Standard Security Life Insurance Company of New York Review (2026)

Introducing a comprehensive review of Standard Security Life Insurance Company of New York, your gateway to a multitude of insurance options backed by financial stability and a commitment to exceptional service.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Standard Security Life Insurance Company of New York is a versatile insurance provider offering a comprehensive range of coverage options, including life insurance, health insurance, property insurance, and auto insurance, along with additional coverage choices like disability insurance and annuities.

The company, with a rich history of dedicated service, maintains a strong financial position to assure policyholders of prompt and reliable claims support. Their commitment to customer satisfaction is reflected in high ratings, and they provide convenient online tools for policy management and claims processing.

Offering competitive rates and various discounts, Standard Security Life Insurance Company empowers policyholders to customize their coverage to their specific needs, making it a compelling choice for those seeking dependable insurance solutions.

Standard Security Life Insurance Company Insurance Coverage Options

Standard Security Life Insurance Company of New York offers a variety of coverage options to meet the diverse needs of its policyholders. Here are the coverage options provided by the company:

- Life Insurance: Standard Security Life Insurance Company offers life insurance policies that provide financial security for your loved ones in the event of your passing. These policies can be tailored to meet your specific needs, ensuring your family’s financial well-being.

- Health Insurance: The company offers a range of health insurance plans that cover medical expenses, prescriptions, and preventive care. These policies help safeguard your health and provide access to quality healthcare services.

- Property Insurance: Standard Security Life Insurance Company of New York provides property insurance policies that protect your home, belongings, and assets. These policies offer coverage for damage, theft, and unforeseen events, giving you peace of mind.

- Auto Insurance: The company’s auto insurance policies ensure both you and your vehicle are protected on the road. Whether you need liability coverage, comprehensive coverage, or collision coverage, they have options to suit your needs.

- Additional Coverage: In addition to the core insurance offerings, Standard Security Life Insurance Company of New York offers additional coverage options such as disability insurance and annuities. These policies can further enhance your overall financial security.

Standard Security Life Insurance Company of New York stands as a reliable partner in safeguarding what matters most to you. With a wide range of insurance coverage options, they empower you to build a financial safety net tailored to your individual requirements.

These coverage options cater to a wide range of insurance needs, allowing policyholders to select the policies that best align with their personal circumstances and priorities.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

