Manhattanlife Insurance and Annuity Company Review (2026)

Discover Manhattanlife Insurance and Annuity Company—a trusted provider offering diverse coverage options with a focus on customer satisfaction and competitive discounts.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive article, we delve into Manhattanlife Insurance and Annuity Company, a stalwart in the insurance industry. We explore their diverse array of coverage options, including life insurance, annuities, Medicare supplements, dental, and vision insurance, providing invaluable protection at every life stage.

Additionally, we highlight their commitment to customer satisfaction and financial stability. We also touch upon the enticing discounts available, allowing policyholders to optimize their insurance investments.

Furthermore, we recognize Manhattanlife’s prominent competitors, major players in the insurance arena, emphasizing the importance of informed decision-making when it comes to securing financial well-being.

Manhattanlife Insurance and Annuity Company Insurance Coverage Options

Manhattanlife Insurance and Annuity Company understands that life is full of uncertainties, which is why they offer a comprehensive range of coverage options to safeguard your financial future and well-being.

Whether you’re planning for retirement, seeking protection for your family, or aiming to reduce healthcare expenses, Manhattanlife has you covered with a variety of insurance solutions.

- Life Insurance: Planning for the future of your loved ones is essential. Manhattanlife offers different types of life insurance policies, including term life and whole life insurance, providing financial security in the event of your passing.

- Annuities: Secure your retirement with Manhattanlife’s annuity products, ensuring a consistent income stream for your golden years, guaranteeing financial stability.

- Medicare Supplements: For those eligible for Medicare, Manhattanlife provides Medicare supplement insurance plans, bridging the gaps in your Medicare coverage and reducing out-of-pocket healthcare expenses.

- Dental Insurance: Your oral health is crucial. Manhattanlife’s dental insurance plans ensure you have access to top-quality dental care, helping you maintain a healthy smile.

- Vision Insurance: Good vision is vital. Their vision insurance plans cover eye care services, including exams and eyewear, supporting your visual health needs.

Manhattanlife Insurance and Annuity Company stands as a reliable partner in safeguarding your financial future and health. Their extensive range of coverage options, from life insurance to dental and vision insurance, ensures you have the protection you need at every stage of life. Explore their offerings today to secure a brighter and more secure tomorrow.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

