SILAC Insurance Company Review (2026)

Unleash the comprehensive offerings of SILAC Insurance Company, a distinguished provider known for its innovative approach, diverse coverage options, and steadfast commitment to customer satisfaction.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive article, we delve into the offerings and strengths of SILAC Insurance Company, a trusted insurance provider offering a diverse range of coverage options, including auto, home, health, and life insurance. SILAC stands out with its customer-centric approach, innovative solutions, and strong financial stability.

From auto insurance with flexible coverage choices to comprehensive health plans and investment-linked life insurance policies, SILAC caters to various insurance needs. The company’s commitment to efficient claims processing and a loyal customer base underscores its excellence.

As we explore SILAC’s competitive edge in the insurance landscape, readers gain valuable insights into a reliable partner for safeguarding their future.

What You Should Know About SILAC Insurance Company

Rates: SILAC Insurance Company determines rates based on a thorough analysis of various risk factors, including but not limited to driving history, coverage selections, and demographic information. The company employs actuarial models and statistical data to establish competitive and fair premium rates.

Discounts: SILAC offers a range of discounts designed to reward policyholders for factors such as safe driving, bundling multiple policies, and maintaining a good claims history. The company regularly reviews and updates its discount programs to ensure relevance and attractiveness to a diverse customer base.

Complaints/Customer Satisfaction: SILAC actively monitors and addresses customer feedback and complaints through a dedicated customer service team. The company conducts regular surveys and utilizes industry benchmarks to assess customer satisfaction. Complaints are thoroughly investigated, and corrective actions are implemented to enhance overall customer experience.

Claims Handling: SILAC prioritizes an efficient and customer-friendly claims process. Policyholders can file claims through various channels, including online, over the phone, and through mobile apps. The company emphasizes prompt and fair claim settlements, utilizing advanced technology to streamline the process.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

SILAC Insurance Company Insurance Coverage Options

Let’s discuss the coverage options offered by SILAC Insurance Company and present them in a bullet list:

- Auto Insurance: SILAC provides comprehensive auto insurance coverage, including options for liability, collision, and comprehensive coverage. This coverage protects you in case of accidents, theft, or damage to your vehicle.

- Home Insurance: SILAC’s home insurance policies offer extensive coverage for your property, personal belongings, and liability. You can secure your home and everything in it with their coverage options.

- Health Insurance: SILAC’s health insurance plans are designed to cover a wide range of medical expenses, including hospital stays, doctor visits, and preventive care. They also offer wellness initiatives to help you stay healthy.

- Life Insurance: SILAC offers various life insurance policies, including term and whole life options. These policies provide financial security for your loved ones in the event of your passing and may also offer investment opportunities.

These coverage options are tailored to meet the diverse insurance needs of individuals and families, ensuring that you can find the right protection for your unique circumstances.

