Individual Assur Co Life Hlth & ACC Review (2025)

Navigating the dynamic landscape of insurance is a quest for both security and peace of mind, and within this realm, "Individual Assur Co" stands as a steadfast beacon.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive article, we explore the offerings of Individual Assur Co, a fictional insurance company committed to providing diverse insurance solutions. With a robust portfolio encompassing life, health, and accident insurance, Individual Assur Co stands out for its competitive premiums, exceptional customer service, and flexible policy options.

They prioritize swift claims processing, ensuring customers receive timely support during challenging times. While the article emphasizes the company’s strengths, it also acknowledges potential areas for improvement, such as limited coverage information and a lack of specific details about discounts.

Overall, Individual Assur Co emerges as a reliable insurance partner, offering a range of policies designed to safeguard individuals and their loved ones from life’s uncertainties.

Individual Assur Co Life Health and Acc Insurance Coverage Options

Individual Assur Co understands the importance of providing comprehensive coverage to meet the diverse needs of its customers. Whether it’s safeguarding your family’s financial future, protecting your health, or ensuring support in case of accidents, Individual Assur Co offers a range of insurance options. Below, we outline the coverage options provided by the company:

- Life Insurance: Individual Assur Co offers life insurance policies designed to provide financial security to your loved ones in the event of your passing. These policies can help cover funeral expenses, and outstanding debts, and provide a source of income to beneficiaries.

- Health Insurance: Protect your well-being with Individual Assur Co’s health insurance plans. These plans offer coverage for medical expenses, including doctor visits, hospital stays, prescription medications, and preventive care.

- Accident Insurance: In the unpredictable world we live in, accidents can happen at any time. Individual Assur Co’s accident insurance provides financial support to help you cover medical bills, rehabilitation costs, and other expenses resulting from accidents.

Individual Assur Co’s commitment to offering a diverse range of insurance coverage options reflects its dedication to providing financial security and peace of mind to its customers. Whether you’re looking for life, health, or accident insurance, the company strives to cater to your unique needs and ensure you’re prepared for life’s uncertainties.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Individual Assur Co Life Health and Acc Insurance Rates Breakdown

