The Travelers Home and Marine Insurance Company Review (2026)

Navigate the insurance realm confidently with The Travelers Home and Marine Insurance Company, a secure choice offering diverse coverage options for homes and marine assets.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

The Travelers Home and Marine Insurance Company stands as a trusted insurance partner, offering a comprehensive array of insurance solutions meticulously tailored to safeguard your most valuable assets.

Backed by an impeccable A++ rating from A.M. Best, symbolizing robust financial stability, and boasting a commendably low complaint level, indicative of high customer satisfaction, Travelers excels in delivering peace of mind.

Their expansive home insurance policies fortify against structural damage, theft, and liability, while marine insurance options cater to boat, yacht, and personal watercraft enthusiasts. Travelers’ uniqueness lies in their unwavering commitment to personalized service, facilitated through a dedicated agent network, and bolstered by a legacy of delighted customers.

Beyond the essentials, they offer supplementary coverage options, such as flood insurance and identity theft protection. In the event of unforeseen circumstances, Travelers’ 24/7 claims support ensures a seamless resolution. By choosing Travelers, you’re not merely acquiring insurance; you’re forging a steadfast partnership to shield the pillars of your life.

What You Should Know About The Travelers Home and Marine Insurance Company

Rates: Travelers Home and Marine Insurance Company excels in offering competitive rates tailored to individual circumstances. Their pricing structure takes into account various factors, including the type of coverage, location, and personal profile. By providing transparent and customized rates, Travelers ensures that policyholders receive fair and competitive pricing for their insurance needs.

Discounts: Travelers is committed to maximizing savings for its policyholders through a variety of discounts. These may include safe driver discounts, multi-policy discounts, and loyalty discounts. The availability and specifics of discounts may vary based on location and individual circumstances.

Complaints/Customer Satisfaction: With a focus on customer satisfaction, Travelers Home and Marine Insurance Company boasts a low complaint record. This indicator reflects the company’s commitment to addressing customer concerns promptly and effectively.

Claims Handling: Travelers prioritizes a seamless and user-friendly claims process. Policyholders have the flexibility to file claims through multiple convenient channels, including an online platform, phone, and a dedicated mobile app. The company’s commitment to efficiency is reflected in its swift claim processing time.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Travelers Home and Marine Insurance Company Insurance Coverage Options

The Travelers Home and Marine Insurance Company offers a wide range of coverage options to cater to the diverse needs of their customers. These coverage options are designed to protect homes, marine assets, and personal belongings. Here is a comprehensive list of the coverage options provided by Travelers:

Home Insurance Coverage:

- Dwelling Coverage: Protection for the structure of your home against damage caused by covered perils, such as fire, wind, or vandalism.

- Personal Property Coverage: Coverage for your personal belongings, including furniture, electronics, and clothing, in the event of theft, damage, or loss.

- Liability Coverage: Financial protection if you are found liable for injuries or property damage to others on your property.

- Additional Structures Coverage: Coverage for structures on your property separate from your main dwelling, such as garages or sheds.

- Loss of Use Coverage: Assistance with temporary living expenses if your home becomes uninhabitable due to a covered event.

- Personal Liability Umbrella: An extra layer of liability protection that extends beyond the limits of your standard policy.

Marine Insurance Coverage:

- Boat Insurance: Comprehensive coverage for various types of boats, including motorboats, sailboats, and fishing boats.

- Yacht Insurance: Specialized coverage for larger, luxury yachts and sailboats.

- Personal Watercraft Insurance: Coverage for jet skis and other personal watercraft.

- Coverage for Marine Equipment: Protection for equipment and accessories related to your marine assets.

- Agreed Value Coverage: Coverage that ensures you receive an agreed-upon value for your boat or yacht in the event of a total loss.

- Liability Coverage on the Water: Protection against liability for accidents or injuries that occur while using your boat.

Additional Coverage Options:

- Flood Insurance: Coverage for damage caused by flooding, which is typically not included in standard home insurance policies.

- Jewelry and Valuable Items Coverage: Extra coverage for high-value items like jewelry, artwork, and collectibles.

