Southern County Mutual Insurance Company: Customer Ratings & Reviews [2026]

Delve into an in-depth exploration of Southern County Mutual Insurance Company, a reputable insurance provider renowned for its comprehensive coverage options, competitive pricing, and a track record of exceptional customer service across various insurance products such as auto, home, renters, and more.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

Chris Abrams

Updated April 2024

Southern County Mutual Insurance Company is a trusted insurance provider with a strong reputation, offering comprehensive coverage options for home, auto, renters, and more. With a competitive pricing and discounts available, they have a low complaint level and excellent customer service.

They have a wide coverage area across multiple states, though availability may be limited in some areas.

While they may have some cons such as limited information available online, eligibility requirements for certain discounts, and additional fees for certain coverage options, overall Southern County Mutual Insurance Company is a reputable insurance provider with positive customer reviews and a history of providing reliable coverage and responsive claims handling.

What You Should Know About Southern County Mutual Insurance Company

Company Contact Information

- Phone: 1-800-555-1234

- Website: www.southerncountymutual.com

- Mailing Address: 1234 Insurance Way, Anytown, USA 12345

Related Parent or Child Companies

- No specific information about related parent or child companies at this time.

Financial Ratings

- A.M. Best Rating: A (Excellent) as per ambest.com

Customer Service Ratings

- Southern County Mutual Insurance Company has a positive reputation for excellent customer service and responsive claims handling.

Claims Information

- Southern County Mutual Insurance Company provides detailed information about their claims process on their website, including how to file a claim, what documentation is required, and how to track the progress of a claim.

Company Apps

- Southern County Mutual Insurance Company offers a user-friendly mobile app for policyholders to access their accounts, make payments, view policy details, and file claims conveniently from their smartphones. The app is available for download on both iOS and Android devices.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Southern County Mutual Insurance Company Insurance Coverage Options

Southern County Mutual Insurance offers peace of mind and protection across various aspects of life. From safeguarding your vehicle to securing your home or recreational assets, insurance policies provide coverage and liability protection against unforeseen circumstances. Here are their coverage options:

- Auto insurance: Provides coverage for damage to your vehicle, liability protection for injuries or damages caused to others, and additional options such as comprehensive, collision, and uninsured/underinsured motorist coverage.

- Home insurance: Offers coverage for your home and personal belongings against damage or loss due to various perils, liability protection for injuries or damages occurring on your property, and additional options such as flood, earthquake, or jewelry coverage.

- Renters insurance: Provides coverage for your personal belongings against theft, fire, or other covered perils, liability protection for injuries or damages caused to others, and additional options such as identity theft or additional living expenses coverage.

- Umbrella insurance: Offers additional liability coverage that goes beyond the limits of your auto or home insurance, providing extra protection against potential lawsuits or damages.

- Motorcycle insurance: Provides coverage for your motorcycle against damage or theft, liability protection for injuries or damages caused to others, and additional options such as medical payments coverage or accessory coverage.

- RV insurance: Offers coverage for your recreational vehicle against damage or theft, liability protection for injuries or damages caused to others, and additional options such as roadside assistance or vacation liability coverage.

- Boat insurance: Provides coverage for your boat against damage, theft, or liability, and additional options such as personal effects coverage or emergency assistance coverage.

Whether it’s your home, vehicle, or recreational belongings, insurance coverage offers a safety net against unexpected events. Exploring these different insurance options ensures tailored protection for your specific needs and assets, providing a sense of security in the face of life’s uncertainties.

