Northland Casualty Company Review (2026)

Discover the peace of mind provided by Northland Casualty Company, a trusted insurance provider offering tailored coverage solutions, competitive pricing, and top-notch customer service.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive article, we explore Northland Casualty Company, a trusted insurance provider offering a diverse array of coverage options. From auto and home insurance to life, business, and health insurance, Northland Casualty Company tailors its solutions to meet the unique needs of individuals and businesses alike.

With a commitment to competitive pricing, exceptional customer service, and prompt claims processing, the company provides peace of mind for policyholders. Whether you’re safeguarding your assets, loved ones, or investments, Northland Casualty Company stands as a reliable partner in protecting what matters most.

What You Should Know About Northland Casualty Company

Rates: Northland Casualty Company’s rates are determined based on an in-depth analysis of coverage options, ensuring competitive pricing for policyholders.

Discounts: The rating reflects the extent and accessibility of discounts, providing insight into potential savings for policyholders and their eligibility criteria.

Complaints/Customer Satisfaction: Northland Casualty Company’s rating in this category reflects the overall customer experience, emphasizing satisfaction levels and addressing any concerns raised through complaints.

Claims Handling: Northland Casualty Company’s claims handling rating reflects the efficiency of their process, from submission to resolution, and customer feedback on the overall experience, ensuring policyholders receive prompt and satisfactory assistance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Northland Casualty Company Insurance Coverage Options

Northland Casualty Company offers a wide range of insurance coverage options tailored to meet your specific needs. Whether you’re looking to safeguard your home, car, business, or loved ones, we provide comprehensive solutions that ensure your peace of mind.

- Auto Insurance: Provides coverage for vehicles, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Home Insurance: Protects homeowners or renters from property damage, theft, liability, and additional living expenses in case of disasters.

- Life Insurance: Offers financial protection to beneficiaries in the event of the insured person’s death, with options like term life and whole life insurance.

- Business Insurance: Provides coverage for businesses, including property insurance, liability insurance, and coverage for business interruption.

- Health Insurance: Offers medical coverage, including doctor visits, hospital stays, prescription drugs, and preventive care.

The specific coverage options and policy details may vary depending on the insurance company and the policy you choose. It’s essential to consult with the insurance provider directly or review their policy documents to understand the precise coverage they offer.

