Repwest Insurance Company Review (2026)

Unlock the legacy of stellar customer service and diverse coverage options, Repwest Insurance Company, stands as a towering presence in the insurance industry, ensuring peace of mind through transparent claims processes as your trusted partner.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive article, we explore Repwest Insurance Company, a trusted name in the insurance industry. Repwest offers a diverse range of coverage options, including auto, property, specialty, commercial, and workers’ compensation insurance.

With a strong A.M. Best rating of “A+ (Superior)” and a low complaint level, Repwest demonstrates its commitment to exceptional customer service and transparent claims processes. The company’s pros include its wide array of insurance solutions, transparent claims handling, and discounts for safe drivers and policy bundling.

While the article highlights the company’s strengths, it also emphasizes the importance of obtaining personalized quotes to determine specific coverage details and pricing. Repwest’s dedication to safeguarding what matters most to individuals and businesses makes it a reliable choice in the insurance landscape.

What You Should Know About Repwest Insurance Company

Rates: Repwest Insurance Company determines rates based on various factors, including the type of coverage, the insured’s driving record, location, and the chosen deductibles. Rates are competitive and reflect the company’s commitment to providing affordable coverage options.

Discounts: Repwest offers a variety of discounts to help policyholders save on their insurance premiums. These discounts may include safe driver discounts, multi-policy discounts for bundling different types of coverage, and other incentives aimed at making insurance more accessible.

Complaints/Customer Satisfaction: The company’s commitment to customer satisfaction is reflected in its low complaint level. Repwest places a strong emphasis on responsive customer service, addressing queries promptly, and resolving concerns efficiently.

Claims Handling: Repwest Insurance Company employs a streamlined and user-friendly claims process, offering multiple channels for filing claims, including online, by phone, and through a mobile app. The company’s commitment to efficient claim processing is evident in its efforts to minimize the time it takes to resolve claims.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Repwest Insurance Company Insurance Coverage Options

We’ll delve into the various coverage options provided by Repwest, ensuring you have the information you need to make informed decisions about safeguarding your assets and well-being. Here are the coverage options offered by Repwest Insurance Company as discussed in the article, presented in a bullet list:

- Auto Insurance: Repwest provides comprehensive auto insurance coverage, including options for liability coverage, collision coverage, and comprehensive coverage. This coverage helps protect you and your vehicle in the event of accidents, damage, or theft.

- Property Insurance: Repwest offers property insurance solutions, which may include coverage for homeowners, renters, and property owners. This coverage safeguards your home and personal belongings, providing peace of mind.

- Specialty Insurance: Repwest specializes in offering insurance for unique and specialty items. This may include coverage for classic cars, recreational vehicles, and other special assets. These tailored policies ensure that your specific needs are met.

- Commercial Insurance: Business owners can benefit from Repwest’s commercial insurance options. This coverage encompasses various aspects of business protection, such as liability coverage and business property insurance, ensuring the stability of your enterprise.

- Workers’ Compensation Insurance: Repwest understands the importance of protecting employees. Their workers’ compensation insurance policies provide coverage in the event of workplace injuries, benefiting both employers and workers.

Repwest Insurance Company stands as a reliable partner in your journey to secure the future. With a focus on offering diverse coverage options, transparent claims processes, and a commitment to customer service, we aim to provide peace of mind for individuals and businesses alike.

