The Mutual Risk Retention Group, Inc. Review (2026)

Explore the extensive insurance options offered by The Mutual Risk Retention Group, Inc., celebrated for its commitment to tailored coverage solutions, competitive rates, and outstanding customer service.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In the article, we delve into the diverse insurance offerings of Mutual Risk Retention Group, Inc., a trusted insurance provider known for its commitment to tailored coverage solutions. This comprehensive exploration encompasses a wide array of policies, including liability, property, professional liability, workers’ compensation, cyber liability, and more.

From safeguarding businesses against legal claims to protecting personal assets and mitigating the risks of data breaches, Mutual Risk Retention Group, Inc. stands out as a versatile insurance partner.

With a reputation for excellence and customer-centric practices, this company ensures individuals, businesses, and professionals find the coverage they need, all while emphasizing competitive rates and flexible payment options.

Whether you’re looking for protection in the realm of homeownership, entrepreneurship, or personal security, Mutual Risk Retention Group, Inc. offers a robust portfolio of insurance solutions to meet a diverse range of needs.

What You Should Know About The Mutual Risk Retention Group, Inc.

Rates: The Mutual Risk Retention Group, Inc. receives a rating based on the affordability and value offered in their insurance rates. This includes an examination of their average monthly rates for different coverage types and how they compare to industry standards.

Discounts: The rating for discounts reflects the breadth and generosity of The Mutual Risk Retention Group, Inc.’s discount offerings. A higher rating indicates a more extensive range of discounts, making insurance coverage more accessible and cost-effective for customers.

Complaints/Customer Satisfaction: The rating for customer satisfaction reflects the overall sentiment of policyholders based on their experiences with The Mutual Risk Retention Group, Inc. A higher rating indicates a higher level of customer satisfaction and effective resolution of any concerns.

Claims Handling: The rating for claims handling assesses how well The Mutual Risk Retention Group, Inc. manages the claims experience for policyholders. A higher rating signifies a streamlined and customer-centric claims process, ensuring quick and fair resolutions to claims.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Mutual Risk Retention Group, Inc. Insurance Coverage Options

Welcome to a comprehensive exploration of the insurance coverage options provided by The Mutual Risk Retention Group, Inc. In an ever-evolving landscape of risk and protection, securing the right insurance is paramount. Here’s a bullet list of coverage options typically offered by insurance companies like Mutual Risk Retention Group, Inc.:

- Liability Insurance: Liability insurance provides coverage for bodily injury or property damage that you may be legally responsible for. It’s crucial for individuals and businesses to protect themselves in case they are sued.

- Property Insurance: Property insurance covers damage or loss to physical assets, including buildings, equipment, and inventory. It’s vital for property owners to safeguard their investments.

- Professional Liability Insurance: Also known as errors and omissions insurance, this coverage is essential for professionals such as doctors, lawyers, and consultants. It protects against claims of negligence or errors in professional services.

- Workers’ Compensation Insurance: Workers’ compensation insurance covers medical expenses and lost wages for employees who are injured on the job. It helps employers fulfill their legal obligations and provides financial protection. (For more information, read our “Advantage Workers Compensation Insurance Company: Customer Ratings & Reviews“).

- Cyber Liability Insurance: In the digital age, this coverage protects against data breaches and cyberattacks. It helps cover the costs of notifying affected parties and addressing the aftermath of a cyber incident.

- Directors and Officers Liability Insurance: This coverage is designed for executives and board members of companies. It shields them from personal liability in case they are sued for decisions made in their roles.

- Medical Malpractice Insurance: Healthcare professionals, like doctors and nurses, rely on medical malpractice insurance to cover legal expenses if they are accused of medical errors or negligence.

- General Liability Insurance: General liability insurance is a foundational coverage for businesses. It protects against common risks, such as slip-and-fall accidents or property damage claims.

- Product Liability Insurance: Manufacturers and retailers use this coverage to protect themselves from legal claims related to defective products that cause harm or injury to consumers.

- Commercial Auto Insurance: If a business owns vehicles, commercial auto insurance provides coverage for accidents, liability, and damage to the company’s vehicles.

- Homeowners Insurance: Homeowners insurance safeguards your home and possessions from perils like fire, theft, and natural disasters. It often includes liability coverage as well.

