State Auto Property & Casualty Insurance Company Review (2026)

Amidst the intricate landscape of insurance providers, State Auto Property & Casualty Insurance Company distinguishes itself as a stalwart industry leader, offering a diverse range of coverage solutions, fortified by financial stability and an unwavering commitment to customer satisfaction.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive article, we delve into State Auto Property & Casualty Insurance Company, a trusted name in the insurance industry. Offering an array of insurance solutions, from home and auto coverage to business protection, State Auto has garnered recognition for its financial stability with an A.M. Best rating of ‘A’ (Excellent) and a commendably low complaint level.

Their competitive edge lies in a multitude of discounts, including safe driver and multi-policy discounts, alongside a seamless claims process and customer-centric approach. With a rich history, wide coverage availability, and a commitment to customer satisfaction, State Auto stands as a reliable choice for safeguarding assets, exemplifying excellence in insurance services.

State Auto Property & Casualty Insurance Company Insurance Coverage Options

Navigating the world of insurance can be a complex journey, and having the right coverage is paramount to protect what matters most to you. Here’s a discussion of the coverage options offered by State Auto Property & Casualty Insurance Company, presented in a bullet list for clarity:

Home Insurance

- Homeowners Insurance: Protects your home and belongings from unforeseen events like fire, theft, or natural disasters.

- Renters Insurance: Offers coverage for your personal property and liability as a renter.

- Condo Insurance: Tailored coverage for condo owners, including building and liability protection.

Auto Insurance

- Car Insurance: Provides coverage for your vehicle, liability, and medical expenses in case of accidents.

- Motorcycle Insurance: Tailored protection for motorcycle enthusiasts.

- RV Insurance: Covers your recreational vehicles for both on-road and off-road adventures.

Business Insurance

- Business Owners Policy (BOP): Comprehensive coverage for small businesses, combining property and liability insurance.

- Commercial Auto Insurance: Protects your business vehicles and drivers.

- Workers’ Compensation: Ensures the well-being of your employees and complies with legal requirements.

Coverage options cater to a diverse range of insurance needs, whether you’re looking to protect your home, vehicles, or business assets. State Auto’s offerings provide a comprehensive safety net for policyholders.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