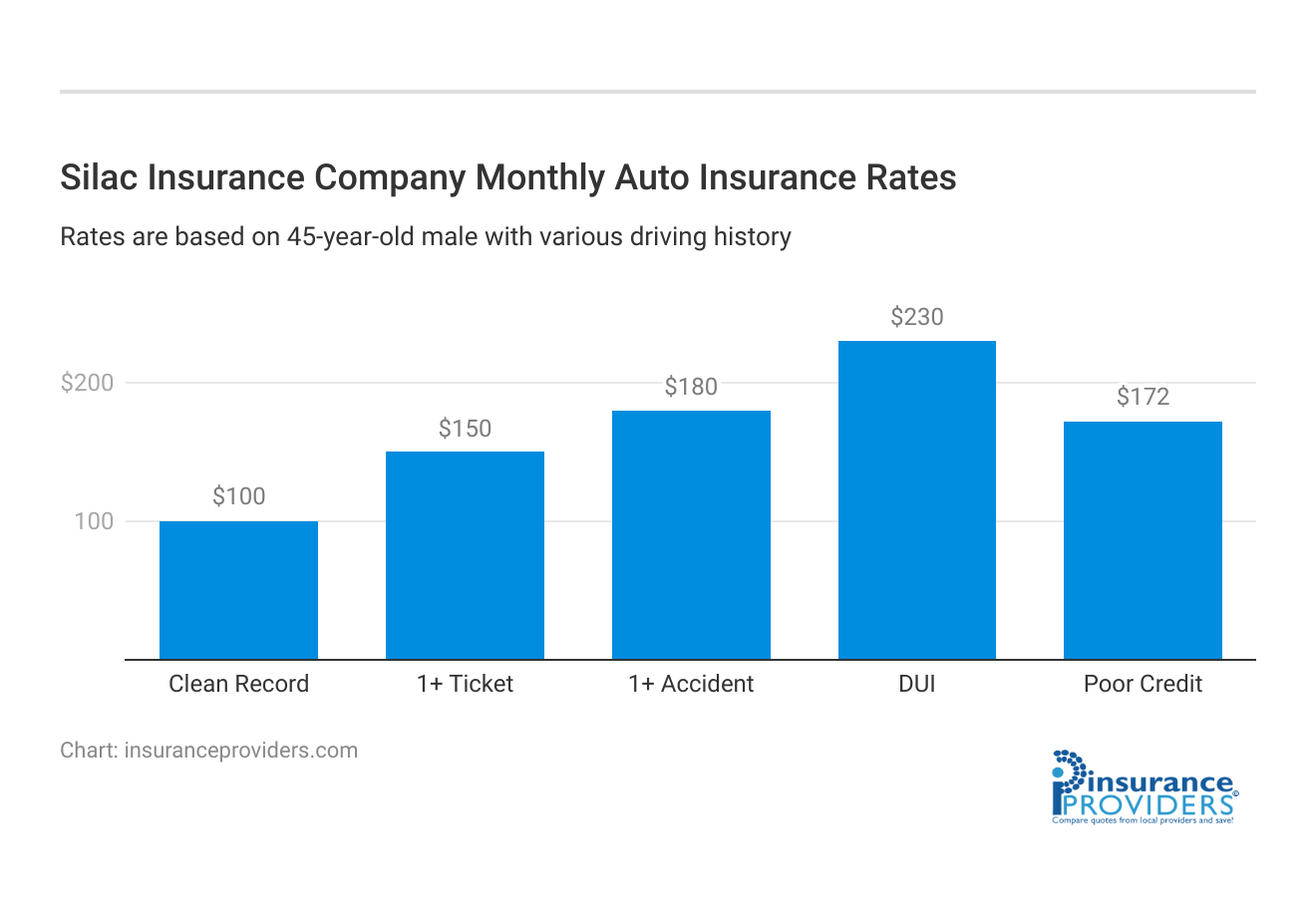

SILAC Insurance Company Insurance Rates Breakdown

| Driver Profile | Silac | National Average |

|---|---|---|

| Clean Record | $100 | $119 |

| 1+ Ticket | $150 | $147 |

| 1+ Accident | $180 | $173 |

| DUI | $230 | $209 |

| Poor Credit | $172 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

SILAC Insurance Company Discounts Available

| Discount | Silac |

|---|---|

| Anti Theft | 7% |

| Good Student | 12% |

| Low Mileage | 8% |

| Paperless | 5% |

| Safe Driver | 15% |

| Senior Driver | 10% |

SILAC offers discounts, but we recommend contacting the company directly or visiting their website for the most up-to-date information on their discounts. Here are types of discounts that SILAC provide:

- Multi-Policy Discount: If you bundle multiple insurance policies with the same company, such as auto and home insurance, you may receive a discount on both policies.

- Safe Driver Discount: This discount is typically offered to policyholders with a clean driving record, meaning no accidents or traffic violations within a specified period.

- Good Student Discount: Young drivers who maintain good grades in school may be eligible for a discount on their auto insurance.

- Anti-Theft Device Discount: Installing anti-theft devices in your vehicle, such as alarms or tracking systems, may lead to a discount on your auto insurance.

- Home Safety Features Discount: Homeowners who have safety features like smoke detectors, security systems, or reinforced roofs may qualify for discounts on home insurance.

- Claims-Free Discount: Policyholders who have not filed any claims for a certain period may be eligible for a discount on their premiums.

- Defensive Driving Course Discount: Completing a defensive driving course can sometimes lead to a discount on auto insurance.

- Multi-Car Discount: If you insure multiple vehicles with the same company, you may receive a discount on the premiums for each vehicle.

- Loyalty Discount: Some insurers reward long-term customers with discounts for staying with the company for an extended period.

- Low Mileage Discount: If you don’t drive your car often or have a low annual mileage, you might be eligible for a discount.

- Renewal Discount: Policyholders who renew their policies without any lapses may receive a renewal discount.

