Provident Life And Casualty Insurance Company Review (2026)

Explore Provident Life And Casualty Insurance Company's formidable insurance portfolio and unwavering commitment to customer-centric service, establishing it as the preferred choice for those seeking reliable coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

This article provides an in-depth exploration of Provident Life And Casualty Insurance Company, shedding light on its diverse insurance offerings and distinguishing features. Beginning with an engaging introduction, the article highlights the types of insurance provided by Provident, including health, life, auto, and home insurance.

It delves into the company’s commitment to excellence, emphasizing personalized service, financial stability, and quick claims processing. The informative content is structured with clarity, offering readers insights into why Provident stands out in the insurance industry.

From the array of coverage options to the advantages of choosing Provident, this article serves as a comprehensive guide for those seeking reliable and comprehensive insurance coverage.

What You Should Know About Provident Life And Casualty Insurance Company

Rates: The rating reflects the competitiveness and fairness of Provident’s premium rates compared to industry standards. A higher rating suggests favorable pricing, considering the range of coverage options offered.

Discounts: The rating indicates the effectiveness and generosity of Provident’s discount programs, providing insights into the potential for policyholders to maximize savings.

Complaints/Customer Satisfaction: The rating reflects the level of customer satisfaction and the resolution of complaints, offering valuable insights into the company’s commitment to addressing customer concerns and providing a positive experience.

Claims Handling: The rating provides an overview of how well Provident manages the claims process, highlighting factors such as speed, transparency, and overall customer satisfaction during the claims resolution process.

Read more:

- Provident American Life & Health Insurance Company: Customer Ratings & Reviews

- Provident American Life and Health Insurance Company Review

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Provident Life And Casualty Insurance Company Insurance Coverage Options

In this comprehensive guide, we explore the wide array of insurance coverage options offered by Provident. Whether you’re looking to protect your health, secure your loved ones’ financial future, or safeguard your assets, Provident’s diverse range of insurance solutions has you covered. Here’s a general list of coverage options:

- Auto Insurance: Coverage for personal and commercial vehicles, including liability, collision, and comprehensive coverage.

- Home Insurance: Protection for homeowners and renters, encompassing dwelling coverage, personal property coverage, and liability coverage.

- Life Insurance: Policies such as term life, whole life, and universal life to provide financial security for your loved ones.

- Health Insurance: Health plans for individuals and families, often including medical, dental, and vision coverage.

- Business Insurance: Coverage for businesses, including property insurance, liability insurance, and workers’ compensation.

- Disability Insurance: Provides income protection in case of a disability preventing you from working.

- Umbrella Insurance: Extra liability coverage that goes beyond the limits of your primary policies.

- Specialty Insurance: Tailored policies for specific needs, such as pet insurance, travel insurance, and more.

With a comprehensive portfolio of insurance coverage options, they provide the flexibility and protection you need in an ever-changing world. From health and life insurance to auto and home coverage, Provident’s commitment to excellence shines through in every policy.

Provident Life And Casualty Insurance Company Insurance Rates Breakdown

| Driver Profile | Provident Life And Casualty Insurance | National Average |

|---|---|---|

| Clean Record | $92 | $119 |

| 1+ Ticket | $129 | $147 |

| 1+ Accident | $175 | $173 |

| DUI | $242 | $209 |

| Poor Credit | $158 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Provident Life And Casualty Insurance Company Discounts Available

| Discounts | Provident Life And Casualty Insurance |

|---|---|

| Anti Theft | 17% |

| Good Student | 19% |

| Low Mileage | 17% |

| Paperless | 9% |

| Safe Driver | 30% |

| Senior Driver | 17% |

Let’s unveil the array of discounts available through Provident, helping you discover how to maximize your savings while enjoying top-notch insurance protection. From safe driver incentives to multi-policy discounts, Provident offers a variety of ways to make your insurance more affordable. Here are some common types of discounts that many insurance companies offer:

- Multi-Policy Discount: Save by bundling multiple insurance policies, such as auto and home insurance.

