Starmount Life Insurance Company Review (2026)

Explore our detailed review of Starmount Life Insurance Company, a trusted provider offering an array of insurance options including life, dental, vision, and critical illness coverage, with a focus on competitive pricing, customizable plans, and dedicated customer service.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive guide, we explore Starmount Life Insurance Company, a trusted name in the insurance industry. Starmount offers a diverse range of insurance products, including life, dental, vision, and critical illness insurance, all designed to safeguard your future.

With an A.M. Best rating of A (Excellent) and a low complaint level, Starmount stands out for its commitment to customer satisfaction and seamless service. Their customizable life insurance options, competitive pricing, and bundling discounts make them an attractive choice for those seeking comprehensive coverage.

While their geographic availability is somewhat limited, Starmount’s dedication to meeting individual needs, easy application process, and efficient claim processing demonstrate their commitment to providing peace of mind in uncertain times.

Starmount Life Insurance Company Insurance Coverage Options

Starmount Life Insurance Company offers a diverse range of coverage options to cater to the unique needs and preferences of their customers. These coverage options span various aspects of insurance, including life, dental, vision, and critical illness coverage. Here’s an overview of the coverage options provided by Starmount:

Life Insurance Coverage

- Term Life Insurance: Provides coverage for a specified term, offering a death benefit to beneficiaries if the insured passes away during the policy term.

- Whole Life Insurance: Offers lifelong coverage with a guaranteed death benefit and potential cash value accumulation over time.

- Universal Life Insurance: Combines life insurance with an investment component, allowing policyholders flexibility in premium payments and potential cash value growth.

Dental Insurance Coverage

- Preventive Care: Includes coverage for routine check-ups, cleanings, and X-rays.

- Basic Procedures: Covers essential dental procedures like fillings and extractions.

- Major Procedures: Provides coverage for more extensive treatments, such as root canals and crowns.

- Orthodontic Coverage: May offer options for orthodontic care, including braces for both adults and children.

Vision Insurance Coverage

- Eye Exams: Covers comprehensive eye exams to assess vision health.

- Prescription Eyewear: Provides benefits for eyeglasses or contact lenses, including frames and lenses.

- LASIK Surgery: Some plans may include coverage for LASIK or other corrective eye surgeries.

Critical Illness Insurance Coverage

- Financial Protection: Offers a lump-sum payment upon the diagnosis of a covered critical illness, helping policyholders manage medical expenses and maintain their financial security.

- Covered Illnesses: Typically include serious conditions such as cancer, heart attack, stroke, and organ transplants, among others.

Starmount’s coverage options are designed to provide policyholders with comprehensive protection and peace of mind in various aspects of life, health, and financial planning. Customers can select the specific coverage options that align with their needs, making it possible to create customized insurance portfolios that suit their individual circumstances.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Starmount Life Insurance Company Insurance Rates Breakdown

