Lincoln Heritage Life Insurance Company Review (2026)

Lincoln Heritage Life Insurance Company, a trusted name since 1963, offers tailored life insurance options focusing on quick approvals, affordability, and exceptional customer service.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive article, we delve into the offerings and strengths of Lincoln Heritage Life Insurance Company. As a trusted pillar in the insurance industry since 1963, Lincoln Heritage specializes in providing a wide spectrum of life insurance options tailored to individual needs.

From Whole Life Insurance with lifelong coverage and cash value buildup to Term Life Insurance for short-term protection and Final Expense Insurance designed to alleviate end-of-life expenses, Lincoln Heritage ensures peace of mind for policyholders and their loved ones.

With a commitment to quick approvals, competitive pricing, and exceptional customer service, Lincoln Heritage has earned its reputation as a reliable choice for safeguarding financial futures.

Despite operating in a highly competitive market, Lincoln Heritage’s niche expertise and dedication to affordability and accessibility continue to distinguish it as a dependable partner in life insurance.

Lincoln Heritage Life Insurance Company Insurance Coverage Options

When it comes to securing your family’s financial future, Lincoln Heritage Life Insurance Company understands that one size does not fit all. They offer a range of coverage options designed to meet your specific needs. Whether you’re planning for the long term, need short-term protection, or want to ensure your final expenses are covered, Lincoln Heritage has you covered.

Whole Life Insurance

- Lifelong coverage with premiums that remain consistent throughout your lifetime.

- Builds cash value over time that can be borrowed against or used for emergencies.

- Ideal for long-term financial planning and leaving a legacy for your loved ones.

Term Life Insurance

- Provides coverage for a specific term, typically 10, 15, 20, or 30 years.

- Affordable premiums with a death benefit payable to beneficiaries.

- Suitable for short-term financial protection, such as covering a mortgage or children’s education.

Final Expense Insurance

- Designed specifically to cover end-of-life expenses.

- Helps alleviate the financial burden on your family during a difficult time.

- Provides funds for funeral costs, burial expenses, and other related end-of-life bills.

Lincoln Heritage Life Insurance Company’s diverse coverage options ensure that you can choose the plan that best suits your unique circumstances and provides the protection your loved ones deserve. These coverage options reflect Lincoln Heritage’s commitment to offering comprehensive and flexible life insurance solutions to ensure their policyholders and their families have peace of mind.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Lincoln Heritage Life Insurance Company Insurance Rates Breakdown

| Driver Profile | Lincoln Heritage Life Insurance Company | National Average |

|---|---|---|

| Clean Record | $109 | $119 |

| 1+ Ticket | $133 | $147 |

| 1+ Accident | $158 | $173 |

| DUI | $183 | $209 |

| Poor Credit | $187 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Lincoln Heritage Life Insurance Company Discounts Available

| Discount | Lincoln Heritage Life Insurance Company |

|---|---|

| Anti Theft | 10% |

| Good Student | 12% |

| Low Mileage | 14% |

| Paperless | 8% |

| Safe Driver | 20% |

| Senior Driver | 12% |

Lincoln Heritage Life Insurance Company understands the importance of providing value to its policyholders. While life insurance policies typically do not have traditional discounts like auto or home insurance, Lincoln Heritage offers certain advantages and features that can be considered as valuable incentives. Here’s a list of these features and advantages:

- Guaranteed Acceptance: One of Lincoln Heritage’s standout features is guaranteed acceptance for qualified applicants. This means that, in many cases, you can secure coverage without the need for a medical exam or answering extensive health questions. This feature can be especially valuable for individuals with health concerns.

- Affordable Premiums: Lincoln Heritage is known for offering competitive and affordable premiums, ensuring that policyholders can obtain the coverage they need without breaking the bank. This affordability can be seen as a form of financial advantage.

- Cash Value Accumulation: Whole Life Insurance policies offered by Lincoln Heritage build cash value over time. While not a traditional discount, this feature allows policyholders to access the accumulated cash value for loans or emergencies, providing added financial flexibility.

- Flexible Payment Options: The company typically offers flexible payment options, allowing policyholders to choose the payment frequency that suits their budget, such as monthly, quarterly, or annually.

While these are not traditional discounts in the sense of percentage reductions, they are essential benefits that Lincoln Heritage provides to enhance the value of their life insurance policies and make them accessible and affordable for a broader range of individuals and families.

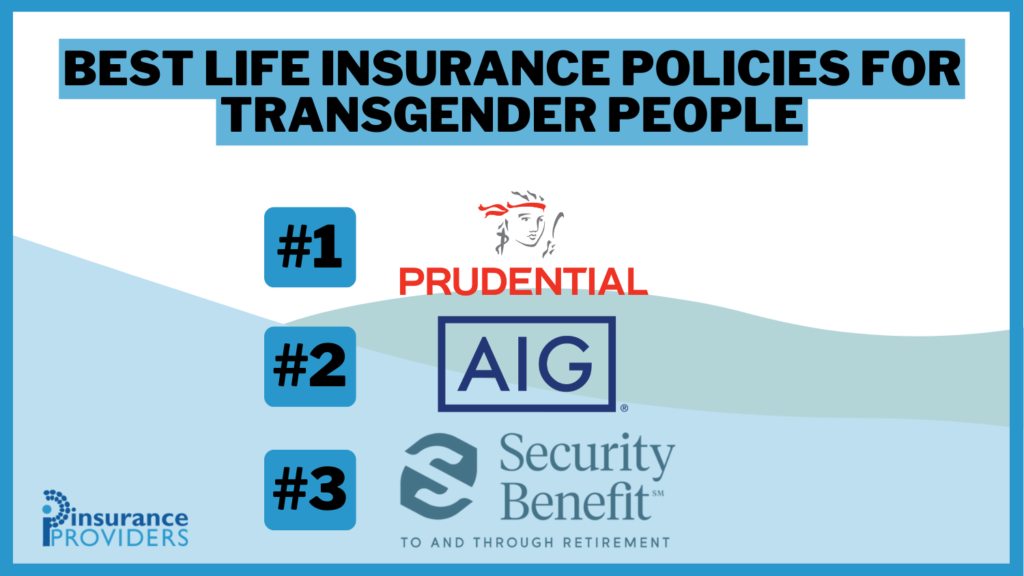

How Lincoln Heritage Life Insurance Company Ranks Among Providers

In the ever-evolving landscape of the life insurance industry, Lincoln Heritage Life Insurance Company faces stiff competition from several well-established insurers.

