Progressive Universal Insurance Company Review (2026)

Progressive Universal Insurance Company, distinguished in the insurance industry, stands out as a top choice with its diverse coverage options, commitment to customization, competitive pricing, and unwavering dedication to customer satisfaction.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive article, we explore Progressive Universal Insurance Company, a trusted name in the insurance industry, offering a diverse range of coverage options, including auto, home, life, business, and health insurance.

With a commitment to customization, competitive pricing, and exceptional customer service, Progressive Universal stands out among its competitors. The company’s policies provide comprehensive protection, with features like 24/7 customer support, fast claims processing, and a variety of discounts to help policyholders save on premiums.

Progressive Universal’s stellar reputation for customer satisfaction and its dedication to addressing individual needs make it a top choice for individuals, families, and businesses seeking reliable insurance coverage.

Read more: Progressive County Mutual Insurance Company: Customer Ratings & Reviews

Progressive Universal Insurance Company Insurance Coverage Options

Progressive Universal Insurance Company is dedicated to providing a wide range of coverage options to meet the diverse needs of its customers. Whether you’re seeking protection for your car, home, life, business, or health, Progressive Universal has you covered. Here are the coverage options offered by the company:

- Auto Insurance: Progressive Universal offers comprehensive auto insurance policies that include liability coverage, collision coverage, and comprehensive coverage. They also provide options for uninsured/underinsured motorist coverage, roadside assistance, and rental car reimbursement.

- Home Insurance: Protect your home and belongings with Progressive Universal’s home insurance. Their policies cover damage to your dwelling, personal property, liability protection, and additional living expenses in case of a covered event like a fire or storm.

- Life Insurance: Progressive Universal offers life insurance policies to provide financial security to your loved ones in the event of your passing. Options include term life insurance and permanent life insurance, with various coverage amounts and customizable features.

- Business Insurance: For businesses, Progressive Universal offers a range of coverage options, including general liability insurance, commercial property insurance, business interruption insurance, workers’ compensation, and more. Tailored solutions are available for businesses of all sizes.

- Health Insurance: Progressive Universal Insurance Company provides health insurance plans that cover medical, dental, and vision expenses. Whether you need individual, family, or group health coverage, they offer plans designed to suit your healthcare needs.

Progressive Universal Insurance Company’s commitment to customization ensures that individuals, families, and businesses can find the protection they need to safeguard their financial well-being.

For specific details and quotes related to these coverage options, it’s advisable to contact Progressive Universal directly or use their online tools for a personalized assessment of your insurance needs.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

