Lincoln Life & Annuity Company of New York Review (2026)

Landing as a trusted choice in the insurance landscape, Lincoln Life & Annuity Company of New York offers diverse insurance and retirement solutions, ensuring financial security and peace of mind.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive article, we’ve delved into the world of Lincoln Life & Annuity Company of New York, a trusted name in insurance and financial services. With a diverse range of coverage options, including life insurance policies, annuity plans, and retirement solutions, Lincoln offers individuals the means to secure their financial future.

Alongside a discussion of discounts and competitive offerings, we’ve explored the company’s main competitors in the insurance industry. Lincoln’s commitment to customer satisfaction, competitive pricing, and a steadfast history of reliability make it a formidable choice for those seeking peace of mind and financial security.

Whether you’re safeguarding your loved ones, planning for retirement, or seeking valuable discounts, Lincoln Life & Annuity Company of New York is poised to support your financial goals.

Lincoln Life & Annuity Company of New York Insurance Coverage Options

When it comes to securing your financial future and protecting your loved ones, Lincoln Life & Annuity Company of New York offers a diverse range of coverage options. Whether you’re seeking life insurance, planning for retirement, or looking for annuity solutions, Lincoln has you covered. Let’s explore the array of coverage options available:

Life Insurance Policies

- Term Life Insurance

- Whole Life Insurance

- Universal Life Insurance

Annuity Plans

- Fixed Annuities

- Variable Annuities

- Indexed Annuities

Retirement Options

- 401(k) Plans

- Individual Retirement Accounts (IRAs)

- Pension Plans

With Lincoln Life & Annuity Company of New York, you can take the first step towards financial security and peace of mind. Their extensive coverage options, including life insurance, annuities, and retirement plans, ensure that you have the support you need for a brighter tomorrow. Explore the possibilities and safeguard your financial future with Lincoln.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Lincoln Life & Annuity Company of New York Insurance Rates Breakdown