These competitors offer a diverse range of products and services, creating a dynamic marketplace where policyholders have numerous choices. Let’s explore some of the main competitors that Lincoln Heritage encounters in this competitive arena.

- State Farm: State Farm is one of the largest insurers in the United States and offers a wide range of insurance products, including life insurance. They have a strong network of agents and a solid reputation for customer service.

- Prudential Financial: Prudential is a well-established insurance company known for its diverse life insurance product offerings, including term, whole life, and universal life policies. They have a strong financial standing and a long history in the industry.

- New York Life: New York Life is a mutual life insurance company with a focus on providing long-term financial protection and retirement planning solutions. They have a robust lineup of life insurance products and a reputation for financial stability.

- Metlife: Metlife is another major player in the life insurance market, offering term, whole life, and universal life policies. They have a global presence and a wide range of financial and insurance services.

- Northwestern Mutual: Northwestern Mutual is known for its emphasis on financial planning and offers a variety of life insurance options, including permanent life insurance policies. They are often recognized for their high financial strength ratings.

- AIG (American International Group): AIG is a global insurance and financial services company that provides a range of life insurance products. They have a substantial presence in both the U.S. and international markets.

- Transamerica: Transamerica offers a variety of life insurance policies, including term and whole life insurance, with a focus on helping individuals and families plan for their financial future.

- Guardian Life Insurance: Guardian Life is a mutual insurance company that specializes in life insurance, disability income insurance, and retirement planning. They have a strong reputation for customer service.

In this fiercely competitive landscape, Lincoln Heritage Life Insurance Company navigates the challenges with its unique strengths, such as specialized final expense insurance, guaranteed acceptance policies, affordability, and exceptional customer service.

As policyholders consider their options, they are presented with a wide range of choices, each offering distinct advantages. Lincoln Heritage’s commitment to its niche and its dedication to providing reliable and affordable coverage continue to make it a notable player in the life insurance arena.

Read more:

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Lincoln Heritage Life Insurance Company Claims Process

Ease of Filing a Claim

Lincoln Heritage Life Insurance Company offers policyholders multiple convenient options for filing insurance claims. Whether you prefer an online, phone, or mobile app approach, they strive to make the process as user-friendly as possible.

This flexibility ensures that you can choose the method that suits your needs and preferences, making it easier to navigate during what can be a challenging time.

Average Claim Processing Time

When it comes to insurance claims, time is of the essence. Lincoln Heritage understands the importance of prompt claim processing. While specific processing times may vary depending on the nature of the claim, they are committed to efficient and timely handling. The company’s track record in this regard is an important factor for policyholders seeking quick resolutions during difficult times.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is a valuable indicator of an insurance company’s performance when it comes to claim resolutions and payouts. Lincoln Heritage encourages transparency and values customer opinions.

The reviews and testimonials from policyholders who have experienced the claims process provide valuable insights into the company’s commitment to delivering on its promises and ensuring policyholders receive the support they need.

Digital and Technological Features of Lincoln Heritage Life Insurance Company

Mobile App Features and Functionality

In today’s digital age, mobile apps play a crucial role in enhancing the customer experience. Lincoln Heritage offers a user-friendly mobile app that allows policyholders to access their accounts, review policy details, and even file claims on the go. The app’s features and functionality are designed to streamline insurance management and provide convenience at your fingertips.

Online Account Management Capabilities

Online account management is another key aspect of Lincoln Heritage’s digital services. Policyholders can log in to their accounts through the company’s website, where they can view policy information, make payments, and update their contact details. This online portal ensures that customers have easy access to their policy-related information whenever they need it.

Digital Tools and Resources

In addition to mobile apps and online account management, Lincoln Heritage provides a range of digital tools and resources to help policyholders make informed decisions about their coverage. These resources may include educational content, calculators, and informative guides, all designed to empower customers to navigate the world of life insurance with confidence.

Frequently Asked Questions

Is Lincoln Heritage Life Insurance available nationwide?

Yes, Lincoln Heritage Life Insurance Company offers coverage across the United States, making their services accessible to customers nationwide.

What is the application process like for Lincoln Heritage Life Insurance?

The application process with Lincoln Heritage is straightforward and typically involves answering a few health-related questions. Many policies offer guaranteed acceptance, meaning no medical exam is required for qualified applicants.

Do they offer life insurance policies for seniors?

Yes, Lincoln Heritage provides life insurance policies without age restrictions. Their policies are accessible to individuals of various age groups, including seniors.

How do I file a claim with Lincoln Heritage?

To file a claim, you can contact Lincoln Heritage’s claims department, and they will guide you through the process. They aim to provide a hassle-free claims experience, ensuring that your loved ones receive the benefits they deserve in a timely manner.

Are there any discounts or special offers available with Lincoln Heritage Life Insurance?

Lincoln Heritage does not typically offer traditional discounts like auto or home insurance. Instead, they focus on providing valuable features, such as guaranteed acceptance for certain policies, affordability, and the ability to access cash value in Whole Life policies.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.