TIAA-CREF Life Insurance Company Review (2026)

Explore the diverse coverage options provided by TIAA-CREF Life Insurance Company, a trusted name in the insurance industry, renowned for its unwavering commitment to financial security and peace of mind.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive article, we explore TIAA-CREF Life Insurance Company, a trusted name in the insurance industry, renowned for its diverse range of coverage options and unwavering commitment to financial security.

Offering an array of insurance products, including term life, whole life, and universal life insurance, TIAA-CREF stands out for its strong financial foundation, exceptional customer service, and competitive pricing. With a rich history dating back to its founding mission, the company has earned accolades for its excellence in service and innovative solutions.

Whether you’re seeking protection for your family, planning for retirement, or simply looking for expert insights, this article provides valuable information to help you make an informed decision about TIAA-CREF Life Insurance Company.

What You Should Know About TIAA-CREF Life Insurance Company

Rates: The evaluation of rates involves a thorough analysis of TIAA-CREF Life Insurance Company’s premium affordability and competitiveness, considering factors such as age, health, and coverage type to provide consumers with a comprehensive understanding of pricing in comparison to industry standards.

Discounts: In assessing discounts, we explore TIAA-CREF’s cost-saving opportunities and eligibility criteria, aiming to guide consumers in maximizing value while maintaining sufficient insurance coverage.

Complaints/Customer Satisfaction: Our analysis of complaints and customer satisfaction delves into consumer feedback and ratings, addressing factors like interaction ease, responsiveness, and overall satisfaction to provide insights into the company’s service quality and responsiveness to customer needs.

Claims Handling: The claims handling category examines the efficiency and effectiveness of TIAA-CREF’s claims process, assessing the ease of filing claims through various channels, average claim processing time, and customer feedback on claim resolutions and payouts to evaluate the company’s reliability in fulfilling financial commitments to policyholders.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

TIAA-CREF Life Insurance Company Insurance Coverage Options

Let’s take an in-depth look at the comprehensive coverage solutions provided by TIAA-CREF, exploring the various types of insurance policies that can help you protect what matters most. TIAA-CREF Life Insurance Company provides a range of coverage options designed to meet the diverse needs of individuals and families. Here are the key coverage options offered by the company:

- Term Life Insurance: This option provides coverage for a specific term, typically 10, 20, or 30 years. It offers a death benefit to beneficiaries if the insured individual passes away during the term.

- Whole Life Insurance: Whole life insurance offers lifelong coverage and includes a cash value component that grows over time. It can provide both a death benefit and an investment component.

- Universal Life Insurance: Universal life insurance offers flexibility in premium payments and death benefit amounts. It also includes a cash value component that can be invested, potentially earning interest over time.

- Annuities: TIAA-CREF offers annuity products that provide a stream of income payments, often used as retirement income. These can include fixed annuities and variable annuities.

- Retirement Planning Services: The company provides retirement planning services to help individuals and families prepare for a financially secure retirement. This can include personalized retirement savings and investment strategies.

In a world filled with uncertainties, having the right insurance coverage is essential for safeguarding your future. TIAA-CREF Life Insurance Company stands as a reliable partner in this journey, offering a diverse range of insurance solutions designed to provide financial security and peace of mind. These coverage options cater to a wide range of financial goals and circumstances, allowing customers to choose the insurance solution that best fits their needs.