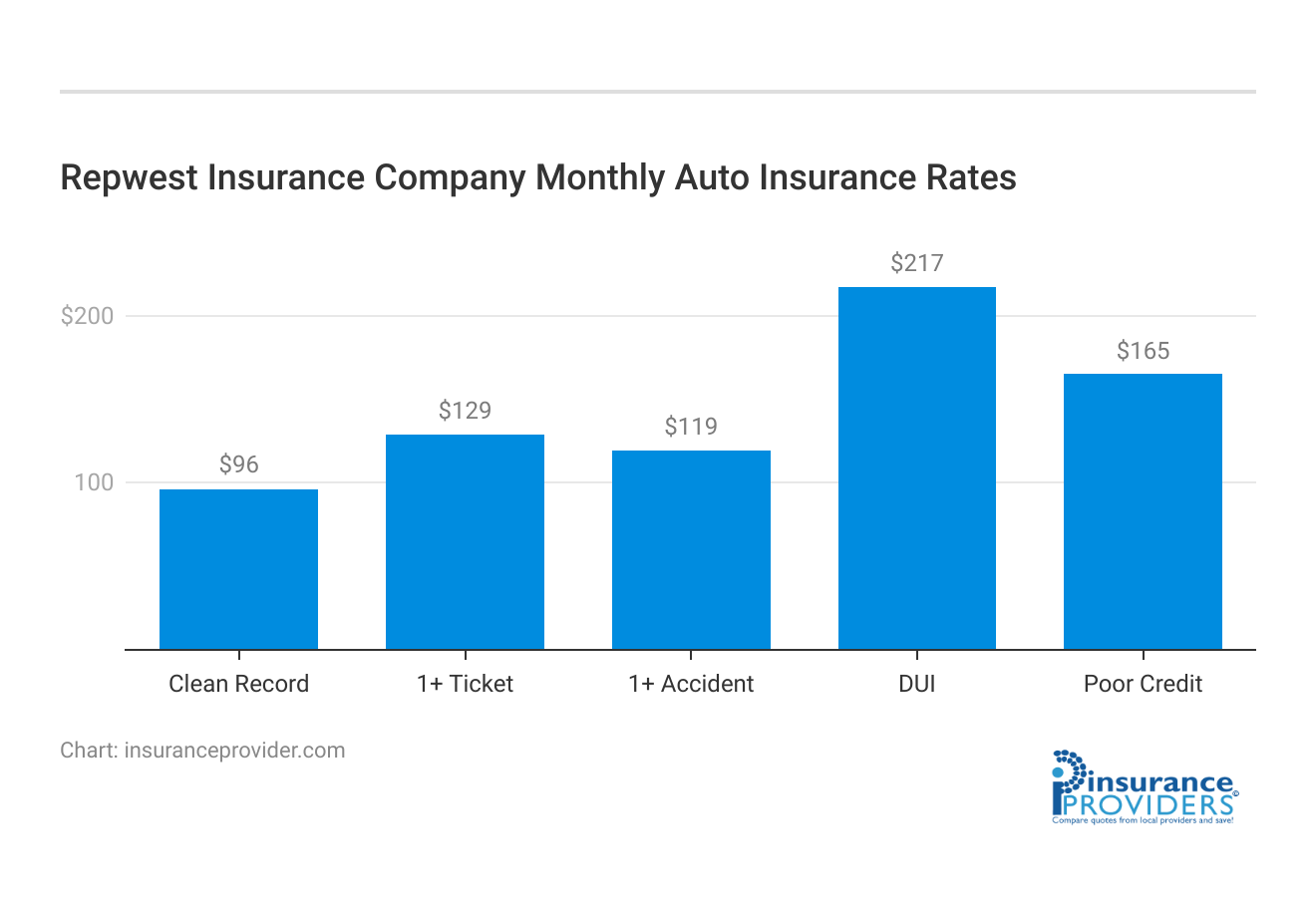

Repwest Insurance Company Insurance Rates Breakdown

| Driver Profile | Repwest Insurance | National Average |

|---|---|---|

| Clean Record | $96 | $119 |

| 1+ Ticket | $129 | $147 |

| 1+ Accident | $119 | $173 |

| DUI | $217 | $209 |

| Poor Credit | $165 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Repwest Insurance Company Discounts Available

| Discounts | Repwest Insurance |

|---|---|

| Anti Theft | 13% |

| Good Student | 15% |

| Low Mileage | 10% |

| Paperless | 8% |

| Safe Driver | 18% |

| Senior Driver | 10% |

Let’s unveil the array of discounts available to help you save while securing the protection you need. Repwest understands the importance of affordability without compromising on quality coverage. Here are some potential discounts that Repwest may offer:

- Safe Driver Discount: Policyholders with a clean driving record may qualify for lower premiums, rewarding safe driving habits.

- Multi-Policy Discount: Repwest may offer discounts to customers who bundle multiple insurance policies, such as auto and home insurance, with them.

- Good Student Discount: Students with good grades often qualify for discounts on their auto insurance premiums.

- Anti-Theft Device Discount: If your vehicle is equipped with approved anti-theft devices, you may be eligible for a discount on your comprehensive coverage.

- Defensive Driving Course Discount: Completing an approved defensive driving course can sometimes lead to lower insurance rates.

- Payment Discounts: Repwest may offer discounts to customers who choose to pay their premiums annually or via electronic funds transfer (EFT).

- Loyalty Discount: Customers who have been with Repwest for an extended period may receive loyalty discounts.

- Safe Vehicle Discount: If your vehicle has safety features like airbags, anti-lock brakes, or electronic stability control, you may qualify for additional savings.

- Low Mileage Discount: Policyholders who drive fewer miles each year may be eligible for lower rates.

- Good Credit Discount: Some insurers offer discounts to customers with excellent credit scores.

Repwest Insurance Company not only prioritizes your peace of mind but also your wallet. Our extensive range of discounts ensures that you can protect what matters most without breaking the bank.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Repwest Insurance Company Ranks Among Providers

Navigating the vast landscape of insurance providers can be a daunting task. That’s why we’re here to shed light on where Repwest Insurance Company stands among its peers. With a focus on transparency, reliability, and customer satisfaction, Repwest has carved out a distinct place in the insurance industry. Here are some categories of competitors that Repwest may face:

- Major National Insurance Carriers: Large, well-known insurance companies like State Farm, Allstate, Geico, Progressive, and Nationwide often compete in multiple insurance segments, including auto, home, and commercial insurance. These companies have a significant market presence and a wide range of coverage options.

