Mercury Casualty Company: Customer Ratings & Reviews [2026]

Mercury Casualty Company emerges as a formidable player in the auto insurance market, distinguishing itself through competitive rates, personalized service, and an array of coverage options.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Licensed Real Estate Agent

Angie Watts is a licensed real estate agent with Florida Executive Realty. Specializing in residential properties since 2015, Angie is a real estate writer who published a book educating homeowners on how to make the most money when they sell their homes. Her goal is to educate and empower both home buyers and sellers so they can have a stress-free shopping and/or selling process. She has studi...

Angie Watts

Updated April 2024

Mercury Casualty Company is a reputable insurance provider offering competitive pricing, reliable coverage, and exceptional customer service. Their variety of insurance products and services includes auto and home insurance.

While their availability is limited to only 11 states, they offer different types of discounts to customers. The company has a low complaint level and has received an A (Excellent) rating from A.M. Best. Customer reviews indicate a positive experience with the company, making it a reliable option for anyone seeking insurance coverage.

What You Should Know About Mercury Insurance Group

Company Contact Information

- Website: https://www.mercuryinsurance.com/

- Phone: 1-800-956-3728

- Email: service@mercuryinsurance.com

Related Parent or Child Companies: Mercury General Corporation

Financial Ratings

- A.M. Best Rating: A (Excellent)

- S&P Global Rating: A (Strong)

Customer Service Ratings

- J.D. Power Auto Insurance Study (2020): 4 out of 5 (above industry average)

- BBB Rating: A+

Claims Information

- 24/7 Claims Reporting Hotline: 1-800-503-3724

- Online Claims Reporting: https://www.mercuryinsurance.com/claims.html

- Mercury’s network of approved auto repair shops offer Lifetime Repair Guarantee (as long as you own the vehicle)

Company Apps

- Mercury GO (Mobile App)

- Available for iOS and Android

- Policy management and claims reporting

- Roadside assistance and accident support

- Digital insurance ID cards

- Mercury Drive Safe (Telematics App)

- Available for iOS and Android

- Monitors driving behavior to reward safe driving with discounts

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mercury Insurance Group Insurance Coverage Options

Mercury Casualty Company offers a range of coverage options for their customers. These coverage options include:

- Liability Coverage: This coverage is required by law and covers bodily injury and property damage you may cause to others while driving your vehicle.

- Collision Coverage: This coverage helps pay for damages to your own vehicle if you are in a collision with another vehicle or object.

- Comprehensive Coverage: This coverage helps pay for damages to your own vehicle that are caused by incidents other than a collision, such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): This coverage helps pay for medical expenses and lost wages for you and your passengers if you are injured in an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage helps protect you if you are in an accident with a driver who does not have insurance or does not have enough insurance to cover the damages.

Mercury Casualty Company also offers optional coverage options, such as roadside assistance and rental car reimbursement. Customers can customize their policy to fit their individual needs and budget. It’s important to note that coverage options may vary by state and customers should consult with their agent or representative to see what coverage options are available in their area.