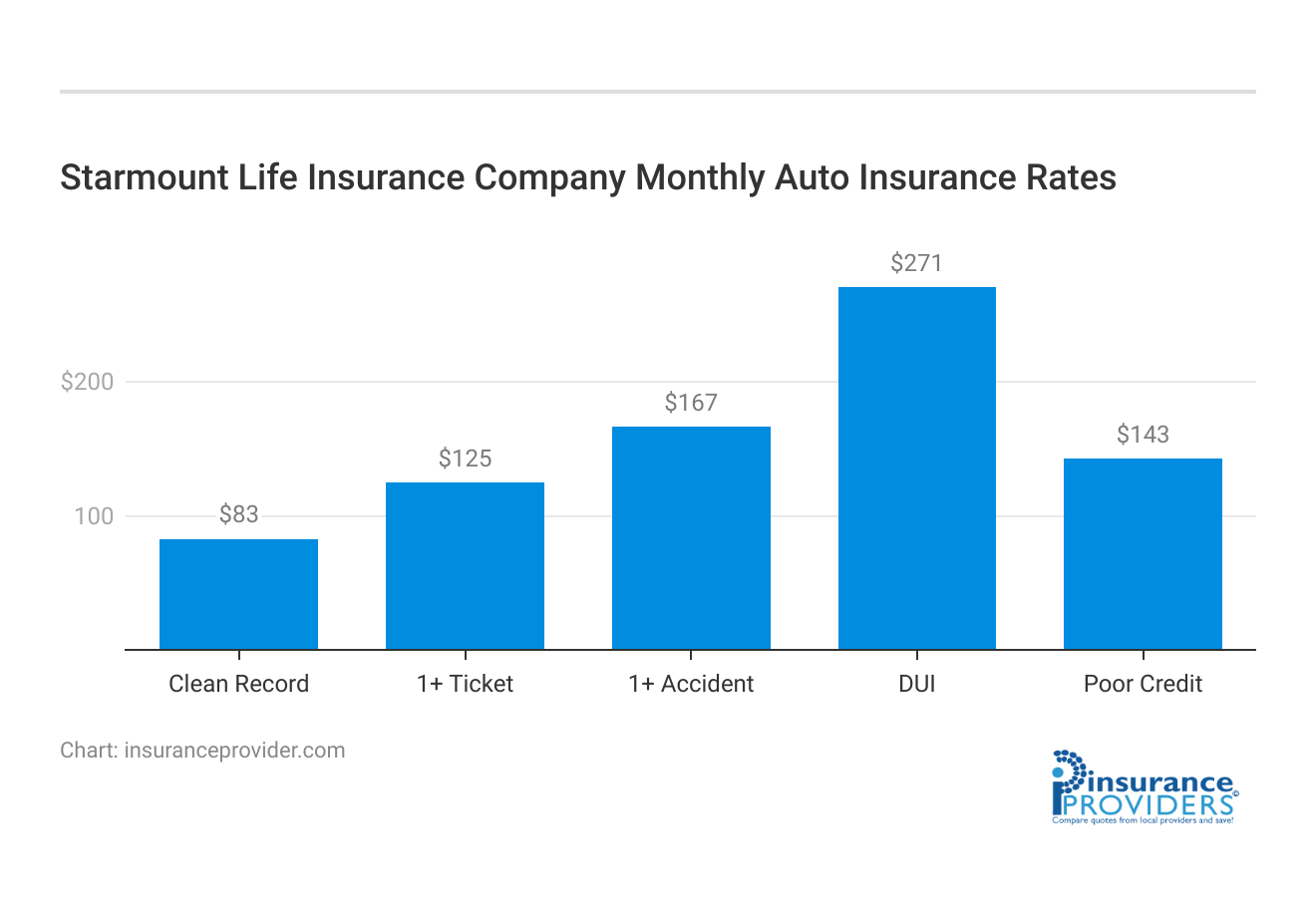

| Driver Profile | Starmount Life | National Average |

|---|---|---|

| Clean Record | $83 | $119 |

| 1+ Ticket | $125 | $147 |

| 1+ Accident | $167 | $173 |

| DUI | $271 | $209 |

| Poor Credit | $143 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Starmount Life Insurance Company Discounts Available

| Discounts | Starmount Life |

|---|---|

| Anti Theft | 8% |

| Good Student | 13% |

| Low Mileage | 10% |

| Paperless | 8% |

| Safe Driver | 13% |

| Senior Driver | 7% |

Starmount Life Insurance Company offers a range of discounts to make their insurance products more appealing and cost-effective for customers. These discounts can help policyholders save on their premiums and ensure that they receive the coverage they need at a competitive price. Here are some of the discounts offered by Starmount:

- Bundling Discount: Starmount provides discounts to customers who bundle multiple insurance policies. By combining, for example, life, dental, and vision insurance, policyholders can enjoy reduced overall premiums, making comprehensive coverage more affordable.

- Healthy Lifestyle Discount: Starmount encourages healthy living by offering discounts to policyholders who meet specific wellness criteria. This can include discounts for non-smokers, regular exercise, or meeting certain health benchmarks, promoting overall well-being and lower premiums.

- Annual Payment Discount: Policyholders who choose to pay their premiums annually, rather than monthly, can benefit from additional savings. This discount rewards customers for their commitment to long-term coverage.

- Family Discount: Starmount recognizes the importance of family coverage and offers discounts for multiple family members covered under the same policy. This ensures that families can protect their loved ones without breaking the bank.

- Auto-Pay Discount: Enrolling in automatic payment methods, such as electronic funds transfer (EFT) or payroll deduction, can earn policyholders a convenient discount while ensuring that payments are made on time.

- Preferred Provider Network (PPO) Discount: Starmount often collaborates with a network of preferred providers for dental and vision services. Policyholders who utilize these in-network providers can enjoy reduced out-of-pocket costs, making healthcare more affordable.

These discounts demonstrate Starmount’s commitment to providing value and affordability to their customers while encouraging healthy lifestyles and responsible financial planning. It’s essential for potential policyholders to discuss these discounts with Starmount’s representatives to determine which ones apply to their specific insurance needs and circumstances.

