The State Life Insurance Company Review (2026)

Unveil the comprehensive suite of insurance offerings, The State Life Insurance Company, delivering reliable coverage across life, health, auto, and home insurance accompanied by a stellar reputation for outstanding customer service.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive article, we explore the offerings of The State Life Insurance Company, a trusted name in the insurance industry. The company provides a diverse range of insurance products, including life, health, auto, and home insurance, all backed by a stellar A+ (Superior) A.M. Best rating and a commendably low complaint level.

State Life’s strength lies in its commitment to financial stability, prompt claims processing, and exceptional customer service. They offer customizable insurance plans, competitive rates, and attractive bundle discounts for auto and home insurance, making them a reliable choice for securing your future.

With their quick approval process for health insurance policies and a history of accolades for excellence, The State Life Insurance Company stands out as a provider dedicated to safeguarding what matters most to you.

What You Should Know About The State Life Insurance Company

Rates: The rating reflects The State Life Insurance Company’s competitive rates, determined through a thorough comparison with industry standards. The company strives to offer cost-effective premiums tailored to individual policyholder profiles.

Discounts: The rating for discounts acknowledges The State Life Insurance Company’s commitment to providing attractive incentives. The company offers a range of discounts, enhancing the affordability of coverage for policyholders.

Complaints/Customer Satisfaction: The customer satisfaction rating considers The State Life Insurance Company’s commendably low complaint level and positive feedback. A focus on customer service contributes to high satisfaction among policyholders.

Claims Handling: The high rating for claims handling underscores The State Life Insurance Company’s commitment to a user-friendly claims process, prompt resolutions, and positive customer feedback on the fairness and efficiency of claim payouts.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The State Life Insurance Company Insurance Coverage Options

The State Life Insurance Company provides a wide range of coverage options to meet the diverse needs of its customers. These coverage options encompass various aspects of life, health, and property insurance. Here’s a breakdown of the coverage options typically offered by the company:

Life Insurance:

- Term Life Insurance: Coverage for a specified term, often with lower premiums.

- Whole Life Insurance: Permanent coverage with a cash value component.

- Universal Life Insurance: Flexible coverage with the ability to adjust premiums and death benefits.

- Final Expense Insurance: Designed to cover funeral and end-of-life expenses.

Health Insurance:

- Individual Health Insurance: Personalized health coverage for individuals.

- Family Health Insurance: Coverage for the entire family in a single policy.

- Group Health Insurance: Coverage provided through an employer or organization.

- Medicare Supplements: Plans to fill gaps in Medicare coverage for seniors.

- Dental Insurance: Coverage for dental care and procedures.

- Vision Insurance: Coverage for eye care, including exams and eyewear.

Auto Insurance:

- Liability Insurance: Protection against damage and injuries you may cause to others.

- Collision Coverage: Coverage for damage to your vehicle in an accident.

- Comprehensive Coverage: Protection against non-collision-related damage (e.g., theft, vandalism).

- Uninsured/Underinsured Motorist Coverage: Coverage if you’re involved in an accident with an uninsured or underinsured driver.

- Personal Injury Protection (PIP): Coverage for medical expenses and more, regardless of fault.

Home Insurance:

- Homeowners Insurance: Protection for your home and personal belongings.

- Condo Insurance: Coverage for condo unit owners, including liability.

- Renters Insurance: Coverage for personal property when renting a home or apartment.

- Flood Insurance: Protection against damage from floods.

- Earthquake Insurance: Coverage for earthquake-related damage.

Additional Benefits:

- Riders: Optional add-ons to customize your insurance policies for specific needs.

- Disability Insurance: Income protection in case of disability-preventing work.

- Long-Term Care Insurance: Coverage for extended healthcare and nursing home expenses.

- Annuities: Investment products that provide a steady income stream.

These coverage options are designed to offer comprehensive protection and financial security in various life situations. It’s important to consult with a State Life insurance agent to tailor your coverage to your unique needs and circumstances. The company’s commitment to customization allows policyholders to create insurance plans that suit their individual or family requirements.

