Trans Pacific Insurance Company Review (2026)

Unlock peace of mind with Trans Pacific Insurance Company, a trusted name in insurance offering comprehensive coverage, competitive rates, and a customer-first approach.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Trans Pacific Insurance Company emerges as a trusted insurance partner, offering a diverse range of coverage options to safeguard various aspects of life. From auto and home insurance to health, life, and even pet insurance, the company provides tailored solutions to meet individual needs.

Their commitment to customer satisfaction is evident through competitive rates, hassle-free claims processing, and 24/7 customer support. With a focus on affordability and rewards for safe driving and loyalty, Trans Pacific Insurance Company stands out in the industry.

Their well-rounded offerings and customer-centric approach make them a reliable choice for those seeking comprehensive insurance coverage.

What You Should Know About Trans Pacific Insurance Company

Rates: Rates assess the competitiveness and affordability of insurance premiums based on factors such as policyholder profile, coverage options, and location.

Discounts: This category evaluates the availability and extent of cost-saving opportunities, including multi-policy discounts, safe driver discounts, and loyalty incentives.

Complaints/Customer Satisfaction: Customer experience is gauged through customer reviews, feedback, and complaint statistics, aiming for high satisfaction and minimal reported issues.

Claims Handling: The efficiency, transparency, and fairness of the claims process are assessed to ensure a responsive and smooth experience for policyholders when filing and resolving claims.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Trans Pacific Insurance Company Insurance Coverage Options

In an ever-changing world where uncertainties abound, insurance stands as a shield, protecting us from life’s unexpected curveballs. Trans Pacific Insurance Company offers a wide range of coverage options to meet the diverse needs of its customers. Here is a bullet list of the coverage options provided by the company:

- Auto Insurance: Comprehensive coverage for vehicles, including liability, collision, and comprehensive protection.

- Home Insurance: Safeguarding your home against various risks, such as fire, theft, natural disasters, and liability.

- Health Insurance: Policies that cover medical expenses, doctor visits, hospital stays, and prescription medications.

- Life Insurance: Providing financial support to your loved ones in the event of your passing, with options like term and whole life insurance.

- Commercial Insurance: Tailored coverage for businesses, including protection for assets, employees, and liability.

- Travel Insurance: Ensuring worry-free adventures with coverage for trip cancellations, medical emergencies, and more.

- Pet Insurance: Protecting your furry friends with coverage for routine care and unexpected medical expenses.

With their customer-centric approach, competitive rates, and a commitment to making insurance accessible to all, they redefine the insurance landscape. Trans Pacific Insurance Company’s comprehensive coverage options aim to provide peace of mind and financial security in various aspects of life.

