Tower Life Insurance Company: Customer Ratings & Reviews [2026]

Discover the diverse range of insurance products provided by Tower Life Insurance Company, from life and disability insurance to long-term care and annuities.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywri...

Tonya Sisler

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated April 2024

Tower Life Insurance Company offers comprehensive and customizable insurance coverage options, including life insurance, disability insurance, long-term care insurance, and annuities. The company has been providing reliable coverage for over 50 years and is licensed to offer insurance in all 50 states.

Tower Life Insurance Company offers competitive rates and discounts for policyholders who bundle multiple insurance products, have a clean driving record, or are members of certain organizations. Customer reviews of the company are overwhelmingly positive, praising their excellent customer service, comprehensive coverage options, and competitive rates.

With an A+ rating from the Better Business Bureau and an A (Excellent) rating from A.M. Best, Tower Life Insurance Company is a trustworthy and reliable choice for anyone looking to secure their financial future.

What You Should Know About Tower Life Insurance Company

Company Contact Information:

- Address: 12900 North Meridian Street, Suite 200, Carmel, IN 46032

- Phone: 800-438-7180

- Email: info@towerlifeinsurance.com

- Website: https://www.towerlifeinsurance.com/

Related Parent or Child Companies:

- Tower Life Insurance Company is a subsidiary of The Kuvare US Holdings, Inc.

Financial Ratings:

- Tower Life Insurance Company has an A (Excellent) rating from A.M. Best, indicating a stable financial outlook.

Customer Service Ratings:

- According to customer reviews, Tower Life Insurance Company has excellent customer service, with many customers praising the company for their prompt and helpful responses to inquiries and claims.

Claims Information:

- Customers can file a claim with Tower Life Insurance Company by calling their toll-free claims hotline at 800-438-7180 or by submitting a claim online through the company’s website.

- The claims process is reported to be efficient and straightforward, with many customers reporting quick resolution of their claims.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tower Life Insurance Company Insurance Coverage Options

Tower Life Insurance Company offers a range of insurance coverage options to meet the individual needs of its customers. These coverage options include:

- Life insurance: Tower Life Insurance Company offers term life, whole life, and universal life insurance policies, with coverage amounts ranging from $50,000 to $5 million or more.

- Disability insurance: Tower Life Insurance Company offers short-term and long-term disability insurance to help replace lost income in the event of a disability.

- Long-term care insurance: This coverage is designed to help pay for the costs of long-term care services, including nursing home care, home health care, and assisted living facilities.

- Annuities: An annuity is a financial product that provides a guaranteed income stream in retirement. Tower Life Insurance Company offers fixed and indexed annuities, with a range of payout options.

Tower Life Insurance Company’s coverage options are customizable, allowing customers to tailor their policies to their unique needs and budget. The company also offers a variety of riders, or add-ons, to enhance coverage, such as accidental death and dismemberment coverage and waiver of premium.