Read more: Casualty Underwriters Insurance Company Review

Mercury Insurance Group Insurance Rates Breakdown

Compare RatesStart Now →

"}” data-sheets-userformat=”{"2":4737,"3":{"1":0},"10":2,"12":0,"15":"Arial"}”>

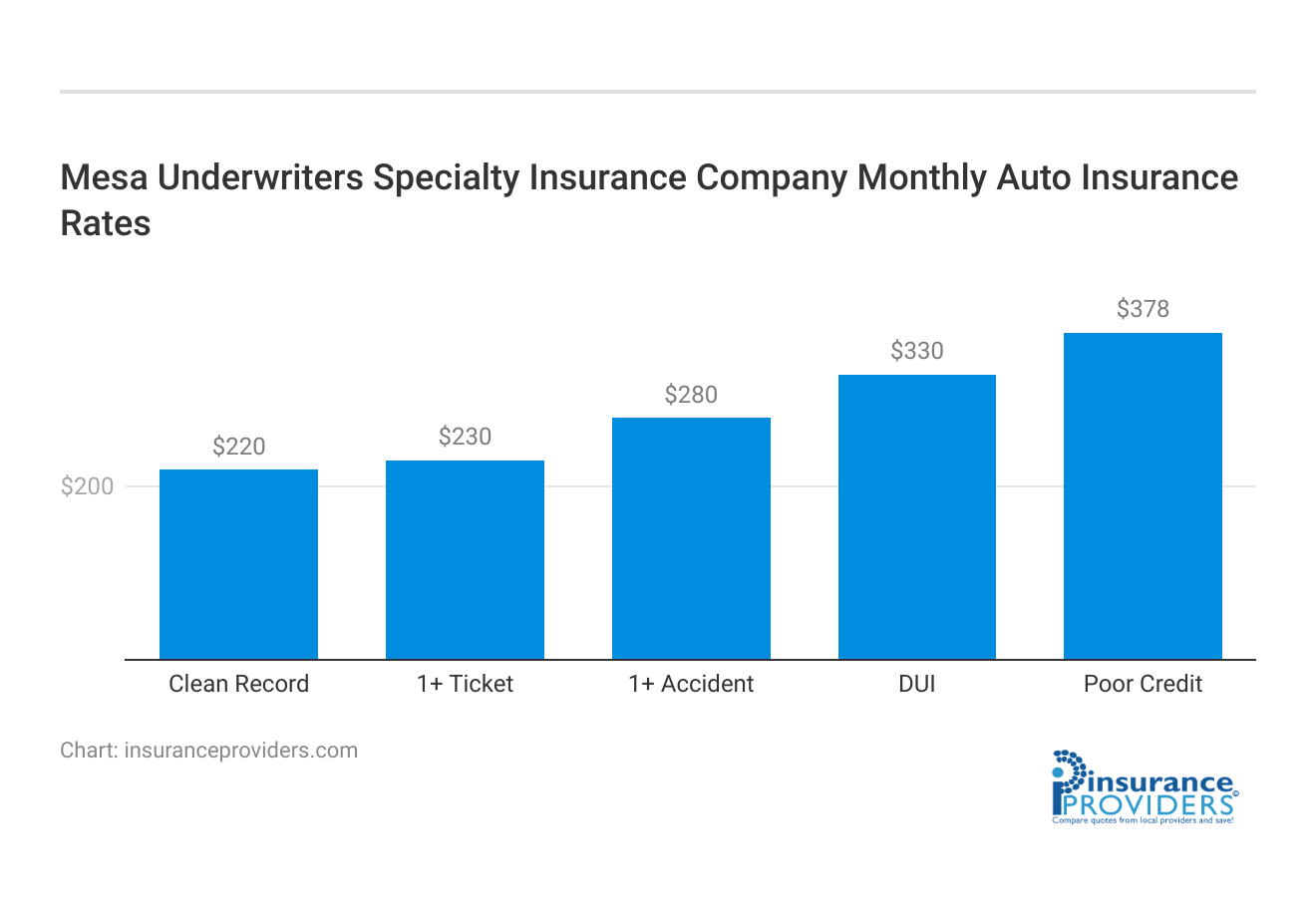

| Driver Profile | Mesa Underwriters Specialty Insurance Company | National Average |

|---|---|---|

| Clean Record | $220 | $208 |

| 1+ Ticket | $230 | $220 |

| 1+ Accident | $280 | $270 |

| DUI | $330 | $320 |

| Poor Credit | $378 | $358 |

Mercury Insurance Group Discounts Available

Compare RatesStart Now →

"}” data-sheets-userformat=”{"2":4737,"3":{"1":0},"10":2,"12":0,"15":"Arial"}”>

| Discount | Mesa Underwriters Specialty Insurance Company |

|---|---|

| Anti Theft | 5% |

| Good Student | 9% |

| Low Mileage | 7% |

| Paperless | 8% |

| Safe Driver | 10% |

| Senior Driver | 10% |

Mercury Casualty Company offers several discounts to their customers. These discounts include:

- Multi-Policy Discount: If you have both auto and home insurance policies with Mercury, you may qualify for a discount on both policies.

- Good Driver Discount: Customers who have maintained a clean driving record for three consecutive years may be eligible for a good driver discount.

- Anti-Theft Discount: If your vehicle is equipped with an anti-theft device, you may be eligible for a discount on your comprehensive coverage.

- Good Student Discount: Full-time students under the age of 25 who maintain a B average or higher may qualify for a good student discount.

- Affinity Group Discount: Members of certain professional organizations or alumni associations may be eligible for a discount on their auto insurance policy.

These discounts can help customers save money on their insurance premiums while still receiving reliable coverage from Mercury Casualty Company. It’s important to note that not all discounts are available in all states, and customers should check with their agent or representative to see which discounts they may be eligible for.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Mercury Insurance Group Ranks Among Providers

In the competitive landscape of auto insurance, Mercury Casualty Company shines with its competitive rates, personalized service, and diverse coverage options, setting itself apart from industry giants like State Farm, Geico, Allstate, and Progressive.

- State Farm: State Farm is a large insurance company that offers a range of insurance products, including auto insurance. They are known for their extensive network of agents and their mobile app, which allows customers to manage their policies and file claims.

- Geico: Geico is a popular auto insurance company known for their catchy commercials and affordable rates. They offer a range of coverage options and discounts to their customers.

- Allstate: Allstate is another large insurance company that offers auto insurance as well as other insurance products. They are known for their bundling discounts and their Drivewise program, which rewards safe driving habits.

- Progressive: Progressive is a well-known auto insurance company that offers a range of coverage options and discounts. They are known for their Snapshot program, which tracks driving habits to help customers save money on their premiums.

While each of these companies has their own strengths and weaknesses, Mercury Casualty Company distinguishes itself through its competitive rates, personalized customer service, and variety of coverage options. By providing quality coverage at an affordable price, Mercury has earned a loyal customer base and established itself as a top player in the auto insurance industry.

Frequently Asked Questions

In which states does Mercury Casualty Company offer insurance coverage?

Mercury Casualty Company offers insurance coverage in 11 states, including Arizona, California, Florida, Georgia, Illinois, Nevada, New Jersey, New York, Oklahoma, Texas, and Virginia.

What types of discounts are available to Mercury Casualty Company customers?

Mercury Casualty Company offers a variety of discounts, including safe driver discounts, multi-policy discounts, and loyalty discounts.

How can I obtain a quote for coverage from Mercury Casualty Company?

Customers can obtain a quote online or by speaking with a representative.

How can I access customer ratings and reviews for Mercury Casualty Company?

To access customer ratings and reviews for Mercury Casualty Company, you can visit various online platforms such as the Better Business Bureau (BBB), Consumer Affairs, Trustpilot, or specialized insurance review websites. These platforms aggregate reviews and ratings from customers who have had experiences with Mercury Casualty Company.

Are customer ratings and reviews important when choosing an insurance company?

Yes, customer ratings and reviews are essential when selecting an insurance company. They provide valuable insights into the experiences of other policyholders, allowing you to assess the company’s customer service, claims handling, policy options, and overall satisfaction.