Mile Auto Insurance Review [2026]

Discover how infrequent drivers can save on car insurance through our comprehensive Mile Auto insurance review, highlighting the company's tailored approach and its strengths in catering to low-mileage drivers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Real Estate Agent

Angie Watts is a licensed real estate agent with Florida Executive Realty. Specializing in residential properties since 2015, Angie is a real estate writer who published a book educating homeowners on how to make the most money when they sell their homes. Her goal is to educate and empower both home buyers and sellers so they can have a stress-free shopping and/or selling process. She has studi...

Angie Watts

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated April 2024

Mile Auto car insurance is worth looking into if you don’t drive frequently. The less you drive, the more you save, so your monthly bill will fluctuate based on your driving that month. The downsides of Mile Auto are that it only offers basic coverages, isn’t sold in very many states, and hasn’t grown enough to be rated by major sites.

If you want to compare Mile Auto’s rates to other insurance companies, use our free quote comparison tool to find your area’s best auto insurance rates.

What You Should Know About Mile Auto

Mile Auto is one of the few companies exclusively selling pay-per-mile car insurance. Pay-as-you-go auto insurance is for low-mileage drivers who want to save money on their policies. If you are considering Mile Auto as a car insurance company for cheap auto insurance, first read our Mile Auto auto insurance review.

We will go over all the pros and cons of Mile Auto, from its average rates and discounts to its customer complaints. Read on to learn all the essential details of Mile Auto.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mile Auto Insurance Coverage Options

Mile doesn’t offer as wide a range of car insurance policies as other companies. However, it offers adequate coverage for drivers who only drive occasionally. The full list of auto insurance coverages provided by Mile Auto is as follows:

- Bodily injury liability insurance: If you cause an accident that injures someone else, bodily injury liability insurance will pay for their medical bills up to the policy limit.

- Property damage liability insurance. If you cause an accident that damages someone else’s car or property, property damage liability insurance will pay for their repair bills up to the policy limit.

- Collision auto insurance. If you collide with another vehicle or object, collision insurance will pay for your vehicle’s repairs up to the policy limit.

- Comprehensive auto insurance. If you crash into an animal or your car is damaged by crime, weather, or falling objects, comprehensive insurance will pay for your vehicle’s repairs up to the policy limit.

- Roadside assistance. Roadside assistance will help you with several common issues, such as jumpstarting dead batteries or opening up a locked car.

- Rental car reimbursement insurance. If your car is in the shop for an extended period after a covered claim, rental car reimbursement will help cover daily rental costs while yours is repaired.

Mile offers different policy and deductible limits, so you can customize your coverage to fit your needs. Read our guide to the top full-coverage auto insurance to learn more about full-coverage insurance.