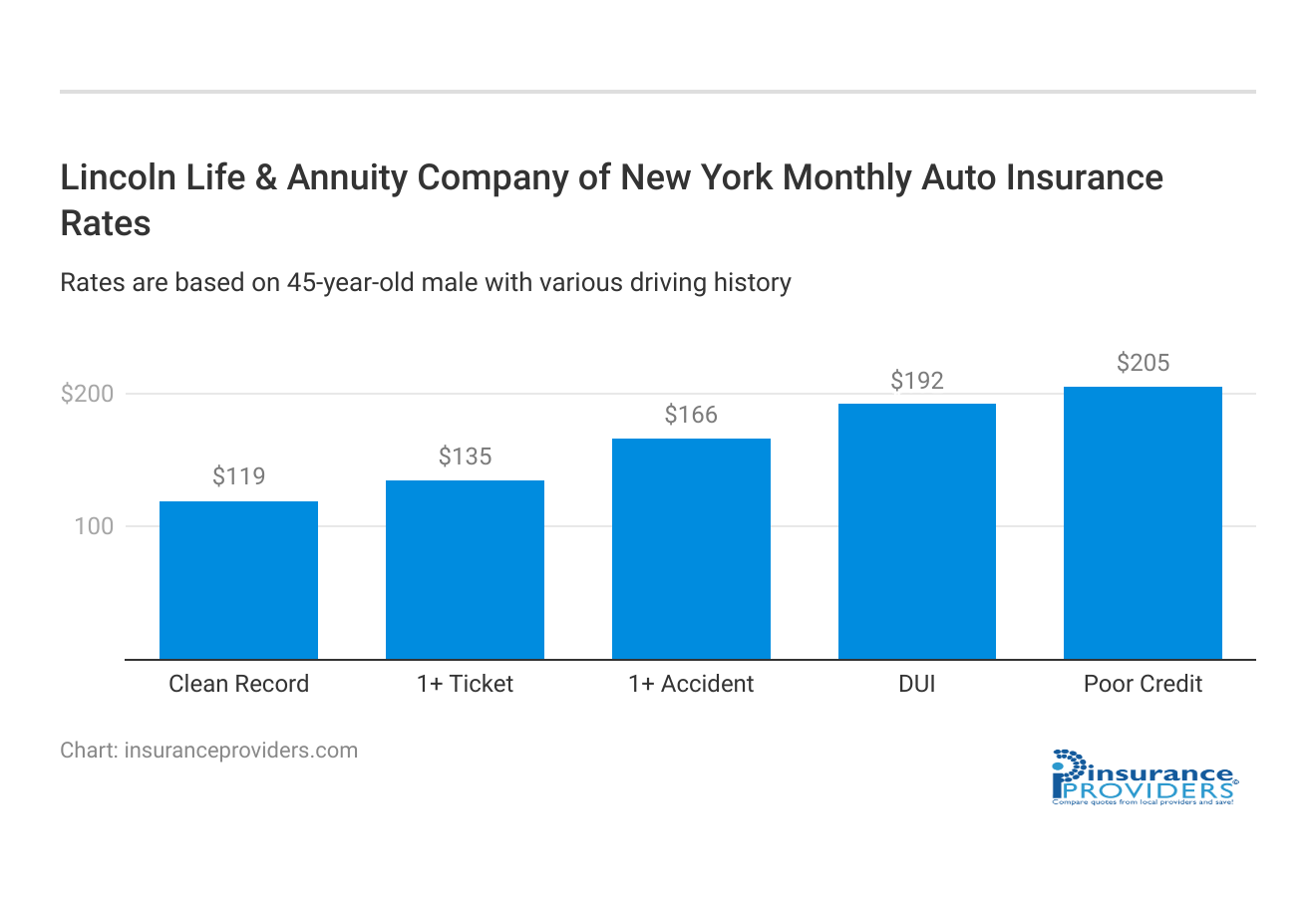

| Driver Profile | Lincoln Life & Annuity Company of New York | National Average |

|---|---|---|

| Clean Record | $119 | $119 |

| 1+ Ticket | $135 | $147 |

| 1+ Accident | $166 | $173 |

| DUI | $192 | $209 |

| Poor Credit | $205 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Lincoln Life & Annuity Company of New York Discounts Available

| Discount | Lincoln Life & Annuity Company of New York |

|---|---|

| Anti Theft | 8% |

| Good Student | 15% |

| Low Mileage | 12% |

| Paperless | 5% |

| Safe Driver | 15% |

| Senior Driver | 10% |

When it comes to managing your insurance expenses, Lincoln Life & Annuity Company of New York goes the extra mile to provide you with cost-saving opportunities. They offer a variety of discounts tailored to help you get the most out of your coverage while keeping your budget in check. Let’s delve into the discounts available:

- Multi-Policy Discount: When you bundle multiple insurance policies, such as life insurance and annuities, you unlock significant savings.

- Good Driver Discount: If you maintain a clean driving record, Lincoln rewards you with reduced rates on certain policies.

- Loyalty Discount: As a thank-you for your long-term commitment, Lincoln offers discounts to policyholders who renew their coverage.

- Safe Driver Discount: Enjoy lower rates if you have a history of safe driving, ensuring your premiums stay affordable.

- Preferred Payment Discount: Simplify your payments and save with automatic premium payments.

- Multi-Vehicle Discount: Insure multiple vehicles under the same policy and benefit from reduced rates.

- Good Student Discount: Young drivers who excel academically can enjoy discounts, making coverage more affordable.

Lincoln Life & Annuity Company of New York not only offers comprehensive coverage but also provides various discounts to help you manage your insurance costs effectively. By taking advantage of these discounts, you can enjoy valuable savings without compromising on the quality of your coverage. Discover how Lincoln can make your insurance experience more affordable and rewarding.

How Lincoln Life & Annuity Company of New York Ranks Among Providers

Navigating the insurance market can be a complex endeavor, with numerous providers vying for your attention. Understanding the key players and their offerings can help you make informed decisions about your financial security.

These companies offer a range of insurance products and services, often vying for the same customer base. Let’s take a closer look at some of Lincoln’s main competitors in the industry:

- Prudential Financial, Inc.: Prudential is a global financial services leader, offering a wide spectrum of life insurance and annuity options. Their reach and reputation in the market make them a direct competitor to Lincoln.

- Metlife, Inc.: Metlife is a well-known insurance giant with a broad portfolio of life insurance and annuity products. They are a formidable player in the industry.

- New York Life Insurance Company: With a rich history and comprehensive offerings, New York Life is a prominent mutual life insurance company competing directly with Lincoln.

- Northwestern Mutual: Northwestern Mutual is renowned for its financial planning services and life insurance products, attracting customers with long-term financial goals.

- AIG (American International Group): AIG operates globally and provides a wide range of insurance and financial services, including life insurance and annuities.

- Massmutual (Massachusetts Mutual Life Insurance Company): Massmutual is a major mutual life insurance company offering a range of financial services, including life insurance and retirement planning.