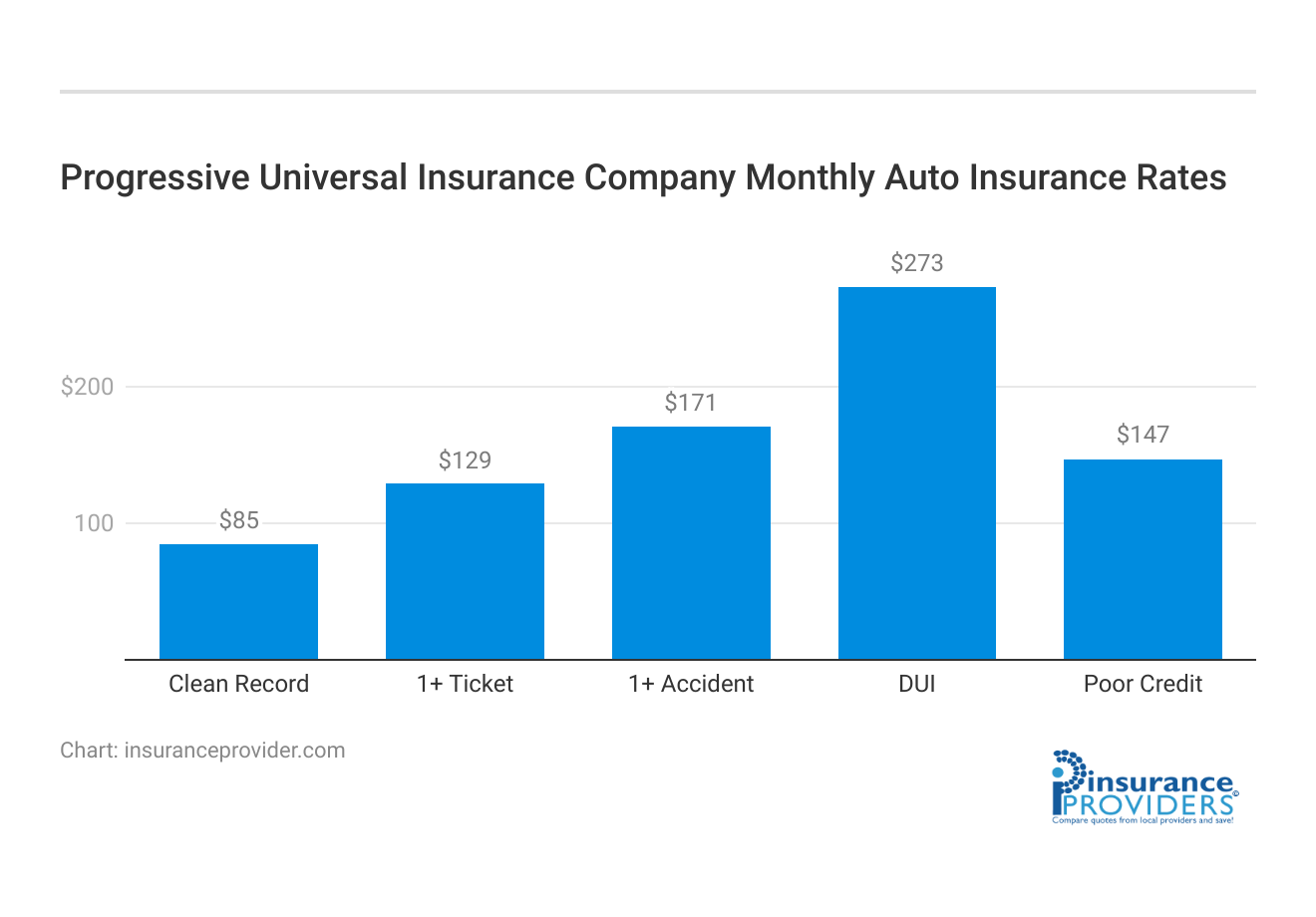

Progressive Universal Insurance Company Insurance Rates Breakdown

| Driver Profile | Progressive Universal Insurance | National Average |

|---|---|---|

| Clean Record | $85 | $119 |

| 1+ Ticket | $129 | $147 |

| 1+ Accident | $171 | $173 |

| DUI | $273 | $209 |

| Poor Credit | $147 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Progressive Universal Insurance Company Discounts Available

| Discounts | Progressive Universal Insurance |

|---|---|

| Anti Theft | 13% |

| Good Student | 18% |

| Low Mileage | 13% |

| Paperless | 9% |

| Safe Driver | 26% |

| Senior Driver | 18% |

Progressive Universal Insurance Company provides various discounts to help policyholders save on their insurance premiums. Here are the discounts offered by the company, presented in a bullet list:

- Multi-Policy Discount: Combine multiple insurance policies with Progressive Universal (e.g., auto and home insurance) to receive a discount on your premiums.

- Safe Driver Discount: If you maintain a good driving record with no accidents or violations, Progressive Universal rewards you with lower insurance rates.

- Home Security Discount: Install home security systems, such as alarms or surveillance cameras, to qualify for reduced home insurance premiums.

- Good Student Discount: Students with good grades often qualify for lower rates on their auto insurance policies. This discount encourages and rewards academic excellence.

- Claim-Free Discount: If you haven’t filed any claims within a specific period, Progressive Universal may offer a discount as a reward for being a responsible policyholder.

- Pay-in-Full Discount: Pay your annual premium in a single lump sum instead of monthly installments to receive a discount on your insurance costs.

- Loyalty Discount: Progressive Universal may offer discounts to long-term customers who renew their policies with the company, rewarding loyalty.

These discounts make Progressive Universal Insurance Company an attractive option for individuals and families looking to save on their insurance expenses while still enjoying comprehensive coverage.

How Progressive Universal Insurance Company Ranks Among Providers

Progressive Universal Insurance Company operates in a highly competitive insurance industry. Its main competitors are established insurance providers that offer similar types of coverage and strive to attract the same customer base. Here are some of Progressive Universal’s main competitors:

- State Farm: State Farm is one of the largest and most well-known insurance companies in the United States. They offer a wide range of insurance products, including auto, home, life, and more. State Farm is known for its extensive agent network and personalized service.