Mile Auto Insurance Rates Breakdown

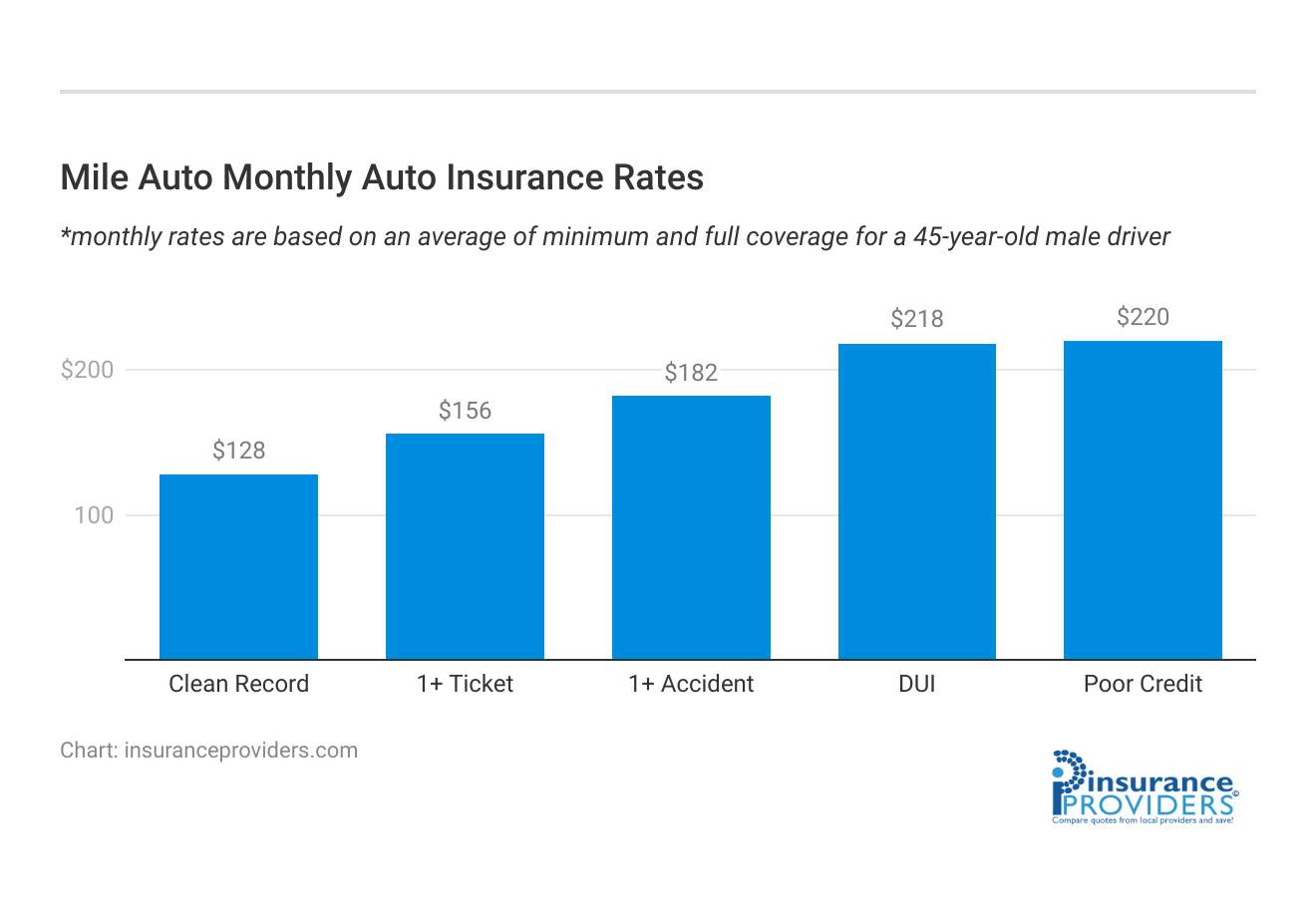

| Driver Profile | Mile Auto | National Average |

|---|---|---|

| Clean Record | $128 | $119 |

| 1+ Ticket | $156 | $147 |

| 1+ Accident | $182 | $173 |

| DUI | $218 | $209 |

| Poor Credit | $220 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Mile Auto boasts that most drivers can save 30%-40% by switching to its pay-per-mile insurance. Mile Auto works by charging a per-mile rate and flat rate that is calculated based on a driver’s driving record, demographics, and coverage needs.

For example, a driver’s base rate might be $40 per month with a $0.07 per mile rate. If that driver drives 200 miles in a month, their monthly rate for car insurance would only be $54.

Of course, this is just an example to show you how Mile calculates its rates each month. Keep in mind that rates will change based on your age, driving record, and more. However, this example of pay-per-mile insurance should give you a good idea of what you might pay at Mile Auto. If you want to see your exact rate at Mile Auto, you can always get a free quote.

Mile Auto Discounts Available

| Discount | Mile |

|---|---|

| Anti Theft | 9% |

| Good Student | 14% |

| Low Mileage | 8% |

| Paperless | 11% |

| Safe Driver | 16% |

| Senior Driver | 7% |

When it comes to Mile Auto Insurance, they understand the value of rewarding their customers. Here are some of the notable discounts they offer:

- Safe Driver Discounts: Rewarding those who maintain a clean driving record without any accidents or violations.

- Multi-Policy Discounts: Offering discounts for customers who bundle multiple insurance policies, such as auto and home insurance, with Mile Auto Insurance.

- Good Student Discounts: Acknowledging the dedication of young drivers who maintain good grades in school.