- Primerica: Primerica specializes in term life insurance and financial services, often focusing on middle-income families and individuals.

- Guardian Life Insurance Company: Guardian offers diverse insurance and financial products, including life insurance and disability income insurance, and has earned a respected position in the industry.

As you explore your options in the insurance and financial services realm, it’s essential to consider the offerings and strengths of these key competitors. Each of these companies strives to provide unique value to customers, making your choice a crucial decision in your financial journey.

Lincoln Life & Annuity Company of New York remains committed to standing out in this competitive field, offering valuable solutions for your financial security and peace of mind.

Read more: Lincoln Heritage Life Insurance Company Review

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Lincoln Life & Annuity Company of New York Claims Process

Ease of Filing a Claim

Lincoln Life & Annuity Company of New York offers a streamlined claims process that caters to the convenience of its policyholders. Customers can file claims through multiple channels, including online, over the phone, and via mobile apps. This flexibility ensures that you can choose the method that suits your preferences and circumstances best.

Average Claim Processing Time

When it comes to the speed of claim processing, Lincoln strives to provide a quick and efficient experience for its policyholders. While specific processing times may vary depending on the nature of the claim, Lincoln is committed to minimizing delays and ensuring that claims are handled promptly to provide financial support when it’s needed most.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is a valuable indicator of an insurance company’s performance, especially when it comes to claim resolutions and payouts. Lincoln Life & Annuity Company of New York has garnered positive reviews from its policyholders for its fair and reliable claims processing.

Customers appreciate the company’s dedication to resolving claims efficiently and providing timely payouts, enhancing their overall satisfaction.

Lincoln Life & Annuity Company of New York Digital and Technological Features

Mobile App Features and Functionality

Lincoln understands the importance of digital convenience in today’s fast-paced world. Their mobile app offers a range of features and functionalities designed to make managing your insurance and retirement accounts easier than ever.

From viewing policy details to making payments and accessing important documents, the app empowers policyholders to have everything they need at their fingertips.

Online Account Management Capabilities

Managing your insurance and retirement accounts online has never been more accessible. Lincoln provides a user-friendly online platform where you can access your account, review policy information, update personal details, and even make changes to your coverage as needed.

This online account management capability ensures that you have control and transparency over your financial security.

Digital Tools and Resources

To assist policyholders in making informed decisions, Lincoln offers a range of digital tools and resources. These include calculators to estimate your insurance needs, retirement planning guides, and educational materials to help you navigate the complexities of insurance and financial planning.

With these digital resources, Lincoln aims to empower its customers to make smart choices for their financial future.

Frequently Asked Questions

How do I apply for life insurance with Lincoln Life & Annuity Company of New York?

Applying for life insurance with Lincoln is a straightforward process. You can start by visiting their official website and using their online quote request tool. Alternatively, you can contact a Lincoln representative who will guide you through the application process, helping you choose the right policy for your needs and circumstances.

Can I change my annuity plan’s investment options?

Yes, many annuity plans offered by Lincoln Life & Annuity Company of New York allow for flexibility in investment options. You can typically make changes to your investment selections, but it’s important to review your specific annuity contract or speak with a Lincoln representative for detailed information on how to modify your investment choices.

What are the tax benefits of Lincoln’s retirement plans?

Lincoln offers various retirement plans, each with its own tax advantages. For instance, contributions to 401(k) plans may be tax-deductible, and earnings grow tax-deferred until withdrawal. Roth IRAs, on the other hand, offer tax-free withdrawals in retirement.

The specific tax benefits depend on the type of retirement plan you choose and your individual circumstances. It’s advisable to consult a tax professional or financial advisor for personalized guidance.

Are there any age restrictions for purchasing life insurance?

While there may be age restrictions on certain types of life insurance policies, Lincoln Life & Annuity Company of New York offers a range of policies suitable for different age groups. Term life insurance, for example, is often available to individuals of various ages.

However, the cost of premiums may vary based on your age and health status. It’s best to discuss your specific needs with a Lincoln representative to find the most suitable policy for your age and circumstances.

How can I contact Lincoln’s customer support?

Lincoln Life & Annuity Company of New York provides multiple ways to contact their customer support team. You can typically find contact information on their official website, including phone numbers, email addresses, and sometimes live chat options.

Additionally, you may find contact details on your policy documents. If you have specific questions or need assistance, reaching out to their customer support is a convenient way to get the information you need.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.