Progressive West Insurance Company: Customer Ratings & Reviews [2026]

Progressive West Insurance Company, a subsidiary of the Progressive Corporation, offers a comprehensive range of insurance products, including auto insurance, with an A+ financial strength rating from A.M. Best, ensuring stability and reliability for its customers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life i...

Maria Hanson

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Updated April 2024

Progressive West Insurance is a subsidiary of the Progressive Corporation. The company offers a variety of insurance products, including auto insurance coverage. For more information on Progressive West insurance premiums, how to find affordable Progressive West Insurance Company car insurance coverage, and other topics, keep reading.

Ready to get started on this Progressive West Insurance Company review? First, use your ZIP code to get a free quote on car insurance so you can start comparing rates from companies in your area today.

What You Should Know About progressive insurance

According to A.M. Best, Progressive West Insurance Company, a subsidiary of Progressive Corporation, has a rating of A+, which also indicates a stable and positive financial outlook for the future.

We also looked at the Better Business Bureau (BBB), but in this case, the rating is for Progressive Corporation, rather than Progressive West. Take a look at this table to see a summary of BBB’s review.

Progressive Corporation BBB Rating

| Rating | Accreditation | Customer Complaints |

|---|---|---|

| A+ | Not Accredited | 2,669 complaints close in the past 3 years, 1,040 of those in the past 12 months |

Both A.M. Best ratings of Progressive and Progressive West Insurance Company reviews on the BBB have mostly positive results that are a good sign for insureds looking for a company with solid customer service and financial stability as a company.

The Progressive West Insurance Company NAIC complaint index is 2.74, which is above average.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

progressive insurance Insurance Coverage Options

Progressive West Insurance Company offers a number of coverage types, including:

- Auto insurance

- Home insurance

- Property insurance

- Health insurance

- Casualty insurance

You can work directly with Progressive West Insurance agents to obtain coverage in any of these areas. Progressive West Insurance Company motorcycle insurance may be available in some areas.

How to Make a Progressive West Insurance Company Claim

To file Progressive West Insurance Company claims, you can go through the Progressive website, call the Progressive Insurance phone number at 1-800-776-4737, or reach out directly to your agent. You should be able to use your Progressive West Insurance Company login to access your claim.

The Bottom Line for Progressive West Insurance Company

Progressive West Insurance Company is a subsidiary of The Progressive Corporation. Coverage from Progressive West is available across the United States and includes Auto, Home, Property, Health, and Casualty coverage. Progressive West Insurance Company payment options are similar to those offered by the parent company, and you can buy Progressive West Insurance Company car insurance online.

The best way to find out if your Progressive West quote is fair is to shop around and get quotes from at least three companies to compare rates. If you need to retrieve your Progressive quote, all you need to do is go online to visit Progressive, enter your quote number, and you’ll see your quote.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

