Old United Life Insurance Company Review (2026)

Old United Life Insurance Company, boasting almost seven decades of experience, offers a diverse array of insurance solutions—from life and health to auto and home coverage—ensuring tailored options and financial stability for your peace of mind.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive article, we delve into the world of Old United Life Insurance Company, a seasoned provider with nearly seven decades of experience. Offering a diverse array of insurance solutions, including life, health, auto, home, and travel coverage, Old United stands as a stalwart in the industry, known for its financial stability and reliability.

The article details the company’s rich history, highlights its commitment to customer satisfaction through positive reviews, and emphasizes its straightforward claims process. Furthermore, it explores the range of discounts available to policyholders, making coverage more accessible.

Old United Life Insurance Company’s dedication to tailoring coverage options to individual needs ensures that customers can secure their financial futures with confidence.

Old United Life Insurance Company Insurance Coverage Options

Old United Life Insurance Company offers diverse insurance policies designed to meet your specific needs. Whether you’re looking to protect your family’s financial future, secure your health, or find peace of mind on the road, they have you covered. Here are the coverage options they provide:

- Life insurance: Safeguard your loved ones’ financial security with a variety of life insurance policies, including term and whole-life options.

- Health insurance: Stay protected against unexpected medical expenses with comprehensive health insurance plans that offer peace of mind when you need it most.

- Auto insurance: Get on the road confidently knowing you have reliable auto insurance coverage to handle unexpected accidents and incidents.

- Home insurance: Protect your most significant investment with comprehensive home insurance policies that provide coverage for various situations.

- Travel insurance: Explore the world worry-free with travel insurance options that ensure you’re protected no matter where your adventures take you.

No matter what stage of life you’re in or what your insurance needs may be, Old United Life Insurance Company has the right coverage options to provide security and peace of mind.

Choosing the right insurance coverage is crucial for your financial well-being and peace of mind. With Old United Life Insurance Company’s wide range of coverage options, you can tailor your insurance portfolio to fit your unique needs and circumstances.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Old United Life Insurance Company Insurance Rates Breakdown

