Northland Insurance Company Review (2026)

Explore Northland Insurance Company's extensive range of coverage options, from home and auto to business and specialty policies, offering competitive rates and exceptional customer service for reliable protection.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Northland Insurance Company, a trusted name in the insurance industry. Northland offers a wide spectrum of coverage options, including home insurance, auto insurance, business insurance, and specialized policies, ensuring that individuals and businesses alike can find tailored protection for their unique needs.

Northland Insurance is an exceptional service, competitive rates, and discounts. Whether you’re a safe driver, homeowner, or loyal customer, we’ve got you covered. Save on safeguarding your assets!

What You Should Know About Northland Insurance

Rates: Our rates assessment scrutinizes Northland Insurance Company’s pricing structures, evaluating the balance between affordability and the value offered across various insurance products.

Discounts: In assessing discounts, we analyze the range and effectiveness of cost-saving opportunities, including safe driving, homeownership, and loyalty programs, to determine how well Northland Insurance Company helps policyholders reduce their insurance costs.

Complaints/Customer Satisfaction: Customer satisfaction is a key focus in our methodology, with an emphasis on analyzing feedback and complaints, considering the nature and volume of issues, and evaluating Northland Insurance Company’s responsiveness in addressing customer concerns.

Claims Handling: The claims handling category evaluates the efficiency and effectiveness of Northland Insurance Company’s claims process, considering factors such as ease of filing claims, average processing time, and the company’s track record for fair and timely resolutions.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Northland Insurance Coverage Options

When it comes to safeguarding what matters most, having the right insurance coverage is paramount. Northland Insurance Company understands this, and they’ve made it their mission to provide a wide array of insurance options to meet your specific needs.

Auto Insurance:

- Comprehensive Coverage

- Collision Coverage

- Liability Coverage

- Uninsured/Underinsured Motorist Coverage

- Personal Injury Protection (PIP)

- Roadside Assistance

Commercial Auto Insurance:

- Commercial Liability Coverage

- Cargo Coverage

- Non-Trucking Liability

- Physical Damage Coverage

- Occupational Accident Coverage

- Motor Truck Cargo Insurance

Truck Insurance:

- Owner-Operator Coverage

- Motor Carrier Coverage

- Long-Haul Truck Insurance

- Local Trucking Insurance

- Refrigerated Truck Insurance

- Dump Truck Insurance

Fleet Insurance:

- Coverage for Multiple Vehicles

- Customized Policies for Fleets

- Risk Management Services

- Claims Management

Motorcycle Insurance:

- Liability Coverage

- Comprehensive Coverage

- Collision Coverage

- Medical Payments Coverage

- Uninsured/Underinsured Motorist Coverage

- Custom Equipment Coverage

Boat and Watercraft Insurance:

- Coverage for Various Types of Watercraft

- Liability Coverage

- Physical Damage Coverage

- Personal Effects Coverage

- Emergency Towing and Assistance

Recreational Vehicle (RV) Insurance:

- Coverage for Motorhomes, Campers, and Trailers

- Liability Coverage

- Comprehensive and Collision Coverage

- Vacation Liability Coverage

- Personal Belongings Coverage

- Emergency Expenses Coverage

Homeowners Insurance:

- Dwelling Coverage

- Personal Property Coverage

- Liability Coverage

- Additional Living Expenses Coverage

- Flood Insurance

- Earthquake Insurance

Renters Insurance:

- Personal Property Coverage

- Liability Coverage

- Additional Living Expenses Coverage

- Loss of Use Coverage

- Valuable Items Coverage

Commercial Property Insurance:

- Building Coverage

- Business Personal Property Coverage

- Business Interruption Coverage

- Equipment Breakdown Coverage

- Commercial General Liability Insurance

General Liability Insurance:

- Coverage for Bodily Injury and Property Damage Claims

- Personal and Advertising Injury Coverage

- Medical Payments Coverage

- Products and Completed Operations Coverage

- Fire Legal Liability Coverage

Workers’ Compensation Insurance:

- Coverage for Employee Injuries or Illnesses

- Wage Replacement

- Medical Expenses

- Employer’s Liability Coverage

- Return to Work Programs

Umbrella Insurance:

- Additional Liability Coverage Beyond Other Policies

- Protection Against Lawsuits and Large Claims

- Coverage for Personal and Business Assets

- Peace of Mind in Case of Catastrophic Events

These coverage options demonstrate the comprehensive range of insurance products offered by Northland Insurance Company:, catering to the diverse needs of individuals and businesses.

