TJM Life Insurance Company: Customer Ratings & Reviews [2026]

Navigate through the offerings, discounts, and customer reviews of T.J.M. Life Insurance Company, a trusted player in the competitive insurance industry.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywri...

Tonya Sisler

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated April 2024

T.J.M. Life Insurance Company offers a wide range of insurance and investment products, including term life insurance, whole life insurance, and annuities. Founded in 1986, the company is dedicated to providing financial security to its customers and is highly rated by independent agencies for its strong financial stability.

T.J.M. Life Insurance Company offers competitive rates for its products and services, with a low complaint level and positive customer reviews for its comprehensive coverage options and attentive customer service.

Although information on discounts and qualifications for discounts is limited, the company’s transparent policies and claims process make it a reliable choice for those seeking financial protection.

What You Should Know About T.J.M. Life Insurance Company

Company Contact Information:

- Website: https://tjminsurance.com/

- Phone: 1-800-928-4998

- Email: info@tjminsurance.com

- Mailing Address: T.J.M. Life Insurance Company, P.O. Box 1218, Dunedin, FL 34697

Related Parent or Child Companies:

- T.J.M. Life Insurance Company is a subsidiary of Torchmark Corporation, a financial services holding company.

Financial Ratings:

- T.J.M. Life Insurance Company has received high financial strength ratings from independent rating agencies, including A+ (Superior) from A.M. Best and AA- (Very Strong) from Fitch Ratings.

Customer Service Ratings:

- T.J.M. Life Insurance Company has received positive reviews from customers for their excellent customer service.

Claims Information:

- To file a claim with T.J.M. Life Insurance Company, customers should contact the company’s claims department by phone or mail. The claims process typically involves providing proof of death and completing a claims form.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

T.J.M. Life Insurance Company Insurance Coverage Options

T.J.M. Life Insurance Company offers a variety of insurance and investment products to its customers. Here are some of the coverage options mentioned in the article:

- Term Life Insurance: Provides coverage for a specific period of time and pays out a death benefit if the policyholder passes away during the term.

- Whole Life Insurance: Provides lifelong coverage and accumulates cash value over time. Can be used as a source of investment or to cover final expenses.

- Annuities: Provides a guaranteed income stream for a specified period of time or for life.

- Universal Life Insurance: Combines the flexibility of term life insurance with the investment component of whole life insurance.

- Indexed Universal Life Insurance: Offers potential for higher returns based on the performance of an underlying index.

- Variable Universal Life Insurance: Allows policyholders to invest in a variety of investment options and may provide a higher rate of return than traditional whole life insurance.

- Group Life Insurance: Provides coverage for groups of employees, typically offered by employers.

- Mortgage Protection Insurance: Pays off the remaining balance on a mortgage if the policyholder passes away.

- Final Expense Insurance: Covers the cost of funeral expenses and other end-of-life expenses.

This is not an exhaustive list of all coverage options offered by T.J.M. Life Insurance Company. Customers are advised to contact the company directly for more information on coverage options and eligibility requirements.