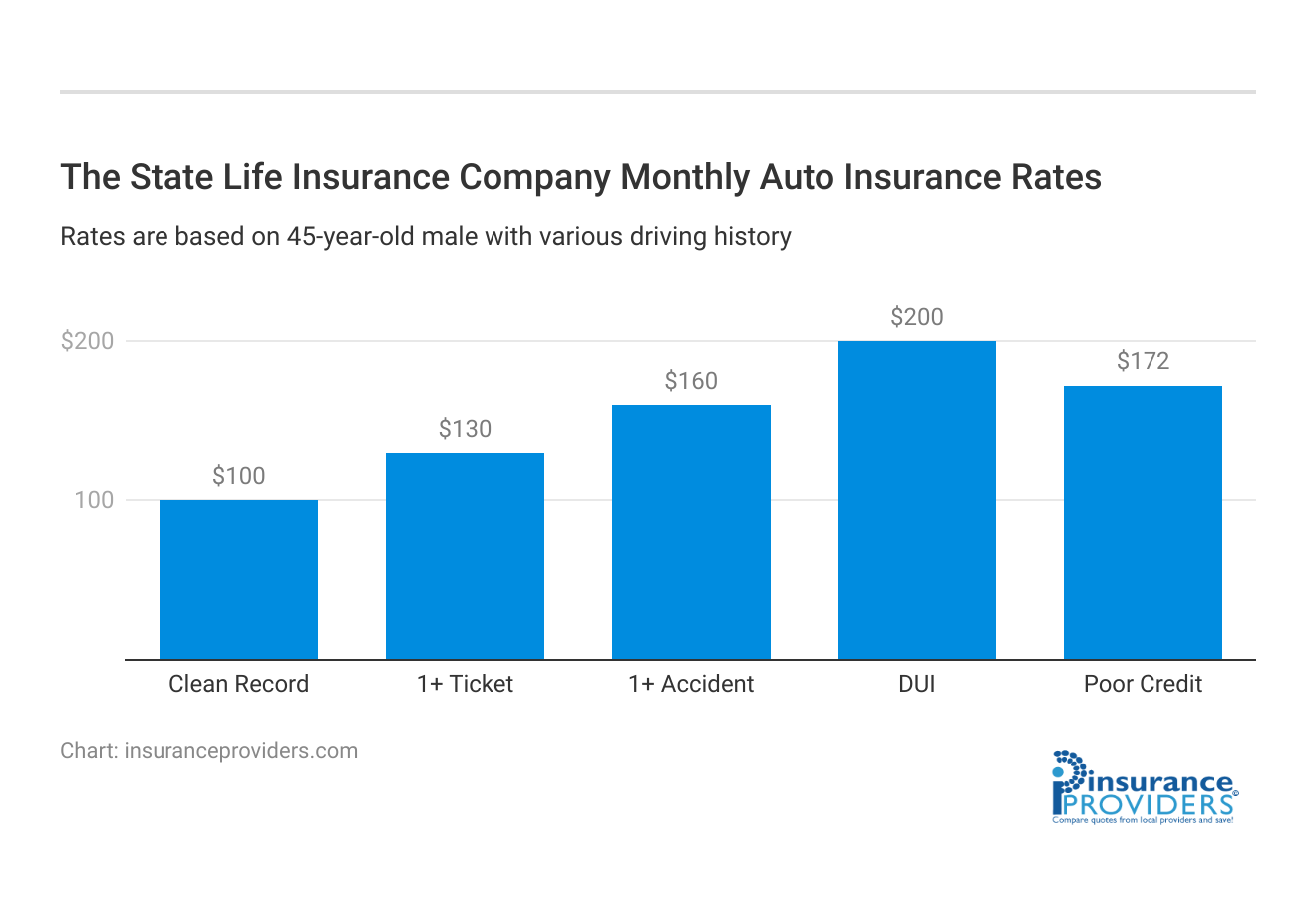

The State Life Insurance Company Insurance Rates Breakdown

| Driver Profile | The State | National Average |

|---|---|---|

| Clean Record | $100 | $119 |

| 1+ Ticket | $130 | $147 |

| 1+ Accident | $160 | $173 |

| DUI | $200 | $209 |

| Poor Credit | $172 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

The State Life Insurance Company Discounts Available

| Discount | The State |

|---|---|

| Anti Theft | 8% |

| Good Student | 12% |

| Low Mileage | 5% |

| Paperless | 7% |

| Safe Driver | 15% |

| Senior Driver | 10% |

The State Life Insurance Company offers a range of discounts to help policyholders save on their insurance premiums. These discounts are designed to make their insurance policies more affordable and accessible. Here are the discounts typically offered by the company:

- Bundle Discount: State Life provides discounts when you bundle multiple insurance policies, such as auto and home insurance, together. This can lead to significant savings on your overall insurance costs.

- Safe Driver Discount: If you have a clean driving record and a history of safe driving, you may qualify for a safe driver discount on your auto insurance premiums.

- Multi-Policy Discount: Besides bundling, State Life often offers additional discounts for having multiple insurance policies with them. This can include life insurance, health insurance, and more.

- Good Student Discount: For families with young drivers, State Life may offer a good student discount. This encourages responsible academic performance and safe driving habits among younger policyholders.

- Home Security Discount: Home insurance policyholders who have installed security systems in their homes may qualify for a discount. This provides an incentive for homeowners to enhance their property’s security.

- Healthy Lifestyle Discount: Some health insurance policies may offer discounts or rewards to policyholders who maintain a healthy lifestyle, such as engaging in regular exercise and maintaining a healthy diet.

- Claims-Free Discount: If you haven’t filed any claims over a specified period, you might be eligible for a claims-free discount. This reward encourages policyholders to maintain a safe and claims-free history.

- Renewal Discounts: State Life often provides incentives for policyholders who renew their policies with them. These discounts reward customer loyalty and encourage policyholders to stay with the company.

- Group Discounts: State Life may offer group discounts to policyholders who are part of certain organizations or affiliations. This can include professional associations or employer-sponsored group insurance plans.