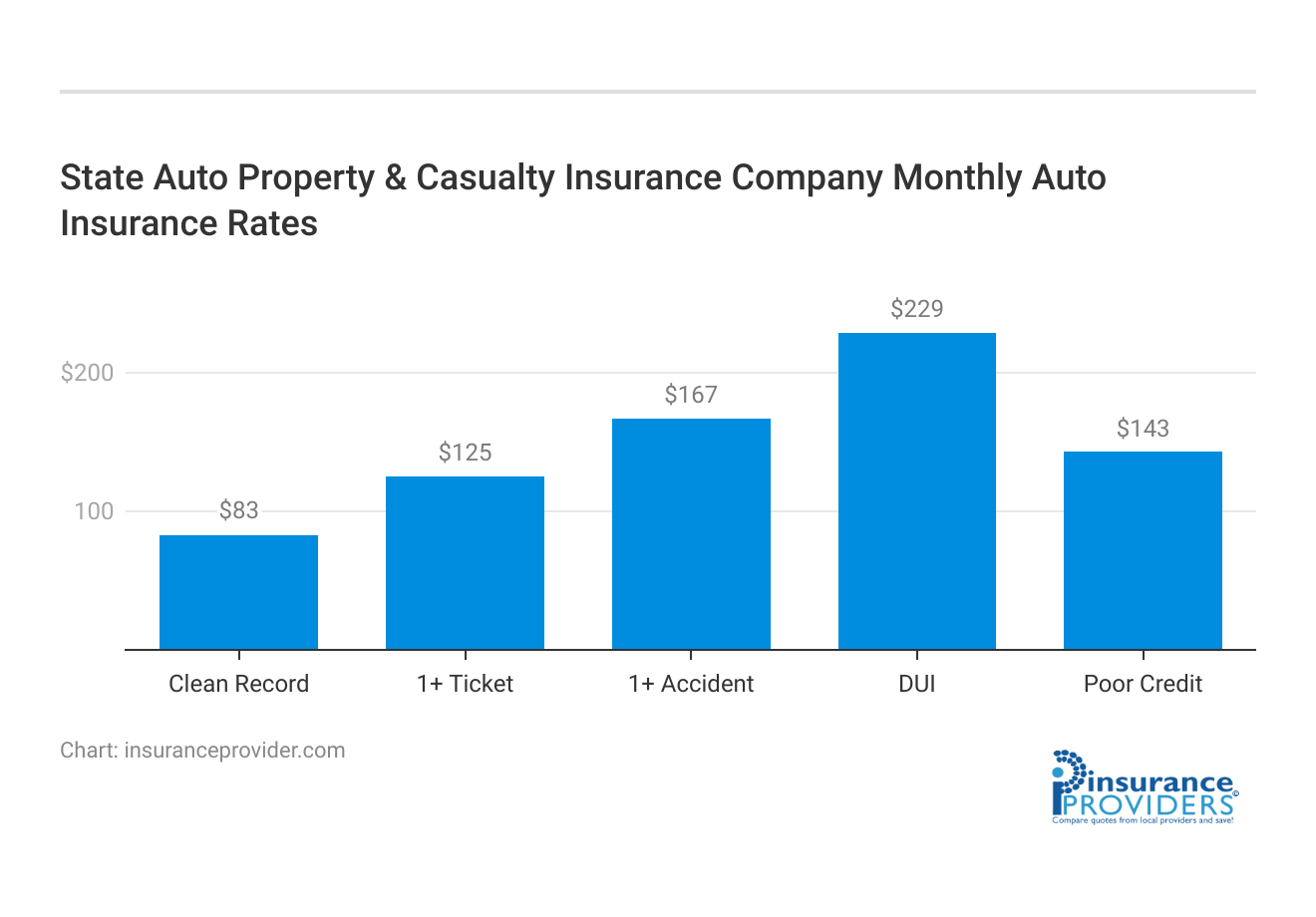

State Auto Property & Casualty Insurance Company Insurance Rates Breakdown

| Driver Profile | State Auto | National Average |

|---|---|---|

| Clean Record | $83 | $119 |

| 1+ Ticket | $125 | $147 |

| 1+ Accident | $167 | $173 |

| DUI | $229 | $209 |

| Poor Credit | $143 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

State Auto Property & Casualty Insurance Company Discounts Available

| Discounts | State Auto |

|---|---|

| Anti Theft | 10% |

| Good Student | 12% |

| Low Mileage | 8% |

| Paperless | 6% |

| Safe Driver | 13% |

| Senior Driver | 9% |

In the world of insurance, finding ways to save without compromising on coverage is a smart strategy. State Auto Property & Casualty Insurance Company understands this. Here’s a discussion of the discounts offered by State Auto Property & Casualty Insurance Company, presented in a bullet list for clarity:

- Safe Driver Discounts: State Auto rewards safe drivers with lower premiums. If you have a clean driving record with no accidents or violations, you may qualify for this discount.

- Multi-Policy Discounts: Bundling your home and auto insurance policies with State Auto can lead to significant savings. This convenient option simplifies your insurance needs while reducing costs.

- Good Student Discounts: If you have a young driver in your household who maintains an excellent academic record, State Auto offers discounts to recognize their responsible behavior.

- Anti-Theft Device Discounts: Installing anti-theft devices in your vehicle can lower the risk of theft, leading to potential discounts on your auto insurance.

- Home Safety Discounts: Implementing safety features in your home, such as a security system or smoke detectors, can make you eligible for discounts on your homeowners’ insurance.

- Paid-in-Full Discounts: Paying your insurance premium in full for the year can often result in a discount on your policy.

- Good Payer Discounts: Consistently paying your insurance premiums on time can lead to discounts as a sign of responsible financial behavior.

- Loyalty Discounts: Staying with State Auto as a long-term customer may qualify you for loyalty discounts, rewarding your commitment to the company.

- New Car Discounts: Insuring a new car with State Auto may result in lower premiums, as new cars often come with advanced safety features.

These discounts provide policyholders with opportunities to reduce their insurance costs while maintaining comprehensive coverage. State Auto encourages responsible driving, home safety, and customer loyalty through these cost-saving incentives.

How State Auto Property & Casualty Insurance Company Ranks Among Providers

State Auto Property & Casualty Insurance Company operates in a highly competitive insurance industry. Its main competitors include both large national carriers and regional insurers. Here are some of the company’s main competitors:

- State Farm: State Farm is one of the largest insurance providers in the United States. They offer a wide range of insurance products, including auto, home, and life insurance. State Farm’s extensive agent network and financial stability make it a formidable competitor.

- Allstate: Allstate is another major player in the insurance industry, known for its diverse insurance offerings and strong brand presence. They provide auto, home, and life insurance, along with various discounts and features.

- Progressive: Progressive is renowned for its innovative approach to auto insurance and its aggressive marketing campaigns. They are particularly competitive in the auto insurance market, offering unique features such as usage-based insurance.