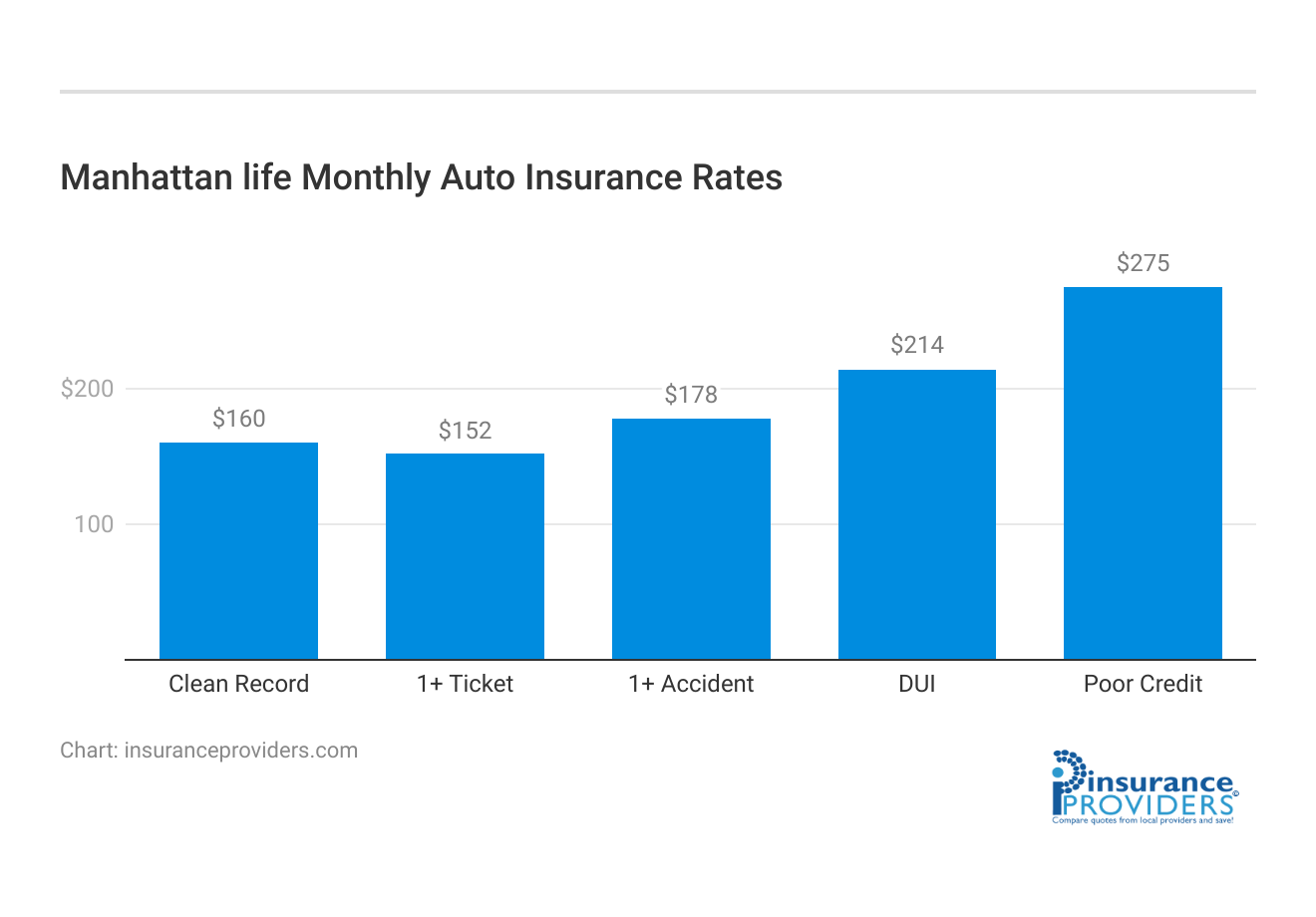

Manhattanlife Insurance and Annuity Company Insurance Rates Breakdown

| Driver Profile | Manhattan life | National Average |

|---|---|---|

| Clean Record | $165 | $119 |

| 1+ Ticket | $147 | $147 |

| 1+ Accident | $173 | $173 |

| DUI | $209 | $209 |

| Poor Credit | $284 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Manhattanlife Insurance and Annuity Company Discounts Available

| Discount | Manhattan life |

|---|---|

| Anti Theft | 13% |

| Good Student | 16% |

| Low Mileage | 9% |

| Paperless | 11% |

| Safe Driver | 19% |

| Senior Driver | 6% |

Manhattanlife Insurance and Annuity Company is committed to providing not only comprehensive coverage but also opportunities for savings through various discounts. These discounts can help you reduce your insurance premiums while still enjoying the same level of protection.

In this section, we’ll explore the discounts offered by Manhattanlife, giving you insights into how you can make the most of your insurance investments.

- Multi-Policy Discount: Simplify your insurance portfolio and save money by bundling multiple policies with Manhattanlife. Whether it’s life insurance, annuities, or other offerings, combining them can qualify you for a valuable multi-policy discount.

- Good Health Discount: If you maintain a healthy lifestyle and meet specific health criteria, Manhattanlife may reward you with discounts, reducing your insurance costs as a reflection of your commitment to well-being.

- Safe Driving Discount: While Manhattanlife primarily specializes in life insurance and annuities, they may offer safe driving discounts if they expand their services to include auto insurance. Safe drivers with a clean record could potentially enjoy lower premiums.

- Early Enrollment Discount: For insurance products like Medicare supplements, enrolling early can lead to substantial savings. Take advantage of early enrollment options to secure coverage at a discounted rate.

- Group Plans: Manhattanlife often extends its offerings to organizations or associations, providing group insurance plans. These plans frequently come with discounted rates, making quality insurance more accessible.

- Payment Discounts: Choosing specific payment methods, such as annual or semi-annual payments, can result in discounts on your premiums, giving you flexibility and cost-saving benefits.

Manhattanlife Insurance and Annuity Company not only offers a diverse range of insurance solutions but also provides opportunities to save through various discounts. By exploring these discount options and tailoring your insurance choices to your specific needs, you can enjoy comprehensive coverage while keeping your premiums manageable.

How Manhattanlife Insurance and Annuity Company Ranks Among Providers

In the highly competitive insurance industry, Manhattanlife Insurance and Annuity Company faces formidable rivals, each vying to provide the best insurance and annuity solutions to consumers. Understanding the company’s main competitors is crucial for individuals seeking the right insurance coverage.

Here, we take a closer look at some of the key competitors of Manhattanlife, highlighting their strengths and offerings in this dynamic marketplace.

- New York Life Insurance Company: New York Life is one of the largest and oldest mutual life insurance companies in the United States. They offer a wide range of life insurance and annuity products, similar to Manhattanlife.

- Prudential Financial, Inc.: Prudential is another major player in the life insurance and annuity market. They provide a diverse portfolio of insurance and retirement products, competing directly with Manhattanlife in these areas.

- Metlife: Metlife is a global insurance giant that offers a variety of life insurance and annuity options. They are known for their extensive customer base and financial strength, making them a formidable competitor.