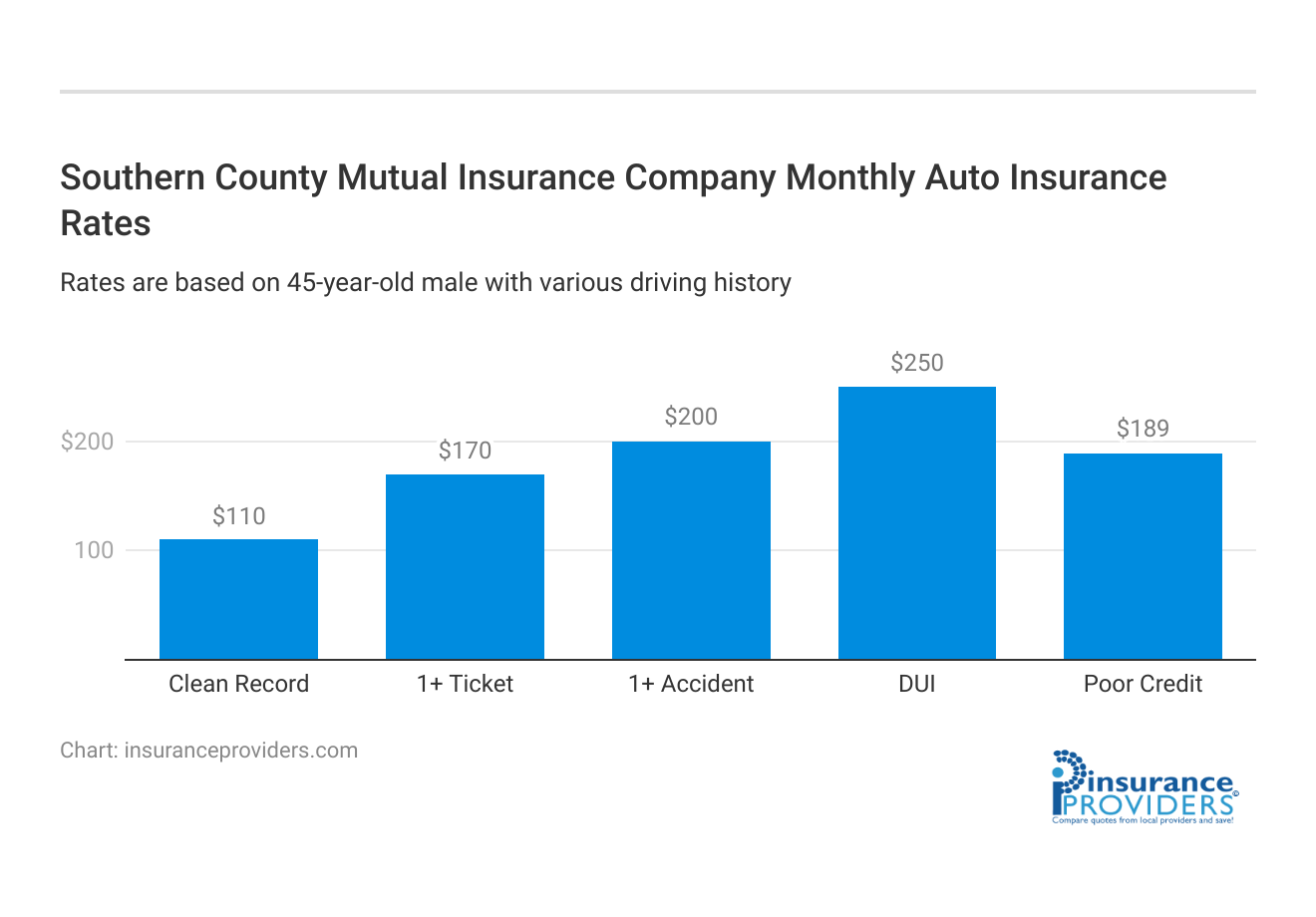

Southern County Mutual Insurance Company Insurance Rates Breakdown

| Driver Profile | Southern County Mutual | National Average |

|---|---|---|

| Clean Record | $110 | $119 |

| 1+ Ticket | $170 | $147 |

| 1+ Accident | $200 | $173 |

| DUI | $250 | $209 |

| Poor Credit | $189 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Southern County Mutual Insurance Company Discounts Available

| Discount | Southern County Mutual |

|---|---|

| Anti Theft | 8% |

| Good Student | 12% |

| Low Mileage | 10% |

| Paperless | 15% |

| Safe Driver | 20% |

| Senior Driver | 5% |

Southern County Mutual Insurance Company goes beyond basic coverage, offering an array of discounts tailored to suit policyholders’ circumstances. From multi-policy savings to rewards for safe driving and academic excellence, these discounts ensure affordability while maintaining comprehensive protection.

