Time Insurance Company: Customer Ratings & Reviews [2026]

Navigate confidently with Time Insurance Company, providing comprehensive and affordable car coverage paired with discounts and exceptional customer service.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Imani Francies is a finance and insurance writer who has strong media and communication skills with a bachelor's degree from Georgia State University. She began her writing career freelancing with various blogs and internships while working full-time as an early childhood educator. She has significant experience in both print and online media as a writer, editor, and author. She works efficient...

Imani Francies

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated April 2024

Time Insurance Company is an affordable option for car insurance coverage. The company’s history dates back to 1892, and their mission is to provide customizable and comprehensive coverage options with exceptional customer service. They offer multiple discounts to policyholders, including safe driving discounts and multi-car discounts.

However, their availability is limited in some states and their customer satisfaction ratings are average. Despite these drawbacks, their low complaint level and 24/7 claims service make them a reliable option for those in need of affordable car insurance coverage.

What You Should Know About Time Insurance Company

Company Contact Information:

- Phone: 1-800-462-2123

- Email: customerservice@timeinsurance.com

- Mailing address: Time Insurance Company, P.O. Box 3057, Milwaukee, WI 53201-3057

Related Parent or Child Companies:

- Time Insurance Company is a subsidiary of Assurant, Inc.

Financial Ratings:

- Time Insurance Company has an A- (Excellent) rating from A.M. Best, a leading credit rating agency for the insurance industry.

Customer Service Ratings:

- Time Insurance Company does not have specific customer service ratings available. However, their 24/7 claims service and low complaint level suggest that they provide reliable customer service.

Claims Information:

- Time Insurance Company offers 24/7 claims service, which can be reached by phone or through their website. Policyholders can file claims online, and the company offers various resources to assist with the claims process.

Company Apps:

- Time Insurance Company does not have a specific mobile app for policyholders, but its website is optimized for mobile devices and offers a variety of tools and resources for managing policies and filing claims.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Time Insurance Company Insurance Coverage Options

Time Insurance Company offers a range of coverage options to meet the needs of different drivers. These include:

- Liability coverage: This is the minimum required coverage in most states and covers damages you cause to other people and their property in an accident.

- Collision coverage: This covers damages to your own vehicle in an accident, regardless of who is at fault.

- Comprehensive coverage: This covers damages to your vehicle from non-collision events, such as theft, vandalism, or natural disasters.

- Personal injury protection (PIP) coverage: This covers medical expenses and lost wages for you and your passengers if you are injured in an accident, regardless of who is at fault.

- Uninsured/Underinsured motorist coverage: This covers damages and injuries if you are hit by a driver who does not have insurance or does not have enough insurance to cover your losses.

- Rental car coverage: This covers the cost of renting a car while your vehicle is being repaired after an accident.

- Roadside assistance: This provides help with common roadside issues, such as flat tires or dead batteries, and can be added to your policy for an additional fee.

These coverage options can be customized to meet your specific needs and budget. Time Insurance Company also offers 24/7 claims service and online resources to help you manage your policy and file claims.

