Norcal Specialty Insurance Company Review (2026)

Discover Norcal Specialty Insurance Company's tailored solutions for professionals and businesses navigating industry-specific risks, explored comprehensively in this insightful review.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive article, we delve into the expansive portfolio of insurance offerings by Norcal Specialty Insurance Company, an industry-leading provider renowned for its specialization in tailoring coverage solutions.

From medical and legal malpractice insurance to architects, engineers, accountants, and cybersecurity protection, Norcal excels in safeguarding professionals and businesses against their unique risks.

Backed by competitive rates, expert claims handling, and a strong emphasis on risk management, Norcal ensures peace of mind and financial security for those operating within the healthcare, legal, design, and accounting sectors.

With a conversational and engaging writing style, this article demystifies each insurance type, delivering invaluable insights for individuals and organizations navigating the evolving landscape of risks and liabilities.

Norcal Specialty Insurance Company Insurance Coverage Options

Norcal Specialty Insurance Company offers a diverse range of coverage options to meet the unique needs of professionals and businesses in various industries. Their specialization lies in providing tailored insurance solutions, primarily focusing on the healthcare, legal, design, and accounting sectors. Here are the key coverage options typically offered by Norcal:

- Medical Malpractice Insurance: Coverage designed for healthcare professionals, including doctors, nurses, and medical practitioners, to protect against liability claims arising from medical errors or negligence.

- Legal Malpractice Insurance: Insurance specifically crafted for lawyers and law firms to shield them from professional liability claims, such as allegations of negligence or ethics violations.

- Architects & Engineers Insurance: Coverage for design professionals in the construction and engineering industries, offering protection against errors, omissions, and professional liabilities.

- Accountants Insurance: Insurance tailored to accountants and CPA firms, providing financial protection in case of errors, omissions, or other liabilities related to financial services.

- Cyber Liability Insurance: Specialized coverage to safeguard businesses from the financial consequences of data breaches, cyberattacks, and privacy breaches in the digital age.

- General Liability Insurance: Provides protection for businesses against common risks, including bodily injury, property damage, and personal injury claims that may occur on their premises.

- Commercial Property Insurance: Coverage for physical assets, such as buildings, equipment, and inventory, protecting against damage or loss due to fire, theft, or other covered perils.

- Workers’ Compensation Insurance: Insurance designed to cover medical expenses and lost wages for employees who suffer work-related injuries or illnesses.

- Employment Practices Liability Insurance (EPLI): Protects businesses against employment-related claims, such as discrimination, harassment, or wrongful termination suits filed by employees.

- Directors and Officers (D&O) Liability Insurance: Coverage for directors and officers of a company, protecting them from personal liability in case of legal actions related to their managerial decisions.

- Business Interruption Insurance: Provides financial assistance to businesses facing disruptions in their operations due to covered events, helping them recover lost income and expenses.

- Professional Liability Insurance: Offers protection for professionals in various fields against claims of professional negligence or errors and omissions in their services.

- Umbrella Insurance: Additional liability coverage that extends the limits of underlying insurance policies, providing extra protection against large claims or lawsuits.

- Commercial Auto Insurance: Coverage for vehicles used for business purposes, ensuring protection against accidents, injuries, and damage related to company vehicles.

- Fidelity and Crime Insurance: Protects businesses from financial losses resulting from employee dishonesty, theft, or fraud.

These coverage options are tailored to the specific needs and risks associated with each profession or industry. Norcal’s focus on customization and expertise in these specialized areas sets them apart as a provider of choice for professionals seeking comprehensive and reliable insurance solutions.