It’s essential to note that the availability and specific details of these discounts may vary depending on your location and the type of insurance policy you’re interested in. To maximize your savings, it’s advisable to speak directly with a State Life insurance agent to discuss which discounts you may be eligible for and how they can apply to your insurance coverage.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How The State Life Insurance Company Ranks Among Providers

The State Life Insurance Company operates in a highly competitive insurance industry, where several prominent competitors vie for market share and customer loyalty. Some of the company’s main competitors include:

- Metlife: Metlife is a global insurance giant known for its extensive range of insurance and financial products. They offer life insurance, annuities, dental insurance, and more. MetLife’s strong brand recognition and international presence make it a formidable competitor.

- Prudential Financial: Prudential is another major player in the insurance sector, offering a wide array of insurance and investment products. They are particularly known for their life insurance policies and retirement solutions. Prudential’s long-established reputation and financial strength pose stiff competition.

- Allstate: Allstate is a leading provider of auto, home, and life insurance in the United States. They are known for their personalized insurance options and innovative technology-driven services. Allstate’s advertising campaigns and nationwide presence make it a strong contender in the industry.

- State Farm: State Farm is a well-known insurance company with a significant auto and home insurance market share. They have a vast network of agents and offer a variety of insurance products, making them a go-to choice for many consumers.

- Nationwide: Nationwide is a major insurer with a broad range of insurance products, including auto, home, life, and pet insurance. They focus on customer service and have a strong presence in the United States.

- AIG (American International Group): AIG is a global insurance and financial services company offering a wide range of products, including life insurance, property and casualty insurance, and retirement solutions. Their international footprint and diverse offerings make them a key competitor.

- Farmers Insurance: Farmers Insurance is a prominent insurer known for its auto, home, and life insurance policies. They emphasize local agents and personalized service, catering to a wide customer base.

They compete in product offerings, pricing, customer service, and brand recognition. The insurance market is highly competitive, with consumers benefiting from various choices and options to meet their insurance needs. Companies must continuously innovate and adapt to stand out in this competitive landscape.

Claims Process at the State Life Insurance Company

Ease of Filing a Claim

Policyholders of The State Life Insurance Company benefit from a user-friendly claims process. They have the flexibility to file claims through multiple channels, including an online portal, over the phone, and even through mobile apps. This accessibility ensures that customers can initiate claims in a manner that suits their preferences and convenience.

Average Claim Processing Time

The State Life Insurance Company places a strong emphasis on efficiency when it comes to claim processing. While the exact processing time may vary based on individual circumstances, the company is dedicated to resolving claims promptly.

Policyholders can rely on the company’s commitment to timely claim resolutions, which is a testament to their dedication to customer satisfaction.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is a valuable aspect of The State Life Insurance Company’s commitment to service excellence. The company strives to ensure that claim resolutions are fair and payouts are efficient. Many satisfied policyholders have provided positive feedback regarding their claim experiences, highlighting the company’s dedication to providing reliable and responsive services.

Digital and Technological Features by the State Life Insurance Company

Mobile App Features and Functionality

The State Life Insurance Company offers a comprehensive mobile app designed to enhance the overall customer experience. The app provides a wide range of features and functionalities that empower policyholders.

With this app, policyholders can conveniently access their insurance accounts, manage policies, make premium payments, and even track the status of their claims. This robust mobile app streamlines insurance-related tasks, providing policyholders with user-friendly and efficient tools.

Online Account Management Capabilities

Recognizing the importance of online account management, The State Life Insurance Company provides policyholders with a secure online portal. This portal grants 24/7 access to policy information, allowing customers to review their coverage, make adjustments to their policies, and monitor their account activity at any time.

These online account management capabilities contribute to a seamless and convenient insurance experience for policyholders.

Digital Tools and Resources

To further empower policyholders, The State Life Insurance Company offers a suite of digital tools and educational resources. These resources are thoughtfully designed to provide customers with valuable insights, calculators, and educational materials.

Whether policyholders are calculating insurance needs, assessing risks, or seeking informative resources, the company’s digital tools are tailored to equip customers with the knowledge needed to make informed decisions about their coverage and insurance-related matters.

Frequently Asked Questions

What types of insurance does The State Life Insurance Company provide?

The State Life Insurance Company offers a diverse range of insurance products, including life, health, auto, and home insurance.

How does The State Life Insurance Company’s financial stability measure up?

The company holds an impressive A+ A.M. Best rating, indicating superior financial strength and stability.

What sets The State Life Insurance Company apart in terms of customer service?

The company is renowned for its outstanding customer service, with a commitment to prompt claims processing and efficient resolution, as reflected in positive customer feedback.

Are there customizable options for insurance plans with The State Life Insurance Company?

Yes, State Life provides customizable insurance plans, allowing policyholders to tailor coverage to their individual or family requirements.

What digital features and tools does The State Life Insurance Company offer?

The company provides a robust mobile app, secure online account management capabilities, and a suite of digital tools and resources to enhance the overall customer experience, facilitating tasks such as policy management, premium payments, and claims tracking.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.