- Identity Theft Protection: Assistance in the event of identity theft, including reimbursement for related expenses.

- Umbrella Insurance: Additional liability coverage that extends beyond the limits of your home or marine insurance policies.

- Home Renovation Coverage: Protection for home improvement projects to safeguard your investment during construction.

- Personal Articles Floater: Coverage for specific valuable items that may have limited protection under a standard policy.

These coverage options are tailored to provide comprehensive protection for both your home and marine assets, ensuring that Travelers’ policyholders have the flexibility to customize their insurance to meet their specific needs and circumstances. It’s important to work with a traveler agent to determine the most suitable coverage options for your unique situation.

Read more: Travelers Specialty Insurance Company Review

The Travelers Home and Marine Insurance Company Insurance Rates Breakdown

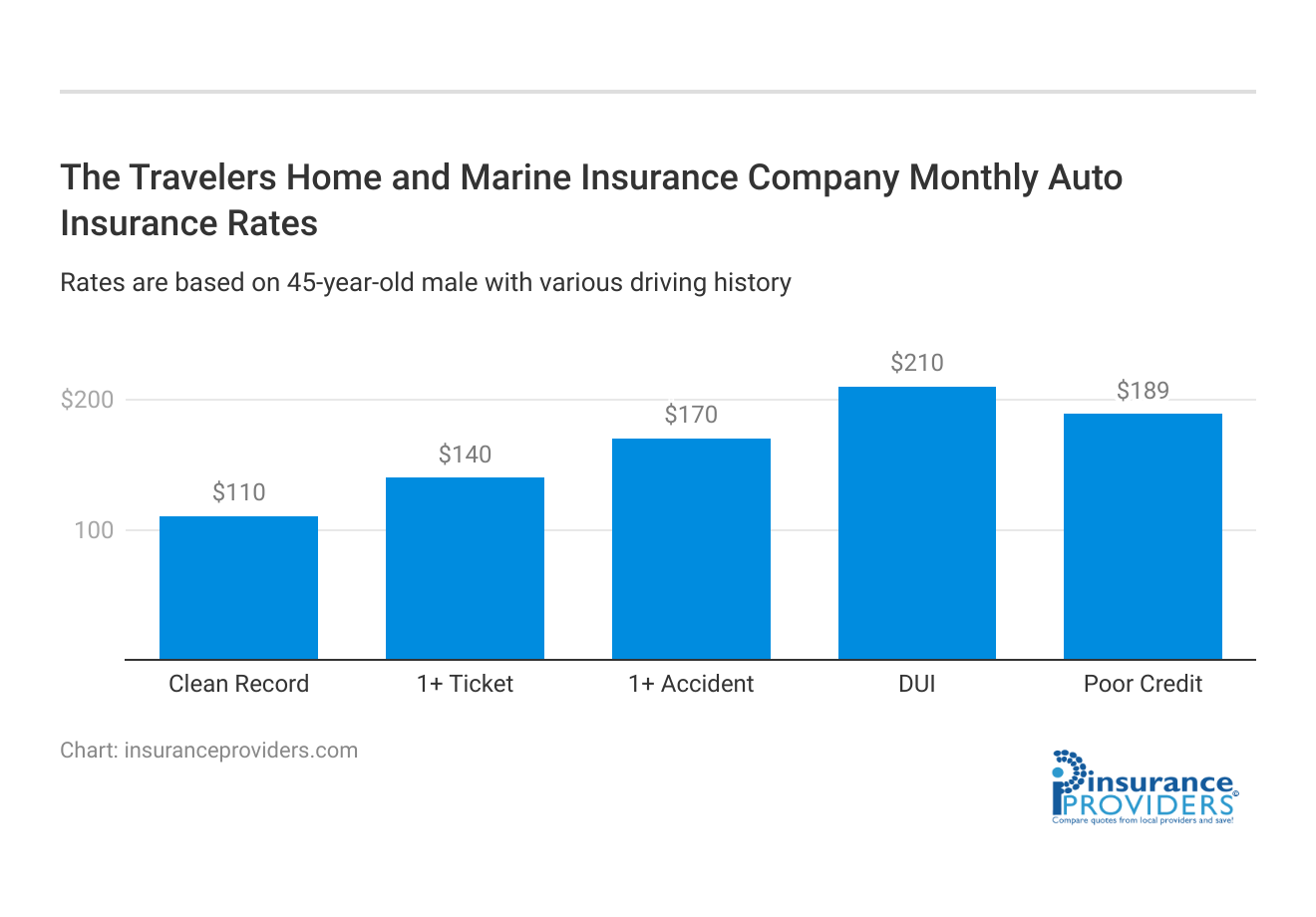

| Driver Profile | The Travelers Home and Marine | National Average |

|---|---|---|

| Clean Record | $110 | $119 |

| 1+ Ticket | $140 | $147 |

| 1+ Accident | $170 | $173 |

| DUI | $210 | $209 |

| Poor Credit | $189 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

The Travelers Home and Marine Insurance Company Discounts Available

| Discount | The Travelers Home and Marine |

|---|---|

| Anti Theft | 10% |

| Good Student | 15% |

| Low Mileage | 8% |

| Paperless | 5% |

| Safe Driver | 20% |

| Senior Driver | 12% |

The Travelers Home and Marine Insurance Company provides various discounts to help customers save on their insurance premiums. These discounts are designed to reward policyholders for specific circumstances or safety measures. Here are some of the discounts offered by the company:

- Multi-Policy Discount: Customers can save by bundling their home and marine insurance policies with Travelers, making it more convenient and cost-effective.

- Protective Device Discount: Installing safety features in your home or on your boat, such as burglar alarms, fire alarms, or tracking systems, can lead to significant discounts.

- Claims-Free Discount: Maintaining a claims-free history with Travelers demonstrates responsible policy management and can result in lower premiums.

- Good Payer Discount: Timely payment of your insurance premiums can earn you a discount, promoting financial responsibility.

- New Home Discount: If your home is relatively new, Travelers may offer a discount, as newer homes tend to have updated electrical, plumbing, and structural components.