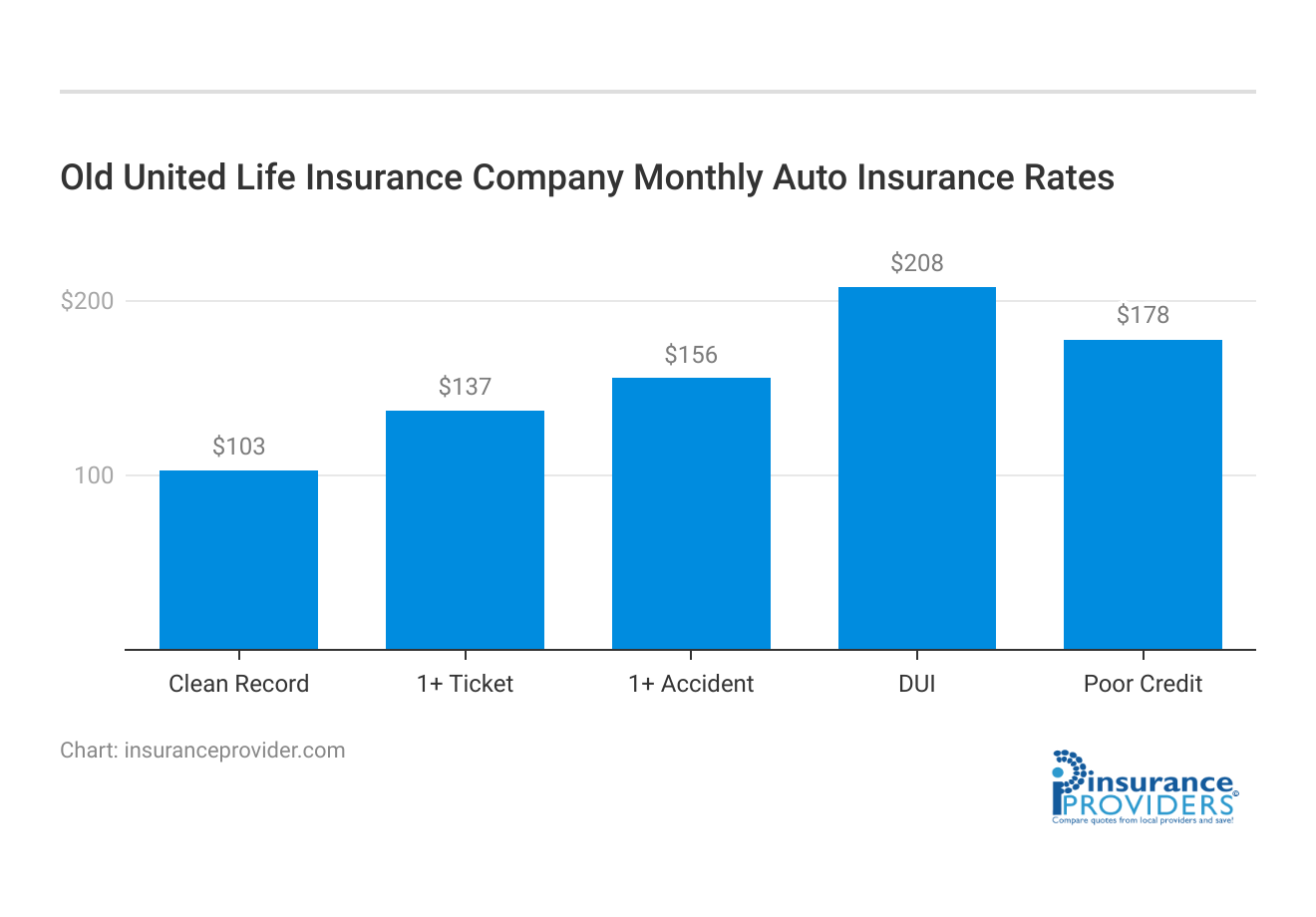

| Driver Profile | Old United Life Insurance | National Average |

|---|---|---|

| Clean Record | $103 | $119 |

| 1+ Ticket | $137 | $147 |

| 1+ Accident | $156 | $173 |

| DUI | $208 | $209 |

| Poor Credit | $178 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Old United Life Insurance Company Discounts Available

| Discounts | Old United Life Insurance |

|---|---|

| Anti Theft | 12% |

| Good Student | 14% |

| Low Mileage | 11% |

| Paperless | 8% |

| Safe Driver | 20% |

| Senior Driver | 12% |

Old United Life Insurance Company recognizes the importance of helping their customers save on insurance costs. They offer various discounts to make coverage more affordable. Here are some of the discounts you can take advantage of:

- Multi-policy discount: Save money when you bundle multiple insurance policies with Old United Life Insurance Company. Combining your home and auto insurance, for example, can lead to significant savings.

- Safe driver discount: If you have a clean driving record and a history of safe driving, you may qualify for a safe driver discount, which can reduce your auto insurance premiums.

- Good student discount: Students with good academic records often qualify for discounts on their auto insurance. This can be a significant benefit for young drivers and their parents.

- Home security discount: If you’ve installed security features in your home, such as alarm systems or smoke detectors, you may be eligible for a discount on your homeowners’ insurance.

- Multi-car discount: Insuring multiple vehicles with Old United Life Insurance Company can lead to savings. This is an excellent option for families with multiple drivers.

- Paid-in-full discount: Paying your premium in one lump sum rather than in monthly installments can result in a discount on your policy.

- Renewal discount: Staying loyal to Old United Life Insurance Company can pay off. They often offer renewal discounts to reward long-term customers.

- Good health discount: Maintaining good health can also lead to discounts on health and life insurance premiums.

These discounts can vary depending on your location and specific policy, so it’s essential to discuss your eligibility with an Old United Life Insurance Company representative. They can help you maximize your savings while ensuring you have the coverage you need.

How Old United Life Insurance Company Ranks Among Providers

The competitive landscapes can change over time, so it’s advisable to conduct current market research for the most up-to-date information. Some potential competitors for Old United Life Insurance Company might include:

- State Farm: State Farm is one of the largest insurance providers in the United States, offering a wide range of insurance products, including auto, home, and life insurance. They have a substantial market presence and a strong network of agents.

