Old Republic General Insurance Corporation Review (2026)

Exploring the depths of protection and peace of mind offered by Old Republic General Insurance Corporation, this article provides a comprehensive overview of the trusted insurance giant, renowned for its diverse coverage options tailored to meet the unique needs of policyholders.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive article, we explore Old Republic General Insurance Corporation, a trusted name in the insurance industry, renowned for its wide array of coverage options tailored to meet the diverse needs of policyholders.

Starting with an introduction highlighting the company’s offerings, we delve into the types of insurance it provides, including auto, home, life, and business coverage, emphasizing the benefits of each. We also uncover the company’s rich history and commitment to customer satisfaction, accompanied by glowing customer reviews.

Furthermore, we discuss the discounts available for savvy consumers and the competitive landscape in which Old Republic operates. With a conversational tone and engaging content, this article is a valuable resource for those seeking to understand the depth of protection and peace of mind that Old Republic General Insurance Corporation can offer.

Old Republic General Insurance Corporation Insurance Coverage Options

Old Republic General Insurance Corporation offers a wide range of coverage options to meet the diverse needs of its policyholders. These coverage options include:

Auto Insurance:

- Liability Coverage: Protection for bodily injury and property damage liability in case you’re at fault in an accident.

- Collision Coverage: Covers the cost of repairing or replacing your vehicle in case of a collision, regardless of fault.

- Comprehensive Coverage: Protection against non-collision incidents like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Coverage in case you’re involved in an accident with an uninsured or underinsured driver.

- Medical Payments Coverage: Assistance with medical expenses resulting from an accident, regardless of fault.

- Personal Injury Protection (PIP): Coverage for medical expenses, lost wages, and other costs after an accident, regardless of fault.

- Rental Car Reimbursement: Pays for a rental car if your vehicle is in the shop due to a covered claim.

Life Insurance:

- Term Life Insurance: Coverage for a specified term, offering a death benefit to beneficiaries.

- Whole Life Insurance: Permanent coverage with a cash value component that can grow over time.

- Universal Life Insurance: Flexible life insurance with the ability to adjust premiums and death benefits.

- Variable Life Insurance: Combines life insurance with investment options.

- Final Expense Insurance: Designed to cover funeral and end-of-life expenses.

- Accidental Death and Dismemberment (AD&D): Provides benefits in case of accidental death or serious injury.

Business Insurance:

- Commercial Property Insurance: Protects your business property, including buildings and equipment.

- Commercial General Liability (CGL) Insurance: Coverage for bodily injury and property damage claims against your business.

- Business Interruption Insurance: Helps cover lost income and operating expenses if your business is temporarily unable to operate due to a covered event.

- Workers’ Compensation: Provides benefits to employees injured on the job.

- Professional Liability Insurance: Protects against claims of professional negligence or errors and omissions.

- Commercial Auto Insurance: Coverage for vehicles used for business purposes.

- Cyber Liability Insurance: Protection against data breaches and cyberattacks.

These are some of the key coverage options offered by Old Republic General Insurance Corporation. Policyholders can customize their insurance plans to suit their specific needs and preferences, making it easier to find the right coverage for their unique circumstances.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

