Starr Specialty Insurance Company Review (2026)

Discover Starr Specialty Insurance Company, recognized for its stellar A.M. Best rating and diverse coverage options, offering tailored solutions and competitive rates for individuals and businesses.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive article, we delve into Starr Specialty Insurance Company, a trusted name in the insurance industry. Offering an impressive array of insurance policies, including property, liability, professional liability, cyber, marine, and aviation coverage, Starr Specialty stands out with an A+ (Superior) A.M.

Best rating and a low complaint level. The company’s pros include competitive rates, tailored policies, efficient claims processing, a dedicated expert team, and a wealth of industry experience.

While their specialized focus may not suit all insurance needs and their availability in certain regions is limited, Starr Specialty Insurance Company shines as a reliable partner in safeguarding assets and interests, providing peace of mind to individuals and businesses alike.

What You Should Know About Starr Specialty Insurance Company

Rates: Starr Specialty Insurance Company’s rating reflects their commitment to providing competitive premiums that align with the value offered in coverage and services.

Discounts: Starr Specialty demonstrates a dedication to affordability by offering various discount opportunities, including safe driver and multi-policy discounts, to reward responsible and loyal policyholders.

Complaints/Customer Satisfaction: Starr Specialty’s rating assesses overall policyholder satisfaction through the analysis of customer feedback, complaint resolution, and the responsiveness of customer service.

Claims Handling: Starr Specialty is evaluated for the efficiency of its claims process, considering the ease of filing claims through different channels and the promptness and fairness in settling claims, as reflected in positive customer feedback.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Starr Specialty Insurance Company Insurance Coverage Options

Starr Specialty Insurance Company provides a comprehensive range of coverage options to meet the diverse needs of their clients. Their extensive portfolio includes various types of insurance policies. Here is a bullet list highlighting some of the coverage options offered by the company:

- Property Insurance: Protects against damage or loss to physical properties, including buildings, equipment, and inventory, due to events like fire, theft, or natural disasters.

- Liability Insurance: Offers protection against claims or lawsuits resulting from bodily injury or property damage for which the insured is legally responsible.

- Professional Liability Insurance: Specifically designed for professionals, this coverage safeguards against claims of negligence, errors, or omissions in the services provided.

- Cyber Insurance: Provides coverage against cyber threats, data breaches, and the associated legal and financial repercussions.

- Marine Insurance: Protects against losses or damage to ships, cargo, and other assets involved in marine transport and shipping.

- Aviation Insurance: Covers aircraft, aviation-related liabilities, and other aviation-related risks, ensuring the safety and security of aviation operations.

- Workers’ Compensation Insurance: Offers financial protection for employees in the event of work-related injuries or illnesses, covering medical expenses and lost wages.

- Directors and Officers (D&O) Insurance: Shields corporate directors and officers from personal liability for decisions made on behalf of the company.

- Product Liability Insurance: Protects manufacturers and sellers from legal claims arising from injuries or damages caused by their products.

- Environmental Liability Insurance: Covers costs associated with environmental cleanup and liabilities stemming from pollution and contamination incidents.

- Kidnap and Ransom Insurance: Provides coverage for individuals and businesses in the event of kidnapping, extortion, or ransom situations.

- Surety Bonds: Offers financial guarantees to ensure contractual obligations are met, often required in construction and other industries.

- Employment Practices Liability Insurance (EPLI): Protects businesses from claims related to employment-related issues, such as discrimination, harassment, and wrongful termination.

- Healthcare Professional Liability Insurance: Tailored coverage for healthcare providers to protect against medical malpractice claims and related legal expenses.

- Financial Lines Insurance: Coverage for financial institutions, including banks and investment firms, to protect against financial and professional liabilities.

- Kidnap and Ransom Insurance: Provides coverage in case of kidnapping, extortion, or ransom situations, offering protection and assistance during crisis events.

- Political Risk Insurance: Protects businesses operating in volatile regions from financial losses due to political instability or government actions.