- AIG (American International Group, Inc.): AIG is a multinational insurance company that offers life insurance, annuities, and various other insurance products. They compete with Manhattanlife on a global scale and have a significant presence in the insurance market.

- Lincoln Financial Group: Lincoln Financial specializes in life insurance, annuities, and retirement planning. They are known for their innovative products and services, which can be appealing to customers looking for similar offerings to Manhattanlife.

- Massmutual (Massachusetts Mutual Life Insurance Company): Massmutual is a mutual company like Manhattanlife and provides life insurance, annuities, and financial planning services. They are known for their strong customer focus and financial stability.

- Northwestern Mutual: Northwestern Mutual is another mutual insurance company that offers life insurance and financial planning services. They compete with Manhattanlife in the life insurance sector and have a strong reputation for customer service.

- Guardian Life Insurance Company: Guardian specializes in life insurance, disability income insurance, and other related products. They are a direct competitor to Manhattanlife, especially in the life insurance segment.

In a market brimming with insurance options, understanding the key competitors of Manhattanlife Insurance and Annuity Company is vital for making informed decisions about insurance coverage. These competitors offer a diverse range of products and services, emphasizing financial stability and customer satisfaction.

By comparing offerings from these companies, consumers can select insurance solutions that best align with their unique needs and preferences.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Manhattanlife Insurance and Annuity Company Claims Process

Ease of Filing a Claim

Manhattanlife Insurance and Annuity Company offers a straightforward and convenient claims process for its policyholders. Claimants have the option to file a claim through multiple channels, including online, over the phone, and through dedicated mobile apps.

The online platform provides an intuitive interface, allowing policyholders to navigate the claims submission process with ease. Furthermore, the availability of phone support facilitates quick and efficient claim filing for those who prefer this method. The mobile apps offer a user-friendly interface, streamlining the process for those on the go.

Average Claim Processing Time

Manhattanlife Insurance and Annuity Company prides itself on a relatively efficient claim processing time. While specific processing durations can vary based on the complexity and nature of the claim, the company strives to handle claims promptly and efficiently. On average, claimants can expect a timely processing period from the submission of the claim to the resolution.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback regarding claim resolutions and payouts at Manhattanlife Insurance and Annuity Company has generally been positive. Policyholders have reported satisfaction with the company’s responsiveness and fair assessment of claims.

The resolution process is perceived as transparent and helpful, ensuring that customers are informed throughout the process. Additionally, the payout process is seen as smooth and timely, contributing to a positive customer experience.

Manhattanlife Insurance and Annuity Company Digital and Technological Features

Mobile App Features and Functionality

Manhattanlife Insurance and Annuity Company offers a feature-rich mobile app that enhances the overall customer experience. The app provides convenient access to policy information, claim status, and relevant updates.

Users can file claims directly through the app, enabling a hassle-free claims submission process. Additionally, the app may offer features such as policy management, premium payments, and contact options for customer support.

Online Account Management Capabilities

The online platform of Manhattanlife Insurance and Annuity Company offers robust account management capabilities. Policyholders can log in to their accounts to view policy details, update personal information, and track claims.

The user-friendly interface allows for easy navigation and efficient management of policies and related services. Online account management empowers policyholders to have control and visibility over their insurance and annuity products.

Digital Tools and Resources

Manhattanlife Insurance and Annuity Company provides various digital tools and resources to assist policyholders in understanding their insurance and annuity products better.

These resources may include educational content, FAQs, calculators, and guides to help users make informed decisions about their insurance coverage and financial planning. These digital tools contribute to the company’s commitment to enhancing financial literacy and empowering policyholders with valuable information.

Frequently Asked Questions

What types of insurance does Manhattanlife offer?

Manhattanlife Insurance and Annuity Company provides a range of insurance options, including life insurance, annuities, Medicare supplements, dental insurance, and vision insurance.

How can I apply for insurance with Manhattanlife?

Applying for insurance with Manhattanlife is a straightforward process. You can begin by visiting their website or contacting a local agent for guidance on the application procedure.

Are there any discounts available for Manhattanlife’s insurance products?

Yes, Manhattanlife offers various discounts, such as multi-policy discounts, good health discounts, and early enrollment discounts. The availability of specific discounts may vary depending on the type of insurance and your eligibility.

What sets Manhattanlife apart from other insurance providers?

Manhattanlife is known for its strong financial stability, diverse insurance portfolio, and unwavering commitment to customer satisfaction. Their comprehensive coverage options make them a trusted choice for many.

Who are the main competitors in the insurance industry for Manhattanlife?

Some of the main competitors of Manhattanlife include New York Life Insurance Company, Prudential Financial, Metlife, AIG, Lincoln Financial Group, Massmutual, Northwestern Mutual, and Guardian Life Insurance Company.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.