progressive insurance Insurance Rates Breakdown

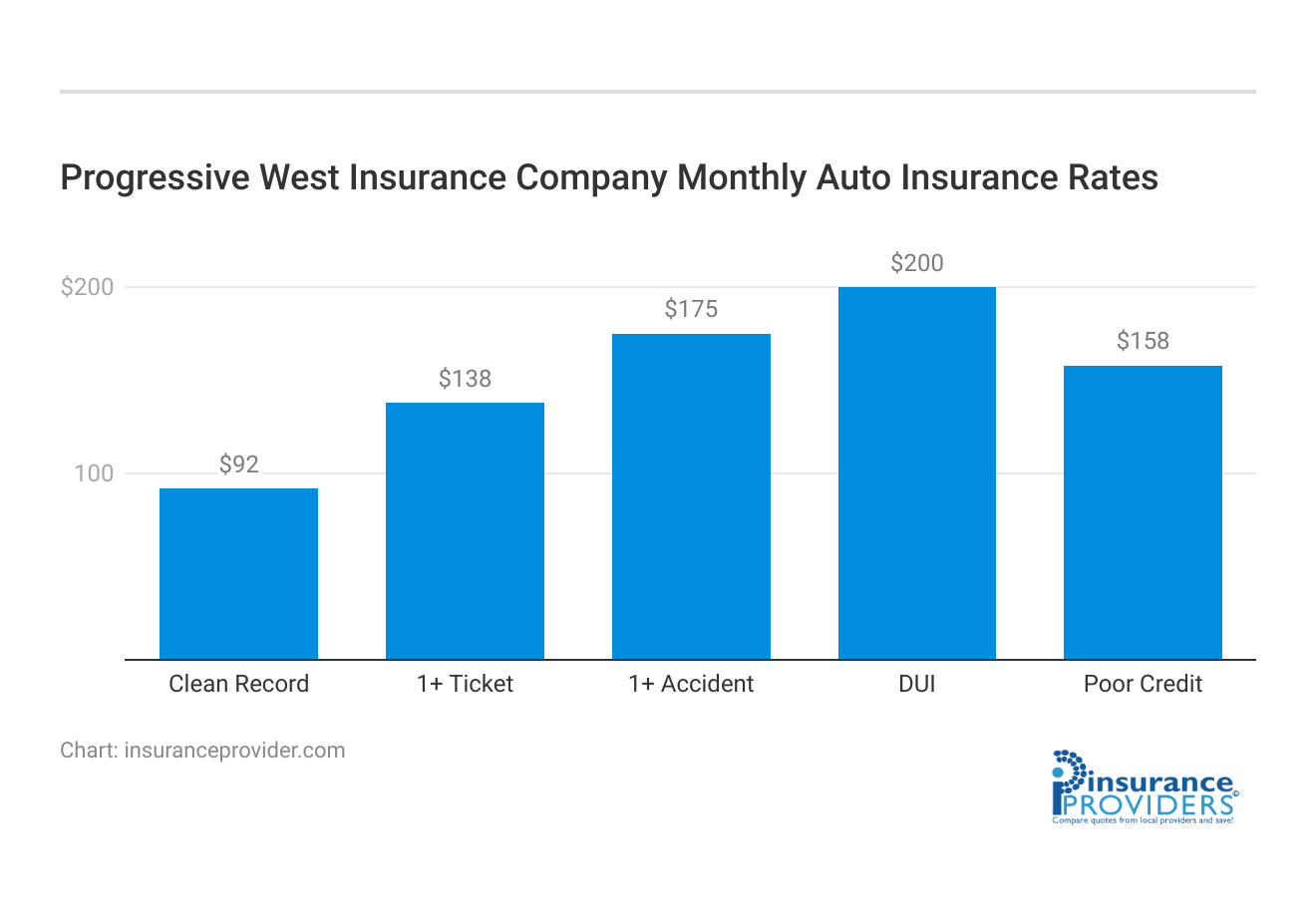

| Driver Profile | Progressive West Insurance | National Average |

|---|---|---|

| Clean Record | $92 | $119 |

| 1+ Ticket | $138 | $147 |

| 1+ Accident | $175 | $173 |

| DUI | $200 | $209 |

| Poor Credit | $158 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

To get a specific quote from Progressive West Insurance, you can go directly to their website, or you can use the Progressive quote phone number at 1-855-347-3939. We don’t have rates for Progressive West Insurance, but we do have rates for Progressive, which may be able to give you an idea of what you could pay if you purchase coverage from Progressive West. Take a look at this table to see annual rates for auto insurance throughout the country.