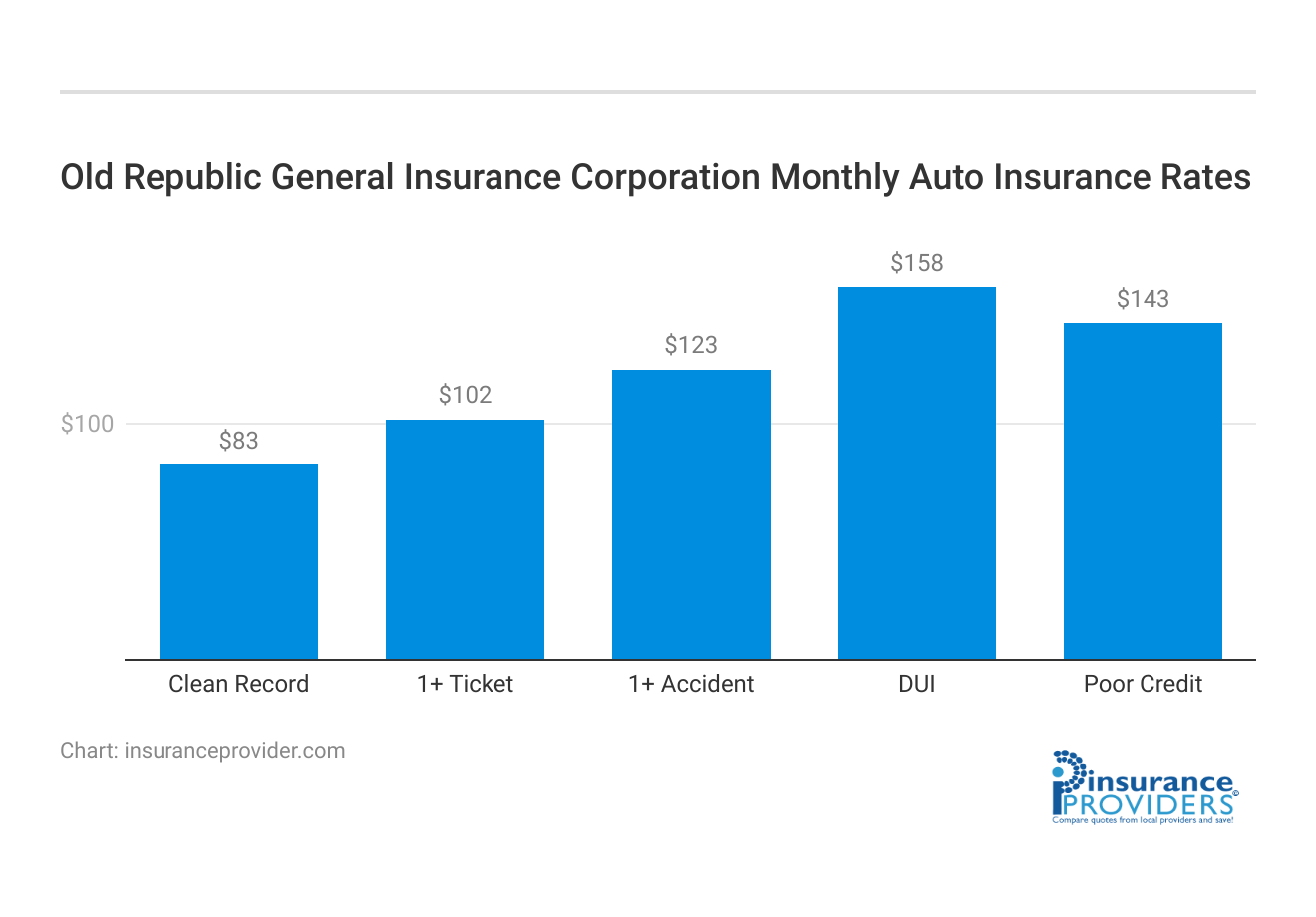

Old Republic General Insurance Corporation Insurance Rates Breakdown

| Driver Profile | Old Republic General | National Average |

|---|---|---|

| Clean Record | $83 | $119 |

| 1+ Ticket | $102 | $147 |

| 1+ Accident | $123 | $173 |

| DUI | $158 | $209 |

| Poor Credit | $143 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Old Republic General Insurance Corporation Discounts Available

| Discounts | Old Republic General |

|---|---|

| Anti Theft | 13% |

| Good Student | 16% |

| Low Mileage | 14% |

| Paperless | 9% |

| Safe Driver | 22% |

| Senior Driver | 13% |

Old Republic General Insurance Corporation offers a range of discounts to help policyholders save on their insurance premiums. These discounts can vary by location and the type of coverage you choose, but here are some common discounts that the company may offer:

- Multi-Policy Discount: Save when you bundle multiple insurance policies, such as auto and home insurance, with the Old Republic.