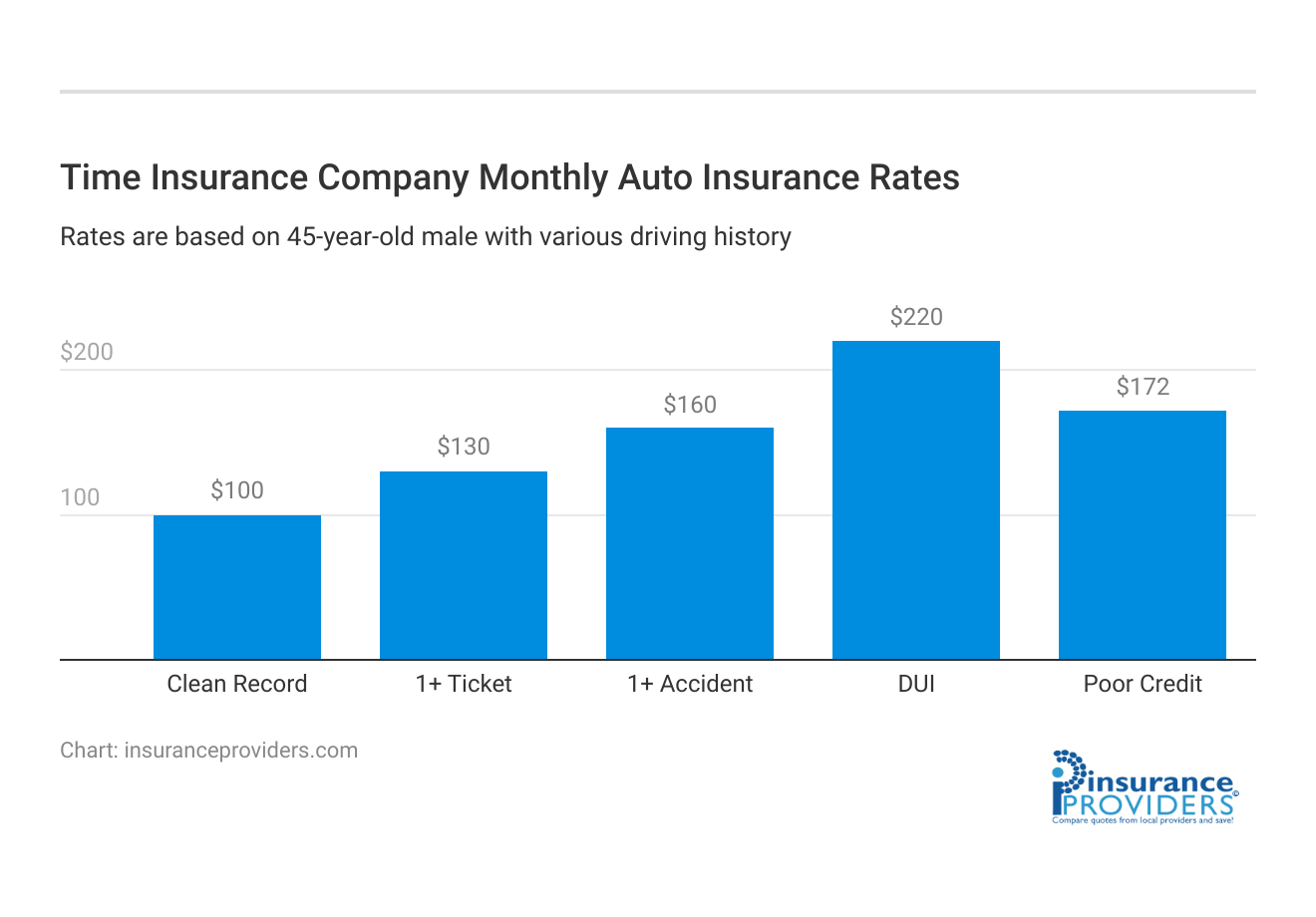

Time Insurance Company Insurance Rates Breakdown

| Driver Profile | Time | National Average |

|---|---|---|

| Clean Record | $100 | $119 |

| 1+ Ticket | $130 | $147 |

| 1+ Accident | $160 | $173 |

| DUI | $220 | $209 |

| Poor Credit | $172 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Time Insurance Company Discounts Available

| Discount | Time |

|---|---|

| Anti Theft | 5% |

| Good Student | 25% |

| Low Mileage | 3% |

| Paperless | 18% |

| Safe Driver | 30% |

| Senior Driver | 1% |

Time Insurance Company offers a range of discounts to policyholders, including:

- Safe driving discounts: Drivers who maintain a clean driving record with no accidents or moving violations can qualify for a safe driving discount.

- Multi-car discounts: Policyholders with multiple cars on the same policy can qualify for a discount on their overall premium.

- Good student discounts: Full-time students who maintain a certain grade point average may qualify for a discount on their car insurance.

- Military discounts: Active duty and retired military members may qualify for a discount on their car insurance.

- Bundling discounts: Policyholders who bundle their car insurance with other insurance products, such as home or renters insurance, can qualify for a discount on their overall premium.

- Anti-theft discounts: Vehicles equipped with anti-theft devices, such as alarms or tracking systems, can qualify for a discount on their car insurance.

- Payment discounts: Policyholders who pay their premiums in full or set up automatic payments may qualify for a discount on their car insurance.

These discounts can help policyholders save money on their car insurance premiums, making Time Insurance Company a more affordable option for those in need of coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Time Insurance Company Ranks Among Providers

Time Insurance Company competes with several other major car insurance companies in the market. Here are some of its main competitors:

- State Farm: State Farm is one of the largest car insurance providers in the United States and offers a range of coverage options, discounts, and online tools to manage policies.

- Geico: Geico is known for its affordable rates and strong customer service, with policies available in all 50 states.

- Progressive: Progressive is a popular choice for drivers who want customizable coverage options and discounts, as well as the ability to manage their policy online.

- Allstate: Allstate offers a range of coverage options and discounts, as well as a rewards program for safe driving.

- Farmers: Farmers is known for its personalized customer service and customizable coverage options, including unique add-ons such as glass repair and pet injury coverage.

These companies all offer a similar range of coverage options, discounts, and online tools, making the car insurance market highly competitive. Customers are encouraged to compare quotes and policies from multiple providers to find the best coverage and rates for their needs.

Frequently Asked Questions

What types of coverage does Time Insurance Company offer for car insurance?

Time Insurance Company provides a range of coverage options, including liability, collision, comprehensive, and additional customizable options to suit individual needs and budgets.

How does Time Insurance Company stand out in terms of discounts for policyholders?

Time Insurance Company offers various discounts, such as safe driving discounts and multi-car discounts, providing policyholders with opportunities to save money on their car insurance premiums.

Can I file claims with Time Insurance Company online, and how does their claims process work?

Yes, Time Insurance Company offers a convenient 24/7 claims service accessible by phone or through their website. Policyholders can file claims online, and the company provides resources to assist throughout the claims process.

What is the financial rating of Time Insurance Company, and how does it impact their reliability?

Time Insurance Company holds an A- (Excellent) rating from A.M. Best, a leading credit rating agency for the insurance industry. This rating signifies a strong financial position, indicating reliability in meeting policyholder obligations.

How does Time Insurance Company compare to other major car insurance providers in the market?

Time Insurance Company competes with key industry players, offering a similar range of coverage options and discounts. Comparing quotes from multiple providers is encouraged to find the best coverage and rates tailored to individual needs.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.