- Safe Driver Discount: Lower rates for drivers with a clean driving record and no recent accidents.

- Good Student Discount: Discounts for students who maintain a certain GPA.

- Anti-Theft Discount: Reduced rates for vehicles equipped with anti-theft devices.

- Home Safety Features Discount: Savings for homes with security systems, smoke detectors, or fire alarms.

- Defensive Driving Course Discount: Discounts for completing an approved defensive driving course.

- Loyalty Discount: Rewards for long-term policyholders who renew with the same company.

- Pay-in-Full Discount: Savings for paying the annual premium in a single payment.

- Usage-Based Discount: Lower rates for drivers who use telematics or tracking devices.

- Military or Employee Discounts: Special discounts for military personnel or employees of specific organizations.

Provident Life And Casualty Insurance Company goes the extra mile to provide policyholders with cost-effective insurance solutions. By offering a diverse range of discounts, they make it easier for you to protect what matters most without breaking the bank.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Provident Life And Casualty Insurance Company Ranks Among Providers

Provident Life And Casualty Insurance Company faces competition from various insurance providers in the industry. Here are some insurance companies that could be considered among Provident’s main competitors:

- State Farm: State Farm is one of the largest and most well-known insurance companies in the United States. They offer a wide range of insurance products, including auto, home, and life insurance, often competing with Provident in these segments.

- Allstate: Allstate is another major insurance provider with a comprehensive portfolio, including auto, home, and life insurance. They compete with Provident in various insurance categories.

- Geico: Known for its competitive auto insurance rates and widespread advertising, Geico often competes with Provident in the auto insurance sector.

- Progressive: Progressive is a prominent auto insurance provider known for its innovative policies and competitive pricing, making it a competitor in the auto insurance market.

- Nationwide: Nationwide offers various insurance products, including auto, home, and pet insurance. They compete with Provident, particularly in the property and casualty insurance space.

- Liberty Mutual: Liberty Mutual is another major player offering auto, home, and life insurance. They may compete with Provident in these insurance categories.

- Farmers Insurance: Farmers Insurance provides a range of insurance options, including auto, home, and business insurance. They can be a competitor for Provident in these areas.

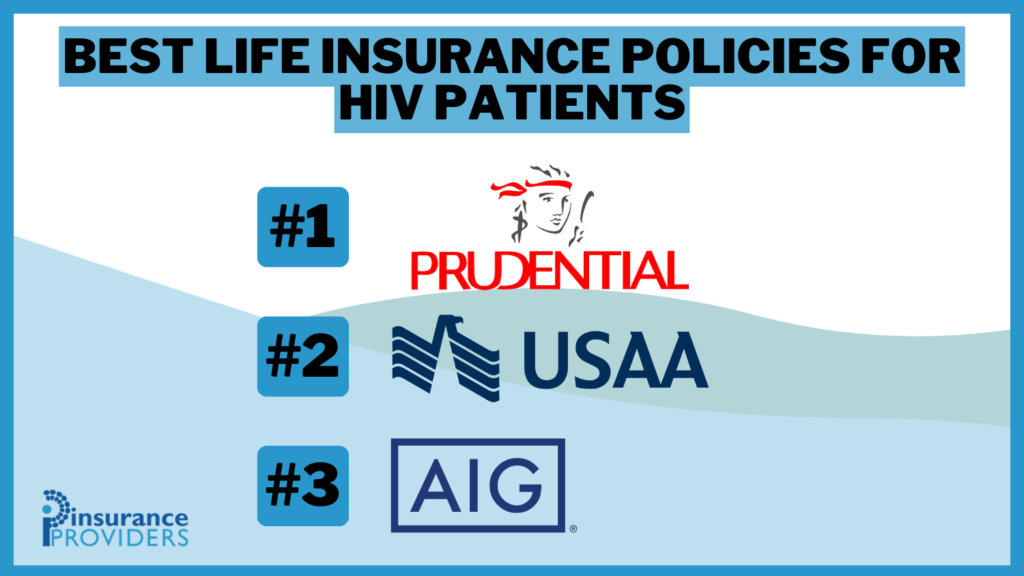

- USAA: USAA primarily serves military members and their families, offering auto, home, and life insurance. While their target market is specific, they could be considered a competitor in certain segments.