- Geico: Geico, part of the Berkshire Hathaway group, is known for its humorous advertising and competitive pricing. They specialize in auto insurance and have gained a significant market share through online and phone-based sales.

- Nationwide: Nationwide offers a broad range of insurance products, including auto, home, and pet insurance. They are known for their focus on customer service and financial stability.

- Farmers Insurance: Farmers Insurance Group provides various insurance options, including auto, home, and business insurance. They have a strong network of agents and competitive rates.

- Liberty Mutual: Liberty Mutual offers a wide range of insurance products and is known for its customizable coverage options and customer-centric approach.

- Travelers: Travelers is a well-established insurer that provides coverage for both individuals and businesses. They are recognized for their expertise in risk management and commercial insurance.

- American Family Insurance: American Family Insurance is a regional insurer with a strong presence in the Midwest. They offer a variety of insurance products and emphasize community involvement.

- Erie Insurance: Erie Insurance is a regional insurer with a reputation for excellent customer service and competitive rates in the regions they serve.

State Auto competes with these companies by offering a range of insurance solutions, maintaining financial stability, and providing excellent customer service. To stay competitive, insurance companies often differentiate themselves through coverage options, pricing, customer service, and innovative technology.

Customers typically compare these factors when choosing an insurance provider, and competition within the industry remains fierce.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

A Look Into the Claims Process of State Auto Property & Casualty Insurance Company

Ease of Filing a Claim

State Auto Property & Casualty Insurance Company offers a user-friendly claims process, providing multiple avenues for policyholders to file claims.

Whether you prefer online convenience, a phone call, or utilizing their mobile app, State Auto ensures that you can easily report and initiate your claims. Their commitment to accessibility and flexibility in claim reporting reflects their dedication to customer satisfaction.

Average Claim Processing Time

One of the key factors that distinguish an insurance company’s service quality is the speed at which they process claims. State Auto Property & Casualty Insurance Company is known for its efficient claim processing. Policyholders often experience prompt responses and resolutions to their claims, helping them get back on their feet quickly during challenging times.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback plays a crucial role in evaluating an insurance company’s performance. State Auto Property & Casualty Insurance Company consistently receives positive feedback regarding their claim resolutions and payouts. Their commitment to fair and timely settlements demonstrates their dedication to providing peace of mind and support to their policyholders.

The Digital and Technological Features of State Auto Property & Casualty Insurance Company

Mobile App Features and Functionality

State Auto Property & Casualty Insurance Company offers a robust mobile app that empowers policyholders with convenient access to their insurance information.

The app features user-friendly navigation, and policy management tools, and even allows users to file claims directly from their mobile devices. It’s a testament to their commitment to modernizing the insurance experience.

Online Account Management Capabilities

Managing insurance policies and accounts has never been easier, thanks to State Auto’s comprehensive online account management capabilities. Policyholders can log in to their accounts, review policy details, make payments, and access important documents at their convenience. This digital convenience enhances the overall customer experience.

Digital Tools and Resources

In addition to its mobile app and online account management, State Auto Property & Casualty Insurance Company provides a range of digital tools and resources to assist policyholders.

These resources include informative articles, FAQs, and educational materials that empower customers to make informed decisions about their insurance coverage. State Auto’s commitment to digital resources underscores its dedication to customer education and support.

Frequently Asked Questions

How can I get a quote from State Auto Property & Casualty Insurance Company?

Getting a quote from State Auto is easy. You can visit their official website and use their online quoting tool, or you can contact a local State Auto agent who will assist you in obtaining a personalized quote tailored to your needs.

What discounts are available for auto insurance policies?

State Auto offers a range of discounts for auto insurance policies, including safe driver discounts, multi-policy discounts for bundling home and auto coverage, good student discounts for young drivers with excellent academic records, and more.

Does State Auto offer bundling options for home and auto insurance?

Yes, State Auto provides bundling options that allow you to combine your home and auto insurance policies. Bundling can lead to significant savings, making it a convenient choice for those looking to simplify their insurance needs while reducing costs.

How do I file a claim with State Auto Insurance?

Filing a claim with State Auto is a straightforward process. You can initiate a claim by contacting their claims department via phone or through their website. A claims representative will guide you through the process, gather necessary information, and assist you in resolving your claim as quickly as possible.

What makes State Auto Property & Casualty Insurance Company stand out from other insurers?

State Auto stands out for its comprehensive range of insurance options, exceptional A.M. Best rating (A – Excellent), low complaint level, and commitment to customer satisfaction. Their array of discounts, seamless claims process, and financial stability make them a reliable choice for your insurance needs.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.