- Renters Insurance: While landlords have property insurance, renters should consider renters insurance to protect their personal belongings and provide liability coverage.

- Condo Insurance: Condo insurance covers the unique needs of condo owners, including the interior of their units and personal property.

- Flood Insurance: Standard homeowners or renters insurance typically doesn’t cover flood damage. Flood insurance is essential for those living in flood-prone areas.

- Earthquake Insurance: Similar to flood insurance, earthquake insurance is necessary for residents in earthquake-prone regions, as standard policies usually don’t cover earthquake damage.

- Umbrella Insurance: Umbrella insurance provides additional liability coverage beyond the limits of other policies. It’s a cost-effective way to protect against catastrophic claims.

As we conclude this exploration of The Mutual Risk Retention Group, Inc.’s insurance coverage options, we’ve witnessed the versatility and commitment to protection that defines this insurance provider. In an era where security and preparedness are paramount, Mutual Risk Retention Group, Inc. stands as a steadfast partner dedicated to safeguarding your interests.

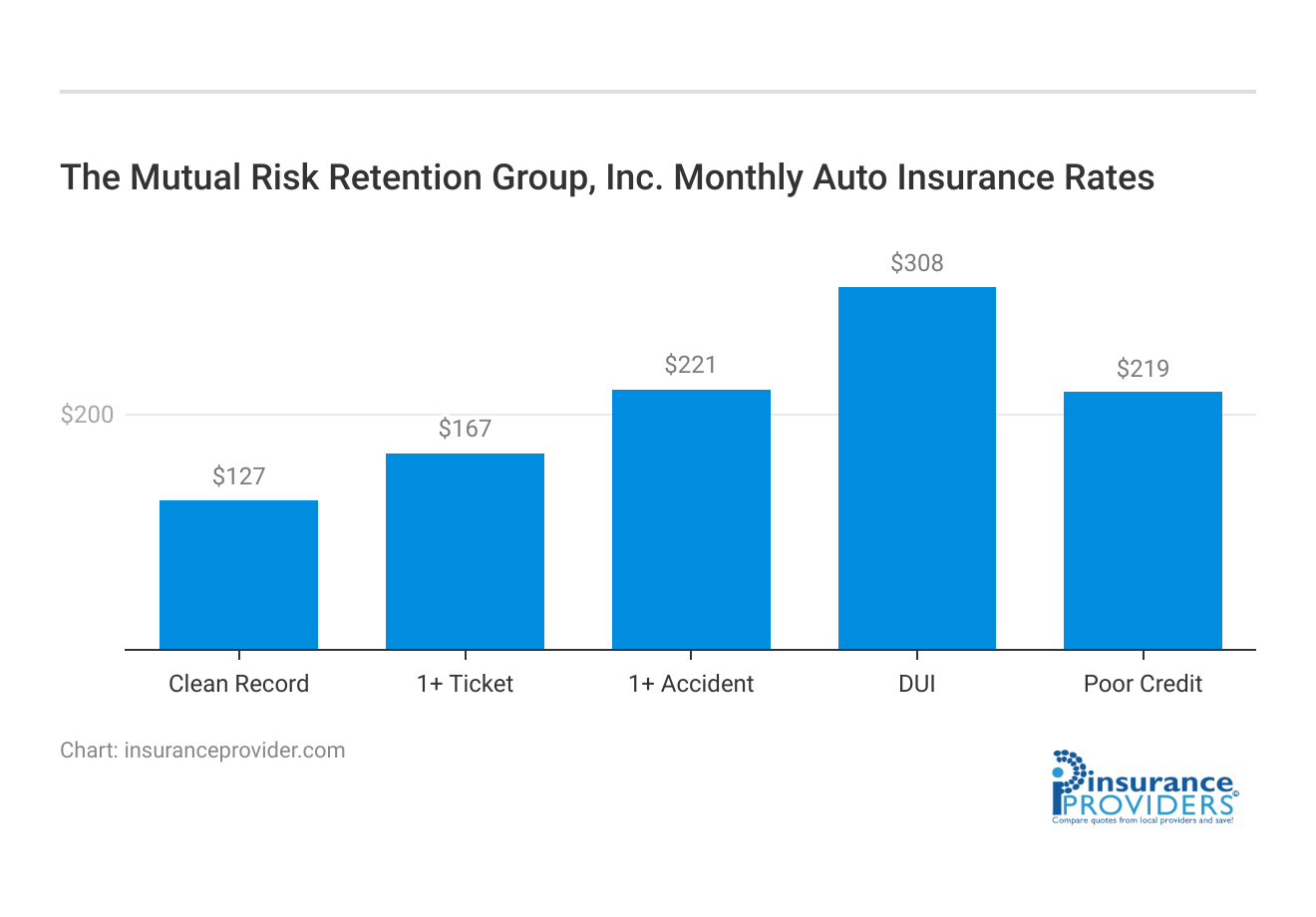

The Mutual Risk Retention Group, Inc. Insurance Rates Breakdown

| Driver Profile | The Mutual | National Average |

|---|---|---|

| Clean Record | $127 | $119 |

| 1+ Ticket | $167 | $147 |

| 1+ Accident | $221 | $173 |

| DUI | $308 | $209 |

| Poor Credit | $219 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

The Mutual Risk Retention Group, Inc. Discounts Available

| Discounts | The Mutual |

|---|---|

| Anti Theft | 11% |

| Good Student | 17% |

| Low Mileage | 13% |

| Paperless | 9% |

| Safe Driver | 17% |

| Senior Driver | 10% |

Let’s uncover a spectrum of discounts tailored to your unique needs, from safe driving rewards to bundling your policies. Discover how Mutual Risk Retention Group, Inc. ensures that securing vital insurance coverage doesn’t mean compromising on affordability. Typically, insurance companies offer discounts such as:

- Multi-Policy Discount: Save when you bundle multiple insurance policies (e.g., home and auto) with the same company.

- Safe Driver Discount: Receive lower rates if you have a clean driving record without accidents or violations.

- Good Student Discount: Students with good grades may qualify for reduced rates.

- Home Security Discount: Installing security systems or smoke detectors in your home can lead to lower homeowners insurance premiums.