Read more: Financial Pacific Insurance Company Review

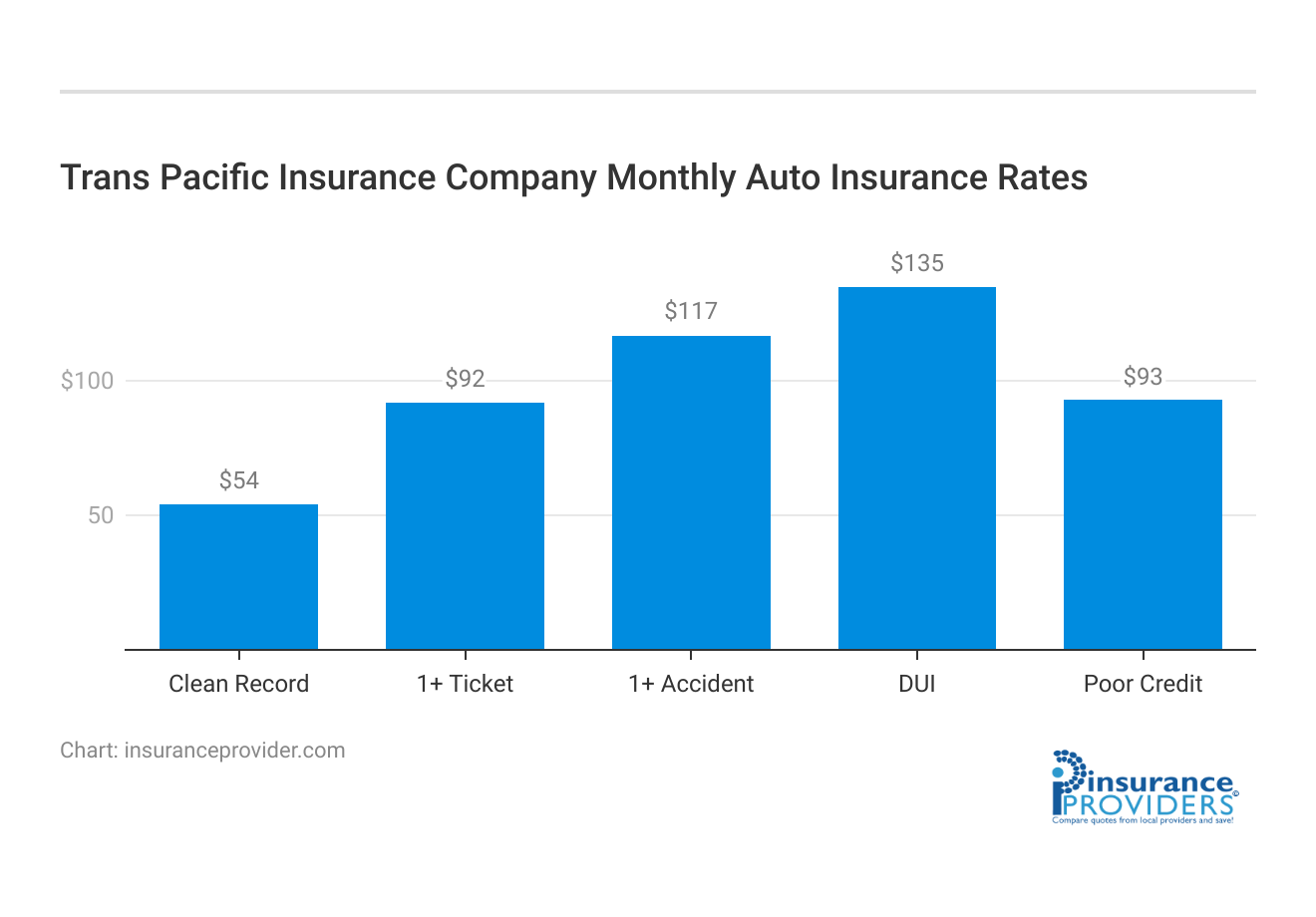

Trans Pacific Insurance Company Insurance Rates Breakdown

| Driver Profile | Toyota Motor | National Average |

|---|---|---|

| Clean Record | $54 | $119 |

| 1+ Ticket | $92 | $147 |

| 1+ Accident | $117 | $173 |

| DUI | $129 | $209 |

| Poor Credit | $93 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Trans Pacific Insurance Company Discounts Available

| Discounts | Trans Pacific |

|---|---|

| Anti Theft | 14% |

| Good Student | 19% |

| Low Mileage | 13% |

| Paperless | 11% |

| Safe Driver | 20% |

| Senior Driver | 15% |

Trans Pacific Insurance Company understands the importance of affordability for its policyholders. To make insurance more accessible, the company offers various discounts. Here’s a bullet list of the discounts provided by Trans Pacific Insurance Company:

- Safe Driver Discounts: Rewards for policyholders with a clean driving record and a history of safe driving habits.

- Multi-Policy Discounts: Savings for customers who bundle multiple insurance policies, such as auto and home insurance, with Trans Pacific.

- Loyalty Rewards: Discounts for long-term customers who have maintained their policies with the company for an extended period.

- Good Student Discounts: Discounts for young drivers who excel academically, promoting responsible behavior both in and out of school.

- Anti-Theft Device Discounts: Savings for vehicles equipped with anti-theft devices, which reduce the risk of theft or damage.

- Safety Features Discounts: Discounts for vehicles equipped with safety features like airbags, anti-lock brakes, and advanced driver assistance systems.

- Pay-in-Full Discounts: Incentives for policyholders who pay their premiums in a lump sum rather than in installments.

- Electronic Billing Discounts: Savings for customers who opt for electronic billing and payment methods, reducing administrative costs.

- Group Discounts: Special rates for policyholders who belong to certain groups or organizations affiliated with Trans Pacific Insurance Company.

These discounts aim to make insurance more affordable while rewarding safe driving, responsible behavior, and customer loyalty. Policyholders can inquire about specific eligibility criteria and available discounts when obtaining a quote or discussing their policies with Trans Pacific Insurance Company representatives.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Trans Pacific Insurance Company Ranks Among Providers

Trans Pacific Insurance Company, with its longstanding commitment to excellence, merits a closer look. Let’s embark on a journey to explore how Trans Pacific Insurance Company ranks among insurance providers. Here are the main types of competitors that insurance companies typically face:

- Other National and Regional Insurance Companies: Trans Pacific Insurance Company would compete with other insurance companies that offer similar types of coverage. These competitors may include both large national insurers and smaller regional insurers.