- Marine Safety Course Discount: Completing a recognized marine safety course can lead to reduced marine insurance rates, emphasizing safe boating practices.

- Home Renovation Discount: If you’ve recently renovated or made improvements to your home, you may be eligible for discounts, as these upgrades often enhance safety and security.

- Multi-Car Discount: If you insure multiple boats or vehicles with Travelers, you can take advantage of this discount, promoting the bundling of policies.

- Continuous Insurance Discount: Staying insured with Travelers for an extended period can result in discounts, as it indicates loyalty and stability.

- Early Quote Discount: Getting a quote from Travelers well before your policy expires can lead to savings, encouraging proactive policy management.

It’s important to note that the availability and specifics of these discounts may vary by location and individual circumstances. To maximize your savings, it’s recommended to discuss discount eligibility with a Travelers agent or representative, as they can provide personalized guidance based on your unique situation.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How The Travelers Home and Marine Insurance Company Ranks Among Providers

The Travelers Home and Marine Insurance Company faces competition in the insurance industry from several formidable competitors. Some of its main competitors include:

- State Farm: State Farm is one of the largest insurance providers in the United States, offering a wide range of insurance products, including home and auto insurance. They are known for their extensive network of agents and competitive pricing.

- Allstate: Allstate is another major player in the insurance industry, offering homeowners, auto, and other insurance products. They are recognized for their innovative insurance coverage options and strong advertising presence.

- Geico: Geico specializes in auto insurance but also offers homeowners and renters insurance. They are well-known for their direct-to-consumer approach and competitive rates.

- Progressive: Progressive primarily focuses on auto insurance but provides bundled options that include home and renters insurance. They are known for their user-friendly online tools and competitive rates.

- Usaa: USAA serves members of the military and their families, providing a range of insurance products, including home and auto insurance. They are highly regarded for their exceptional customer service and tailored coverage for military personnel.