Monthly Progressive Insurance Rates by State

| State | Monthly Average Progressive Premium |

|---|---|

| Alaska | $255 |

| Alabama | $371 |

| Arkansas | $443 |

| Arizona | $298 |

| California | $237 |

| Colorado | $353 |

| Connecticut | $410 |

| District of Columbia | $414 |

| Delaware | $348 |

| Florida | $465 |

| Georgia | $375 |

| Hawaii | $182 |

| Iowa | $200 |

| Idaho | Data Not Available |

| Illinois | $295 |

| Indiana | $325 |

| Kansas | $345 |

| Kentucky | $462 |

| Louisiana | $622 |

| Maine | $304 |

| Maryland | $341 |

| Massachusetts | $320 |

| Michigan | $447 |

| Minnesota | Data Not Available |

| Missouri | $285 |

| Mississippi | $359 |

| Montana | $361 |

| North Carolina | $199 |

| North Dakota | $302 |

| Nebraska | $313 |

| New Hampshire | $225 |

| New Jersey | $331 |

| New Mexico | $260 |

| Nevada | $339 |

| New York | $314 |

| Ohio | $286 |

| Oklahoma | $403 |

| Oregon | $302 |

| Pennsylvania | $371 |

| Rhode Island | $436 |

| South Carolina | $381 |

| South Dakota | $313 |

| Tennessee | $305 |

| Texas | $389 |

| Utah | $319 |

| Virginia | $208 |

| Vermont | $435 |

| Washington | $267 |

| West Virginia | Data Not Available |

| Wisconsin | $261 |

| Wyoming | $367 |

Rates vary by state, but keep in mind not only are these rates average, meaning your exact rates will vary based on a number of personal factors, but these are also rates for Progressive, rather than for Progressive West, so these are just a baseline. Progressive West Insurance Company car insurance quotes may be different.

Where is Progressive West Insurance Company available?

Can you find Progressive West Insurance Company in California? The answer is yes, as the company’s products are available throughout most of the United States.

The Progressive West Insurance Company address in Cleveland, OH is found at the top of this page.

progressive insurance Discounts Available

| Discounts | Progressive West Insurance |

|---|---|

| Anti Theft | 14% |

| Good Student | 19% |

| Low Mileage | 16% |

| Paperless | 11% |

| Safe Driver | 29% |

| Senior Driver | 14% |

Progressive West Insurance Company understands the importance of providing affordable insurance options for its customers. To make coverage more accessible and cost-effective, they offer a variety of discounts. Here’s a breakdown of the discounts available:

- Multi-Policy Discount: Combine multiple insurance policies with Progressive West to enjoy a discount on your overall premium.

- Safe Driver Discount: Maintain a clean driving record, and Progressive West rewards you with a discount for safe driving habits.

- Good Student Discount: Students with excellent academic performance may qualify for a discount on their insurance premiums.

- Multi-Car Discount: Insure more than one vehicle with Progressive West to benefit from a discounted rate.

- Home and Auto Bundle Discount: Bundle your home and auto insurance policies with Progressive West for additional savings.

- Anti-Theft Device Discount: Equip your vehicle with anti-theft devices to qualify for a discount on your auto insurance.

- Paperless Billing Discount: Opt for paperless billing and receive a discount on your insurance premiums.

- Pay-in-Full Discount: Pay your annual premium in full to enjoy a discount on your insurance coverage.

- Defensive Driving Course Discount: Successfully completing a defensive driving course may make you eligible for a discount.

- Loyalty Discount: Stay with Progressive West over an extended period, and you could qualify for a loyalty discount.

- Good Credit Discount: Maintain a good credit score, and Progressive West may offer a discount on your insurance rates.

It’s essential to discuss these discounts with a Progressive West representative to ensure you take advantage of all the opportunities to save on your insurance premiums. Keep in mind that eligibility criteria for discounts may vary, so inquire about the specific requirements for each discount when customizing your insurance policy.

How progressive insurance Ranks Among Providers

In the competitive landscape of the insurance industry, Progressive West faces competition from several prominent players. Understanding the strengths and offerings of its main competitors provides valuable insights into the choices available to consumers. Here are some of Progressive West’s key competitors:

- Geico: Geico, known for its catchy advertising and competitive rates, is a major competitor for Progressive West. They offer a variety of insurance products, emphasizing simplicity and online efficiency.

