Monumental Life Insurance Company: Customer Ratings & Reviews [2026]

Explore the breadth of insurance options and discounts offered by Monumental Life Insurance Company – safeguarding your financial future is our priority.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated April 2024

The article is a review of Monumental Life Insurance Company, a reputable provider of insurance products and services. The company offers a variety of options to help individuals and families achieve financial security and peace of mind, including life insurance, annuities, and retirement plans.

Monumental Life Insurance Company has a strong reputation for quality and value, with competitive rates and helpful customer service. While the claims process can be slow at times, the company has a low complaint level and generally positive reviews from customers.

Overall, Monumental Life Insurance Company is a strong contender for those seeking reliable insurance options.

What You Should Know About Monumental Life Insurance Company

Company Contact Information

- Phone: 1-800-638-3080

- Email: info@monlife.com

- Mailing address: 4333 Edgewood Rd NE, Cedar Rapids, IA 52499

Related Parent or Child Companies

- Monumental Life Insurance Company is a subsidiary of Transamerica Corporation, a financial services company that offers a range of insurance and investment products.

Financial Ratings

- Monumental Life Insurance Company has an A (Excellent) rating from A.M. Best, indicating a strong ability to meet policyholder obligations.

Customer Service Ratings

Customers have praised Monumental Life Insurance Company for its helpful customer service, but some have noted that the claims process can be slow at times. Overall, the company has a positive reputation for customer service.

Claims Information

- To file a claim with Monumental Life Insurance Company, customers can call the claims department at 1-800-638-3080 or complete the online claims form on the company’s website. The claims process can take some time, but the company works to resolve claims as quickly as possible.

Company Apps

- Monumental Life Insurance Company does not currently offer a mobile app for customers. However, customers can manage their policies and make payments through the company’s website or by calling customer service.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Monumental Life Insurance Company Insurance Coverage Options

Monumental Life Insurance Company offers a range of insurance products to help individuals and families achieve financial security and peace of mind. These products include:

- Life insurance: The company offers term life, whole life, and universal life insurance policies to meet the needs of customers at different stages of life.

- Annuities: Monumental Life Insurance Company offers fixed, indexed, and variable annuities to help customers plan for retirement and protect their savings.

- Medicare supplement insurance: Customers who are eligible for Medicare can purchase a Medicare supplement insurance policy from Monumental Life Insurance Company to help cover out-of-pocket costs.

- Final expense insurance: This type of insurance can help cover end-of-life expenses, such as funeral costs and medical bills.

- Accident insurance: Customers can purchase an accident insurance policy from Monumental Life Insurance Company to help cover unexpected medical expenses and lost income due to an accident.

- Dental insurance: The company offers a range of dental insurance options to help customers maintain good oral health and save money on dental procedures.

These insurance products provide a range of coverage options to help customers meet their unique needs and protect their financial futures. Monumental Life Insurance Company representatives can help customers choose the right insurance products for their needs and budget.