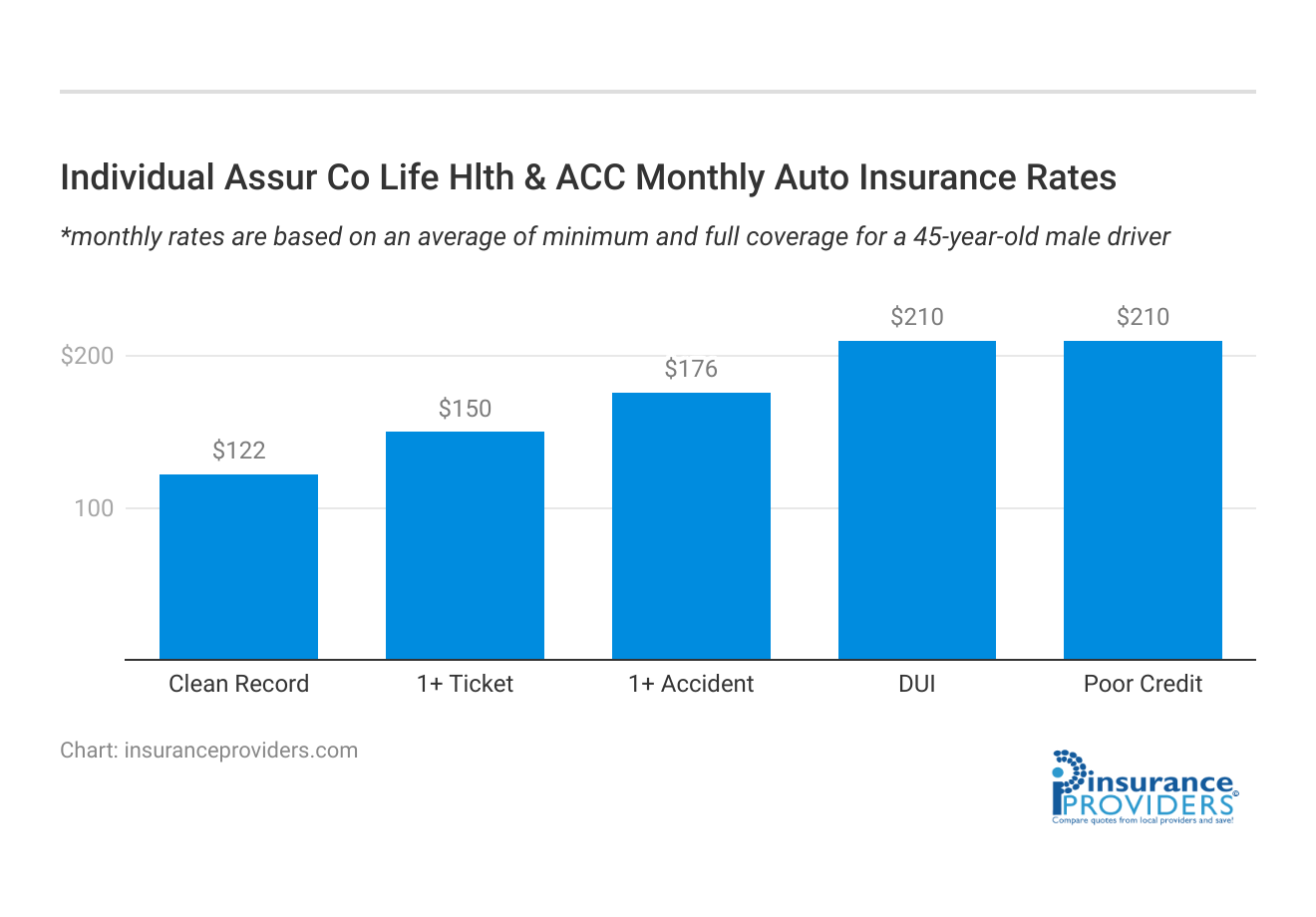

| Driver Profile | Individual Assur Co Life Hlth & ACC | National Average |

|---|---|---|

| Clean Record | $122 | $119 |

| 1+ Ticket | $150 | $147 |

| 1+ Accident | $176 | $173 |

| DUI | $210 | $209 |

| Poor Credit | $210 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Individual Assur Co Life Health and Acc Discounts Available

| Discount | Individual Assur Co Life Hlth & ACC |

|---|---|

| Anti Theft | 8% |

| Good Student | 15% |

| Low Mileage | 5% |

| Paperless | 11% |

| Safe Driver | 6% |

| Senior Driver | 3% |

At Individual Assur Co, they understand the importance of making insurance coverage more affordable for their valued customers. To help you save on your insurance premiums, the company offers a variety of discounts. Here are the discounts you may be eligible for:

- Multi-Policy Discount: Save money by bundling multiple insurance policies with Individual Assur Co. When you combine your life, health, and accident insurance, you can enjoy significant savings on your premiums.

- Healthy Lifestyle Discount: If you maintain a healthy lifestyle and meet certain health criteria, you may qualify for a healthy lifestyle discount. This encourages and rewards policyholders for making positive choices that promote well-being.

- Safe Driver Discount: If you have an accident insurance policy with Individual Assur Co and have a history of safe driving, you could be eligible for a safe driver discount, reducing your accident insurance premium.

- Long-Term Policyholder Discount: Loyalty is rewarded at Individual Assur Co. Policyholders who have been with the company for an extended period may qualify for a long-term policyholder discount.

- Good Credit Discount: Maintaining good credit is important, and Individual Assur Co recognizes that. If you have a strong credit history, you may be eligible for a good credit discount on your insurance policies.

The availability and terms of these discounts can vary widely between insurance companies, so it’s essential to inquire with Individual Assur Co directly to understand the specific discounts you may be eligible for. These discounts can help make your insurance coverage more cost-effective while still providing you with the protection you need.

Individual Assur Co strives to make insurance coverage accessible and affordable for its customers by offering a range of discounts. These discounts reward loyalty, safe practices, and responsible financial management, allowing policyholders to enjoy the benefits of comprehensive insurance coverage without breaking the bank.

How Individual Assur Co Life Health and Acc Ranks Among Providers

Identifying the main competitors of a fictional company like “Individual Assur Co” would depend on various factors such as the company’s niche, target market, and the types of insurance products it offers. However, in a competitive insurance industry, we can consider some generic types of competitors that Individual Assur Co might face:

- Established Insurance Giants: Large, well-known insurance companies with extensive resources and a wide range of insurance products are often major competitors. These companies have the advantage of brand recognition and may offer competitive rates.