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

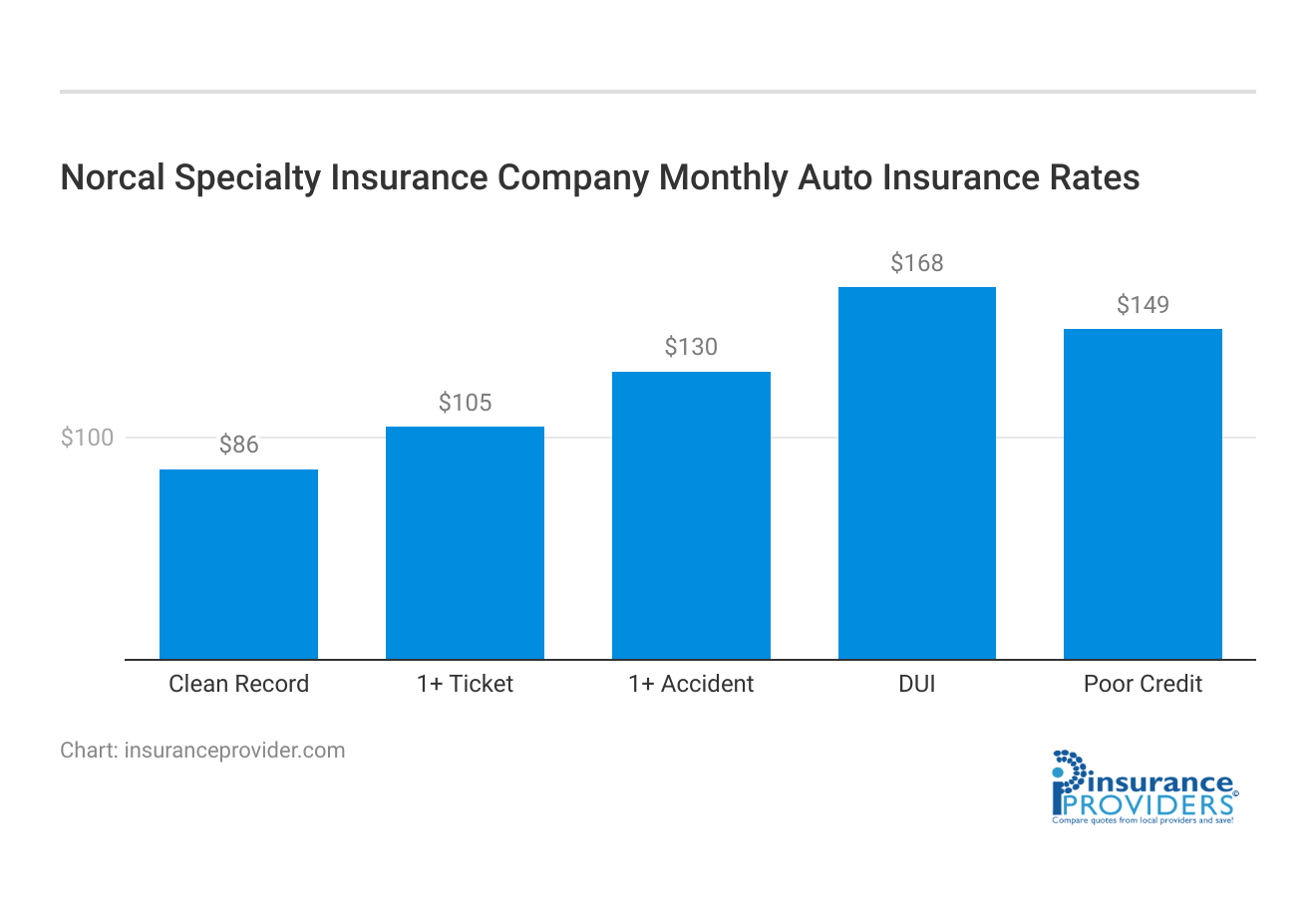

Norcal Specialty Insurance Company Insurance Rates Breakdown

| Driver Profile | Norcal Specialty Insurance | National Average |

|---|---|---|

| Clean Record | $86 | $119 |

| 1+ Ticket | $105 | $147 |

| 1+ Accident | $130 | $173 |

| DUI | $168 | $209 |

| Poor Credit | $149 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Norcal Specialty Insurance Company Discounts Available

| Discounts | Norcal Specialty Insurance |

|---|---|

| Anti Theft | 16% |

| Good Student | 21% |

| Low Mileage | 19% |

| Paperless | 10% |

| Safe Driver | 25% |

| Senior Driver | 16% |

Norcal Specialty Insurance Company offers a range of discounts to help policyholders save on their insurance premiums while maintaining quality coverage. These discounts are designed to reward safe practices, loyalty, and responsible behavior. Here are the discounts typically offered by Norcal:

- Claims-Free Discount: Policyholders who maintain a claims-free record for a specified period can enjoy lower premiums as a reward for their responsible behavior.

- Multi-Policy Discount: Norcal encourages bundling multiple insurance policies together. Customers who choose to combine various coverage options, such as medical malpractice and legal malpractice insurance, can benefit from reduced rates.

- Risk Management Discount: Norcal places a strong emphasis on risk management. Policyholders who actively engage in risk reduction activities or implement recommended risk management strategies may be eligible for discounts.

- Early Renewal Discount: Policyholders who renew their insurance policies with Norcal before the expiration date may receive a discount on their premiums as an incentive for timely renewals.

- Group or Association Discount: Norcal often partners with professional associations and organizations. Members of these groups may be eligible for exclusive discounts on insurance coverage.

- New Business Discount: New customers who choose Norcal for their insurance needs may qualify for special introductory discounts to welcome them to the company.

- Mature Driver Discount: In some cases, Norcal may offer discounts to policyholders who are older and have a long history of safe driving or practice in their respective professions.

- Safety and Security Features Discount: For certain types of coverage, such as cyber liability insurance, policyholders who implement robust cybersecurity measures may be eligible for discounts.

- Continuous Coverage Discount: Policyholders who maintain continuous coverage with Norcal over an extended period may receive loyalty discounts as a token of appreciation for their ongoing partnership.

It’s important to note that the availability and specifics of these discounts may vary depending on the type of insurance and the location. Norcal Specialty Insurance Company encourages customers to discuss discount options with their insurance agents or representatives to determine which discounts apply to their specific policies and circumstances.

How Norcal Specialty Insurance Company Ranks Among Providers

Norcal Specialty Insurance Company operates in a niche market, providing specialized insurance solutions primarily tailored to professionals in the healthcare, legal, design, and accounting industries. Here are some of Norcal’s main competitors:

- The Doctors Company: The Doctors Company is a prominent competitor in the medical malpractice insurance sector. They offer extensive coverage options for healthcare professionals and are known for their risk management services and financial stability.

