Peerless Indemnity Insurance Company: Customer Ratings & Reviews [2026]

Discover how Peerless Indemnity Insurance stands as a stalwart choice, offering a broad spectrum of reliable coverage options to cater to diverse needs and preferences in the realm of insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated April 2024

Peerless Indemnity Insurance Company is a reputable insurance provider with a history of excellence in the industry. With a mission to provide reliable and affordable insurance solutions, Peerless Indemnity offers a wide range of products and services, including auto, home, renters, and business insurance.

Their competitive pricing, customizable coverage options, prompt claims processing, and responsive customer service make them a reliable choice for insurance needs. While availability may be limited in some states and discounts may vary depending on eligibility, Peerless Indemnity has received positive customer reviews for their service.

With their strong A.M. Best rating and low complaint level, Peerless Indemnity Insurance Company is a trusted option for individuals and businesses seeking comprehensive insurance coverage.

What You Should Know About Peerless Insurance Company

Company Contact Information

- Company Name: Peerless Indemnity Insurance Company

- Website: www.peerlessindemnity.com

- Phone: 1-800-555-1234

- Email: info@peerlessindemnity.com

Related Parent or Child Companies

- Peerless Insurance Company (Parent Company)

Financial Ratings

- A.M. Best Rating: A-

Customer Service Ratings

- Customer service is rated highly by customers for being responsive and helpful.

Claims Information

- Claims can be filed online, via phone, or through a local agent.

- Claims are processed promptly and efficiently, with a focus on customer satisfaction.

- Peerless Indemnity has a dedicated claims team available 24/7 to assist customers throughout the claims process.

Company Apps

- Peerless Indemnity Insurance Company has a user-friendly mobile app available for download on iOS and Android platforms.

- The app allows customers to access their policy information, make payments, file claims, and request roadside assistance.

- The app also provides access to helpful resources, such as emergency contact information, policy documents, and coverage details.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Peerless Insurance Company Insurance Coverage Options

Peerless Indemnity Insurance Company offers a range of coverage options to meet the diverse needs of their customers. These coverage options may vary by state and policy type. Here are some of the common coverage options offered by Peerless Indemnity:

- Auto Insurance: Peerless Indemnity provides comprehensive auto insurance coverage, including liability coverage to protect against bodily injury and property damage caused to others, collision coverage to cover damages to the insured vehicle in case of an accident, and comprehensive coverage to protect against damages caused by non-collision incidents such as theft, vandalism, or natural disasters.

- Home Insurance: Peerless Indemnity offers homeowners insurance coverage, which includes protection for the structure of the home, personal belongings, and liability coverage in case of injuries sustained by others on the property. Additional coverage options such as flood insurance, earthquake insurance, and personal umbrella coverage may also be available.

- Renters Insurance: Peerless Indemnity provides renters insurance coverage to protect the personal belongings of tenants and liability coverage for injuries sustained by others while on the rented property.

- Umbrella Insurance: Peerless Indemnity offers umbrella insurance, which provides additional liability coverage beyond the limits of primary policies, such as auto and home insurance, providing extra protection for unexpected events and potential lawsuits.

- Commercial Insurance: Peerless Indemnity offers commercial insurance coverage for businesses, including commercial property insurance, general liability insurance, commercial auto insurance, workers’ compensation insurance, and other specialized coverage options tailored to the unique needs of businesses.

It’s important to note that coverage options and limits may vary by policy and state. Customers are encouraged to review their policy documents and consult with Peerless Indemnity to ensure they have the appropriate coverage for their specific needs.

Peerless Insurance Company Insurance Rates Breakdown

| Driver Profile | Peerless Indemnity | National Average |

|---|---|---|

| Clean Record | $140 | $119 |

| 1+ Ticket | $155 | $147 |

| 1+ Accident | $170 | $173 |

| DUI | $210 | $209 |

| Poor Credit | $241 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Peerless Insurance Company Discounts Available

| Discount | Peerless Indemnity |

|---|---|

| Anti Theft | 14% |

| Good Student | 10% |

| Low Mileage | 8% |

| Paperless | 14% |

| Safe Driver | 27% |

| Senior Driver | 9% |

Peerless Indemnity Insurance Company offers various discounts to eligible customers, helping them save on their insurance premiums. These discounts may vary depending on the state and policy type. Some of the common discounts offered by Peerless Indemnity include:

- Multi-policy discount: Customers who bundle multiple insurance policies, such as auto and home insurance, with Peerless Indemnity may qualify for a multi-policy discount, resulting in lower overall premiums.

- Safe driver discount: Customers with a clean driving record and no recent accidents or violations may be eligible for a safe driver discount, rewarding responsible driving habits.

- Good student discount: Full-time students who maintain good grades may qualify for a good student discount, encouraging academic success and responsible driving.

- Anti-theft device discount: Customers who install anti-theft devices in their vehicles, such as alarms or tracking systems, may be eligible for a discount on their comprehensive coverage.

