Lion Insurance Company Review [2026]

Lion Insurance Company, headquartered in Holiday, FL, stands as a stalwart provider, offering specialized workers’ compensation and diverse business insurance solutions, with an esteemed A rating for financial strength from A.M. Best, their commitment to tailored coverage and job site safety speaks volumes in the insurance realm.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life i...

Maria Hanson

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Heidi Mertlich

Updated April 2024

If you’re a business owner, you know you probably need a variety of different business insurance coverage types. This can include professional liability insurance, property insurance, vehicle insurance, and more. This Lion Insurance Company review will help.

If you have employees, you may need workers’ compensation insurance. Depending on where your business is located, Lion Insurance Company may be an option for purchasing workers’ compensation coverage.

Read this article to learn where Lion Insurance Company quotes are available, Lion Insurance Company ratings, and how to find Lion Insurance Company rates so you can decide if it’s right for your business’s needs. Before we get started on this Lion Insurance Company review, use your ZIP code to get a free quote for workers’ compensation coverage from multiple companies.

What You Should Know About Lion Insurance Company

Lion Insurance Company offers workers’ compensation coverage (which we’ll discuss later). Underwriting of its policies through an affiliate professional employer organization, SouthEast Personnel Leasing, Inc.

It also works with companies to enhance worksite safety and tailor coverages to specific company needs. The company has been in business since the mid-1980s, and the Lion Insurance logo is the head of a lion.

Lion Insurance Company: Insurance Ratings

Ratings for insurance companies provide information like customer service ratings, financial standing and outlook for the future, and more. A.M. Best is one such company, and it has been rating Lion Insurance Company since 2005. Take a look at this table to see A.M. Best Lion Insurance Company ratings.

A.M. Best Ratings for Lion Insurance Company

| A.M. Best Rating Type | A.M. Best Financial Strength Rating |

|---|---|

| Rating | A (excellent) |

| Financial SIze Category | VIII ($100 M to $250 M) |

| Outlook | Stable |

| Effective Date | December 11, 2019 |

Using information like this can help you differentiate between companies (beyond just how much it will charge you for a policy).

How to Make a Lion Insurance Company Insurance Claim

To make an insurance claim with Lion Insurance Company, you can start by calling them or using the “Contact Us” function on the company’s website. The company has decades of experience in claims management and it works to provide efficient and effective resolution to any submitted claims, as well as prevent insurance fraud.

According to the FBI, insurance fraud (across the industry) costs over $40 billion per year, so it comes as no surprise that Lion Insurance Company is committed to preventing it wherever it can.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Lion Insurance Company Insurance Coverage Options

Lion Insurance Company, a casualty insurance company focused on the business sector, specifically offers workers’ compensation coverage for various types of businesses. Lion Insurance Company sells workers’ compensation coverage to businesses in 18 states and the District of Columbia.

It has over 30 years of experience in the industry and work with companies to not just have appropriate coverage but actually improve job site safety. Lion Insurance Company prides itself on offering tailored policies that meet the specific needs of each company. But only you can decide if Lion Insurance Company is right for your business.