Starr Specialty Insurance Company’s diverse array of coverage options reflects its commitment to meeting the unique insurance needs of individuals and businesses across various industries. Policyholders can select the specific coverage that aligns with their risks and requirements, ensuring they have the protection they need to safeguard their assets and operations.

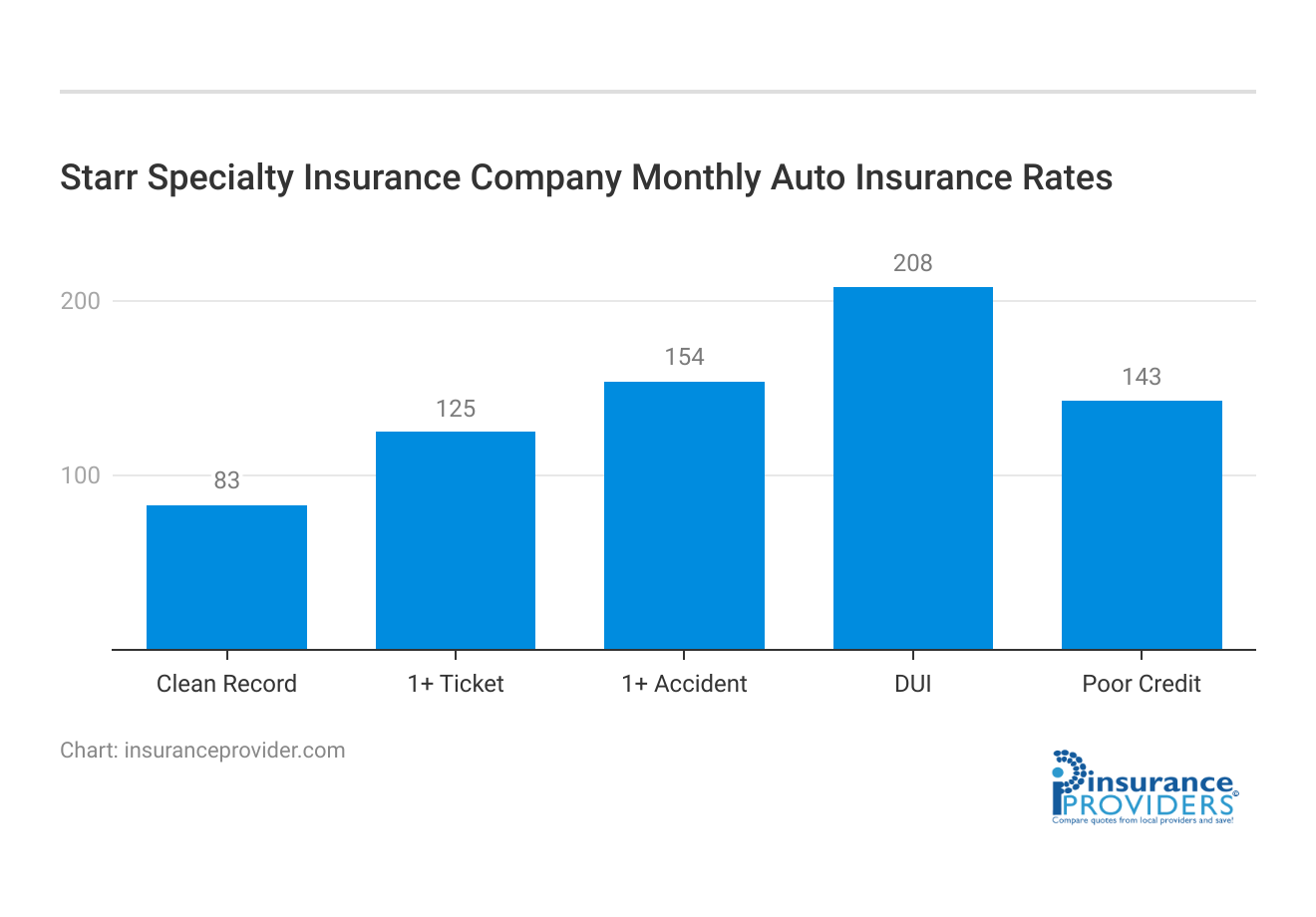

Starr Specialty Insurance Company Insurance Rates Breakdown

| Driver Profile | Starr Specialty | National Average |

|---|---|---|

| Clean Record | $83 | $119 |

| 1+ Ticket | $125 | $147 |

| 1+ Accident | $154 | $173 |

| DUI | $208 | $209 |

| Poor Credit | $143 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Starr Specialty Insurance Company Discounts Available

| Discounts | Starr Specialty |

|---|---|

| Anti Theft | 8% |

| Good Student | 13% |

| Low Mileage | 10% |

| Paperless | 11% |

| Safe Driver | 15% |

| Senior Driver | 7% |

Starr Specialty Insurance Company understands the importance of providing value to its customers, and they offers various discounts to make insurance more affordable and accessible. Here are some of the discounts that the company may offer:

- Multi-Policy Discount: Customers who bundle multiple insurance policies, such as home and auto or business and liability insurance, can often enjoy significant discounts on their premiums.

- Claims-Free Discount: Policyholders who maintain a claims-free record for a specified period may be eligible for discounts as a reward for responsible risk management.

- Safety and Security Features Discount: For home or business insurance, implementing safety and security measures like installing burglar alarms, fire sprinkler systems, or surveillance cameras can lead to lower premiums.

- Good Driver Discount: In the case of auto insurance, drivers with a clean driving record and no accidents or traffic violations can qualify for reduced rates.

- Good Student Discount: Parents with young drivers who excel academically may be eligible for discounts on auto insurance for their student drivers.

- Anti-Theft Device Discount: Installing anti-theft devices in vehicles or security systems for homes or businesses can often result in lower insurance costs.

- Group or Association Discounts: Starr Specialty may offer special discounts to members of certain professional groups, associations, or affiliations.