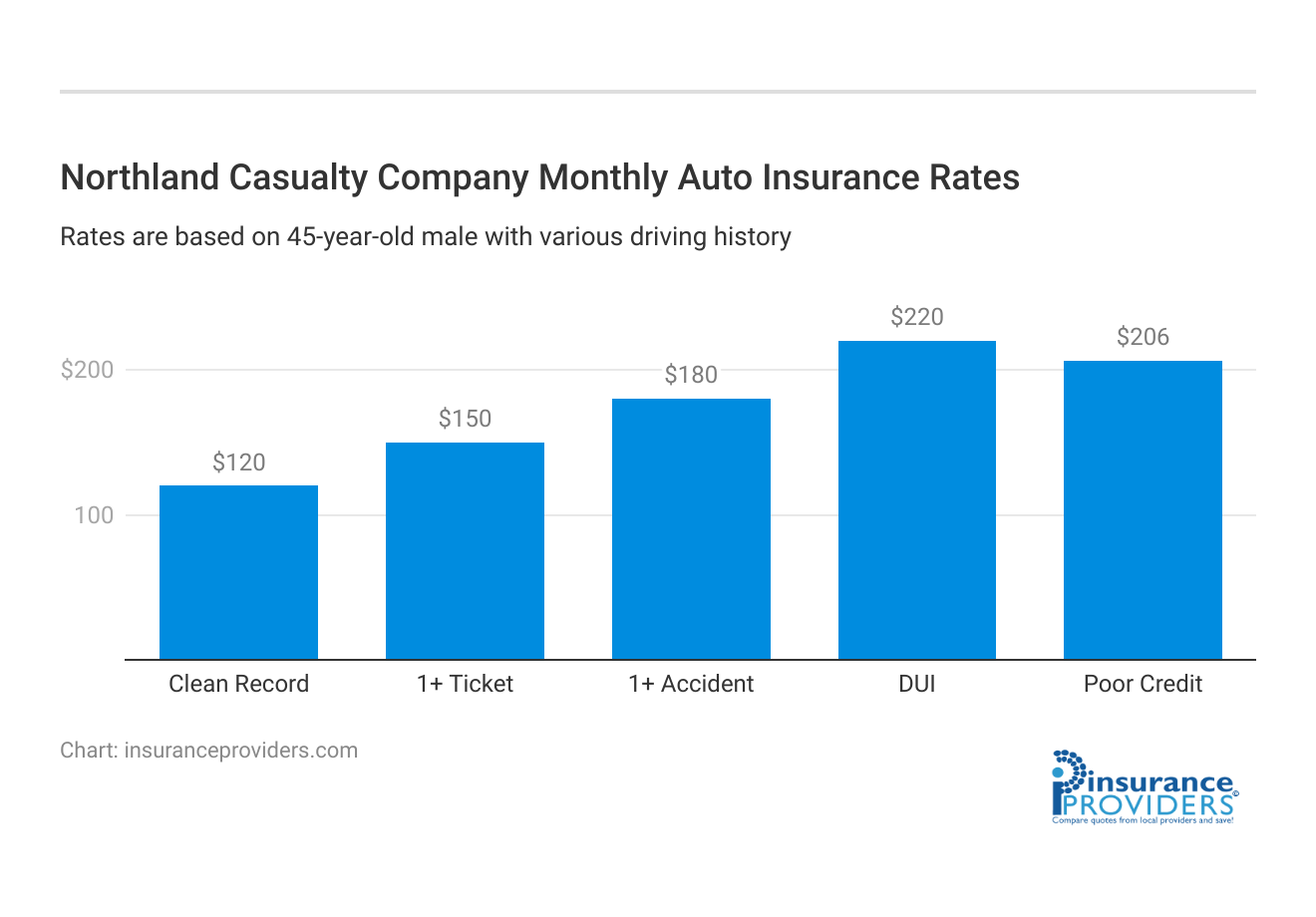

Northland Casualty Company Insurance Rates Breakdown

| Driver Profile | Northland Casualty | National Average |

|---|---|---|

| Clean Record | $120 | $119 |

| 1+ Ticket | $150 | $147 |

| 1+ Accident | $180 | $173 |

| DUI | $220 | $209 |

| Poor Credit | $206 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Northland Casualty Company Discounts Available

| Discount | Northland Casualty |

|---|---|

| Anti Theft | 6% |

| Good Student | 12% |

| Low Mileage | 5% |

| Paperless | 3% |

| Safe Driver | 17% |

| Senior Driver | 8% |

At Northland Casualty Company, we believe in making insurance not only comprehensive but also affordable. We understand the importance of providing our customers with opportunities to save on their insurance premiums. That’s why we offer a range of discounts that can help you protect what matters most without breaking the bank.

- Safe Driver Discount: Rewarding policyholders who maintain a clean driving record with lower premiums.

- Multi-Policy Discount: Encouraging customers to bundle multiple insurance policies, such as home and auto insurance, to receive a discount on both.

- Good Student Discount: Recognizing the achievements of young drivers who maintain good grades in school.

- Defensive Driving Course Discount: Offering discounts to policyholders who complete a recognized defensive driving course.

- Anti-Theft Device Discount: Lowering premiums for vehicles equipped with anti-theft devices, reducing the risk of theft.

- Low Mileage Discount: Providing savings to policyholders who drive fewer miles, as lower mileage typically correlates with a lower risk of accidents.

- Home Safety Features Discount: Offering discounts for homeowners who have safety features like smoke detectors, security systems, and fire extinguishers in place.

- Loyalty Discount: Rewarding long-term customers with lower premiums to incentivize continued loyalty.

- New Vehicle Discount: Providing discounts for insuring new or recently purchased vehicles.

- Pay-in-Full Discount: Offering savings to customers who pay their annual premium in a single payment rather than in installments.

- Paperless Billing Discount: Encouraging customers to receive and manage their bills electronically, reducing administrative costs.

The availability and terms of these discounts can vary by insurance company and location. It’s important for potential policyholders to inquire about and understand the specific discounts offered by Northland Casualty Company and how they can apply to their insurance policies.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Northland Casualty Company Ranks Among Providers

To identify the main competitors of Northland Casualty Company or any insurance company, you would typically consider factors such as market share, industry reputation, and the types of insurance products they offer. Here is a general framework for discussing competitors:

- State Farm: State Farm is one of the largest insurance providers in the United States. They offer a wide range of insurance products, including auto, home, and life insurance. Their extensive agent network and brand recognition make them a formidable competitor.