- Geico: Geico is renowned for its humorous advertising campaigns and competitive auto insurance rates. They focus primarily on auto insurance but also offer other coverage types. Geico is known for its user-friendly online interface and 24/7 customer support.

- Allstate: Allstate is another major player in the insurance industry, offering various insurance products, including auto, home, and life insurance. They are known for their strong customer service and extensive network of local agents.

- Progressive: Progressive, while similar in name to Progressive Universal, is a separate insurance company. Progressive is one of the largest auto insurers in the United States and is known for its innovative Snapshot program, which rewards safe drivers with lower premiums.

- Liberty Mutual: Liberty Mutual is a global insurance company offering a wide range of insurance products. They emphasize customization and offer various discounts to policyholders. Liberty Mutual is known for its diverse coverage options.

- Farmers insurance: Farmers insurance provides a range of insurance products, including auto, home, and business insurance. They have a strong local agent presence and offer customizable policies.

- USAA: USAA primarily serves military members and their families, providing auto, home, and other insurance products. They are known for excellent customer service and competitive rates for their target audience.

- Nationwide: Nationwide offers various insurance products and is known for its vanishing deductible program, which reduces deductibles for safe drivers over time. They also have a presence in financial services.

These competitors, along with many others, create a competitive landscape in the insurance industry. Progressive Universal Insurance Company distinguishes itself through its customization options, competitive pricing, and focus on customer satisfaction.

Understanding the strengths and weaknesses of these competitors can help consumers make informed decisions when selecting an insurance provider.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Progressive Universal Insurance Company Claims Process

Ease of Filing a Claim

Progressive Universal Insurance Company offers multiple convenient options for filing insurance claims. Customers can file claims through their online platform, over the phone, or via their mobile app. This flexibility ensures that policyholders can choose the method that suits them best, making the claims process more accessible and user-friendly.

Average Claim Processing Time

One of the key factors that sets Progressive Universal Insurance Company apart is its commitment to fast and efficient claims processing. On average, the company strives to process claims within a few business days, providing policyholders with prompt assistance during stressful situations.

This quick turnaround time enhances the overall customer experience and adds to the company’s reputation for excellent service.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is crucial when evaluating an insurance provider’s performance. Progressive Universal Insurance Company consistently receives positive reviews for its claim resolutions and payout processes. Policyholders often express satisfaction with the company’s responsiveness and fair settlements, further establishing its reputation as a reliable insurer.

Progressive Universal Insurance Company Digital and Technological Advancements

Mobile App Features and Functionality

Progressive Universal Insurance Company offers a feature-rich mobile app that allows customers to manage their insurance policies conveniently. The app provides access to policy information, digital ID cards, and the ability to file claims directly from a mobile device.

Additionally, customers can make payments, view billing statements, and receive important updates through the app, enhancing the overall user experience.

Online Account Management Capabilities

Policyholders can take advantage of robust online account management capabilities offered by Progressive Universal Insurance Company. This includes the ability to review and update policy details, track claims in real time, and access policy documents online.

The online portal is user-friendly and provides a seamless experience for customers to stay informed and in control of their insurance coverage.

Digital Tools and Resources

To further assist customers in making informed decisions and managing their insurance needs, Progressive Universal Insurance Company provides a range of digital tools and resources. These resources include insurance calculators, informative articles, and educational content to help policyholders better understand their coverage options and insurance-related topics.

Frequently Asked Questions

Can I bundle my home and auto insurance with Progressive Universal for additional savings?

Yes, Progressive Universal offers a multi-policy discount, allowing you to bundle your home and auto insurance for significant savings on your premiums.

What types of health insurance plans does Progressive Universal offer?

Progressive Universal provides various health insurance plans, including individual, family, and group coverage, with options for comprehensive medical, dental, and vision insurance.

How quickly can I expect my insurance claim to be processed with Progressive Universal?

Progressive Universal is known for its fast and hassle-free claims processing. In many cases, claims are processed within a few business days, but the exact timeline can vary depending on the nature of the claim.

Does Progressive Universal offer any rewards or loyalty programs for long-term policyholders?

Yes, Progressive Universal values its loyal customers. They may offer loyalty discounts or rewards programs for policyholders who renew their coverage with the company, providing additional incentives for long-term relationships.

How financially stable is Progressive Universal Insurance Company?

Progressive Universal maintains a strong financial foundation, which is reflected in its A.M. Best rating of A+. This rating signifies the company’s ability to meet its financial obligations and provide policyholders with confidence in its stability.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.