How Starmount Life Insurance Company Ranks Among Providers

Starmount Life Insurance Company faces competition from several key players in the insurance industry, each offering its own set of products and services. Some of the main competitors of Starmount include:

- Metlife: Metlife is a well-established insurance company known for its diverse range of insurance products, including life, dental, vision, and critical illness insurance. They have a strong global presence and a history of financial stability.

- Aetna: Aetna, now a part of CVS Health, offers comprehensive health and dental insurance options. They are particularly known for their extensive network of healthcare providers and competitive healthcare plans.

- Prudential Financial: Prudential is a renowned life insurance provider, offering various types of life insurance policies and investment products. They have a long-standing reputation for financial strength and stability.

- Guardian Life Insurance: Guardian Life is recognized for its focus on individualized financial planning and insurance solutions. They offer a range of life, dental, and vision insurance products with an emphasis on customization.

- Unitedhealth Group: Unitedhealth Group is one of the largest healthcare and insurance companies globally. They provide a wide array of health and dental insurance options and have a substantial network of healthcare professionals and facilities.

- Cigna: Cigna is known for its global health services, including dental and vision insurance. They emphasize wellness and preventive care, and their plans often include extensive coverage options.

- Nationwide: Nationwide is a diversified insurance and financial services company offering various types of insurance, including life and dental insurance. They are known for their personalized approach to coverage.

- Principal Financial Group: Principal Financial Group specializes in retirement and investment solutions but also offers life insurance options. They focus on helping individuals plan for a secure financial future.

The competition in the insurance industry is intense, with companies continually evolving their products and services to attract and retain customers. Consumers should carefully evaluate the offerings, pricing, and customer service of these competitors to make informed choices about their insurance needs.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Starmount Life Insurance Company Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Starmount Life Insurance Company offers multiple convenient options for filing a claim. Policyholders can choose to file a claim online through their official website, over the phone by contacting their customer service, or even through mobile apps designed to streamline the claims process.

This flexibility allows customers to choose the method that best suits their preferences and needs, making it easier to initiate a claim when necessary.

Average Claim Processing Time

Starmount Life Insurance Company is committed to providing efficient claim processing. While the specific processing time may vary depending on the nature of the claim, they prioritize quick and fair settlements. Policyholders can typically expect a reasonable turnaround time for their claims, ensuring that they receive the necessary support during challenging times.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is essential in evaluating an insurance company’s performance in claim resolutions and payouts. Starmount has received positive feedback from its customers regarding the fairness and promptness of claim resolutions and payouts.

Their commitment to customer satisfaction is evident in the consistent praise they receive in this aspect, further establishing their reputation as a trusted insurer.

Starmount Life Insurance Company Digital and Technological Features

Mobile App Features and Functionality

Starmount Life Insurance Company offers a user-friendly mobile app that provides policyholders with convenient access to their insurance information. The app includes features such as policy management, claims submission, and premium payment options.

Customers can easily navigate through the app to perform various tasks related to their insurance policies, enhancing their overall experience.

Online Account Management Capabilities

Policyholders can efficiently manage their insurance accounts through Starmount’s online platform. This digital resource allows customers to access policy details, update personal information, and review payment history.

The online account management capabilities make it convenient for policyholders to stay informed and make necessary adjustments to their policies.

Digital Tools and Resources

Starmount provides a range of digital tools and resources to help policyholders make informed decisions about their insurance coverage. These resources may include online calculators, educational articles, and FAQs.

By offering these digital tools, Starmount aims to empower customers with the knowledge and information they need to make the right coverage choices for their unique needs.

Frequently Asked Questions

How do I apply for Starmount insurance policies?

Applying for Starmount insurance is easy. You can visit their website, fill out an online application, or contact their customer service for assistance in the application process.

What is the waiting period for dental and vision insurance coverage?

The waiting periods for dental and vision insurance coverage may vary depending on the specific policy. It’s essential to review the policy details to understand the waiting period for your chosen plan.

Are there discounts available for bundling multiple insurance policies with Starmount?

Yes, Starmount often offers discounts for bundling multiple insurance policies. Be sure to inquire about available discounts when you discuss your insurance needs with their representatives.

Can I customize my life insurance coverage with Starmount?

Absolutely! Starmount offers customizable life insurance policies to suit your unique requirements. You can work with their experts to tailor a policy that fits your budget and financial goals.

How long does it take for a critical illness insurance claim to be processed?

Starmount understands the urgency of critical illness claims. Typically, they strive to process claims efficiently, ensuring you receive the necessary support during challenging times. The processing time may vary based on the specifics of your claim, but they prioritize quick and fair settlements.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.