Companies with a history of few or no claims may be eligible for discounts as they are considered lower risk.

- Safety Measures Discount: Implementing safety measures, such as security systems or workplace safety protocols, can lead to reduced premiums.

- Payment Discounts: Some insurers offer discounts for businesses that pay their premiums in full annually or through electronic funds transfer (EFT).

- Professional Associations: Being a member of specific professional associations or industry groups can sometimes qualify you for discounted rates.

- New Business Discount: Start-ups and new businesses may be eligible for discounts or incentives to attract new clients.

- Safety Training: Providing safety training to employees can lead to discounts as it demonstrates a commitment to risk reduction.

Please note that the availability and specifics of discounts can vary, and it’s advisable to directly contact Indiana Lumbermens Mutual Insurance Company or visit their website to inquire about the specific discounts they offer for your business.

How Indiana Lumbermens Mutual Insurance Company Ranks Among Providers

Identifying the main competitors of Indiana Lumbermens Mutual Insurance Company in the insurance industry can be challenging without access to specific market research or data.

- Commercial Insurance Giants: Large national or international insurance companies that specialize in commercial insurance, such as The Hartford, Chubb, or Liberty Mutual, could be considered competitors.

- Specialized Insurers: Companies that focus on specific niches or industries, like technology, healthcare, or construction insurance, might compete with Indiana Lumbermens in those specific sectors.

- Regional Insurers: Depending on the company’s geographic reach, regional insurers may also pose competition, particularly if they have a strong local presence.

- Online Insurance Providers: Some businesses may prefer the convenience of online insurance providers, like Hiscox or Next Insurance, which offer digital-first approaches to purchasing coverage.

- Brokerage Firms: Insurance brokerage firms, such as Marsh & McLennan or Aon, can also be competitors, especially when businesses seek customized insurance solutions.

- Government Insurance Programs: In some cases, government-sponsored insurance programs or state-run insurance pools might be alternatives for businesses, particularly for certain types of coverage like workers’ compensation.

It’s important to note that the competitive landscape can vary by region, industry, and the specific needs of businesses.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Indiana Lumbermens Mutual Insurance Company Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Indiana Lumbermens Mutual Insurance Company strives to make the claims process as convenient as possible for its customers. They offer multiple channels for filing claims, including online submissions, over-the-phone assistance, and mobile app functionality.

This flexibility ensures that policyholders can choose the method that suits them best, whether they prefer the ease of digital submission or the personalized support of a phone call.

Average Claim Processing Time

Efficiency is a key aspect of Indiana Lumbermens Mutual Insurance Company’s claims process. While specific processing times may vary depending on the nature of the claim, the company aims for swift claim resolutions. Their commitment to quick and efficient processing helps minimize disruptions to businesses, allowing them to get back on track without unnecessary delays.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is essential for evaluating an insurance company’s performance, especially when it comes to claim resolutions and payouts. Indiana Lumbermens Mutual Insurance Company has garnered favorable customer reviews in this regard.

Their strong financial stability and dedication to providing fair and timely payouts have contributed to positive experiences for policyholders.

Indiana Lumbermens Mutual Insurance Company Digital and Technological Features

Mobile App Features and Functionality

Indiana Lumbermens Mutual Insurance Company offers a user-friendly mobile app with a range of features and functionalities. Policyholders can access their accounts, file claims, view policy details, and even make payments conveniently through the app. This digital tool enhances the overall customer experience by providing easy access to important information and services on the go.

Online Account Management Capabilities

The company’s online account management capabilities are designed to empower policyholders with greater control over their insurance policies. Customers can log in to their accounts online to review and manage their coverage, update personal information, and track the status of claims.

This online portal simplifies the administrative aspects of insurance, making it more convenient for policyholders to stay informed and engaged.

Digital Tools and Resources

Indiana Lumbermens Mutual Insurance Company offers a variety of digital tools and resources to assist policyholders in understanding their coverage and making informed decisions. These resources may include educational materials, calculators, and guides to help businesses assess their insurance needs.

By providing valuable digital resources, the company supports its customers in making confident choices regarding their insurance coverage.

Frequently Asked Questions

How do I choose the right insurance type for my business?

Assess your business’s needs and risks, and consult with Indiana Lumbermens for expert guidance on the most suitable coverage.

What makes Indiana Lumbermens Mutual Insurance Company stand out in the industry?

Their long-standing history, commitment to clients, and diverse range of insurance options set them apart.

Can I bundle multiple insurance policies with them for discounts?

Yes, bundling multiple policies often leads to cost savings. Contact Indiana Lumbermens for details.

How fast is their claims processing?

Indiana Lumbermens aims for swift claims processing to minimize disruptions to your business.

Are there any specific industries they specialize in?

Indiana Lumbermens serves a wide range of industries, offering tailored solutions to meet their unique needs. Contact them to discuss your specific industry requirements.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.