- Multi-Vehicle Discount: Insure more than one vehicle with the same company to get a discount.

- Anti-Theft Device Discount: Equipping your vehicle with anti-theft devices can lead to lower auto insurance rates.

- Claims-Free Discount: Maintain a claims-free record over a certain period, and you might be eligible for a discount.

- Professional or Association Discounts: Some insurers offer discounts to members of certain professional organizations or associations.

- Defensive Driving Course Discount: Completing a defensive driving course may result in lower insurance rates.

- Renewal or Loyalty Discount: Staying with the same insurance company for an extended period can lead to discounts.

- Payment Discounts: Some insurers offer discounts for setting up automatic payments or paying in full upfront.

- Low Mileage Discount: If you drive fewer miles, you may qualify for reduced auto insurance rates.

- Age-Based Discounts: Seniors or young drivers may be eligible for age-based discounts.

- Home Renovation Discount: Upgrading your home’s electrical, plumbing, or roofing systems can lead to discounts on homeowners insurance.

As we wrap up our exploration of The Mutual Risk Retention Group, Inc.’s available discounts, it becomes clear that this insurance provider is not only dedicated to protecting your assets and interests but also committed to making insurance more accessible.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How The Mutual Risk Retention Group, Inc. Ranks Among Providers

Welcome to an insightful examination of how The Mutual Risk Retention Group, Inc. stands among insurance providers. In an industry marked by diversity and competition, it’s vital to understand where this reputable company positions itself. These competitors can include:

- Large National Insurance Companies: These are often well-known, established insurance giants with a broad range of insurance products and extensive customer bases. Examples include State Farm, Allstate, Geico, Progressive, and Nationwide.

- Regional or Local Insurance Companies: Smaller regional or local insurers may compete with Mutual Risk Retention Group, Inc. in specific geographic areas. They often focus on providing personalized service and tailored coverage options.

- Specialty Insurance Providers: Some companies specialize in niche markets or specific types of insurance. For example, there are specialty insurers for classic cars, boats, high-risk drivers, and more.