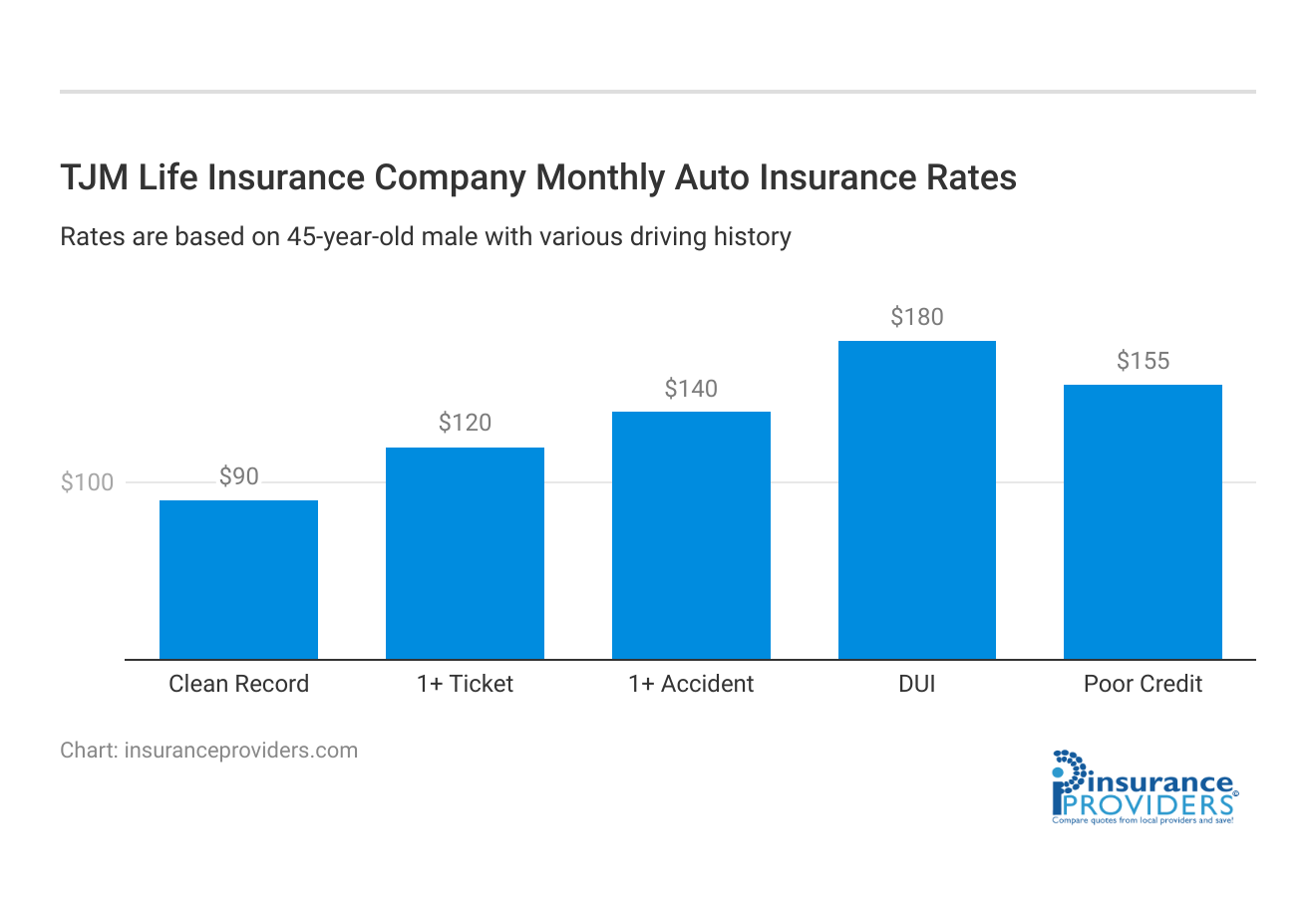

T.J.M. Life Insurance Company Insurance Rates Breakdown

| Driver Profile | TJM | National Average |

|---|---|---|

| Clean Record | $90 | $119 |

| 1+ Ticket | $120 | $147 |

| 1+ Accident | $140 | $173 |

| DUI | $180 | $209 |

| Poor Credit | $155 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

T.J.M. Life Insurance Company Discounts Available

| Discount | TJM |

|---|---|

| Anti Theft | 7% |

| Good Student | 10% |

| Low Mileage | 5% |

| Paperless | 12% |

| Safe Driver | 18% |

| Senior Driver | 3% |

T.J.M. Life Insurance Company offers several types of discounts to customers, including:

- Multi-policy discount: Customers who have multiple policies with T.J.M. Life Insurance Company may be eligible for a discount on their premiums.

- Non-smoker discount: Customers who do not smoke or use tobacco products may be eligible for a discount on their premiums.

- Preferred health discount: Customers who meet certain health criteria, such as having a healthy BMI and no history of tobacco or drug use, may be eligible for a discount on their premiums.

- Group discount: Customers who are members of certain groups or organizations may be eligible for a discount on their premiums.

- Payment method discount: Customers who choose to pay their premiums annually or semi-annually may be eligible for a discount.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How T.J.M. Life Insurance Company Ranks Among Providers

Considering the overall landscape of the life insurance industry, below are some potential competitors and their unique features that set them apart:

- State Farm: A well-known insurance company that offers a range of insurance and investment products, including life insurance. State Farm may appeal to customers who value a long-standing reputation and personalized service, as they have local agents in many areas.

- Allstate: Another well-known insurance company that offers a range of insurance and investment products, including life insurance. Allstate may appeal to customers who want a one-stop-shop for all their insurance needs, as they offer a variety of insurance products in addition to life insurance.

- Northwestern Mutual: A mutual insurance company that has a reputation for financial strength and stability. Northwestern Mutual may appeal to customers who value a company with a long history of paying dividends and a commitment to financial security.

- New York Life: A mutual insurance company that offers a range of life insurance and investment products, including annuities and long-term care insurance. New York Life may appeal to customers who value a company with a long-standing reputation and a commitment to financial strength.

- Prudential: A well-known insurance company that offers a range of insurance and investment products, including life insurance. Prudential may appeal to customers who value a company with a long-standing reputation and a variety of insurance and investment options.

This is not an exhaustive list of competitors, and the factors that distinguish one company from another may vary based on individual needs and preferences. Customers are advised to research and compare multiple companies before choosing a life insurance provider.

Frequently Asked Questions

What types of insurance products does T.J.M. Life Insurance Company offer?

T.J.M. Life Insurance Company provides a range of insurance and investment products, including term life insurance, whole life insurance, and annuities.

How does T.J.M. Life Insurance Company rate in terms of financial strength and stability?

T.J.M. Life Insurance Company has received high financial strength ratings from independent agencies, including A+ (Superior) from A.M. Best and AA- (Very Strong) from Fitch Ratings.

What sets T.J.M. Life Insurance Company apart from its competitors in the industry?

T.J.M. Life Insurance Company distinguishes itself through competitive rates, a low complaint level, and positive customer reviews for comprehensive coverage options and attentive customer service.

How can customers file a claim with T.J.M. Life Insurance Company?

To file a claim, customers should contact the company’s claims department by phone or mail, providing proof of death and completing a claims form.

Is T.J.M. Life Insurance Company affiliated with any specific insurance provider, and how does this affiliation impact their content?

T.J.M. Life Insurance Company is not affiliated with any single insurance provider, ensuring unbiased content. Their editorial guidelines prioritize being an objective, third-party resource for insurance-related information.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.