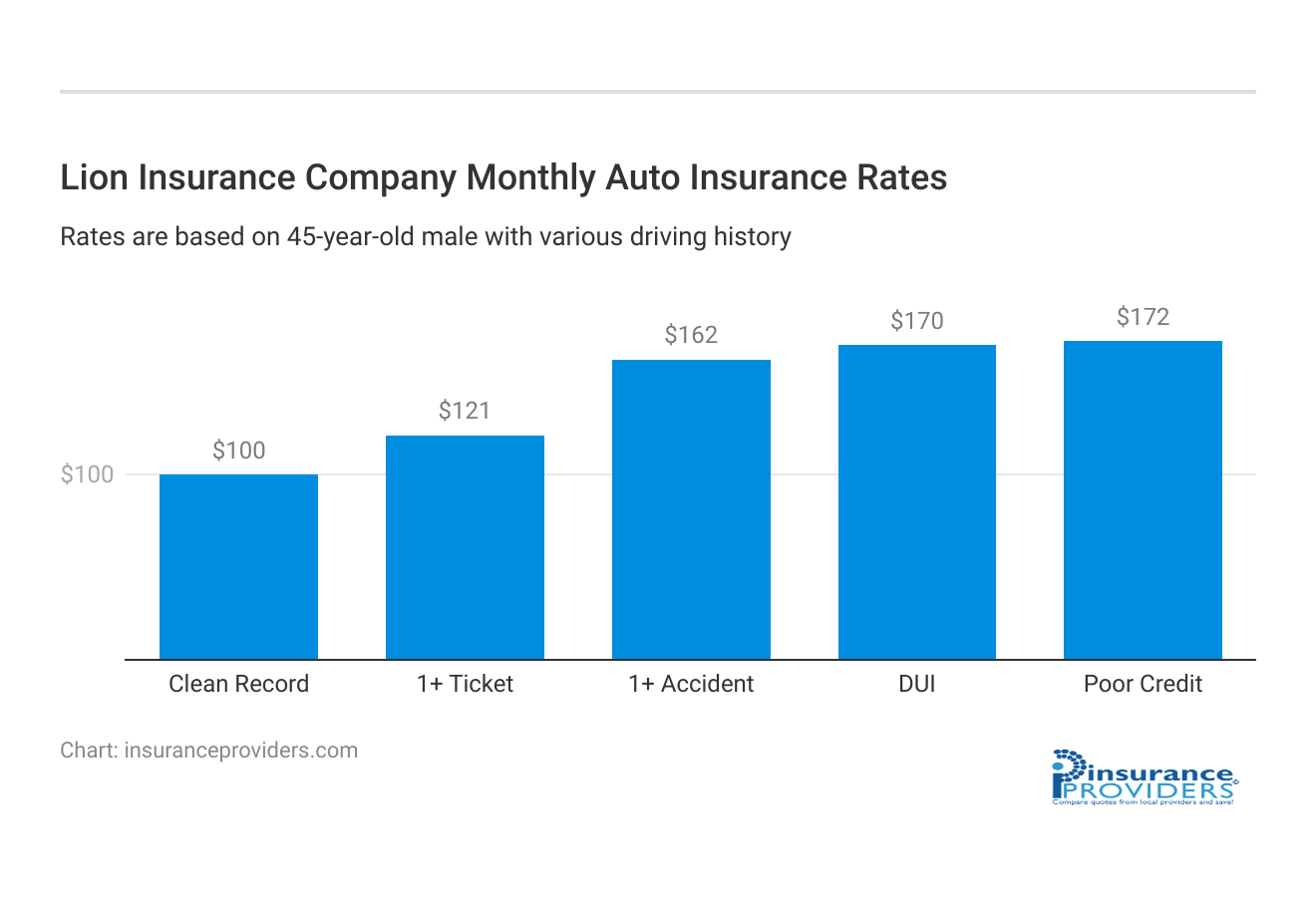

Lion Insurance Company Insurance Rates Breakdown

| Driver Profile | Lion Insurance Company | National Average |

|---|---|---|

| Clean Record | $100 | $119 |

| 1+ Ticket | $121 | $147 |

| 1+ Accident | $162 | $173 |

| DUI | $170 | $209 |

| Poor Credit | $172 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Lion Insurance Company rates for its workers’ compensation coverage will vary by state, company size, and a number of other factors. Because these rates can vary so widely, we don’t have average rates. However, you can get quotes for your company’s needs by calling Lion Insurance Company directly or by using our free tool (which will also allow you to compare rates from other similar companies).

What is Lion Insurance Company’s availability?

Lion Insurance Company workers’ compensation coverage is available in a number of states and the District of Columbia. Take a look at this table to see the complete list of states in which you can purchase workers’ compensation coverage from Lion Insurance Company.