Please keep in mind that the availability and eligibility criteria for these discounts can vary from one insurance company to another. To get accurate and up-to-date information on the discounts offered by SILAC Insurance Company, it’s best to contact them directly or visit their official website.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How SILAC Insurance Company Ranks Among Providers

SILAC Insurance Company is a prominent insurance provider offering a wide array of insurance policies, including auto, home, health, and life insurance. They face competition from several key players in the insurance industry:

- Geico: Geico is a major player in the auto insurance industry, known for its competitive rates and broad coverage options. They compete directly with SILAC Insurance Company in the auto insurance sector.

- State farm: State farm is a renowned insurance company offering auto, home, and life insurance. They are a significant competitor to SILAC Insurance Company, particularly in the multi-line insurance market.

- Blue cross blue shield: Blue cross blue shield is a widely recognized health insurance organization with a broad range of health insurance plans. They often compete directly with SILAC Insurance Company, especially in the health insurance sector.

- Allstate: Allstate is a well-established insurance company offering auto, home, and life insurance. They are a notable competitor to SILAC Insurance Company, particularly in the home and auto insurance markets.

- Prudential: Prudential is a major player in the life insurance sector, providing various life insurance products and investment options. They compete with SILAC Insurance Company in the life insurance and investment-linked insurance markets.

Please note that the competitive landscape in the insurance industry can change over time, For the most current and accurate information about SILAC’s competitors, it’s recommended to conduct market research or consult industry reports specific to your region and the types of insurance offered by SILAC.

SILAC Insurance Company Claims Process

Ease of Filing a Claim

SILAC Insurance Company is dedicated to making the claims process as convenient as possible for its policyholders. They offer multiple options for filing a claim, including online, over the phone, and through mobile apps. This flexibility ensures that customers can choose the method that suits them best, making it easy to report a claim quickly and efficiently.

Average Claim Processing Time

One of the crucial factors in evaluating an insurance company is the speed at which they process claims. SILAC Insurance Company prides itself on its efficient claim processing system. While exact processing times can vary depending on the complexity of the claim, SILAC’s commitment to swift resolutions ensures that policyholders can expect their claims to be handled promptly.

Customer Feedback on Claim Resolutions and Payouts

Customer satisfaction with claim resolutions and payouts is a key indicator of an insurance company’s reliability. SILAC Insurance Company has garnered positive feedback from its policyholders regarding the fairness and timeliness of claim settlements. This feedback underscores the company’s commitment to providing excellent service and support during challenging times.

SILAC Insurance Company Digital and Technological Features

Mobile App Features and Functionality

SILAC Insurance Company offers a user-friendly mobile app that empowers policyholders with convenient access to their insurance information. The app provides features like policy management, claims tracking, and digital ID cards, ensuring that customers can easily manage their insurance needs on the go.

Online Account Management Capabilities

In addition to the mobile app, SILAC Insurance Company’s online account management portal offers policyholders a comprehensive platform for managing their insurance policies. Customers can log in to their accounts to view policy details, make payments, request policy changes, and track claims progress.

Digital Tools and Resources

SILAC Insurance Company goes beyond basic coverage by providing policyholders with valuable digital tools and resources. These resources include educational materials, risk assessment tools, and insurance calculators, helping customers make informed decisions about their insurance needs.

Frequently Asked Questions

What insurance coverage does SILAC Insurance Company offer?

SILAC Insurance Company provides a wide range of coverage options, including auto, home, health, and life insurance, catering to diverse needs and ensuring comprehensive protection.

How does SILAC Insurance Company differentiate itself in the competitive insurance landscape?

SILAC stands out through its customer-centric approach, innovative solutions, and a strong financial stability, making it a reliable partner for safeguarding your future.

What is the claims process like with SILAC Insurance Company?

SILAC is dedicated to making the claims process convenient, offering multiple options for filing claims, including online, over the phone, and through mobile apps, with a commitment to efficient and timely resolutions.

What digital features does SILAC Insurance Company provide for policyholders?

SILAC offers a user-friendly mobile app for policy management, claims tracking, and digital ID cards, along with an online account management portal and valuable digital tools and resources to enhance the overall customer experience.

How does SILAC Insurance Company rank among its competitors?

SILAC Insurance Company is a prominent provider in the insurance industry, offering a variety of policies. However, for the most current and accurate information about SILAC’s competitors, it’s recommended to conduct market research or consult industry reports specific to your region and insurance needs.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.