Pekin Life Insurance Company Review (2026)

Discover Pekin Life Insurance Company's diverse coverage options and stellar reputation in our in-depth review, making it a reliable choice for those seeking personalized insurance solutions.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive article, we explore the offerings of Pekin Life Insurance Company, a trusted name in the insurance industry. Pekin provides a diverse range of coverage options, including term life, whole life, universal life, final expense, and annuities, catering to a wide array of insurance needs.

The company’s strong financial stability, flexible premium options, and the potential for cash value accumulation in certain policies make it an attractive choice for individuals seeking reliable protection and financial growth. With a low complaint level and positive customer testimonials, Pekin’s commitment to customer satisfaction and personalized service shines through.

This article provides a detailed overview of Pekin’s insurance options, highlighting its pros and cons, as well as insight into discounts, competitors, and frequently asked questions for those considering their insurance needs.

Pekin Insurance Coverage Options

Pekin Life Insurance Company stands out for its commitment to providing a wide-ranging suite of insurance solutions that cater to diverse needs. Here, we delve into their comprehensive coverage options, offering a detailed exploration of the various plans and benefits they offer.

Term Life Insurance

- This option provides coverage for a specified term, such as 10, 20, or 30 years.

- It is an excellent choice for individuals who need protection during critical periods, such as raising children or paying off a mortgage.

- If the policyholder passes away during the term, the beneficiaries receive the death benefit.

Whole Life Insurance

- Whole life insurance offers lifelong protection.

- In addition to the death benefit, it also includes a cash value component that grows over time.

- This cash value can be accessed or borrowed against during the policyholder’s lifetime.

- It’s a long-term investment in both insurance coverage and potential financial growth.

Universal Life Insurance

- Universal life insurance provides flexibility in premium payments and potential cash value growth.

- Policyholders can adjust the amount and frequency of premium payments, making it adaptable to changing financial circumstances.

- The policy’s cash value can be invested, potentially leading to greater returns.

- It’s a versatile option for individuals seeking long-term protection with financial flexibility.

Final Expense Insurance

- Final expense insurance, also known as burial or funeral insurance, is designed to cover end-of-life expenses.

- It ensures that loved ones are not burdened with the financial costs associated with a funeral, burial, or cremation.

- Policies typically have lower coverage amounts, making them affordable and accessible.

Annuities

- Annuities are financial products that help secure your retirement.

- Pekin offers various types of annuities, including fixed and indexed annuities.

- These products provide a steady stream of income during retirement, ensuring financial stability in your later years.

With flexible universal life plans and final expense coverage designed to alleviate end-of-life financial concerns, Pekin ensures comprehensive protection. Additionally, their diverse range of annuities secures a stable financial future, making Pekin Life Insurance Company a versatile choice for individuals seeking tailored and enduring insurance solutions.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