- Renewal Discounts: Customers who renew their policies with Starr Specialty Insurance Company may be rewarded with loyalty discounts.

- Payment Discounts: Policyholders who choose to pay their premiums annually or through automatic electronic funds transfer (EFT) may receive discounts.

- Safety Training Discounts: Some insurance policies, particularly those related to specialty coverage like marine or aviation, may offer discounts to individuals who have completed safety training or certification programs.

- Affinity Discounts: Starr Specialty may partner with organizations or employers to offer exclusive discounts to their members or employees.

Prospective policyholders should inquire directly with Starr Specialty Insurance Company to determine which discounts may apply to their specific circumstances, helping them save on their insurance premiums while ensuring adequate coverage.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Starr Specialty Insurance Company Ranks Among Providers

Starr Specialty Insurance Company operates in a competitive insurance industry where several prominent players provide similar services and products. While the competitive landscape can vary by region and specific insurance niche, some of the company’s main competitors in the insurance sector include:

- Chubb Insurance: Chubb is a global insurance giant known for its extensive range of insurance products, including property and casualty, liability, and specialty lines. They compete with Starr Specialty in providing comprehensive coverage options and high-quality service.

- AIG (American International Group): AIG is another major player in the insurance industry, offering a wide variety of insurance solutions. They often compete with Starr Specialty in areas such as professional liability, cyber insurance, and specialized coverage.

- Travelers Insurance: Travelers is renowned for its commercial and personal insurance offerings. They are a strong competitor in areas like property insurance and have a solid reputation for customer service and claims handling.

- Hartford Insurance: Hartford specializes in commercial insurance and boasts a range of policies suitable for businesses of all sizes. They compete with Starr Specialty in sectors like property, liability, and workers’ compensation insurance.

- Zurich Insurance Group: Zurich is a global insurance company with a presence in many countries. They offer a variety of business and personal insurance solutions and can be a competitor in multiple areas.