- Allstate: Allstate is known for its extensive advertising campaigns and provides various insurance options, including auto, home, life, and more. They emphasize technology-driven tools for policyholders.

- Progressive: Progressive is a major player in the auto insurance sector, offering competitive rates and innovative policies. They are known for their user-friendly online platform and unique coverage options.

- Geico: Geico is well-known for its catchy advertising and competitive auto insurance rates. They focus on providing direct-to-consumer insurance and often highlight their cost-saving options.

- Nationwide: Nationwide offers a wide range of insurance products and financial services. They have a strong presence in auto, home, and pet insurance, along with other lines of coverage.

- Prudential: Prudential is a significant competitor in the life insurance sector, offering various life insurance and retirement planning products. They have a long-standing history and a strong financial reputation.

- Metlife: Metlife is another major player in the life insurance market, providing life insurance, dental insurance, and other financial services. They have a global presence.

- AIG (American International Group): AIG is known for offering a broad spectrum of insurance products, including life, property, and casualty insurance, as well as retirement and investment solutions.

- Farmers Insurance: Farmers Insurance provides auto, home, and life insurance, among other products. They often emphasize their personalized approach to coverage.

- Liberty Mutual: Liberty Mutual offers various insurance products, including auto, home, and property insurance. They are known for their focus on customer service and comprehensive coverage options.

The competitive landscape can vary by region, and customer preferences and market dynamics can change over time. To make an informed decision about insurance providers, consumers should compare offerings, pricing, customer service, and coverage options based on their individual needs and circumstances.

Additionally, it’s advisable to check the latest market developments and customer reviews when evaluating competitors.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Old United Life Insurance Company Claims Process

Ease of Filing a Claim

Old United Life Insurance Company understands the importance of a smooth and hassle-free claims process. They offer multiple channels for filing claims, ensuring convenience for their policyholders.

You can file a claim online through their user-friendly website, over the phone by speaking with their dedicated customer support team, or even via their mobile app, providing flexibility to suit your preferences.

Average Claim Processing Time

When it comes to processing claims, Old United Life Insurance Company is committed to efficiency. While specific processing times may vary depending on the nature and complexity of the claim, they strive to expedite the process. Policyholders can expect a reasonable and timely resolution to their claims.

Customer Feedback on Claim Resolutions and Payouts

Customer satisfaction is paramount to Old United Life Insurance Company, and this extends to their claims resolutions and payouts. They take pride in delivering fair and transparent outcomes for their policyholders. To gauge customer sentiment, they actively collect feedback on their claims handling process and continuously work to improve it.

Old United Life Insurance Company Digital and Technological Features

Mobile App Features and Functionality

Old United Life Insurance Company offers a feature-rich mobile app that empowers policyholders with convenient access to their insurance information. The app allows you to view policy details, make premium payments, initiate claims, and even track the status of your claims—all from the palm of your hand. It’s designed to simplify insurance management on the go.

Online Account Management Capabilities

Managing your insurance policies has never been easier, thanks to Old United Life Insurance Company’s online account management capabilities. Through their secure online portal, policyholders can review and update their policies, view billing statements, and access important documents, ensuring complete control and transparency over their coverage.

Digital Tools and Resources

Old United Life Insurance Company provides a wealth of digital tools and resources to assist policyholders in making informed decisions. From online calculators to educational materials, they offer valuable resources that empower individuals to better understand their insurance options and make choices that align with their unique needs and circumstances.

Frequently Asked Questions

How long has Old United Life Insurance Company been in business?

Old United Life Insurance Company was founded in 1952, boasting almost seven decades of experience.

What types of insurance does Old United Life Insurance Company offer?

Old United Life Insurance Company offers life, health, auto, home, and travel insurance.

How can I file a claim with Old United Life Insurance Company?

Filing a claim is easy; simply contact their customer support, and they will guide you through the process.

Is Old United Life Insurance Company financially stable?

Yes, the company maintains financial strength, ensuring they can fulfill their commitments to policyholders.

Are there any drawbacks to choosing Old United Life Insurance Company?

While the company offers many advantages, it’s crucial to consider factors like pricing and specific policy details before making a decision. Conducting thorough research and comparing options is recommended.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.