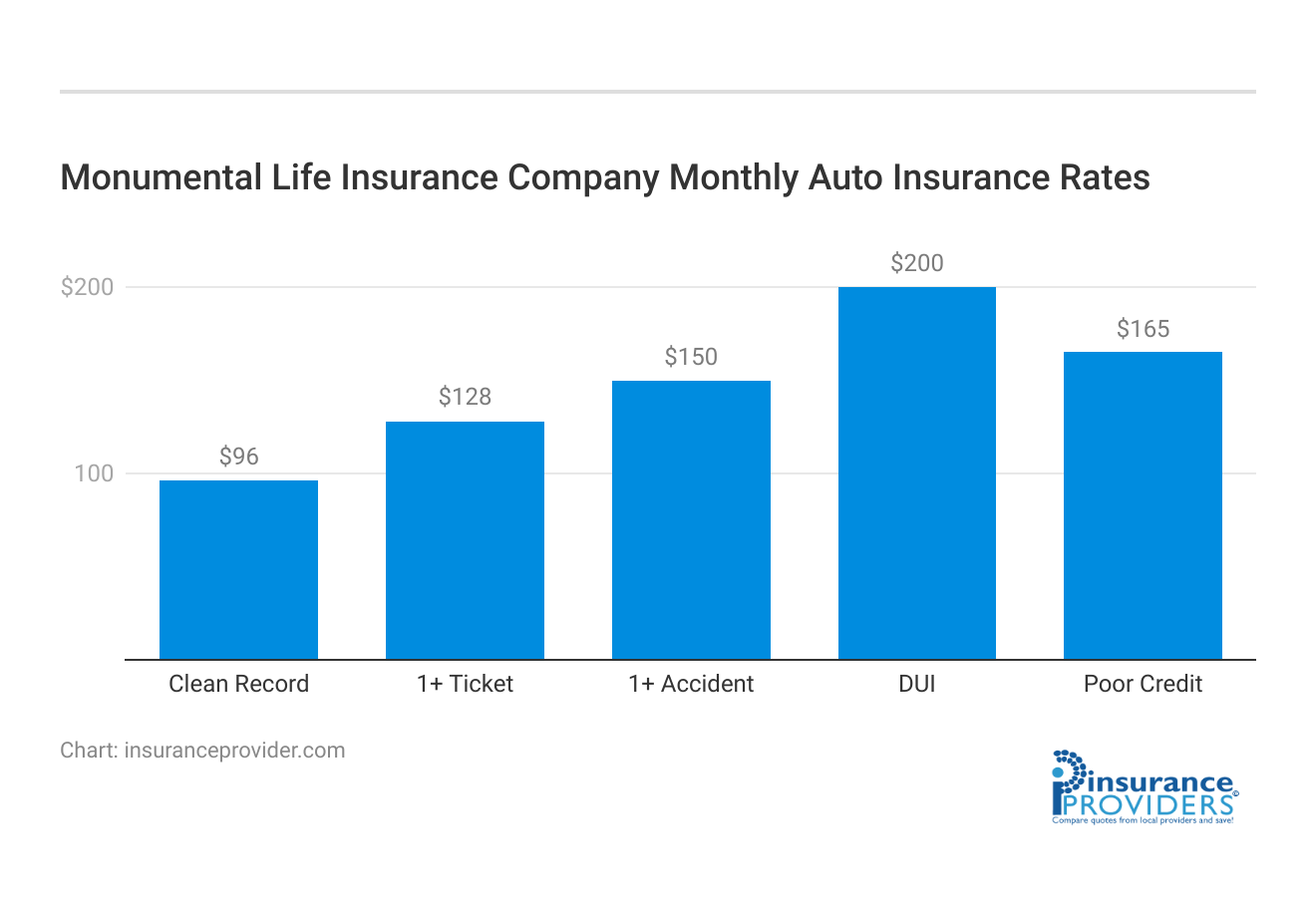

Monumental Life Insurance Company Insurance Rates Breakdown

| Driver Profile | Monumental Life Insurance | National Average |

|---|---|---|

| Clean Record | $96 | $119 |

| 1+ Ticket | $128 | $147 |

| 1+ Accident | $150 | $173 |

| DUI | $200 | $209 |

| Poor Credit | $165 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Monumental Life Insurance Company Discounts Available

| Discounts | Monumental Life Insurance |

|---|---|

| Anti Theft | 12% |

| Good Student | 14% |

| Low Mileage | 10% |

| Paperless | 10% |

| Safe Driver | 16% |

| Senior Driver | 12% |

Monumental Life Insurance Company offers a range of discounts to help customers save money on their insurance premiums. These discounts include:

- Multi-policy discount: Customers who bundle multiple insurance policies with Monumental Life Insurance Company can save on their premiums.

- Safe driver discount: Customers who have a clean driving record may qualify for a safe driver discount.

- Good student discount: Full-time students who maintain a certain GPA may be eligible for a discount on their insurance premiums.

- Homeowner discount: Homeowners may be able to save on their insurance premiums by purchasing their home insurance policy through Monumental Life Insurance Company.

- Pay in full discount: Customers who pay their premiums in full upfront may be able to save on their insurance costs.

These discounts can help customers save money on their insurance premiums while still receiving the coverage they need. It’s important to speak with a Monumental Life Insurance Company representative to see which discounts you may be eligible for and how much you can save.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Monumental Life Insurance Company Ranks Among Providers

Monumental Life Insurance Company’s main competitors are other insurance companies that offer similar products and services. Some of the company’s biggest competitors include:

- State Farm: State Farm is one of the largest insurance companies in the United States and offers a range of insurance products, including life insurance, annuities, and Medicare supplement insurance.

- Allstate: Allstate is another large insurance company that offers life insurance, annuities, and other types of insurance products.

- Nationwide: Nationwide is a well-known insurance company that offers life insurance, annuities, and a range of other insurance products and services.

- Prudential: Prudential is a leading provider of life insurance, annuities, and retirement planning services.

- MetLife: MetLife is a large insurance company that offers a range of insurance products, including life insurance, annuities, and dental insurance.

These companies are well-established in the insurance industry and have strong brand recognition. Monumental Life Insurance Company competes with these companies by offering competitive rates, a range of insurance products, and excellent customer service.

Frequently Asked Questions

How do I qualify for a multi-policy discount?

To qualify for a multi-policy discount, you need to have two or more insurance policies with Monumental Life Insurance Company.

What is the coverage amount for term life insurance?

The coverage amount for term life insurance can range from $50,000 to $1 million, depending on your needs and budget.

Does Monumental Life Insurance Company offer online account management?

Yes, the company offers online account management, allowing you to manage your policy and make payments online.

Does Monumental Life Insurance Company offer discounts on insurance premiums?

Yes, Monumental Life Insurance Company offers various discounts to aid customers in saving money on their insurance premiums. These discounts encompass multi-policy discounts and savings for specific coverage types. Talking to a company representative helps determine eligibility and potential savings.

How does Monumental Life Insurance Company’s customer service fare?

Monumental Life Insurance Company receives positive feedback for its helpful customer service. While some clients have mentioned a slower claims process at times, overall, the company maintains a positive reputation for its service quality.

How does Monumental Life Insurance Company rate in terms of financial stability?

Monumental Life Insurance Company boasts an A (Excellent) rating from A.M. Best, signifying its robust ability to meet policyholder obligations.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.