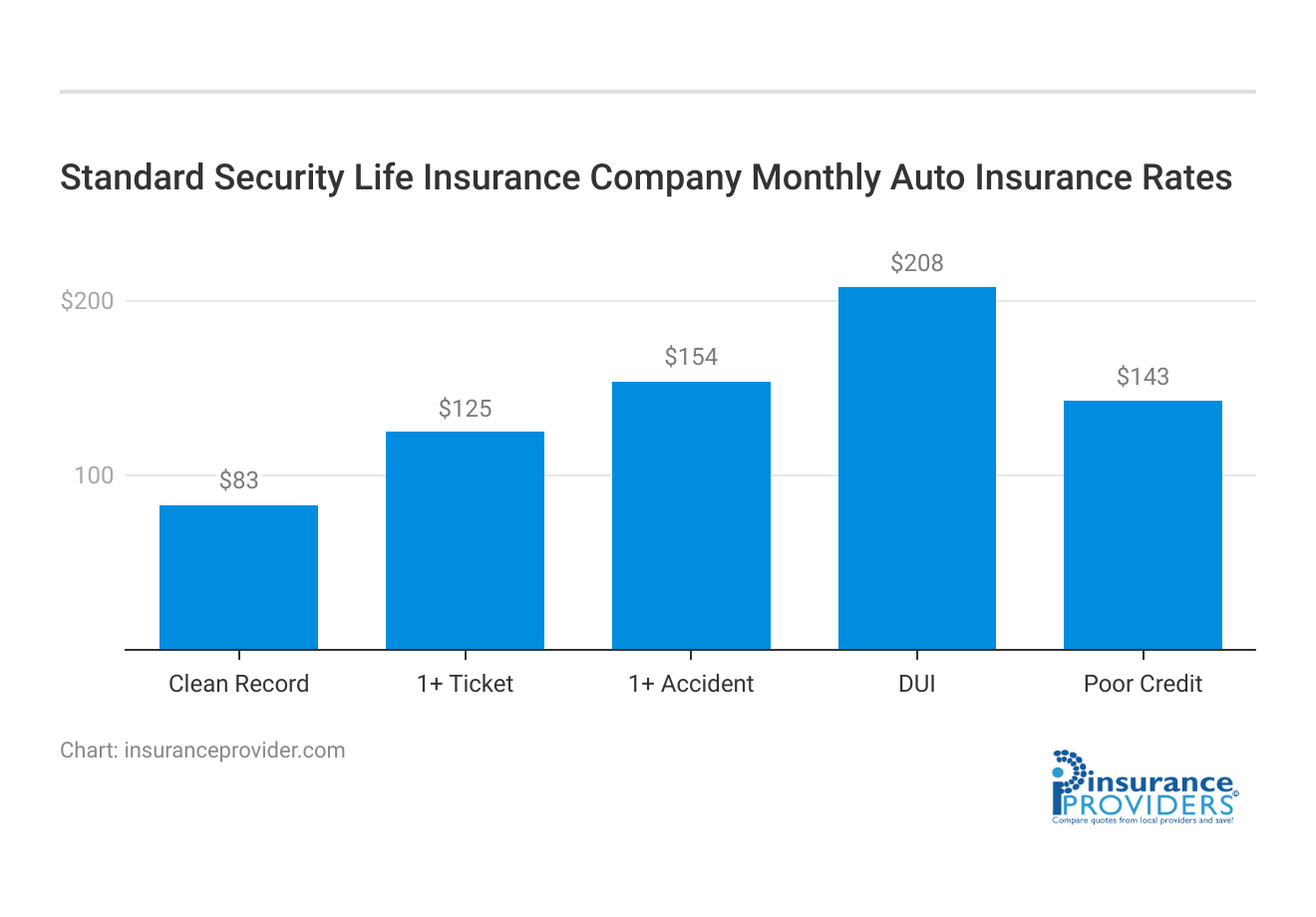

Standard Security Life Insurance Company Insurance Rates Breakdown

| Driver Profile | Standard Security | National Average |

|---|---|---|

| Clean Record | $83 | $119 |

| 1+ Ticket | $125 | $147 |

| 1+ Accident | $154 | $173 |

| DUI | $208 | $209 |

| Poor Credit | $143 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Standard Security Life Insurance Company Discounts Available

| Discounts | Standard Security |

|---|---|

| Anti Theft | 8% |

| Good Student | 13% |

| Low Mileage | 10% |

| Paperless | 8% |

| Safe Driver | 13% |

| Senior Driver | 10% |

Standard Security Life Insurance Company of New York understands the importance of affordability in insurance. To make insurance more accessible and cost-effective for their policyholders, they offer various discounts. Here are some of the discounts you may be eligible for:

- Multi-Policy Discount: When you bundle multiple insurance policies with Standard Security Life Insurance Company of New York, such as auto and home insurance, you can often receive a discount on your premiums.

- Safe Driver Discount: If you have a clean driving record and maintain safe driving habits, you may qualify for a safe driver discount on your auto insurance policy.

- Good Student Discount: Students who maintain good grades in school can often benefit from a good student discount on their auto insurance premiums.

- Anti-Theft Device Discount: Installing anti-theft devices in your vehicle can help reduce the risk of theft and qualify you for a discount on your auto insurance.

- Safety Features Discount: Vehicles equipped with safety features such as airbags, anti-lock brakes, and electronic stability control may be eligible for discounts.

- Payment Discounts: Some insurers offer discounts for policyholders who choose to pay their premiums annually or through electronic funds transfer (EFT).

- Long-Term Policyholder Discount: Staying loyal to your insurance provider can sometimes result in discounts as a reward for your long-term commitment.

It’s important to note that eligibility for discounts can vary based on your specific policy, location, and other factors. To find out which discounts you qualify for and how much you can save, it’s advisable to discuss your options directly with Standard Security Life Insurance Company of New York or their authorized agents.

How Standard Security Life Insurance Company Ranks Among Providers

Welcome to an insightful exploration of how Standard Security Life Insurance Company ranks among insurance providers. In a landscape where choosing the right insurance partner is crucial for your financial well-being, understanding where a company stands in the industry hierarchy is essential. Some potential competitors in the insurance industry include:

- Large National Insurers: Major national insurance companies like State Farm, Allstate, Geico, and Progressive often compete in various insurance sectors, including auto, home, and life insurance.

- Regional Insurance Companies: Regional insurers may compete in specific geographic areas and can be strong competitors within those regions. Examples might include companies like Amica Mutual Insurance or The Hartford.