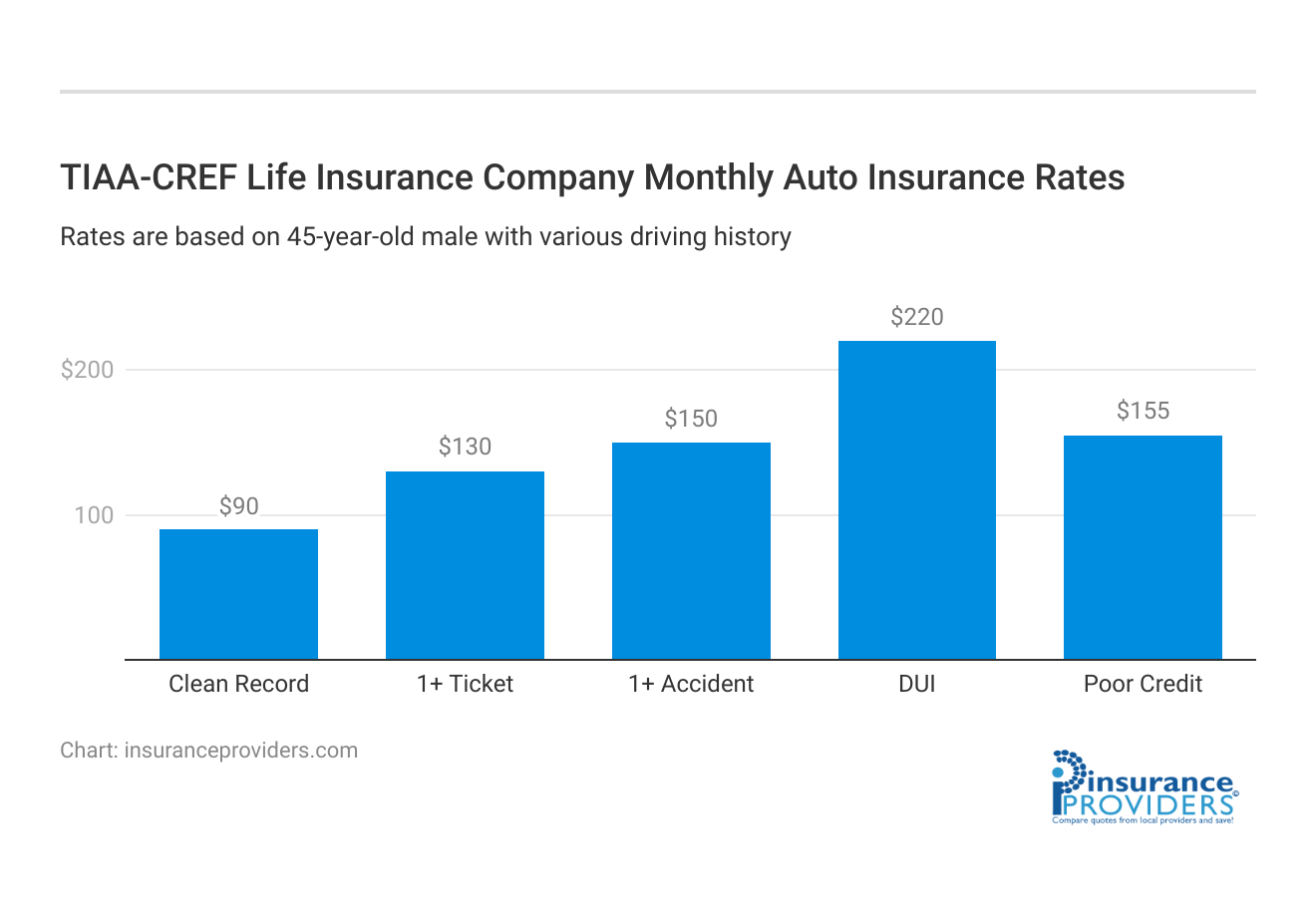

TIAA-CREF Life Insurance Company Insurance Rates Breakdown

| Driver Profile | TIAA-CREF | National Average |

|---|---|---|

| Clean Record | $90 | $119 |

| 1+ Ticket | $130 | $147 |

| 1+ Accident | $150 | $173 |

| DUI | $220 | $209 |

| Poor Credit | $155 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

TIAA-CREF Life Insurance Company Discounts Available

| Discount | TIAA-CREF |

|---|---|

| Anti Theft | 20% |

| Good Student | 15% |

| Low Mileage | 10% |

| Paperless | 8% |

| Safe Driver | 25% |

| Senior Driver | 5% |

TIAA-CREF Life Insurance Company may offer various discounts to policyholders to help them save on their insurance premiums. While specific discounts may vary by location and policy type, here are some common discounts that insurance companies often provide:

- Multi-Policy Discount: If you bundle multiple insurance policies with TIAA-CREF, such as auto and home insurance, you may be eligible for a multi-policy discount. This can result in significant savings on your premiums.

- Safe Driver Discount: For auto insurance policies, maintaining a clean driving record with no accidents or traffic violations can often qualify you for a safe driver discount. This reflects your lower risk as a driver.

- Good Student Discount: If you have a student on your policy who maintains good grades, you may be eligible for a good student discount. This incentive encourages students to excel academically.

- Safety Features Discount: If your car is equipped with safety features like anti-lock brakes, airbags, or an anti-theft system, you may be eligible for a discount. These features reduce the risk of accidents or theft.

- Home Security Discount: For homeowners insurance, having a home security system in place can lead to a discount on your premium. This helps protect your property and lowers the risk of theft or damage.

- Loyalty Discount: Some insurance companies reward long-term customers with loyalty discounts. If you’ve been with TIAA-CREF for an extended period and maintain a good claims history, you may qualify for this discount.

- Payment Discounts: Opting for automatic payments or paying your premium in full upfront can sometimes lead to payment discounts, making insurance more affordable.

- Low Mileage Discount: If you drive fewer miles annually, you may be eligible for a low mileage discount. This is often applicable for auto insurance policies.

- Group Discounts: TIAA-CREF may offer discounts to members of certain groups or organizations. If you belong to an eligible group, you can benefit from this group discount.

It’s essential to discuss your specific eligibility for discounts with TIAA-CREF or your insurance agent, as qualification criteria and available discounts may vary. Taking advantage of these discounts can help you reduce your insurance costs while maintaining valuable coverage.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How TIAA-CREF Life Insurance Company Ranks Among Providers

When it comes to securing your financial future and protecting your loved ones, choosing the right life insurance provider is paramount. In this article, we delve into the world of TIAA-CREF Life Insurance Company and its standing among insurance providers. Here are some of the well-known competitors that TIAA-CREF may face in this sector:

- Prudential Financial: Prudential is a global financial services company that offers a wide range of insurance and retirement products, including life insurance, annuities, and retirement planning solutions. They compete with TIAA-CREF in the life insurance and retirement markets.