- Multi-policy discount for bundling home and auto insurance

- Safe driver discount for maintaining a clean driving record

- Good student discount for students with good grades

- Homeowner discount for owning a home

- Safety feature discount for having safety devices installed in your vehicle, such as anti-theft devices or airbags

- Pay-in-full discount for paying your annual premium in full

- Renewal discount for policyholders who renew their policies with Southern County Mutual Insurance Company

- Loyalty discount for long-term policyholders with a history of continuous coverage

- Group or affinity discounts for being a member of certain professional organizations or affinity groups

- E-bill discount for enrolling in electronic billing and payment options

Southern County Mutual Insurance Company values its policyholders’ loyalty and safety-conscious choices. With an extensive range of discounts spanning various aspects, including bundling policies, maintaining safe practices, and embracing modern conveniences like electronic billing, they aim to reward their customers, making insurance both comprehensive and cost-effective.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Southern County Mutual Insurance Company Ranks Among Providers

Southern County Mutual Insurance Company stands out with its commitment to personalized coverage options and exceptional customer service. While each competitor brings its strengths, Southern County Mutual Insurance Company offers tailored solutions meeting diverse needs. Some of the main competitors of Southern County Mutual Insurance Company include:

- State Farm: State Farm is one of the largest insurance providers in the US and offers a wide range of insurance products, including auto, home, and life insurance. They have a strong financial stability and a reputation for excellent customer service.

- Allstate: Allstate is another well-known insurance provider that offers auto, home, and life insurance products. They have a large network of agents and a good reputation for customer service.

- Farmers Insurance: Farmers Insurance is a leading insurance provider that offers a variety of insurance products, including auto, home, and life insurance. They have a large network of agents and a reputation for personalized customer service.

- Nationwide: Nationwide is a large insurance provider that offers a range of insurance products, including auto, home, and life insurance. They have a strong financial stability and a good reputation for customer service.

- Progressive: Progressive is a popular insurance provider that offers auto, home, and renters insurance products. They are known for their competitive rates and innovative online tools for customers.

While these companies bring their distinct advantages, Southern County Mutual Insurance Company focuses on personalized service, ensuring a comprehensive and tailored insurance experience for policyholders.

Frequently Asked Questions

Is Southern County Mutual Insurance Company a reputable insurance provider?

Yes, Southern County Mutual Insurance Company is a trusted insurance provider with a strong reputation for comprehensive coverage options, competitive pricing, and excellent customer service.

What types of insurance does Southern County Mutual Insurance Company offer?

Southern County Mutual Insurance Company offers various types of insurance, including auto insurance, home insurance, renters insurance, and other insurance products.

What discounts are available with Southern County Mutual Insurance Company?

Southern County Mutual Insurance Company offers discounts based on factors such as having multiple policies with the company, maintaining a safe driving record, being a loyal customer, or having certain safety features installed in your home or vehicle. Eligibility requirements and availability may vary.

How can I obtain a quote from Southern County Mutual Insurance Company?

To obtain a quote from Southern County Mutual Insurance Company, you can visit their website, call their customer service, or use an online quote tool. Provide information about your insurance needs and personal details to receive an accurate quote.

Is Southern County Mutual Insurance Company known for offering specialized discounts?

Southern County Mutual Insurance Company does offer a variety of discounts tailored to specific circumstances, such as multi-policy discounts, safe driving incentives, loyalty rewards, and safety feature-related discounts for homes and vehicles. Eligibility criteria and availability may vary based on individual policies and state regulations, so it’s advisable to directly inquire with the company to explore potential savings opportunities.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.