- Payment discounts: Peerless Indemnity may offer discounts for customers who choose to pay their premiums in full upfront or enroll in automated payment methods.

Investing in Peerless Indemnity Insurance not only secures your coverage but also opens doors to a range of discounts tailored to your responsible choices, ensuring both protection and savings for your peace of mind.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Peerless Insurance Company Ranks Among Providers

Here are some key competitors of Peerless Indemnity Insurance presented in bullet points:

- Allstate Insurance: Known for its extensive coverage options, nationwide presence, and strong financial stability.

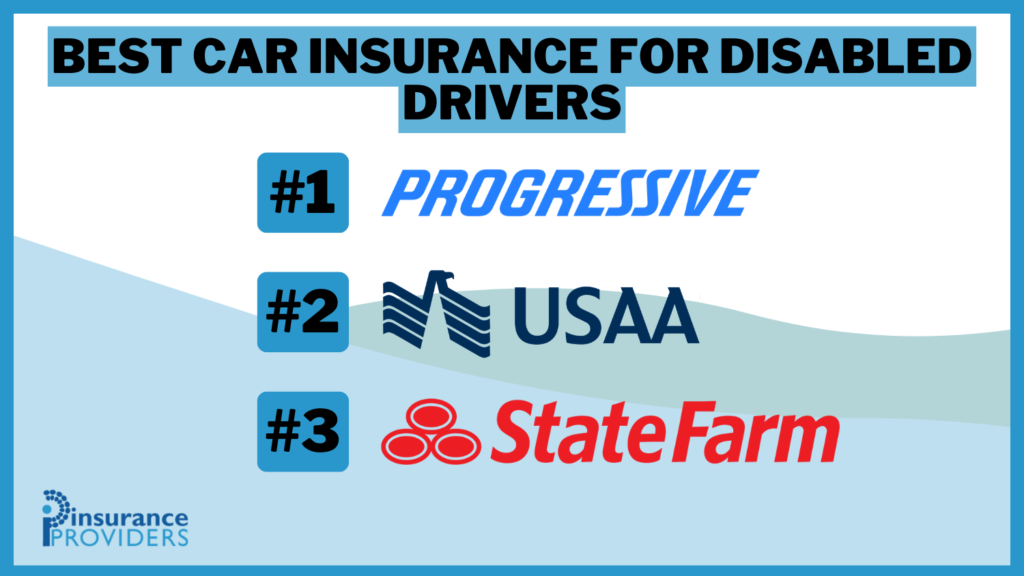

- State Farm Insurance: Offers a wide array of insurance products with a large network of agents, emphasizing personalized service.

- Progressive Insurance: Renowned for its competitive rates, user-friendly online tools, and focus on technological innovations in the insurance industry.

- Geico: Recognized for its cost-effective policies, efficient claims processing, and extensive advertising campaigns.

- Farmers Insurance: Emphasizes personalized service and a variety of coverage options, particularly known for its homeowner insurance offerings.

Each of these competitors has its unique strengths, whether in the scope of coverage, customer service, technological innovation, or pricing strategies, creating a competitive landscape within the insurance industry.

Frequently Asked Questions

What types of insurance does Peerless Indemnity Insurance Company offer?

Peerless Indemnity Insurance Company provides a comprehensive range of coverage options, including auto, home, renters, business, boat, and motorcycle insurance plans. These offerings cater to various needs, ensuring customers can safeguard their assets with tailored insurance solutions.

How can I qualify for discounts offered by Peerless Indemnity Insurance Company?

To qualify for discounts, customers have multiple avenues: bundling policies (such as auto and home insurance), maintaining a clean driving record, being a homeowner, and meeting specific eligibility criteria. These factors contribute to reduced rates and cost-saving benefits.

Does Peerless Indemnity Insurance Company have a smooth claims process?

Yes, Peerless Indemnity Insurance Company is recognized for its efficient and customer-centric claims process. With a dedicated claims department staffed by experienced professionals, the company ensures prompt and fair settlements, regardless of the scale of the claim, fostering a hassle-free experience for policyholders.

Are the insurance policies offered by Peerless Indemnity Insurance Company affordable?

Yes, Peerless Indemnity Insurance Company is known for its competitive pricing and affordable insurance policies. They understand the importance of balancing cost and coverage, and they work diligently to provide their customers with cost-effective options that meet their specific needs and budget.

Is Peerless Indemnity Insurance Company financially stable?

Yes, Peerless Indemnity Insurance Company is renowned for its efficient and customer-centric claims process. They have a dedicated claims department staffed with experienced professionals who are committed to providing prompt and fair claims settlements. Whether it’s a minor incident or a significant loss, Peerless Indemnity works diligently to ensure a smooth and hassle-free claims experience for their policyholders.

Is Peerless Indemnity Insurance Company financially stable?

Absolutely. Peerless Indemnity Insurance Company boasts a strong financial foundation and a track record of stability. This stability is reflected in high ratings from independent agencies, assuring customers of the company’s ability to fulfill its obligations and provide reliable coverage when needed.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.