Tower Life Insurance Company Insurance Rates Breakdown

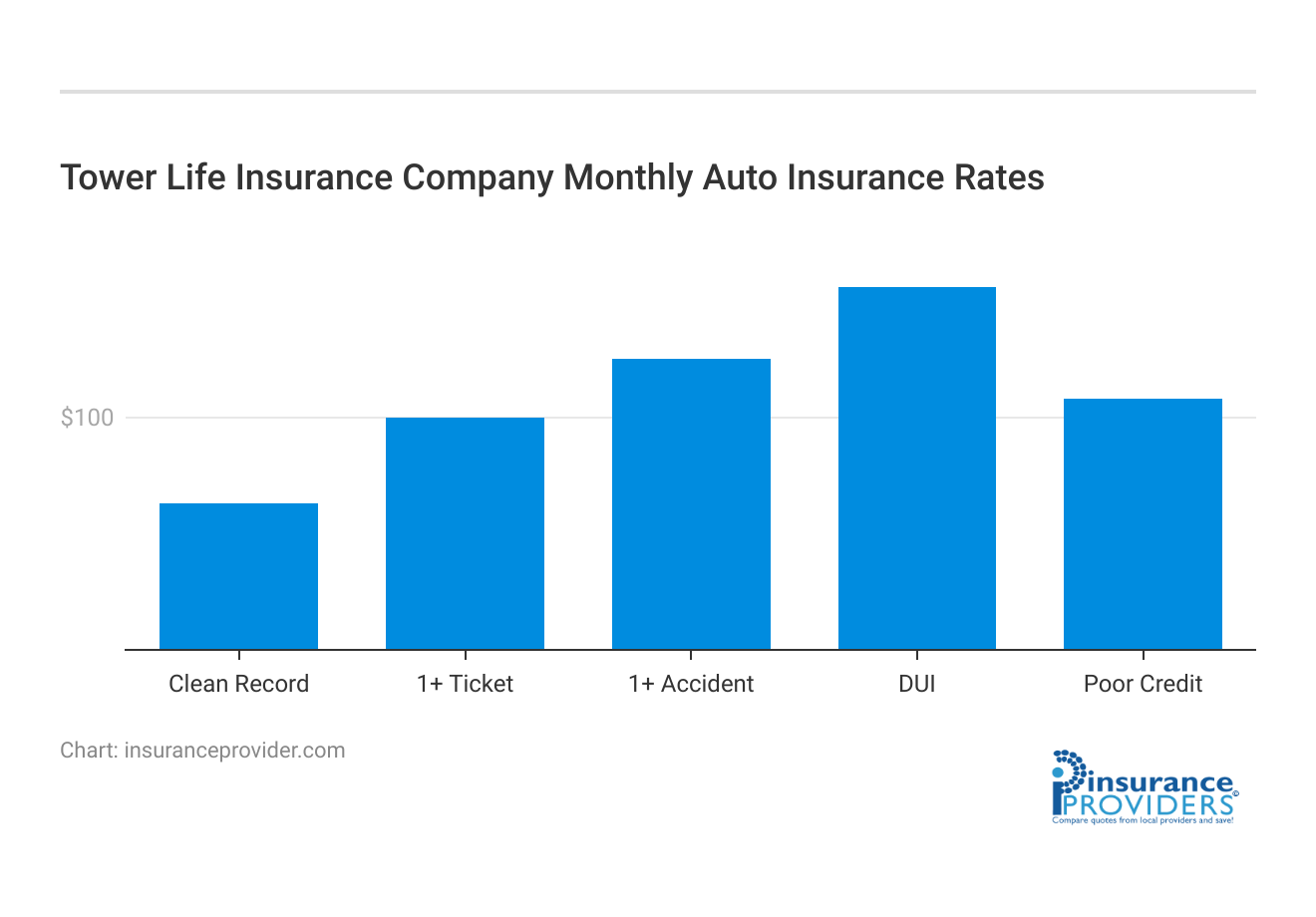

| Driver Profile | Tower National | National Average |

|---|---|---|

| Clean Record | $58 | $119 |

| 1+ Ticket | $94 | $147 |

| 1+ Accident | $123 | $173 |

| DUI | $146 | $209 |

| Poor Credit | $100 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Tower Life Insurance Company Discounts Available

| Discounts | Tower Life |

|---|---|

| Anti Theft | 14% |

| Good Student | 19% |

| Low Mileage | 13% |

| Paperless | 10% |

| Safe Driver | 20% |

| Senior Driver | 15% |

Tower Life Insurance Company offers a variety of discounts to help policyholders save on their premiums. These discounts include:

- Multi-policy discount: Customers who bundle multiple insurance policies with Tower Life Insurance Company can receive a discount on their premiums.

- Safe driver discount: Policyholders with a clean driving record can receive a discount on their auto insurance premiums.

- Good student discount: Students who maintain a certain grade point average can receive a discount on their auto insurance premiums.

- Membership discounts: Tower Life Insurance Company partners with certain organizations to offer discounted rates to members, such as AAA and AARP. (For more information, read our”AAA Life Insurance Review“).

- Home security system discount: Homeowners with a monitored home security system can receive a discount on their home insurance premiums.

- Age-based discounts: Seniors who are 55 or older can receive a discount on their auto insurance premiums.

These discounts can help customers save a significant amount of money on their insurance premiums and are a great way to take advantage of the company’s competitive rates.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Tower Life Insurance Company Ranks Among Providers

Tower Life Insurance Company operates in a highly competitive insurance market, with several other companies offering similar products and services. Some of the main competitors of Tower Life Insurance Company include:

- State Farm: State Farm is a well-known insurance company that offers a range of products, including auto, home, and life insurance.

- Allstate: Allstate is another major insurance company that offers a variety of insurance products, including auto, home, and life insurance, as well as financial products like annuities and mutual funds.

- Nationwide: Nationwide is a large insurance company that offers auto, home, and life insurance, as well as pet insurance and retirement planning services.

- MetLife: MetLife is a global insurance company that offers a range of products, including life insurance, dental insurance, and retirement planning services.

- AIG: AIG is a multinational insurance company that offers a variety of insurance products, including life insurance, property and casualty insurance, and travel insurance.

These companies, along with several others, are strong competitors in the insurance market and offer similar products and services to Tower Life Insurance Company. To remain competitive, Tower Life Insurance Company must continue to innovate and offer competitive rates and discounts to attract and retain customers.

Read more: Trustage Auto Insurance Review

Frequently Asked Questions

What types of insurance coverage does Tower Life Insurance Company offer?

Tower Life Insurance Company provides a comprehensive range of insurance coverage, including life insurance, disability insurance, long-term care insurance, and annuities.

How long has Tower Life Insurance Company been in operation, and where is it licensed to offer insurance?

Tower Life Insurance Company boasts over 50 years of experience in providing reliable coverage and is licensed to offer insurance in all 50 states.

What discounts are available to policyholders with Tower Life Insurance Company?

Tower Life Insurance Company offers competitive rates and discounts for policyholders who bundle multiple insurance products, maintain a clean driving record, or are members of certain organizations.

How does Tower Life Insurance Company handle claims, and what is the reported efficiency of their claims process?

Customers can file a claim with Tower Life Insurance Company by calling their toll-free claims hotline at 800-438-7180 or by submitting a claim online through the company’s website.

What are the financial and customer service ratings of Tower Life Insurance Company?

Tower Life Insurance Company holds an A+ rating from the Better Business Bureau and an A (Excellent) rating from A.M. Best, indicating a stable financial outlook. Customer reviews highlight excellent customer service, with prompt and helpful responses to inquiries and claims.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.