- State Farm: State Farm, with a vast network of agents and a long-standing reputation, competes with Progressive West in various insurance categories. They are known for their personalized service and comprehensive coverage options.

- Allstate: Allstate is another formidable competitor, offering a range of insurance products and emphasizing features like accident forgiveness. Their strong brand presence and nationwide reach make them a contender in the industry.

- Liberty Mutual: Liberty Mutual competes with Progressive West, especially in the auto and home insurance sectors. They focus on customizable coverage and offer various discounts, appealing to a diverse customer base.

- Nationwide: Nationwide is known for its diverse insurance portfolio, including auto, home, and pet insurance. Their emphasis on customer-centric solutions and a wide range of coverage options positions them as a competitor.

- Farmers Insurance: Farmers Insurance competes in the market with a focus on personalized service and a wide array of insurance products. They have a strong agent network, catering to customers seeking face-to-face interactions.

- USAA: While primarily serving military members and their families, USAA competes with Progressive West in offering insurance solutions. Their commitment to service members and veterans is a unique selling point.

Each of these competitors brings its own strengths, unique features, and customer-focused strategies to the table. Progressive West distinguishes itself through a blend of comprehensive coverage, competitive rates, and a user-friendly experience. Understanding the competitive landscape helps consumers make informed decisions based on their specific needs and preferences.

Frequently Asked Questions

What is Progressive West Insurance Company?

Progressive West Insurance Company, a notable subsidiary of the renowned Progressive Corporation, stands as a prominent player in the insurance industry. This esteemed entity specializes in a diverse range of insurance offerings, encompassing auto insurance, homeowners insurance, and boat insurance, among others. With an unwavering commitment to customer satisfaction and financial protection, Progressive West Insurance Company remains steadfast in its pursuit of providing comprehensive coverage and peace of mind to individuals and families alike.

What is the A.M. Best rating for Progressive West Insurance Company?

Progressive West Insurance Company, a reputable and forward-thinking insurance provider, boasts an impressive A+ financial strength rating bestowed upon it by the esteemed institution A.M. Best. This prestigious rating serves as a testament to the company’s unwavering stability and offers a promising glimpse into its prosperous financial trajectory. With this commendable recognition, Progressive West Insurance Company confidently positions itself as a reliable and trustworthy entity, assuring its valued customers of a secure and thriving future.

What is the complaint level for Progressive West Insurance Company?

The National Association of Insurance Commissioners (NAIC) complaint index for Progressive West Insurance Company is 2.74, which is higher than the average rating provided by NAIC for similar companies operating in the insurance industry.

How can I get a quote from Progressive West Insurance Company?

You have two convenient options for obtaining a quote from Progressive West Insurance Company: Firstly, you can effortlessly access a quote directly from their user-friendly website. Alternatively, you may choose to acquire a quote by dialing the Progressive quote phone number, which is 1-855-347-3939.

What types of insurance coverage does Progressive West Insurance Company offer?

Progressive West Insurance Company, a renowned insurance provider, proudly presents a comprehensive range of insurance coverage options meticulously designed to safeguard your interests. With an unwavering commitment to protecting what matters most to you, our offerings span multiple domains, comprising auto insurance, home insurance, property insurance, health insurance, and casualty insurance. Tailored to address your distinct needs, our diverse portfolio ensures that you receive the utmost protection and peace of mind. Experience the confidence that comes with Progressive West Insurance Company—your trusted partner in safeguarding your future.

How can I file a claim with Progressive West Insurance Company?

To initiate a claim with Progressive West Insurance Company, you have three convenient options available. Firstly, you can visit their user-friendly website and file a claim electronically. Alternatively, you may choose to reach out to them by dialing the Progressive Insurance phone number at 1-800-776-4737, where their dedicated representatives will guide you through the process. Lastly, another viable route is to get in touch with your trusted agent who can assist you in initiating the claim.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.