- Liberty Mutual: Liberty Mutual offers a variety of insurance products, including homeowners and auto insurance. They are known for their customizable coverage options and a strong presence in the insurance market.

- Farmers Insurance: Farmers Insurance provides homeowners, auto, and other insurance products. They are recognized for their localized agents and personalized customer service.

- Nationwide: Nationwide offers homeowners, auto, and specialty insurance products. They are known for their strong financial stability and broad coverage options.

- Chubb: Chubb is a high-end insurance provider known for offering premium home and marine insurance coverage. They cater to affluent individuals and offer specialized coverage for valuable assets.

- American Family Insurance: American Family Insurance offers a range of insurance products, including homeowners and auto insurance. They are recognized for their commitment to community involvement and customer-focused initiatives.

To remain competitive, Travelers continues to emphasize its strengths, such as comprehensive coverage, financial stability, and a dedicated agent network, while also adapting to evolving customer needs and industry trends.

Travelers Home and Marine Insurance Company Claims Process

Ease of Filing a Claim

Travelers Home and Marine Insurance Company provides a streamlined and user-friendly process for filing claims. Customers have the flexibility to file claims through various convenient channels, including online through their website, over the phone, or through their dedicated mobile app.

The online platform and mobile app offer intuitive interfaces, making it easy for customers to report incidents and initiate their claims promptly.

Average Claim Processing Time

Travelers Home and Marine Insurance Company is committed to efficient claim processing. The average claim processing time is relatively swift, ensuring that customers receive timely responses and settlements for their claims.

The company employs modern technologies and efficient workflows to expedite the evaluation and resolution of claims, minimizing any potential disruptions for policyholders.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback regarding claim resolutions and payouts with Travelers Home and Marine Insurance Company is generally positive. Customers appreciate the responsiveness of the claims team and the fairness in assessing and settling claims.

The company ensures open communication throughout the claims process, keeping customers informed of the progress and actions taken. Additionally, Travelers’ commitment to fair and reasonable payouts contributes to high levels of customer satisfaction and trust.

Travelers Home and Marine Insurance Company Digital and Technological Features

Mobile App Features and Functionality

The Travelers mobile app offers a range of features and functionalities that enhance the overall customer experience. Customers can conveniently manage their policies, access important documents, file claims, and track their claim status through the app. The intuitive design and user-friendly interface of the app make it easy for users to navigate and utilize its various features effectively.

Online Account Management Capabilities

Travelers Home and Marine Insurance Company provides robust online account management capabilities for policyholders. Through their online platform, customers can access and manage their policies, view payment history, update personal information, and request policy changes.

The online portal is designed to be accessible and easy to use, empowering customers to have control and visibility over their insurance accounts.

Digital Tools and Resources

In addition to their mobile app and online account management capabilities, Travelers offers various digital tools and resources to support their customers. These tools may include informative blogs, guides, and educational materials related to insurance coverage and home or marine safety.

By providing valuable digital resources, Travelers aims to empower customers with knowledge and insights to make informed decisions about their insurance coverage and risk management.

Frequently Asked Questions

What makes The Travelers Home and Marine Insurance Company stand out?

Travelers stands out with a top-notch A++ rating for financial stability and a low complaint record. They offer diverse coverage for homes and marine assets, ensuring customer peace of mind.

How does Travelers simplify the claims process?

Travelers provides a user-friendly claims process online, by phone, or through their app. They leverage modern tech for efficient and timely responses.

What coverage does Travelers offer for homeowners and marine enthusiasts?

Travelers covers homes for structural damage, theft, and liability. For marine assets, they insure boats, yachts, and watercraft, and offer extras like flood and identity theft protection.

How does Travelers use digital features for customer convenience?

Travelers’ mobile app lets you manage policies, file claims, and track status. Online account tools allow easy access to policy details, payment history, and changes. They also offer informative digital resources.

What sets Travelers apart in the insurance industry, and how do they adapt to change?

Travelers excels with comprehensive coverage, financial stability, and a committed agent network. To adapt, they focus on strengths and stay responsive to customer needs, making them a trusted and flexible insurance choice.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.