- Regional Insurance Providers: Smaller, regional insurance providers can be strong competitors in specific geographic areas. They often have a deep understanding of local markets and may offer personalized services.

- Specialized Niche Insurers: Some insurance companies focus on specific niches or specialized insurance products. For example, there are insurers that specialize in health insurance, life insurance, or accident insurance. These niche insurers can be formidable competitors within their chosen domain.

- Online Insurance Marketplaces: Online insurance comparison websites and marketplaces are becoming increasingly popular. These platforms allow customers to compare quotes from multiple insurance providers, making it easy for consumers to find the best deals.

- Credit Unions and Banks: Some financial institutions, such as credit unions and banks, offer insurance products to their customers. These institutions may compete with Individual Assur Co, especially if they have a strong customer base.

- Emerging Insurtech Startups: The insurance technology (insurtech) sector has seen significant growth. Insurtech startups leverage technology to streamline processes and offer innovative insurance products. They may disrupt traditional insurance markets and compete for customers.

- Insurance Aggregators: Aggregator websites and apps aggregate insurance quotes from various providers, making it convenient for consumers to compare options. These platforms can divert potential customers from Individual Assur Co.

- Employee Benefits Providers: Companies that offer employee benefits packages, including insurance, may compete in the health and life insurance sectors. They often provide group insurance options to employees.

- Mutual Insurance Companies: Mutual insurance companies are owned by policyholders and often have a customer-focused approach. They may compete on the basis of customer satisfaction and policyholder dividends.

- Government Insurance Programs: In some countries, government-sponsored insurance programs compete with private insurers, particularly in health insurance.

The competitive landscape can evolve, and new players may enter the market over time. Individual Assur Co would need to continuously assess its competitive positioning and adapt its strategies to remain competitive in the insurance industry.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Individual Assur Co Life Hlth & ACC Claims Process

Ease of Filing a Claim

Individual Assur Co understands the importance of a seamless claims process for its customers. They offer multiple avenues for filing a claim, ensuring convenience and accessibility. Customers have the option to file claims online through their website, over the phone by speaking with a dedicated claims representative, or using their mobile app.

Average Claim Processing Time

Timeliness is crucial when it comes to insurance claims, and Individual Assur Co prioritizes swift claim processing. On average, they aim to process claims efficiently, ensuring that customers receive the support they need during challenging times.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback plays a vital role in evaluating an insurance company’s performance. Individual Assur Co values customer satisfaction and strives to provide fair and efficient claim resolutions. In this section, we will delve into customer reviews and their experiences with the company’s claim resolutions and payouts.

Individual Assur Co Life Hlth & ACC Digital and Technological Features

Mobile App Features and Functionality

In today’s digital age, insurance companies are increasingly focusing on enhancing their mobile app offerings. Individual Assur Co is no exception, and they have developed a feature-rich mobile app to cater to the needs of their tech-savvy customers.

Online Account Management Capabilities

Online account management is a key aspect of modern insurance services. Individual Assur Co provides a user-friendly online platform for policyholders to manage their accounts conveniently. From updating personal information to reviewing policy details and making premium payments, customers can access a wide range of account management features online.

Digital Tools and Resources

In addition to their mobile app and online account management, Individual Assur Co offers a suite of digital tools and resources to help customers make informed decisions about their insurance coverage. These tools may include calculators, educational materials, and other resources designed to empower policyholders.

Frequently Asked Questions

What is the difference between term life and whole life insurance?

Term life insurance provides coverage for a specified term, while whole life insurance provides coverage for your entire life. Whole life policies also have a cash value component.

Can I customize my health insurance plan with Individual Assur Co?

Yes, Individual Assur Co offers customizable health insurance plans, allowing you to select the coverage that best suits your needs and budget.

How quickly are accident insurance claims processed with Individual Assur Co?

Individual Assur Co prioritizes quick claims processing, ensuring that you receive the support you need promptly in case of an accident.

Do they offer discounts for bundling multiple insurance policies?

Yes, Individual Assur Co often provides discounts for bundling multiple insurance policies, making it cost-effective to protect various aspects of your life.

Is Individual Assur Co available nationwide?

Yes, Individual Assur Co offers insurance coverage nationwide, providing access to their comprehensive policies across the country.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.