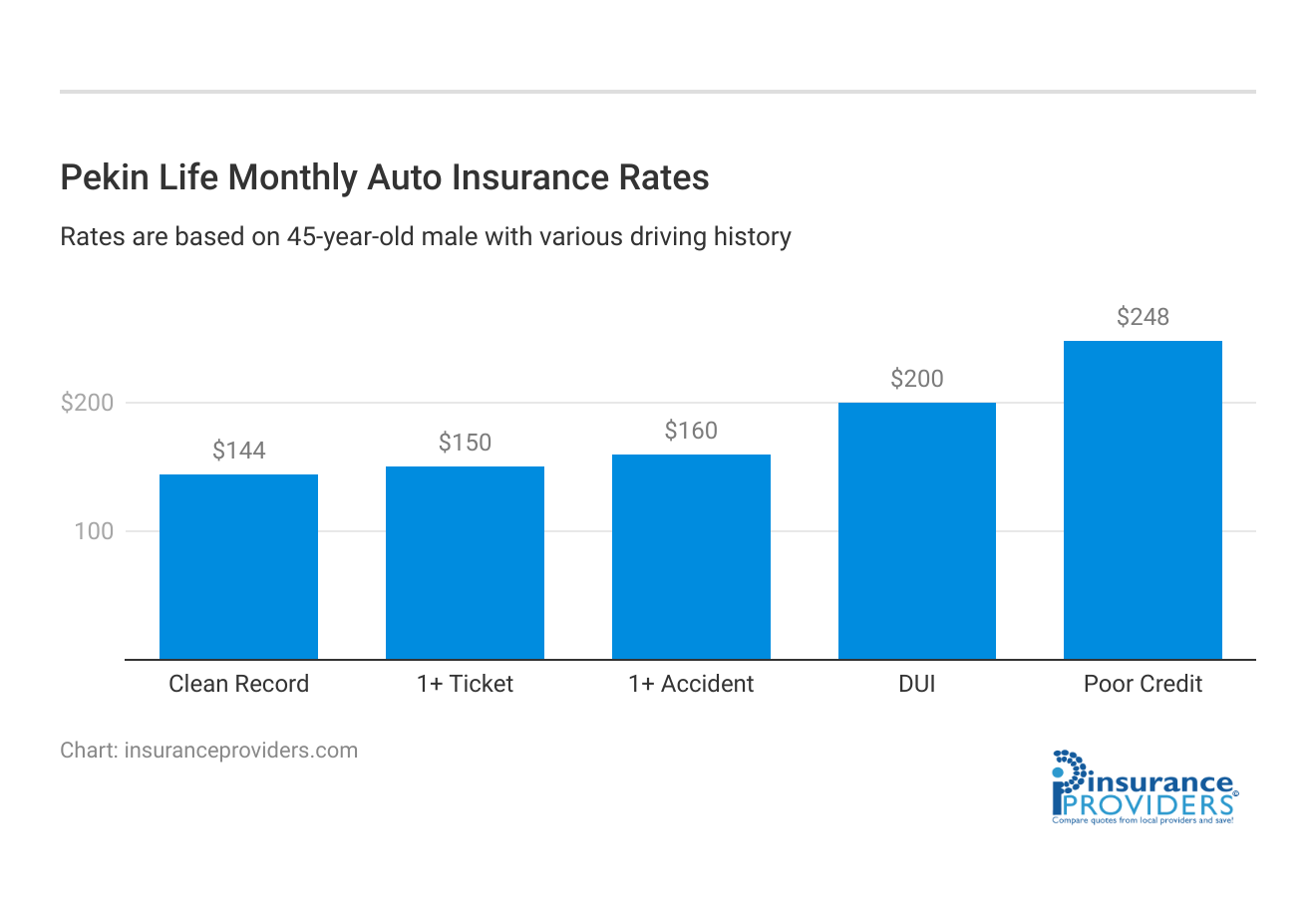

Pekin Insurance Rates Breakdown

| Driver Profile | Pekin Life | National Average |

|---|---|---|

| Clean Record | $144 | $119 |

| 1+ Ticket | $150 | $147 |

| 1+ Accident | $160 | $173 |

| DUI | $200 | $209 |

| Poor Credit | $248 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Pekin Insurance Discounts Available

| Discount | Pekin Life |

|---|---|

| Anti Theft | 12% |

| Good Student | 8% |

| Low Mileage | 7% |

| Paperless | 13% |

| Safe Driver | 25% |

| Senior Driver | 10% |

Pekin Life Insurance Company may offer various discounts to help policyholders save on their insurance premiums. While specific discounts can vary based on location and policy type, here are some common discounts you might find:

- Multi-Policy Discount: If you have multiple insurance policies with Pekin, such as auto and home insurance, you may qualify for a discount on both policies.

- Safe Driver Discount: Policyholders with a clean driving record and no recent accidents or violations may be eligible for lower auto insurance rates.

- Good Student Discount: If you have a student on your policy who maintains good grades in school, you could receive a discount on their auto insurance.

- Safety Features Discount: Vehicles equipped with safety features like anti-lock brakes, airbags, and anti-theft devices may qualify for discounts on auto insurance premiums.

- Pay-in-Full Discount: Paying your insurance premium in a single, annual payment may make you eligible for a discount.

- Paperless Billing Discount: Opting for electronic billing and communication can sometimes lead to lower premiums.

- Senior Citizen Discount: Senior policyholders may be eligible for discounts on certain insurance products.

- Loyalty Discount: Staying with Pekin as a long-term customer may earn you discounts on your policies.

- Good Health Discount: For life insurance policies, maintaining good health and participating in health assessments can lead to lower premiums.

It’s essential to inquire with Pekin Life Insurance Company directly or through their website to understand which discounts apply to your specific situation and policy. These discounts can provide valuable savings, so be sure to take advantage of any that you qualify for.

How Pekin Insurance Ranks Among Providers

Pekin Life Insurance Company operates in a highly competitive insurance industry. Its main competitors are other insurance providers that offer similar types of insurance products and services. Here are some of the company’s main competitors:

- State Farm: State Farm is one of the largest insurance companies in the United States, offering a wide range of insurance products, including auto, home, life, and more. They are known for their extensive network of agents and competitive rates.