- Attorneys’ Liability Assurance Society (ALAS): ALAS is a significant player in the legal malpractice insurance space. They provide coverage and risk management services specifically tailored to law firms and attorneys, competing directly with Norcal in this niche.

- AXIS Insurance: AXIS Insurance is a competitor in the architects and engineers insurance market. They offer coverage for design professionals and have a global presence, providing Norcal with competition in this specialized area.

- Chubb: Chubb is a well-known insurance company that provides various types of coverage, including cyber liability insurance. They compete with Norcal in the cybersecurity insurance sector, offering comprehensive solutions for businesses facing digital threats.

- Hiscox: Hiscox is another notable player in the cyber liability insurance market. They specialize in providing coverage for small to medium-sized businesses and compete with Norcal in offering tailored solutions for cyber risks.

- Travelers Insurance: Travelers is a large insurance company with a diverse range of coverage options. They compete with Norcal across various insurance sectors and may offer bundled insurance packages, attracting businesses and professionals seeking comprehensive coverage.

It’s important to note that Norcal’s competitive advantage lies in its specialization and expertise in serving professionals in specific industries. While these competitors may offer overlapping services, Norcal’s tailored approach and industry-specific knowledge can make them the preferred choice for professionals in healthcare, law, design, and accounting.

Read More: Axis Insurance Company: Customer Ratings & Reviews

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Norcal Specialty Insurance Company Claims Process

Ease of Filing a Claim

Norcal Specialty Insurance Company offers multiple convenient options for filing claims. Policyholders can file claims online through the company’s website, making it a hassle-free and time-saving process. the company also provides a mobile app, enhancing accessibility for policyholders to initiate and track their claims through a user-friendly interface.

Average Claim Processing Time

Norcal Specialty Insurance Company prides itself on efficient claims processing. On average, the company processes claims in a timely manner, ensuring that policyholders receive the support they need promptly.

The specific processing time may vary depending on the nature and complexity of the claim, but Norcal’s commitment to expeditious claim handling is evident in its reputation for customer satisfaction.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback on claim resolutions and payouts with Norcal Specialty Insurance Company has been largely positive. Policyholders appreciate the company’s dedication to fair and prompt claim settlements.

Norcal’s expert claims handling team ensures that claims are thoroughly evaluated and resolved to the satisfaction of policyholders. The company’s transparency and commitment to addressing customer needs contribute to a high level of trust and satisfaction among its clientele.

Norcal Specialty Insurance Company Digital and Technological Features

Mobile App Features and Functionality

Norcal Specialty Insurance Company’s mobile app offers a range of features and functionalities designed to enhance the overall customer experience. Users can conveniently access policy information, file claims, and track the status of existing claims through the app.

Additionally, the app provides resources for risk management and valuable information related to insurance coverage. Its user-friendly interface ensures that policyholders have access to essential tools and services right at their fingertips.

Online Account Management Capabilities

Policyholders can easily manage their accounts online through Norcal’s user-friendly web portal. The online account management platform allows customers to view and update their policy details, make payments, and access important documents. It provides a seamless and efficient way for policyholders to stay in control of their insurance coverage and account information.

Digital Tools and Resources

Norcal Specialty Insurance Company offers a wealth of digital tools and resources to assist policyholders in understanding their insurance coverage and managing their risks effectively. These resources include informative articles, guides, and risk management tools available on the company’s website.

Policyholders can access valuable insights and information to make informed decisions about their insurance needs and risk mitigation strategies. Norcal’s commitment to providing digital resources underscores its dedication to empowering its customers with knowledge and support.

Frequently Asked Questions

What types of insurance does Norcal Specialty Insurance Company offer?

Norcal offers a range of insurance coverage options tailored to professionals and businesses. These include Medical Malpractice Insurance, Legal Malpractice Insurance, Architects and engineers Insurance, Accountants Insurance, Cyber Liability Insurance, and more. Each is designed to address specific industry-related risks.

What is the average annual rate for insurance from Norcal?

The average annual rate can vary based on factors such as the type of coverage, location, and individual circumstances. However, for a 45-year-old male driver with a clean record, the average annual rate is approximately $800.

How does Norcal handle claims for its insurance policies?

Norcal has a dedicated claims team with expertise in various industries. They work closely with policyholders to investigate and resolve claims efficiently, ensuring the best possible outcome. Their expertise is especially valuable in the legal and medical malpractice sectors.

Can individuals purchase insurance from Norcal, or is it primarily for professionals?

While Norcal specializes in providing coverage for professionals and businesses in specific industries, they do offer some coverage options for individuals. It’s advisable to contact Norcal or your insurance agent to discuss your specific needs.

What sets Norcal apart from other insurance providers in its specialized sectors?

Norcal’s differentiation lies in its deep expertise and specialization in serving professionals in healthcare, law, design, accounting, and other fields. They offer tailored coverage options, strong risk management support, and a commitment to addressing the unique risks faced by each profession, setting them apart as a trusted and industry-focused insurance provider.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.