- Safe Driver Discount: Reward for policyholders with a clean driving record and no recent accidents or traffic violations.

- Good Student Discount: Discounts for students who maintain good grades, typically a B average or higher.

- Anti-Theft Device Discount: Savings for vehicles equipped with anti-theft devices that reduce the risk of theft.

- Defensive Driving Course Discount: Discounts for completing a certified defensive driving course, which can improve your driving skills and safety.

- Home Safety Features Discount: If your home is equipped with safety features like smoke detectors, burglar alarms, or fire extinguishers, you may qualify for this discount.

- Pay-in-Full Discount: Save by paying your annual premium in a single lump sum rather than in installments.

- Paperless Billing Discount: Opting for electronic billing and policy documents can sometimes lead to cost savings.

- Loyalty or Renewal Discount: Reward for policyholders who renew their coverage with the Old Republic, demonstrating customer loyalty.

- Professional Group or Association Discount: Discounts for policyholders who are members of certain professional groups or associations.

- Low Mileage Discount: If you don’t drive your vehicle frequently, you may qualify for this discount.

- Age-Related Discounts: Some policies offer discounts for older or retired individuals.

- New Customer Discount: Occasionally, insurance companies offer special discounts to attract new customers.

- Military Discount: Discounts may be available to active-duty military personnel and veterans.

Please note that the availability of these discounts can vary based on your location and the specific policy you choose. To determine which discounts apply to your situation, it’s essential to speak with an Old Republic General Insurance Corporation representative or visit their website for the most up-to-date information.

How Old Republic General Insurance Corporation Ranks Among Providers

Old Republic General Insurance Corporation operates in a highly competitive insurance industry, and it faces competition from several prominent companies in various segments of the insurance market. Here are some of its main competitors:

- State Farm: State Farm is one of the largest and most well-known insurance companies in the United States. It offers a wide range of insurance products, including auto, home, life, and more. State Farm’s extensive agent network and strong brand recognition make it a formidable competitor.

- Geico: Geico, known for its catchy advertising campaigns, specializes in auto insurance but also offers other insurance products. Geico is renowned for its competitive rates and user-friendly online tools, making it a popular choice for many consumers.

- Allstate: Allstate is another major player in the insurance industry, offering a comprehensive suite of insurance options. It’s known for its extensive network of local agents and a range of coverage options, including auto, home, and life insurance.

- Progressive: Progressive is a prominent auto insurance provider that has gained recognition for its innovative pricing model and the ability to provide competitive rates to a wide range of drivers. They also offer other insurance products, including home and renters insurance.

- Farmers Insurance: Farmers Insurance Group is known for its comprehensive coverage options, including auto, home, life, and business insurance. It operates through a network of agents and offers various discounts to policyholders.

- Liberty Mutual: Liberty Mutual is a global insurance company that provides a variety of insurance products, including auto, home, and renters insurance. It offers customizable policies and a strong online presence.

- Nationwide: Nationwide is a well-established insurer offering a broad range of insurance products. It’s known for its versatile coverage options and features like vanishing deductibles.

- Travelers: Travelers is a leading insurance company offering insurance products for both individuals and businesses. They are recognized for their risk management solutions and have a strong presence in the commercial insurance sector.

- USAA: USAA primarily serves military members and their families. It is highly regarded for its customer service and specialized coverage options.

- American Family Insurance: American Family is a regional insurer that has been expanding its footprint. It offers various insurance products and is known for its commitment to supporting local communities.

Old Republic General Insurance Corporation competes with these companies by emphasizing its strengths, such as its customizable policies, strong financial stability, and trusted reputation.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Old Republic General Insurance Corporation Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Old Republic General Insurance Corporation aims to make the claims process as convenient as possible for policyholders. They offer multiple avenues for filing a claim, ensuring flexibility and ease of access. Policyholders can choose to file a claim through the following methods:

- Online: The company provides an online platform where policyholders can submit their claims electronically. This method allows for quick and efficient claim filing from the comfort of your own home.