- Metlife: Metlife is another prominent insurer with a strong presence in life insurance, annuities, and retirement planning. They provide similar products and services as TIAA-CREF.

- New York Life Insurance Company: New York Life is a mutual life insurance company and one of the largest insurers in the United States. They specialize in life insurance, retirement planning, and investment products.

- Northwestern Mutual: Northwestern Mutual is known for its life insurance and financial planning services. They offer a variety of life insurance policies and investment options.

- MassMutual: Massachusetts Mutual Life Insurance Company, commonly known as MassMutual, is a mutual insurer that provides life insurance, retirement planning, and investment products.

- Ameriprise Financial: Ameriprise offers financial planning, retirement planning, and investment services in addition to life insurance. They compete with TIAA-CREF in the financial planning space.

- Voya Financial: Voya is a financial services company that provides retirement, investment, and insurance solutions, including life insurance and annuities.

- Lincoln Financial Group: Lincoln Financial offers life insurance, annuities, and retirement planning services. They are a significant player in the insurance and retirement market.

- Guardian Life Insurance Company: Guardian Life provides life insurance, disability insurance, and retirement planning services, often catering to both individuals and businesses.

As we conclude our exploration of TIAA-CREF Life Insurance Company’s position among insurance providers, it becomes clear that the company’s commitment to excellence, financial stability, and diverse range of insurance options places it as a strong contender in the industry.

TIAA-CREF Life Insurance Company Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

When it comes to filing a claim with TIAA-CREF Life Insurance Company, policyholders have the convenience of multiple options. Whether you prefer the ease of online submissions, the personal touch of speaking over the phone, or the accessibility of mobile apps, TIAA-CREF has you covered.

Their user-friendly digital interfaces and dedicated customer service team make the claims process straightforward and accessible.

Average Claim Processing Time

TIAA-CREF Life Insurance Company prides itself on its efficient claims processing. While specific processing times may vary depending on the nature of the claim and supporting documentation, policyholders can generally expect a prompt and responsive service.

The company’s commitment to quick claim settlements is a testament to its dedication to providing financial security when it matters most.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is a valuable indicator of an insurance company’s performance. TIAA-CREF Life Insurance Company has garnered positive reviews for its fair and transparent claim resolutions and timely payouts.

Policyholders have expressed satisfaction with the company’s commitment to meeting their financial needs during challenging times, further solidifying its reputation as a trusted insurance provider.

TIAA-CREF Life Insurance Company Digital and Technological Features

Mobile App Features and Functionality

TIAA-CREF Life Insurance Company understands the importance of staying connected with policyholders in today’s digital age. Their mobile app offers a range of features and functionalities designed to enhance the customer experience.

From accessing policy information to submitting claims on-the-go, the app provides a seamless way for customers to manage their insurance needs conveniently.

Online Account Management Capabilities

Managing your insurance policy online has never been easier with TIAA-CREF. The company offers robust online account management capabilities, allowing policyholders to view policy details, make payments, and update information with ease. This digital convenience empowers customers to have greater control over their insurance coverage and ensures they can stay up-to-date on their policies.

Digital Tools and Resources

TIAA-CREF goes beyond basic insurance services by providing policyholders with a range of digital tools and resources. These resources include educational materials, calculators, and informative content to help customers make informed decisions about their insurance needs.

The company’s commitment to leveraging technology for customer empowerment sets it apart in the insurance industry’s digital landscape.

Frequently Asked Questions

What types of insurance does TIAA-CREF Life Insurance Company offer?

TIAA-CREF Life Insurance Company provides a range of insurance products, including term life, whole life, and universal life insurance, catering to diverse financial goals and circumstances.

How does TIAA-CREF Life Insurance Company compare to other providers in the industry?

TIAA-CREF stands out for its strong financial foundation, exceptional customer service, and competitive pricing, positioning itself as a top contender in the insurance industry.

What is the claims process like with TIAA-CREF Life Insurance Company?

TIAA-CREF offers policyholders multiple options, including online submissions, phone communication, and mobile apps, ensuring a user-friendly and efficient claims process. The company is known for its prompt claim settlements.

Are there discounts available with TIAA-CREF Life Insurance Company?

TIAA-CREF provides various discounts, but eligibility criteria may vary. To reduce insurance costs while maintaining valuable coverage, it’s essential to discuss specific discount options with TIAA-CREF or your insurance agent.

What digital features does TIAA-CREF Life Insurance Company offer for policy management?

TIAA-CREF prioritizes digital convenience, offering a mobile app with features like accessing policy information, submitting claims on-the-go, and robust online account management capabilities, empowering customers to have greater control over their insurance coverage.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.