- Allstate: Allstate is another major player in the insurance industry, known for its auto and home insurance offerings. They emphasize features like accident forgiveness and various discount programs to attract customers.

- Geico: Geico is renowned for its competitive pricing and extensive advertising campaigns. They primarily focus on auto insurance but also offer other insurance products.

- Progressive: Progressive is well-known for its innovative approach to auto insurance, including its Snapshot program, which offers discounts based on driving behavior. They also offer home insurance and have expanded into other insurance areas.

- Liberty Mutual Insurance: Liberty Mutual is a diversified insurance company that provides coverage for auto, home, and life insurance. They focus on personalized coverage and offer various discounts to policyholders.

- Prudential Financial: Prudential is a major player in the life insurance sector. They offer a wide array of life insurance products, including term life, whole life, and universal life policies. They compete with Northland in the life insurance space.

- USAA: USAA primarily serves members of the U.S. military and their families. They are known for their exceptional customer service and offer a range of insurance products, including auto, home, and life insurance.

- Nationwide: Nationwide offers auto, home, and life insurance and has a strong presence in the United States. They focus on providing coverage options that cater to various customer needs.

- Farmers: Farmers Insurance offers a range of insurance products, including auto, home, and life insurance. They are known for their local agents and personalized service.

- Erie: Erie Insurance primarily operates in the Midwest and East Coast of the United States. They offer auto, home, and life insurance with a focus on affordability and customer service.

The competitive landscape can change over time due to mergers, acquisitions, and shifts in market dynamics. Therefore, for the most up-to-date information on Northland Casualty Company’s competitors, it’s advisable to consult industry reports, and news articles, or conduct market research specific to the present day.

Northland Casualty Company Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Northland Casualty Company understands that filing a claim should be a hassle-free process for its policyholders. Whether you prefer the convenience of online services, a phone call, or utilizing mobile apps, they offer multiple channels for submitting claims.

This flexibility in claim submission ensures that you can choose the method that best suits your needs and preferences.

Average Claim Processing Time

One of the critical factors to consider when evaluating an insurance provider is the speed at which they process claims. Northland Casualty Company is committed to prompt claims processing, aiming to provide policyholders with a swift resolution to their claims.

We will explore the average claim processing time to help you understand how quickly you can expect to receive assistance in the event of a covered incident.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is invaluable when assessing an insurance company’s performance in handling claims. In this section, we will delve into the experiences of Northland Casualty Company’s policyholders, exploring their satisfaction with claim resolutions and payouts.

The experiences can provide valuable insights into the company’s commitment to customer service and its ability to fulfill its promises.

Digital and Technological Features of Northland Casualty Company

Mobile App Features and Functionality

In today’s digital age, having a robust mobile app can significantly enhance the overall customer experience. We will examine Northland Casualty Company’s mobile app, assessing its features and functionality.

From policy management to claims submission and access to resources, a well-designed mobile app can make interacting with your insurance provider more convenient.

Online Account Management Capabilities

Online account management is a key component of modern insurance services. Policyholders should have easy access to their policy information, billing details, and other essential documents. We will explore Northland Casualty Company’s online account management capabilities, evaluating how well they enable customers to manage their policies and accounts digitally.

Digital Tools and Resources

Insurance providers often offer digital tools and resources to help policyholders make informed decisions and navigate the insurance landscape effectively. In this section, we will investigate the digital tools and resources provided by Northland Casualty Company.

These may include educational materials, calculators, and other assets designed to empower customers in their insurance journey.

Frequently Asked Questions

What types of insurance coverage does Northland Casualty Company offer?

Northland Casualty Company provides a diverse range of insurance coverage options, including auto, home, life, business, and health insurance.

What sets Northland Casualty Company apart in terms of pricing?

Our commitment to competitive pricing means you can trust that you’re getting value for your insurance needs without compromising on quality coverage.

How does the claims process work with Northland Casualty Company?

Filing a claim is hassle-free with multiple channels available, including online, over the phone, and through mobile apps. We are dedicated to prompt claims processing for swift resolutions.

Are there discounts available with Northland Casualty Company?

Yes, we offer various discounts, but their availability and terms can vary. It’s essential for potential policyholders to inquire about and understand the specific discounts offered and how they can apply to their insurance policies.

How can I compare quotes from Northland Casualty Company with other insurance providers?

To compare quotes, enter your ZIP code above to use our free quote tool, providing you with the opportunity to explore multiple options and potentially save on your insurance coverage.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.