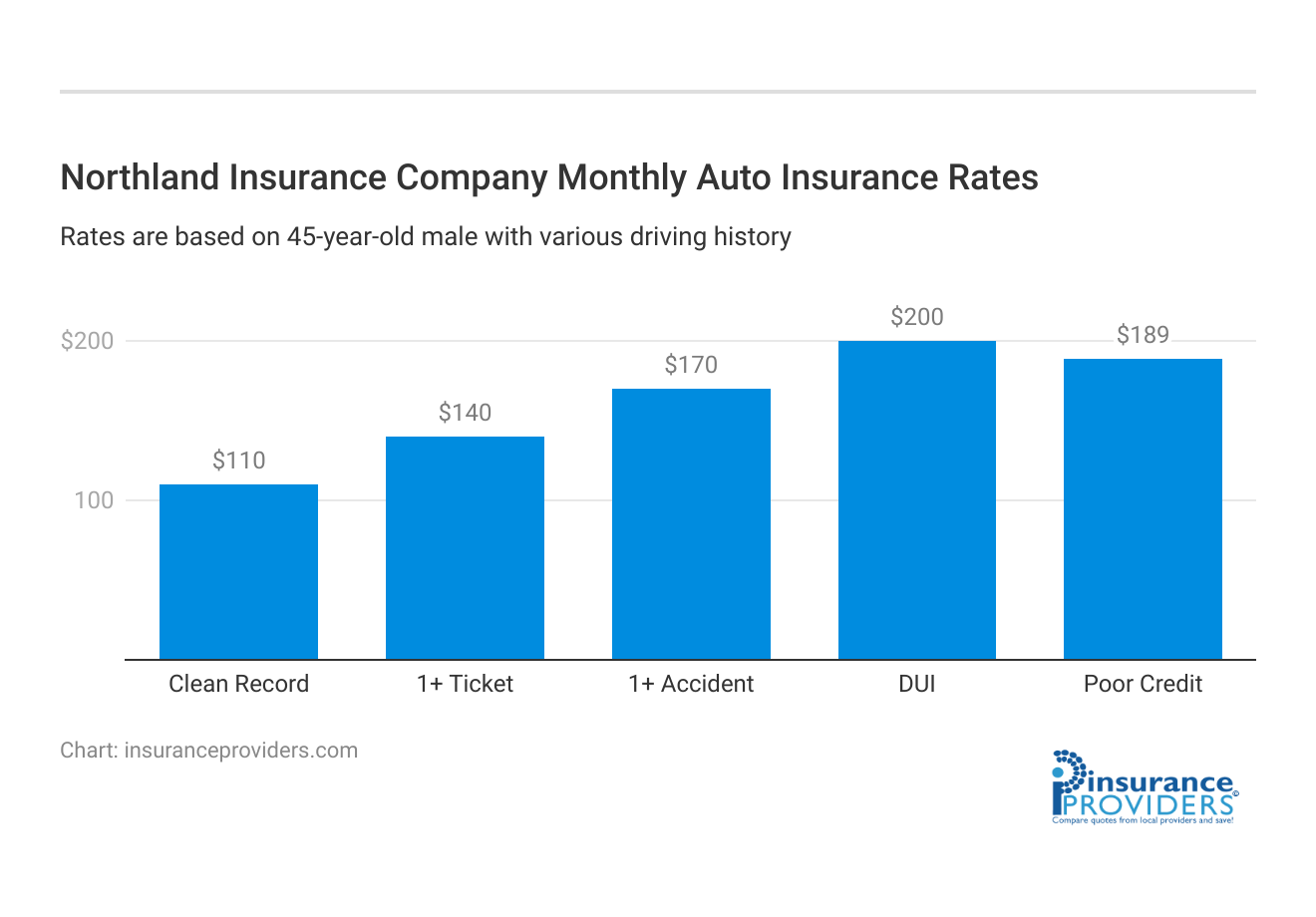

Northland Insurance Rates Breakdown

| Driver Profile | Northland | National Average |

|---|---|---|

| Clean Record | $110 | $119 |

| 1+ Ticket | $140 | $147 |

| 1+ Accident | $170 | $173 |

| DUI | $200 | $209 |

| Poor Credit | $189 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Northland Insurance Discounts Available

| Discount | Northland |

|---|---|

| Anti Theft | 7% |

| Good Student | 11% |

| Low Mileage | 6% |

| Paperless | 4% |

| Safe Driver | 18% |

| Senior Driver | 9% |

Finding ways to save on your insurance premiums is always a smart move. At Northland Insurance Company, we not only provide comprehensive coverage options but also offer a range of discounts to help you protect what matters most without breaking the bank. Let’s explore the discounts available to you.

- Safe Driver Discount: If you have a clean driving record without accidents or traffic violations, you may qualify for a safe driver discount, which can significantly reduce your premium.

- Multi-Policy Discount: Combining multiple insurance policies, such as home and auto insurance, with Northland can lead to substantial savings. This bundling discount rewards you for consolidating your insurance needs.

- Good Student Discount: Students with good grades often qualify for lower rates. If you’re a student maintaining a high GPA, Northland may offer you a good student discount.

- Anti-Theft Device Discount: If your vehicle is equipped with anti-theft devices or alarm systems, you can receive a discount on your auto insurance premium. These security features reduce the risk of theft and damage.

- Home Safety Features Discount: For homeowners, having safety features like smoke detectors, security systems, and fire extinguishers can lead to lower home insurance premiums. Northland rewards you for taking precautions to protect your home.

- Pay-in-Full Discount: Paying your insurance premium in full upfront can result in a discount. This option can save you money over the long term by avoiding installment fees.

- Multi-Vehicle Discount: If you insure more than one vehicle with Northland, you may be eligible for a multi-vehicle discount. This can lead to substantial savings, especially for families with multiple cars.