- Liberty Mutual: Liberty Mutual is known for its extensive range of insurance products, including auto, home, and commercial insurance. They are a strong competitor in personal lines of insurance.

- Allianz: Allianz is a global insurance and financial services company with a substantial footprint in various insurance sectors. They are often considered a competitor in specialty lines of insurance.

- Berkshire Hathaway: Berkshire Hathaway, led by Warren Buffett, operates in the insurance industry through its subsidiary companies, such as GEICO and Berkshire Hathaway Specialty Insurance. They are significant competitors in various segments of the insurance market.

Starr Specialty Insurance Company distinguishes itself through its focus on specialized coverage and a commitment to tailored solutions, but it competes with these and other industry giants by delivering high-quality service and coverage options

Starr Specialty Insurance Company Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Starr Specialty Insurance Company offers a user-friendly claims process that caters to the diverse needs of its policyholders. Whether you prefer the convenience of online filing, a quick phone call, or utilizing their mobile app, Starr Specialty ensures you can report claims with ease.

This flexibility in filing methods allows you to choose the most convenient option for your specific situation, ensuring a hassle-free experience.

Average Claim Processing Time

One of the critical aspects of any insurance company’s claims process is the speed at which claims are processed. Starr Specialty Insurance Company has consistently demonstrated an efficient claims processing system, working diligently to settle claims promptly.

Policyholders can expect their claims to be handled in a timely manner, reducing the stress and uncertainty often associated with insurance claims.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is invaluable when assessing the performance of an insurance company. Starr Specialty Insurance Company has earned positive reviews from its policyholders regarding claim resolutions and payouts.

Their commitment to fair and equitable claim settlements has garnered the trust and satisfaction of their customers. This track record of reliability is a testament to Starr Specialty’s dedication to serving the best interests of its policyholders.

Starr Specialty Insurance Company Digital and Technological Features

Mobile App Features and Functionality

Starr Specialty Insurance Company offers a comprehensive mobile app that empowers policyholders with convenient features and functionality. Whether you need to access your policy information, file a claim, make payments, or simply stay updated on your coverage, the mobile app provides a seamless and user-friendly experience.

With the app at your fingertips, managing your insurance needs has never been more convenient.

Online Account Management Capabilities

For those who prefer managing their insurance policies online, Starr Specialty Insurance Company provides robust online account management capabilities. Policyholders can log in to their accounts to review policy details, make changes, and access important documents.

This online portal simplifies the process of staying informed and in control of your insurance coverage.

Digital Tools and Resources

In today’s digital age, access to informative resources and tools is essential. Starr Specialty Insurance Company offers a wealth of digital resources to assist policyholders in making informed decisions about their insurance coverage.

From educational materials to risk assessment tools, these digital resources empower individuals and businesses to navigate the complexities of insurance with confidence.

Frequently Asked Questions

What types of insurance does Starr Specialty Insurance Company offer?

Starr Specialty Insurance Company provides a comprehensive array of insurance policies, including property, liability, professional liability, cyber, marine, and aviation coverage.

How does Starr Specialty Insurance Company stand out in the industry?

Starr Specialty distinguishes itself with a stellar A.M. Best rating, indicating financial strength, and maintains low complaint levels, showcasing a commitment to customer satisfaction.

What are the advantages of choosing Starr Specialty Insurance Company?

Starr Specialty offers competitive rates, tailored policies, efficient claims processing, a dedicated expert team, and extensive industry experience, providing reliable protection for individuals and businesses.

Does Starr Specialty Insurance Company operate in specific regions, and are there any limitations to their coverage?

While Starr Specialty is renowned for its specialized focus, coverage availability may be limited in certain regions, and its tailored policies may not suit all insurance needs.

How can policyholders file claims with Starr Specialty Insurance Company, and what is the average processing time?

Starr Specialty offers a user-friendly claims process through online filing, phone calls, or a mobile app, ensuring convenience, and consistently demonstrates efficient claims processing, settling claims promptly to reduce stress for policyholders.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.