- Specialized Insurers: Some companies specialize in niche insurance markets, such as pet insurance, travel insurance, or specialty lines like classic car insurance. These specialized insurers could be competitors in their respective niches.

- Health Insurance Providers: In the health insurance sector, companies like Blue Cross Blue Shield, UnitedHealth Group, and Aetna (a subsidiary of CVS Health) are among the major competitors.

- Life Insurance Companies: Other life insurance providers, such as New York Life, Northwestern Mutual, and Prudential Financial, compete in the life insurance market.

- Online Insurtech Startups: Insurtech startups like Lemonade, Root Insurance, and Policygenius have disrupted the insurance industry with digital-first approaches and may be seen as competitors, particularly among tech-savvy customers.

- Mutual Insurance Companies: Mutual insurance companies like MassMutual and Guardian Life Insurance Company often compete in the life insurance and financial services sectors.

The competitive landscape in the insurance industry is complex, with numerous players offering a wide range of products and services. Companies compete on factors such as pricing, coverage options, customer service, financial stability, and technological innovation.

To assess Standard Security Life Insurance Company of New York’s specific competitors and their relative strengths and weaknesses, it would be necessary to conduct a detailed competitive analysis based on current market conditions.

Read more: Amica Life Insurance Company Review

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Standard Security Life Insurance Company of New York Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Standard Security Life Insurance Company of New York offers policyholders convenient options for filing insurance claims. You can file a claim through their user-friendly online portal, over the phone, or even through their mobile app.

This flexibility ensures that policyholders can choose the method that suits them best, making the claims process more accessible and efficient.

Average Claim Processing Time

The average claim processing time is a critical factor for policyholders who rely on insurance to provide financial assistance during challenging times. While specific processing times may vary depending on the nature of the claim, Standard Security Life Insurance Company of New York is committed to prompt and reliable claims support.

Policyholders can expect their claims to be processed efficiently, providing peace of mind when it matters most.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is invaluable in assessing an insurance company’s performance. Standard Security Life Insurance Company of New York has received positive feedback regarding their claim resolutions and payouts.

Their commitment to customer satisfaction is reflected in high ratings, suggesting that policyholders have been satisfied with the company’s handling of claims. This positive feedback reinforces their reputation as a reliable insurance provider.

Standard Security Life Insurance Company of New York Digital and Technological Features

Mobile App Features and Functionality

Standard Security Life Insurance Company of New York offers a feature-rich mobile app that enhances the overall customer experience. The app provides policyholders with easy access to their policy information, the ability to file claims, make premium payments, and even access digital insurance cards.

These features make managing insurance on the go convenient and efficient.

Online Account Management Capabilities

Policyholders can access and manage their policies through Standard Security Life Insurance Company of New York’s online portal. This user-friendly platform allows you to view policy details, make updates, and track claims. It’s a valuable resource for policyholders who prefer to manage their insurance digitally, providing transparency and control.

Digital Tools and Resources

In addition to the mobile app and online portal, Standard Security Life Insurance Company of New York provides various digital tools and resources to assist policyholders in making informed decisions. These resources may include educational materials, calculators, and other online tools to help you understand your insurance options and plan for the future.

These digital resources empower policyholders to make smart choices when it comes to their insurance coverage.

Frequently Asked Questions

What types of insurance does Standard Security Life Insurance Company of New York offer?

Standard Security Life Insurance Company of New York offers a range of insurance types, including life insurance, health insurance, property insurance, auto insurance, and additional coverage options like disability insurance and annuities.

How can I access my policy and manage it online with Standard Security Life Insurance Company of New York?

Standard Security Life Insurance Company of New York provides convenient online tools that allow policyholders to access and manage their policies online. You can use their website to view your policy details, submit claims, and make premium payments.

Are there discounts available for policyholders with Standard Security Life Insurance Company of New York?

Yes, Standard Security Life Insurance Company of New York offers discounts to eligible policyholders. These discounts can help you save on your insurance premiums while maintaining comprehensive coverage.

How does the claims process work with Standard Security Life Insurance Company of New York?

The claims process with Standard Security Life Insurance Company of New York is designed to be straightforward and efficient. Policyholders can file claims online or through their customer support team.

What is the company’s history and financial strength?

Standard Security Life Insurance Company of New York has a long history of serving its customers with dedication and excellence. As for financial strength, the company maintains a strong financial position, ensuring that policyholders’ claims are met promptly and efficiently.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.