- Defensive Driving Course Discount: Completing a defensive driving course can not only make you a safer driver but also qualify you for a discount on your auto insurance premium.

- Renewal Discount: Staying loyal to Northland can be rewarding. They often offer renewal discounts to policyholders who continue their coverage with them.

- Military or First Responder Discount: Active duty or retired military personnel and first responders may be eligible for special discounts as a token of appreciation for their service.

It’s important to note that the availability and eligibility criteria for these discounts may vary by location and the specific policy you choose. It’s recommended to consult with a Northland Insurance representative to determine which discounts you qualify for and how they can be applied to your insurance policies.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Northland Insurance Ranks Among Providers

Keep in mind that the competitive landscape can change over time, and specific competitors may vary depending on the region and the types of insurance products offered. Here are some key categories of potential competitors:

- National insurance companies: These are large, well-established insurance companies that offer a wide range of insurance products similar to Northland. Examples might include State Farm, Allstate, Geico, Progressive, and Nationwide.

- Regional insurance companies: Some regional insurers focus on specific geographic areas and may have a strong presence in particular states or regions. These companies can be formidable competitors, especially in their target markets.

- Specialty insurance providers: Companies that specialize in niche insurance markets or specific types of coverage, such as classic car insurance, pet insurance, or specialty business insurance, may compete with Northland in specific areas.

- Online insurance startups: With the rise of digital technology, online-based insurance startups have entered the market. They often offer competitive rates and user-friendly interfaces, appealing to tech-savvy consumers.

- Mutual insurance companies: Mutual insurance companies are owned by policyholders and may offer competitive rates and personalized service. They may be considered competitors in the industry.