- Allstate: Allstate is another major player in the insurance industry, providing coverage for auto, home, life, and various other insurance needs. They are recognized for their advertising campaigns and extensive customer base.

- Geico: Geico is known for its auto insurance offerings and clever marketing campaigns. They often appeal to customers with competitive rates and user-friendly online tools.

- Progressive: Progressive is famous for its innovative approach to auto insurance, offering features like usage-based insurance and a wide range of discounts. They are a strong competitor in the auto insurance market.

- Northwestern Mutual: Northwestern Mutual is a prominent life insurance provider with a focus on financial planning and investment services. They compete with Pekin in the life insurance and annuities sectors.

- Prudential: Prudential is another major player in the life insurance market, offering various life insurance products and investment options. They are known for their financial strength and diverse offerings.

- Farmers Insurance: Farmers Insurance provides a range of insurance products, including auto, home, and life insurance. They have a substantial network of agents and competitive offerings.

- Nationwide: Nationwide offers a broad spectrum of insurance options, including auto, home, and financial services. They compete with Pekin in various insurance sectors.

- Liberty Mutual: Liberty Mutual is known for its auto, home, and renters insurance products. They are recognized for their customized coverage options.

- Aflac: Aflac specializes in supplemental insurance, particularly in the areas of accident, health, and disability coverage. They compete with Pekin in the supplemental insurance sector.

These competitors, along with numerous others, collectively contribute to the rich tapestry within which Pekin Life Insurance Company operates, driving innovation, choice, and customer-centric approaches in the insurance sector.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pekin Life Insurance Company Claims Process

Ease of Filing a Claim

Pekin Life Insurance Company offers multiple convenient options for filing insurance claims. Policyholders can choose to file their claims online through the company’s user-friendly website, over the phone by speaking with a customer service representative, or even through mobile apps for added convenience.

This flexibility in filing methods ensures that policyholders can easily initiate the claims process in a way that suits their preferences and needs.

Average Claim Processing Time

The average claim processing time at Pekin Life Insurance is known for its efficiency. Policyholders can typically expect their claims to be processed in a timely manner, allowing them to receive the necessary financial assistance when they need it most.

Pekin’s commitment to prompt claim processing reflects its dedication to providing reliable service to its customers.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is a crucial aspect of evaluating an insurance company’s performance in handling claims. Pekin Life Insurance has received positive feedback from its policyholders regarding the resolution of claims and the timeliness of payouts.

This feedback highlights the company’s commitment to delivering on its promises and ensuring that policyholders receive the financial support they rely on during challenging times.

Pekin Life Insurance Company’s Digital and Technological Features

Mobile App Features and Functionality

Pekin Life Insurance Company offers a feature-rich mobile app that enhances the overall customer experience. The app provides policyholders with convenient access to their insurance information, allowing them to view policy details, make premium payments, and even initiate claims from the palm of their hand.

The user-friendly interface and robust functionality make managing insurance policies on the go a breeze.

Online Account Management Capabilities

Pekin’s online account management capabilities are designed to empower policyholders with easy access to their accounts. Through the company’s website, policyholders can log in to their accounts to review policy documents, update personal information, and track claims in real-time.

This digital convenience simplifies the process of managing insurance policies and ensures that policyholders have the information they need at their fingertips.

Digital Tools and Resources

In addition to its mobile app and online account management, Pekin Life Insurance provides a range of digital tools and resources to help policyholders make informed decisions about their insurance coverage.

These resources may include calculators to estimate coverage needs, educational articles on various insurance topics, and FAQs to address common inquiries. These digital assets contribute to Pekin’s commitment to customer empowerment and education in the insurance space.

Frequently Asked Questions

What makes Pekin Life Insurance Company stand out in the market?

Pekin’s dedication to customer satisfaction and financial stability sets them apart. They offer diverse insurance options with flexible features.

Can I customize my insurance policy with Pekin?

Pekin allows you to tailor your coverage to fit your unique needs. They offer additional riders for added protection

How do I apply for insurance with Pekin?

Applying is easy. You can start the process by filling up the application form and requirements. Pekin’s agents are there to assist you.

What is the advantage of whole life insurance over term life insurance?

Whole life insurance not only provides lifelong protection but also accumulates cash value over time, making it an investment in addition to coverage.

Are Pekin’s policies affordable for individuals on a budget?

Yes, Pekin offers flexible premium options, making their policies accessible to individuals with varying budgets.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.