- Low Mileage Discounts: Offering reduced rates for individuals who drive fewer miles, promoting environmentally friendly and cautious driving habits.

- Vehicle Safety Feature Discounts: Providing discounts for vehicles equipped with advanced safety features like anti-lock brakes, airbags, or anti-theft devices.

- Senior Discounts: Catering to the needs of senior drivers by offering specific discounts tailored to their circumstances.

- Payment Discounts: Providing incentives for customers who opt for electronic payment methods or pay their premiums in full upfront.

- Affinity Group Discounts: Offering discounts to members of certain organizations or groups that have partnered with Mile Auto Insurance.

These discounts serve as a testament to Mile Auto Insurance’s commitment to providing cost-effective solutions and recognizing responsible driving habits and customer loyalty.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Mile Auto Ranks Among Providers

So how does Mile Auto compare to other usage-based insurance companies? Only a few other companies offer pay-per-mile or usage-based insurance, so we want to give you a general idea of how these programs compare. Take a look at the table below to see how Mile Auto compares to other major pay-per-mile programs:

Average Annual Telematic Insurance Rates by Company

| Insurance Company | Program | Device | Unemployed Annual Rates | Earned Savings (Up to) | Potential Savings |

|---|---|---|---|---|---|

| AAA | AAADrive | Mobile App | $165 | 30% | $115 |

| Allstate | Drivewise | Mobile App | $165 | 25% | $123 |

| American Family | KnowYourDrive | Plug-in | $165 | 40% | $99 |

| Esurance | DriveSense | Mobile App | $165 | 30% | $115 |

| Liberty Mutual/SafeCo | RightTrack | Mobile App or Plug-in | $165 | 30% | $115 |

| MetLife | My Journey | Plug-in | $165 | 30% | $115 |

| Nationwide | SmartRide | Plug-in | $165 | 40% | $99 |

| Progressive | Snapshot | Mobile App or Plug-in | $165 | 20% | $132 |

| Mile Auto | Mile Auto | Neither | $165 | 40% | $99 |

| State Farm | Drive Safe & Save | Mobile App or Plug-in | $165 | 50% | $83 |

| The Hartford | TrueLane | Plug-in | $165 | 25% | $123 |

| Travelers | IntelliDrive | Mobile App | $165 | 30% | $115 |

| Metromile | Metromile | Mobile App | $165 | 60% | $66 |

Mile Auto is one of the few companies that doesn’t use a plug-in tracking device. While you will have to take an odometer picture each month to submit, it won’t track your data like other pay-per-mile insurance companies.

The downside of Mile Auto is that it isn’t as well-established as programs like Allstate Milewise or Nationwide SmartMiles, which are backed by accredited companies that sell coverage in multiple states.

Frequently Asked Questions

How much does Mile Auto insurance cost?

Generally, you can expect your monthly Mile Auto car insurance cost to be less than $100. Your Mile Auto insurance quotes will ultimately depend upon your personal coverage needs, demographics, driving record, and how much you drive each month.

Is Mile Auto cheap?

Mile Auto is cheap as it is a pay-per-mile car insurance company. However, it won’t be cheap if you drive more than 10,000 miles per year, as you’ll end up paying the same as for a traditional car insurance policy.

Does Mile Auto have maximum mile charges daily?

No, Mile Auto does not have maximum mile charges. Other car insurance companies with pay-per-mile programs usually have a daily cap of 200 miles, which means you won’t be charged for more than 200 miles if you go on an occasional long trip. You should contact a Mile Auto agent if you’re planning a road trip.

How does Mile Auto Insurance work?

Mile Auto Insurance uses a device called a telematics device or a mobile app to track the number of miles driven by the insured vehicle. The device collects data on mileage and other driving factors, such as speed and braking. Based on the collected data, Mile Auto Insurance calculates premiums, charging policyholders a base rate and an additional cost per mile driven.

Does Mile Auto offer roadside assistance or additional services?

Mile Auto’s focus is on providing pay-per-mile insurance, and it does not typically offer additional services like roadside assistance as part of its coverage.

Is Mile Auto available nationwide or limited to specific states?

Currently, Mile Auto’s availability is limited and not sold in many states. It’s essential to check whether the company operates in your state before considering it as an insurance option.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.