- Independent insurance agents and brokers: While not insurance companies themselves, independent agents and brokers can represent multiple insurance companies, including Northland’s competitors. They help customers find the best insurance policies for their needs.

- Captive insurance agents: Captive agents work exclusively for one insurance company, promoting their products. Some larger insurers use this model, and their agents may compete directly with Northland’s representatives.

It’s important to note that competition in the insurance industry can vary widely based on the specific types of insurance offered (e.g., auto, home, business), the geographic region, and the target customer demographic. Each competitor may have its own strengths, weaknesses, and unique selling points, making the insurance market a diverse and competitive landscape.

Northland Insurance Company Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

When it comes to filing a claim with Northland Insurance Company, policyholders have the convenience of multiple options. The company offers a user-friendly online platform that allows customers to submit claims electronically, making the process efficient and accessible from the comfort of their homes.

Additionally, Northland Insurance provides a dedicated phone line for those who prefer filing claims over the phone, ensuring flexibility to suit various customer preferences. Furthermore, the availability of mobile apps enhances the ease of claim submission, providing policyholders with a convenient and modern way to initiate their claims.

Average Claim Processing Time

One of the critical aspects of the claims process is the speed at which claims are processed. Northland Insurance Company understands the importance of timely claim resolution and has a reputation for efficient claim processing.

While specific processing times may vary depending on the nature and complexity of the claim, the company’s commitment to swift resolutions is reflected in its track record of providing customers with timely payouts.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback plays a significant role in evaluating an insurance company’s claims process. Northland Insurance Company has garnered positive reviews from customers regarding its claim resolutions and payouts.

Policyholders have reported satisfaction with the company’s responsiveness and willingness to address their claims promptly and fairly. This positive feedback reflects Northland Insurance’s commitment to customer service and ensuring that claimants receive the support they need during challenging times.

Digital and Technological Features of Northland Insurance Company

Mobile App Features and Functionality

Northland Insurance Company offers a robust mobile app that provides policyholders with a range of features and functionalities. The app allows users to manage their policies, access important documents, and even file claims directly from their mobile devices.

It provides a user-friendly interface that simplifies insurance-related tasks, making it a valuable tool for customers who prefer the convenience of mobile app access.

Online Account Management Capabilities

For policyholders who prefer managing their insurance accounts online, Northland Insurance offers comprehensive online account management capabilities.

Through their secure online portal, customers can access policy information, make payments, review coverage details, and update their personal information. This online convenience ensures that customers have easy access to their insurance accounts 24/7, enhancing their overall experience with the company.

Digital Tools and Resources

In today’s digital age, access to helpful digital tools and resources is essential for insurance customers. Northland Insurance Company provides a range of digital resources to assist policyholders in making informed decisions about their coverage.

These resources may include educational materials, calculators, and informative articles on various insurance topics. Such tools empower customers to better understand their policies and make choices that align with their insurance needs.

Frequently Asked Questions

What types of insurance does Northland Insurance Company offer?

Northland Insurance Company provides a comprehensive range of coverage options, including home insurance, auto insurance, business insurance, and specialized policies to cater to the diverse needs of individuals and businesses.

How competitive are the rates at Northland Insurance Company?

Northland Insurance Company is committed to offering competitive rates, ensuring that individuals, whether safe drivers, homeowners, or loyal customers, can benefit from cost-effective solutions while safeguarding their assets.

What discounts are available with Northland Insurance policies?

Northland Insurance Company offers various discounts tailored to different circumstances, such as safe driving, homeownership, or customer loyalty. The availability and eligibility criteria for these discounts may vary, and it’s recommended to consult with a Northland Insurance representative for personalized information.

How does the claims process work with Northland Insurance Company?

Northland Insurance Company provides policyholders with multiple options for filing claims, including a user-friendly online platform, a dedicated phone line, and mobile apps, ensuring flexibility to suit various customer preferences. The company is known for its commitment to efficient and timely claim processing.

What digital features does Northland Insurance Company offer for policy management?

Northland Insurance Company provides a robust mobile app for policyholders, allowing them to manage their policies, access important documents, and file claims directly from their mobile devices.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.