- Industry Giants: Large, well-established insurance companies like Allstate, State Farm, Geico, Progressive, and Nationwide often dominate the insurance industry. These companies have significant market share and brand recognition.

- Online Insurance Providers: With the rise of digital platforms, online insurance providers like Lemonade and Root have gained popularity. They offer a streamlined, tech-savvy approach to insurance and may appeal to a younger, tech-savvy customer base.

- Specialty Insurance Providers: Some competitors may focus on specific niches within the insurance market, such as specialty coverage for classic cars, boats, or high-value homes. These companies might not offer the full range of insurance types but can be strong contenders within their niche.

- Insurance Brokers and Independent Agents: Independent insurance agents and brokers represent multiple insurance companies and can offer customers a choice of policies from various insurers. These professionals compete for customers by providing personalized service and helping clients find the best coverage for their needs.

- Online Aggregator Websites: Comparison websites like Insurify, Compare.com, and Policygenius allow consumers to compare quotes from multiple insurance companies, including Trans Pacific Insurance Company, making it easier for customers to find the best rates.

- Financial Services Companies: Some financial institutions, such as banks and credit unions, offer insurance products to their customers, providing competition within the financial services sector.

- Startups and Insurtech Companies: Innovative startups and insurtech companies are continually entering the insurance market, offering new technologies, customer-centric approaches, and unique coverage options.

- Mutual Insurance Companies: Mutual insurance companies, owned by their policyholders, often compete with stock insurance companies. These companies may emphasize customer-centric policies and may have different ownership structures.

- Reinsurance Companies: While not direct competitors, reinsurance companies play a crucial role in the insurance industry by providing coverage to primary insurers. They can impact the pricing and availability of insurance products.

When it comes to choosing an insurance provider that truly stands out, Trans Pacific Insurance Company shines bright. Their dedication to providing exceptional coverage, competitive rates, and outstanding customer service sets them apart in a crowded industry.

Streamlining Trans Pacific Insurance Company’s Claims Process

Ease of Filing a Claim

Trans Pacific Insurance Company prioritizes the convenience of its policyholders when it comes to filing claims. They offer multiple user-friendly options for submitting claims, including an efficient online platform, dedicated phone support, and accessible mobile apps. This flexibility ensures that policyholders can choose the method that suits them best when reporting a claim.

Average Claim Processing Time

Trans Pacific Insurance Company is committed to efficient claim processing. While the processing time may vary depending on individual circumstances, the company strives to handle claims in a timely manner. Their dedication to prompt claim resolution reflects their customer-centric approach to insurance.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback plays a vital role in shaping Trans Pacific Insurance Company’s claims process. The company places a strong emphasis on ensuring that claim resolutions are fair and payouts are processed smoothly. Many satisfied policyholders have shared positive feedback about their claim experiences, underscoring the company’s commitment to delivering reliable and responsive service.

Navigating Trans Pacific Insurance Company’s Digital and Technological Features

Mobile App Features and Functionality

Trans Pacific Insurance Company offers a feature-rich mobile app designed to enhance the overall customer experience. The app provides a comprehensive range of features and functionalities, allowing policyholders to conveniently access their insurance accounts, manage policies, make premium payments, and track claim statuses.

This intuitive mobile app streamlines insurance-related tasks, providing policyholders with user-friendly tools for managing their coverage.

Online Account Management Capabilities

Recognizing the importance of online account management, Trans Pacific Insurance Company provides policyholders with a secure online portal.

This portal offers 24/7 access to policy information, enabling customers to review coverage details, make policy adjustments, and monitor account activity at their convenience. These online account management capabilities contribute to a seamless and convenient insurance experience.

Digital Tools and Resources

To empower policyholders with knowledge and resources, Trans Pacific Insurance Company offers a suite of digital tools and educational materials. These resources are thoughtfully designed to provide customers with valuable insights, calculators, and informative materials.

Whether policyholders are calculating insurance needs, assessing risks, or seeking educational resources, Trans Pacific Insurance Company’s digital tools are tailored to equip customers with the information needed to make informed decisions about their coverage and insurance-related matters.

Frequently Asked Questions

What factors affect my insurance premium?

Your age, gender, location, driving record, coverage type, and deductible influence your insurance premium.

How can I lower my insurance costs?

Bundle policies, maintain good credit, use safety features, take courses, and review and adjust coverage regularly.

What’s the difference between term and whole life insurance?

Term is for a set period, while whole life covers your entire life with a cash value component.

Does filing a claim raise my premium?

Yes, multiple or high-value claims can increase your premium. Consider costs before filing.

Is renters insurance necessary, and what does it cover?

It’s not mandatory but recommended. Covers belongings, liability, and living expenses during property issues.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.