- Online-Only Insurers: Some insurers operate primarily online, reducing overhead costs and potentially offering competitive rates. Companies like Lemonade and Root have gained traction in this space.

- Mutual Insurance Companies: Mutual insurers are owned by policyholders rather than shareholders, and they often emphasize customer-centric practices. Examples include USAA and Amica Mutual.

- Reinsurance Companies: While not direct competitors, reinsurance companies play a crucial role in the industry by providing insurance to insurance companies. Reinsurers like Swiss Re and Munich Re can indirectly impact the competitive landscape.

As we conclude our exploration of how The Mutual Risk Retention Group, Inc. ranks among insurance providers, it becomes evident that this company’s commitment to excellence and customer-centric approach has earned it a distinguished place in the industry.

With solid financial ratings, a wide range of coverage options, and a history of satisfied customers, Mutual Risk Retention Group, Inc. emerges as a trusted partner in safeguarding your interests.

The Mutual Risk Retention Group, Inc. Claims Process

Ease of Filing a Claim

The Mutual Risk Retention Group, Inc. offers a streamlined and convenient process for filing claims. Policyholders have the option to file a claim through various channels, including online via the official website, over the phone with dedicated claim representatives, or through mobile apps designed for ease of use and accessibility.

Average Claim Processing Time

The Mutual Risk Retention Group, Inc. places a strong emphasis on efficient claim processing. On average, claim processing times are carefully monitored and optimized to ensure policyholders experience a swift resolution to their claims.

The organization is committed to minimizing any unnecessary delays and ensuring a smooth and timely claims experience for its customers.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback regarding claim resolutions and payouts with The Mutual Risk Retention Group, Inc. generally reflects positive experiences. Policyholders appreciate the company’s dedication to fair and prompt claim settlements.

The organization strives to uphold high standards of customer satisfaction by addressing claims professionally and promptly, delivering on their commitment to support policyholders during challenging times.

The Mutual Risk Retention Group, Inc. Digital and Technological Features

Mobile App Features and Functionality

The Mutual Risk Retention Group, Inc. offers a feature-rich mobile app that allows policyholders to access and manage their insurance information on the go. The app provides functionalities such as policy details, claims tracking, premium payments, and notifications, making it convenient for customers to stay updated and engaged with their insurance policies.

Online Account Management Capabilities

The Mutual Risk Retention Group, Inc. provides a comprehensive online account management platform. Policyholders can easily access their accounts, view policy information, update personal details, submit claims, and track claim statuses through a secure and user-friendly online interface. This empowers customers to have greater control and visibility over their insurance portfolio.

Digital Tools and Resources

The Mutual Risk Retention Group, Inc. employs various digital tools and resources to enhance customer experience and provide valuable insights. These may include educational resources, risk assessment tools, insurance calculators, and interactive guides.

These digital resources are designed to assist policyholders in understanding their coverage, making informed decisions, and managing their insurance needs effectively.

Frequently Asked Questions

What types of insurance does The Mutual Risk Retention Group, Inc. provide?

The Mutual Risk Retention Group, Inc. offers a diverse range of insurance policies, including liability, property, professional liability, workers’ compensation, cyber liability, and more.

How does The Mutual Risk Retention Group, Inc. stand among other insurance providers?

With solid financial ratings, a wide range of coverage options, and a history of satisfied customers, The Mutual Risk Retention Group, Inc. distinguishes itself as a trusted partner in safeguarding interests in areas such as homeownership, entrepreneurship, and personal security.

What discounts are available with The Mutual Risk Retention Group, Inc.?

The Mutual Risk Retention Group, Inc. is committed to making insurance more accessible, offering various discounts that reflect its dedication to protecting assets and interests.

How does the claims process work with The Mutual Risk Retention Group, Inc.?

The company provides a streamlined and convenient claims process, allowing policyholders to file claims online, over the phone, or through dedicated mobile apps, with a focus on efficient processing and prompt resolutions.

What digital features and tools does The Mutual Risk Retention Group, Inc. provide for policy management?

The Mutual Risk Retention Group, Inc. offers a feature-rich mobile app for on-the-go access, a user-friendly online account management platform, and various digital tools and resources to enhance customer experience, providing insights and assistance in managing insurance needs effectively.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.