- Over the Phone: For those who prefer a more personal touch, Old Republic General Insurance Corporation offers a phone hotline dedicated to claims. Customers can speak directly with a representative to initiate the claims process and receive guidance.

- Mobile Apps: The insurer has invested in mobile app technology to enhance the claims experience. Through their mobile app, policyholders can easily file claims, upload necessary documents, and track the progress of their claims on their mobile devices.

Average Claim Processing Time

Old Republic General Insurance Corporation strives for a prompt and efficient claims processing system. While the exact processing time can vary depending on the nature and complexity of the claim, the company is committed to minimizing delays. Policyholders can generally expect a fair and timely resolution of their claims.

Customer Feedback on Claim Resolutions and Payouts

The satisfaction of policyholders with claim resolutions and payouts is a crucial aspect of any insurance company’s reputation. Old Republic General Insurance Corporation places a strong emphasis on customer feedback and continually seeks to improve its claims handling processes.

Customer reviews and feedback are regularly monitored and analyzed to identify areas for improvement. The company aims to provide fair and satisfactory claim resolutions to maintain its reputation for customer satisfaction and trust.

Old Republic General Insurance Corporation Digital and Technological Features

Mobile App Features and Functionality

Old Republic General Insurance Corporation offers a mobile app that provides policyholders with a range of useful features and functionalities. These include:

- Claim Filing: Policyholders can conveniently file claims through the mobile app, streamlining the process.

- Policy Management: The app allows users to manage their insurance policies, view policy documents, and make updates or changes as needed.

- Bill Payment: Policyholders can make premium payments securely through the app, ensuring they stay up-to-date with their payments.

- Digital ID Cards: The app provides access to digital insurance ID cards, making it easy to provide proof of coverage when needed.

Online Account Management Capabilities

Old Republic General Insurance Corporation’s online account management capabilities offer policyholders the freedom to access and manage their insurance policies from their computers or mobile devices. Key features include:

- Policy Information: Access to policy details, coverage limits, and premium payment history.

- Document Access: Conveniently view and download policy documents and certificates.

- Claims Tracking: Keep track of ongoing claims and their status.

- Coverage Updates: Request changes or updates to coverage directly through the online portal.

Digital Tools and Resources

In addition to its mobile app and online account management capabilities, Old Republic General Insurance Corporation provides a range of digital tools and resources to assist policyholders:

- Insurance Calculators: Tools to help customers estimate coverage needs and premiums for various insurance products.

- Educational Resources: Informational articles, guides, and FAQs to help policyholders understand insurance concepts and make informed decisions.

- Claims FAQs: Frequently asked questions related to the claims process, providing clarity and guidance for policyholders.

These digital features and resources are designed to enhance the overall customer experience and empower policyholders to manage their insurance effectively in the digital age.

Frequently Asked Questions

How can I get a quote for Old Republic’s insurance policies?

To obtain a quote from Old Republic General Insurance Corporation, you can visit their official website or get in touch with a local insurance agent. The website typically offers online quote tools that allow you to input your information and receive a customized insurance quote based on your specific needs and circumstances.

What factors affect the cost of auto insurance with Old Republic?

Several factors can influence the cost of auto insurance with the Old Republic. These factors may include your age, driving history, the type of vehicle you drive, your location, coverage limits, deductibles, and any discounts you qualify for.

Are there any discounts available for bundling home and auto insurance?

Yes, Old Republic General Insurance Corporation often offers discounts for bundling multiple insurance policies, such as home and auto insurance.

How can I file a claim with the Old Republic?

Filing a claim with Old Republic is a straightforward process. You can typically initiate a claim by contacting their claims department through the phone number provided on your policy documents or their website.

Does the Old Republic offer any specialized insurance products for businesses?

Yes, Old Republic General Insurance Corporation provides a range of specialized insurance products for businesses.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.