- Regional Insurance Companies: Depending on Repwest’s geographic focus, it may compete with regional insurance carriers that have a strong presence in specific states or regions. These regional insurers may offer more localized services and tailored coverage.

- Specialty Insurance Providers: In the specialty insurance market, Repwest might face competition from companies that specialize in specific types of coverage, such as classic car insurance, RV insurance, or workers’ compensation insurance. These niche insurers may have expertise in unique policy offerings.

- Online Insurance Startups: A growing number of digital-first insurance startups have emerged in recent years. These companies leverage technology to provide convenient, often lower-cost insurance options. Some examples include Lemonade and Root Insurance.

- Mutual Insurance Companies: Mutual insurance companies, like USAA or Amica Mutual, are owned by their policyholders and often have a reputation for strong customer service and competitive rates.

- Insurance Brokers and Agents: Independent insurance agents and brokers can also be competitors, as they offer a variety of insurance products from different carriers, including those that compete with Repwest.

- Captives and Self-Insured Entities: Certain businesses and organizations choose to self-insure or form captive insurance companies to manage their risk. While not traditional competitors, they may influence the insurance market in specific sectors.

- Reinsurance Companies: While not direct competitors, reinsurance companies play a vital role in the insurance industry by providing risk management services to primary insurers like Repwest.

Repwest Insurance Company is not just another name in the insurance arena; it’s a trusted partner committed to delivering excellence. Through robust financial ratings, a low complaint level, and a wide range of coverage options, Repwest has solidified its reputation as a reliable provider.

Claims Process at Repwest Insurance Company

Streamlined Claim Filing Methods

Repwest Insurance Company understands that the ease of filing a claim is crucial during stressful times. They offer a variety of methods for you to choose from when filing a claim.

Whether you prefer the convenience of filing online, the personal touch of a phone call, or the mobility of their mobile app, Repwest ensures that the process is user-friendly and adaptable to your needs.

Efficient Claim Processing

In the world of insurance, time is of the essence. Repwest Insurance Company recognizes this and strives to process claims swiftly and efficiently.

While the exact processing time may vary depending on the complexity of the claim, you can trust Repwest to handle your claim with the urgency it deserves. This commitment to timely resolutions helps alleviate the typical frustrations associated with insurance claims.

Customer Satisfaction in Claim Resolution

The true measure of an insurance company’s performance is how satisfied its customers are with the claim resolution process. Repwest Insurance Company proudly boasts a low complaint level and a commitment to transparency.

This dedication to customer service is reflected in the positive feedback they receive from policyholders. Repwest’s customers consistently express their satisfaction with the company’s fair claim resolutions and prompt payouts.

Digital Advancements and Technological Offerings at Repwest Insurance Company

Empowering Mobile App Features

Repwest Insurance Company’s mobile app is a game-changer for policyholders. Packed with a range of features and functionalities, this app puts the power of insurance management in the palm of your hand.

From reviewing and managing your policies to filing claims and accessing vital documents, Repwest’s mobile app offers a seamless and convenient experience. It empowers you to have greater control over your insurance matters, all at your fingertips.

Seamless Online Account Management

For those who prefer managing their insurance policies and accounts online, Repwest Insurance Company offers a robust online portal.

This portal is designed to make your life easier. You can easily update your personal information, make payments, and access your policy documents from anywhere, at any time. The online convenience ensures that you have 24/7 access to your insurance information whenever you need it.

Accessible Digital Tools and Resources

Repwest Insurance Company goes above and beyond in providing digital tools and resources to support their policyholders. Whether you’re seeking educational resources to deepen your understanding of insurance or handy calculators to assess your coverage needs, Repwest’s digital offerings have you covered.

These resources are thoughtfully designed to empower you with the knowledge needed to make informed decisions about your insurance, reinforcing your reputation as a customer-focused insurance provider.

Frequently Asked Questions

What types of insurance coverage does Repwest Insurance Company offer?

Repwest Insurance Company provides a comprehensive range of coverage options, including auto, property, specialty, commercial, and workers’ compensation insurance.

How does Repwest Insurance Company fare in terms of financial stability and reliability?

Repwest holds an “A+ (Superior)” rating from A.M. Best, reflecting its strong financial standing and commitment to excellence in customer service.

What sets Repwest Insurance Company apart in terms of customer satisfaction and claims processing?

Repwest distinguishes itself through transparent claims processes, efficient claim filing methods, and a commitment to prompt and customer-friendly claim resolutions, contributing to its low complaint level.

How does Repwest Insurance Company leverage technology for customer convenience?

Repwest offers a user-friendly mobile app empowering policyholders with features such as policy management, claims filing, and document access. Additionally, their online portal facilitates 24/7 account management for those who prefer digital interactions.

What discounts are available with Repwest Insurance Company?

Repwest not only prioritizes peace of mind but also offers a range of discounts, ensuring policyholders can protect their assets without straining their budget. These discounts may include incentives for safe driving and bundling policies.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.