Lion Insurance Company Availability by State

| States | Lion Insurance Company Availability |

|---|---|

| Alabama | Yes |

| Alaska | No |

| Arizona | Yes |

| Arkansas | No |

| California | No |

| Colorado | Yes |

| Connecticut | No |

| Delaware | No |

| District of Columbia | Yes |

| Florida | No |

| Georgia | Yes |

| Hawaii | No |

| Idaho | No |

| Illinois | Yes |

| Indiana | No |

| Iowa | No |

| Kansas | No |

| Kentucky | No |

| Louisiana | Yes |

| Maine | No |

| Maryland | Yes |

| Massachusetts | No |

| Michigan | No |

| Minnesota | No |

| Mississippi | Yes |

| Missouri | No |

| Montana | No |

| Nebraska | No |

| Nevada | Yes |

| New Hampshire | No |

| New Jersey | Yes |

| New Mexico | Yes |

| New York | No |

| North Carolina | Yes |

| North Dakota | No |

| Ohio | No |

| Oklahoma | Yes |

| Oregon | No |

| Pennsylvania | Yes |

| Rhode Island | No |

| South Carolina | Yes |

| South Dakota | No |

| Tennessee | Yes |

| Texas | Yes |

| Utah | No |

| Vermont | No |

| Virginia | Yes |

| Washington | No |

| West Virginia | No |

| Wisconsin | No |

| Wyoming | No |

Read more:

To contact them, you can use the Lion Insurance Company phone number, 727-682-0155. The Lion Insurance Company address for its headquarters is in Florida, specifically 2739 US Highway 19 North, Holiday, FL, 34691.

Lion Insurance Company Discounts Available

| Discount | Lion Insurance Company |

|---|---|

| Anti Theft | 10% |

| Good Student | 12% |

| Low Mileage | 15% |

| Paperless | 5% |

| Safe Driver | 13% |

| Senior Driver | 10% |

Lion Insurance Company understands the value of saving a dime without compromising on coverage. They offer a range of discounts tailored to meet your specific needs:

- Safety Incentives: Rewarding businesses with excellent safety records.

- Multi-Policy Discounts: Bundling multiple policies for added savings.

- Loyalty Rewards: Long-term policyholders enjoy special rates.

- Claim-Free Benefits: Stay claim-free and watch your rates stay steady.

- Group Affiliations: Discounts for being part of certain professional associations.

- Employee Training Initiatives: Supporting ongoing education and training.

Lion Insurance Company isn’t just about policies; it’s about tailored solutions for your business. Whether it’s workers’ compensation or specialized coverage, they’ve got your back.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Lion Insurance Company Ranks Among Providers

Lion Insurance Company faces competition from prominent players in the insurance industry. Recognizing these key competitors helps evaluate Lion Insurance Company’s standing in this competitive landscape.

- Progressive Insurance: Renowned for its diverse coverage options and user-friendly policies.

- State Farm: A major insurance provider with a wide range of offerings and a strong customer service reputation.

- Allstate Corporation: Known for comprehensive insurance solutions and innovative coverage plans.

- Liberty Mutual: A significant player in the industry, offering various insurance products with a focus on customer satisfaction.

Amidst these notable competitors, Lion Insurance Company distinguishes itself through its specialized workers’ compensation and tailored business insurance solutions. Exploring the strengths of these key competitors provides valuable insights into the competitive dynamics of the insurance market.

Frequently Asked Questions

What types of insurance coverage does Lion Insurance Company offer?

Lion Insurance Company specializes in workers’ compensation coverage tailored for various businesses. While their primary focus is on this specific insurance type, they may not provide other forms of coverage.

Is Lion Insurance Company a good choice for workers’ compensation coverage?

With over 30 years of industry experience, Lion Insurance Company emphasizes tailored policies to meet the unique needs of businesses. Their commitment to improving job site safety and an A rating for financial strength from A.M. Best speaks volumes for their reliability.

What are Lion Insurance Company’s ratings and financial strength?

Lion Insurance Company boasts an A rating for financial strength from A.M. Best, a renowned rating agency providing insights into customer service, financial standing, and future outlook for insurance companies.

How do I make an insurance claim with Lion Insurance Company?

Making an insurance claim with Lion Insurance Company is straightforward. You can start by contacting them directly or using the “Contact Us” function on their website. Their decades of claims management experience ensure efficient resolution and fraud prevention.

In which states is Lion Insurance Company’s workers’ compensation coverage available?

Lion Insurance Company provides workers’ compensation coverage in 18 states and the District of Columbia. Availability may vary by state, so it’s essential to check their coverage availability using the provided state-by-state table.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.