- Chubb: Chubb is known for providing high-end insurance solutions, including specialty coverage, which can overlap with Provident’s offerings in specific areas.

- The Hartford: The Hartford focuses on insurance for older adults and AARP members, offering auto, home, and life insurance. They may compete with Provident in these segments.

The competitive landscape can vary significantly by region, the specific insurance products offered, and the target customer base. Additionally, industry dynamics may have changed since my last update, so it’s advisable to conduct up-to-date research to determine Provident’s main competitors in the present day.

Claims Process for Provident Life And Casualty Insurance Company

Ease of Filing a Claim

When it comes to the claims process, Provident Life And Casualty Insurance Company strives to offer convenience and accessibility to its policyholders. The company understands that filing a claim can be a stressful experience, and they have taken steps to simplify the process. Policyholders have multiple options for filing claims.

Average Claim Processing Time

One of the key factors that policyholders consider when choosing an insurance provider is the speed at which claims are processed. Provident Life And Casualty Insurance Company has a track record of efficient claim processing.

While the exact processing time can vary depending on the nature and complexity of the claim, Provident is committed to minimizing delays and ensuring that policyholders receive prompt attention.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is a valuable indicator of an insurance company’s performance in handling claims. Provident Life And Casualty Insurance Company places a strong emphasis on customer satisfaction, and this is reflected in the feedback from policyholders regarding claim resolutions and payouts.

The company strives to ensure that claims are settled fairly and promptly, and customer reviews often highlight the positive experiences they have had with Provident’s claims department.

Provident Life And Casualty Insurance Company’s Digital and Technological Features

Mobile App Features and Functionality

In today’s digital age, insurance companies are expected to offer robust mobile app experiences. Provident Life And Casualty Insurance Company is no exception. Their mobile app provides a range of features and functionality designed to make managing insurance policies and claims easier for policyholders.

Online Account Management Capabilities

In addition to the mobile app, Provident Life And Casualty Insurance Company offers robust online account management capabilities through their website. Policyholders can create and access their online accounts to perform various tasks, such as:

Digital Tools and Resources

Provident understands that informed policyholders are better equipped to make decisions about their insurance coverage. To that end, they provide a range of digital tools and resources to assist policyholders in understanding their options and making informed choices. These resources may include:

By offering these digital and technological features, Provident Life And Casualty Insurance Company aims to empower its policyholders with the tools and resources they need to manage their insurance effectively and make well-informed decisions.

Frequently Asked Questions

What types of insurance does Provident Life And Casualty Insurance Company offer?

Provident Life And Casualty Insurance Company provides a diverse range of insurance solutions, including health, life, auto, and home insurance.

How does Provident stand out in the insurance industry?

Provident distinguishes itself through its commitment to excellence, emphasizing personalized service, financial stability, and efficient claims processing.

What coverage options are available through Provident’s insurance solutions?

Provident offers a comprehensive portfolio of coverage options, ensuring flexibility and protection in areas such as health, life, auto, and home insurance.

How does Provident Life And Casualty Insurance Company handle claims processing?

Provident prioritizes a convenient and accessible claims process, aiming for efficient claim resolution and prompt attention to policyholders’ needs.

What digital features does Provident provide to enhance the policyholder experience?

Provident offers a robust mobile app, online account management capabilities, and digital tools and resources, empowering policyholders with the tools they need to manage their insurance effectively.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.